When the law allows you to work without a work book

Articles 44 and 48 of the Labor Code of the Russian Federation allow the employment of an employee by an employer on the terms of an employment contract, but without recording this fact in the work book:

- external part-time work – when the employee is a full-time employee of another enterprise, and works for the specified company on a part-time basis or remote access;

- performing work duties for a citizen-individual who does not have the status of an individual entrepreneur.

Only the listed circumstances give the right to conclude employment contracts with employees without entering information about the work in the work book.

Unregistered employee

Working without an employment contract entails the following pros, cons and consequences for the employee:

- Positive traits:

- irregular working hours, for which the worker receives additional pay;

- wages partially exceed the official due to unpaid contributions;

- You may not provide the documentation necessary to conclude a contract:

- diploma of graduation from an educational institution;

- medical record;

- TIN;

- SNILS (ed. note: from September 29, 2020, the list of mandatory documents for employment has changed. Since the paper form of SNILS has been stopped issuing, an electronic version of this document is now required. You can obtain it on the State Services portal or in the personal account of the Pension Fund of the Russian Federation, or MFC Paper SNILS received earlier are valid.);

- identification document;

- birth certificates if there are children.

- a person not registered in the established form cannot be financially responsible;

- Failure to comply with discipline and internal order does not result in punishment by entering it into the work book;

- Negative qualities and consequences for an employee performing labor activities without official employment:

- deprivation of guaranteed obligations provided for in Article 21 of the Labor Code;

- working without a contract does not provide confidence in timely payment of wages;

- work without work deprives the accrual of seniority and, accordingly, pensions;

- work without registration can lead to unplanned dismissal without warning from the manager;

- non-payment of compensation for dismissal.

- Description of consequences:

- a fine for working without an employment contract, since when receiving a salary, tax deductions were not paid in accordance with Article 198 of the Criminal Code;

- subsequently, unpaid wages on time will lead to the thought: “how to get the money back?”;

- To get your money back, you will have to prove to the court that:

- worked without an employment contract;

- were in an employment relationship;

- the employer did not formalize it on his own initiative.

External part-time work - nuances of work

A citizen who has several jobs and is registered under employment contracts has full rights guaranteed to him by labor legislation:

- leave, in the amount provided by law, provided in agreement with management at the same time for all employers;

- in case of illness - obtaining a certificate of incapacity for work for each place of work separately;

- accrual of labor and insurance pension experience.

Keep in mind: at the request of an employee who is a part-time employee, the employer can enter an additional place of work in the work book, guided by the information from the certificate issued by the main company.

Legality

The first thing you should pay attention to is the legality of this work. Is it possible to work without a work book, and even officially?

According to established legislation, it is impossible to work with a contract without a work permit. The corresponding entries must be made in the employee’s document.

The agreement may be oral, but such experiments are not encouraged. Indeed, in this case, employment will be considered unofficial. And this, in turn, is illegal. Registration for work under an employment contract takes place in Russia. But without an entry in the work book, the work is considered risky.

This is important to know: Retrenchment under a fixed-term employment contract

Employment with an individual

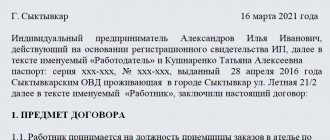

Household assistant, nanny, tutor, gardener - such professions are often in demand on the labor market in the private sector. Citizens who are not business entities by status have the right to hire employees if this activity is not related to making a profit.

Naturally, there cannot be any entry in the work book about this period of work activity, and the employee’s rights are protected by a formalized employment contract between individuals.

When entering into such an agreement, the private employer must notify local authorities about hiring people for work. Data about dismissed employees is transmitted in the same way.

The working conditions of a private owner must not contradict the provisions of labor legislation - regarding the length of working hours, the provision of days off and annual leave, and other social guarantees.

A private individual acting as an employer must be responsible for paying insurance contributions to extra-budgetary funds (medical insurance, social insurance, Pension Fund) in order to ensure the availability of insurance and work experience for his employee.

Is work under a contract without a work book included in the length of service?

When an employee works under an employment contract, he is subject to all the employer’s obligations to contribute insurance contributions to the Pension Fund and the Social Insurance Fund. Accordingly, in this case, the period of work will be included in the length of service.

If a person’s employer is an individual, then, according to Article 303 of the Labor Code of the Russian Federation, he is obliged to pay insurance premiums for all employees with whom he has an employment contract. That is, these periods are also included in the length of service, only they are confirmed not by a work book, but by a contract.

Work under a work contract needs to be considered in more detail, since it is regulated not by the Labor Code, but by the Civil Code. In order to find out whether it is possible to include in the length of service, you need to refer to the pension legislation:

- The Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2009 N 212-FZ establishes that amounts received for work performed under a GPC agreement are subject to payment contributions to the Pension Fund, but are not included in the list of amounts from which social security contributions are paid. In other words, an enterprise that has entered into a contract with an individual pays contributions for it only to the Pension Fund.

- The Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ establishes periods of work that can be included in the insurance period. This includes all periods during which contributions to the Pension Fund were paid for the employee.

Accordingly, we can conclude that work under a contract can be included in the insurance period.

Contract agreement and service agreement - how do they differ from an employment contract?

An alternative to an employment contract are civil law contracts (CLA) that are often used in practice:

- on the provision of services;

- contract;

- author's;

- agent

Work under these types of contracts is subject to the norms of civil law, in contrast to the agreement, which lies within the scope of the Labor Code.

FILES Contract agreement for the performance of work with an individual (sample).doc Contract for the provision of services (universal, sample).doc Civil contract with an employee (sample).doc

The differences between an employment contract and civil law contracts are discussed in more detail in a separate section.

.

Civil contracts are often designed to disguise ordinary employment contracts, since they have a number of valuable advantages for the employer:

- the contractor under the GPC agreement performs the task assigned to him at his own peril and risk, the customer is only interested in the final result;

- the contract has a strictly defined validity period;

- after completing the assigned task, the customer pays only the agreed amount, and not all the working time spent by the contractor on completing the work;

- the period of validity of the GPC agreement is counted in the employee’s insurance period, but is not included in the length of service;

- the customer has no obligations for the employee’s social security, does not pay for vacation, sick time or business trips;

- the contract/service agreement can be terminated at any time before signing the work completion certificate at the initiative of the customer;

- The contractor uses its own equipment and materials to perform work under the GPC agreement.

Important: for using a GPC agreement that replaces an employment agreement, the employer is subject to punishment in the form of a fine. The head of the organization will be required to pay from 10 to 20 thousand rubles, and the enterprise - from 50 to 100 thousand rubles.

What cannot be specified in a contract

Fiscal authorities pay serious attention to the correct execution of work contracts and contracts for the provision of services by an individual. It is these types of GPC agreements that are most often used by employers to conceal the fact of labor relations. To avoid claims from regulatory authorities, the terms and wording of the contract should be used with caution.

It is advisable to comply with the following conditions in a civil contract:

- it is impossible to link a job or service to specific labor functions or to the indication of positions according to the staffing table;

- it is necessary to have quantitative parameters of the work performed in the civil process agreement;

- the order should not be long-term, but one-time in nature;

- It is not allowed to mention the employee’s compliance with the organization’s internal regulations;

- the contractor is not provided with a workplace or the necessary equipment to complete the task;

- payment under the contract should not overlap in time with the salary payment deadlines established by the company, a fixed guaranteed amount of payments is not allowed;

- engaging a contractor under a contract to perform overtime work or sending him on a business trip at the expense of the employer.

The certificate of completion of work is a mandatory part of the GPC agreement

An indispensable condition for the correct drawing up of a civil contract is the execution of a certificate of completion of work upon completion of the prescribed task. The document can have any form, it is important to have the required attributes:

- document's name;

- date of;

- indication of the customer organization and contractor data;

- transfer of the completed amount of work with certain units of measurement and the amount of monetary remuneration;

- signatures and details of the contractor and the customer.

Important: since the GPC agreement is concluded for a specific period of time, in order to continue the activities of the contractor, a new agreement must be drawn up, listing a different scope of work. The acceptance certificate is drawn up in addition to each contract.

The difference between an employment contract and a civil law one

The differences between an employment contract and a work contract are as follows:

- When an employment contract is concluded, the employee is hired for a specific position available in the staffing table.

- The employee is subject to the internal labor regulations and other local regulations of the enterprise.

- The employee performs work under direct supervision.

- The job function is indicated as the job.

- The contractor under a contract is not subject to the work schedule of the enterprise, unless this is specifically stated.

- The subject of the contract is a certain amount of work.

- The contractor under the GPC agreement is not an employee of the organization.

- A contract, unlike an employment contract, cannot be of unlimited duration.

- An employment contract is regulated by the Labor Code, and a contract is governed by the Civil Code.

What risks does an employee take when applying for employment under a GPC agreement?

From a legal point of view, a civil law contract is a completely acceptable alternative to a regular employment agreement. In certain situations, a contract or agency agreement may be more beneficial for the employee:

- a civil contract does not oblige the employee to visit the office every day - the assigned amount of work is carried out at any time convenient for the person;

- the performer does not have a direct supervisor, he acts on his own behalf and is responsible only to himself;

- The contractor is not tied to a specific company; if he has the potential, he can cooperate with several organizations, which will significantly increase his remuneration.

At the same time, a citizen working under a civil law contract is not protected from the whims of the customer by the provisions of labor legislation. The negative consequences of civil legal contracts are as follows:

- the performer does not have the right to any type of leave (annual, educational, maternity leave);

- in case of illness, time spent on treatment is not paid;

- an employee registered under a GPC agreement has a “gap” in his work experience;

- the remuneration received by the contractor under a civil contract is not subsequently taken into account when calculating average earnings (to pay for vacations or social benefits);

- if the assigned task is completed in violation of the deadline, the customer has the right to apply penalties to the contractor;

- The customer may, on his own initiative, terminate the contract at any time before its expiration. In the best case scenario, the contractor will receive only part of the amount due to him, in the worst case, he will be left without remuneration.

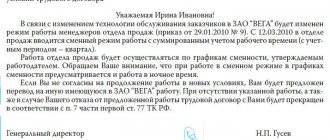

Applying for a job without a work book is possible. Ultimately, the guarantee of compliance with legal relations between an employee and an employer is not an entry in the work book, but a correctly completed contract. If an employee has a choice, then it makes sense to give preference to a standard employment contract. In situations where the employer insists on employment under a GPC agreement, you should protect yourself as much as possible by carefully studying the terms of the contract.

What forms of employment are there?

At the moment, the following forms of employee work are distinguished:

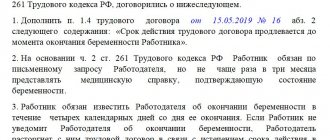

1. Contract form of employment. It is the conclusion of a fixed-term contract with a specific date for the start and end of work. This form differs from a regular employment contract in that it more freely defines its terms for both parties.

2. Constant work. With this form of employment, a full social package is guaranteed, strict conditions are determined regarding the performance of the employee’s duties, namely, a work schedule and a remuneration system.

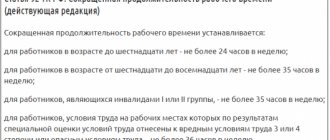

3. Part-time employment. It is a part-time job for people who have a permanent job or for retirees or students.

4. Voluntary work. This type of hiring does not involve remuneration and is based on the candidate’s voluntary consent to the position.

Wages were not paid for work without a work record book or contract - what should an employee do?

In case of non-payment of the promised money for the work performed, any citizen of the Russian Federation can defend their rights.

To do this you need:

- Prepare evidence that you worked in this organization, but you were not hired. You can involve witnesses, employees who worked with you at the enterprise.

- Write an application to the labor inspectorate. In the complaint, indicate during what period you worked, what position you held, and what were your responsibilities. Write down who hired you, with whom the terms of cooperation were discussed, what salary they promised.

- Wait for a response from the labor inspectorate and payment of wages from the company.

- If there is no response or action, then you should write a statement of claim to the court. The document is written more formally, briefly and clearly. The essence of the situation is outlined and the requirements are listed, for example, “to hold the employer accountable and to recover from him the money due for the work in the amount of... thousands of rubles.”

In accordance with Article 67 of the Labor Code of the Russian Federation, an employment contract is considered valid - even if it was not concluded on paper - in words between the employee and the employer when the employee began to fulfill his duties and began work.