Why check the counterparty?

Checking a counterparty means protecting your own company from possible risks and allowing yourself to consistently plan future activities.

At the same time, the verification process is not a one-time activity, but a comprehensive and systematic work. In most cases, verified counterparties comply with all agreements, and the company’s management does not expect any surprises. The main negative consequences of poor verification of the counterparty and cooperation with an unreliable partner are, for example, delays in delivery of certain cargoes, delivery of low-quality goods. To prevent such undesirable consequences, a company representative must be required to review the following documents:

- A copy of the legal entity registration document.

- A copy of the company's charter.

- A copy of the document confirming registration with the Federal Tax Service of Russia.

- Accounting statements for the last year ended.

- A copy of the identity document of the head of the company.

Liability for lack of care

If due diligence is not exercised, that is, transactions are concluded with an unscrupulous counterparty, responsibility falls on the shoulders of the person who executed such an agreement.

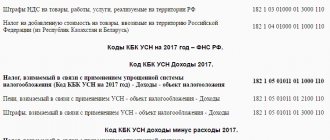

Responsibility is associated with additional taxes - VAT and income tax. The fact is that the documents that were used to increase expenses reduced the taxable base for income tax. In addition, they provided the opportunity to reimburse VAT from the budget. If the counterparty is found to be dishonest and the company has not checked it, then it illegally paid less taxes, and therefore must pay additional taxes.

There are no penalties specifically for concluding an agreement with an unscrupulous counterparty. Financial risks consist only in the fact that the company will not be able to legally reduce taxes, and therefore will incur more expenses.

FREE check – “Open services”

Almost all the main parameters for verifying a counterparty can be found in open sources of information. The only disadvantage of such a check is that collecting and analyzing information will take quite a long time.

Checking a partner on the official portal of the Federal Tax Service of Russia

Checking the counterparty by TIN

The official website of the Tax Service of the Russian Federation provides several useful services that work online and allow you to obtain certain information about a potential partner. You can check the TIN, the fact of registration of a legal entity, the region of its activity, the scope of work and a number of other information. The data is grouped into sections, all of which are available at nalog.ru. Users of the portal also have access to information about the prohibition of activities for a particular organization. To obtain such information, simply enter the organization’s TIN. A new service is currently being tested that will help identify companies created for fraudulent purposes.

Of course, the lion's share of tax and other information relating to the company's activities is not publicly available. However, the list of data available for review is constantly expanding. Recently, a lot of new information about the activities of any organization has become available on the official website of the tax service. It became possible to evaluate the company’s financial balance over the past year. The average number of employees of the organization also became available. You can clarify information about tax payments made and existing overdue debts. All information can be obtained for free online.

Register of unreliable suppliers

The Federal Antimonopoly Service has compiled a Unified Federal Register of Unreliable Suppliers. This information is available online 24 hours a day at any time.

Card index of arbitration decisions

File of arbitration cases

At the moment, there are over 15 million arbitration cases in the file cabinet. A simple search form allows you to obtain all the information available for a company from this file in record time. At the same time, the information card that appears after processing the search request contains information about the subjects of the case, the process itself and its results.

Bank of Enforcement Proceedings

Information about debts

The interactive service of the Federal Bailiff Service allows you to obtain information about the existing debts of the counterparty, which were confirmed in court. The amount of debt, its reason and the extent of repayment are available.

The Unified Federal Register allows you to familiarize yourself with important facts about the company’s activities, including its relationships with other market participants. To search for the counterparty you are checking, you need to fill out a fairly simple search form. You can search by contact information, individual taxpayer number, etc.

Register of current licenses

If the prospective partner is engaged in a licensed type of work, then it would be useful to check the validity of the company’s license to carry out the core type of activity. This can also be done online.

The Department of Natural Resources has information on licensing activities related to the management of hazardous waste. The communications supervisory organization licenses organizations involved in the transmission and dissemination of information. Other areas are also dealt with by the relevant departments. You can make a request on their official portals.

Checking your passport for validity

Russian passport verification

The database of the Russian Ministry of Internal Affairs is always up to date, as it is constantly updated. This information resource allows you to check the passport of a manager, potential counterparty or individual entrepreneur with whom you intend to cooperate.

The invalidity of an identity document may indicate a high risk of fraudulent activity on the part of the counterparty. It is better not to have any business contacts with such a partner.

Government contracts

Government contracts

If a potential partner regularly enters into contracts with government agencies for the supply of goods or services, then such a counterparty can be considered reliable. – You can cooperate with him.

Register of inspections

On the official portal of the Prosecutor General's Office of Russia proverki.gov.ru you can always find up-to-date information about already completed and planned official inspections of any organization. A simple search form allows you to quickly get the information you need.

Website of the prospective partner

You should definitely look at the company’s official website and its pages on social networks, if any. The appearance of the site and its accessibility can say a lot about the organization. Pay attention to the counterparty's portfolio; many companies post information on cooperation with well-known brands on their websites. This information is also worth checking. Real reviews are of great importance. If there are too many negative reviews, then it is better to refuse cooperation with such an organization.

Control questions

The Russian Federal Tax Service recommends asking yourself a few simple questions that will help you assess the feasibility of cooperation with a particular organization. These are the questions:

- What kind of relationship unites you and the head of the company?

- Do you know the employees of the organization?

- Do you have any experience of business interaction with this counterparty?

- What has been done to verify the reliability of the counterparty?

How to prove good faith

From the criteria, in principle, it is clear what needs to be done in order not to come under scrutiny: more income and taxes, high salaries, say “no” to dubious transactions. In practice, the most common operation can turn into unsafe. In part, in previous articles we have already examined complex situations:

- Controlled transactions - practice under 115-FZ

- Explanations for low average wages – application of the minimum wage

I would like to note that careful selection of suppliers when working with VAT is relevant not only for large organizations, because a small company using the simplified tax system is sometimes required to pay tax (when importing).

As for other ways to ensure confirmation of your own integrity, you will need:

- When creating a company, check the participants and the manager for the presence of disqualification, unfinished court cases, large debts, in order to avoid refusal of registration and unnecessary attention at the initial stage.

- Somehow it is not customary (and the law does not require) when registering to be interested in the origin of the property contributed as a contribution to the authorized capital, but it should be. Spouses, for example, have joint property (including money); if the other spouse did not know about its use to create a company, he has the right to go to court, demand its return, and include it in the share, which, of course, will not benefit the organization. The easiest way is to obtain a notarized consent.

- Conduct the most open dialogue in transactions, guided, however, by the principle of reasonableness, while maintaining commercial secrets.

- Avoid too favorable terms in contracts, unless this is one of the customs of business or does not provide the company with additional benefits. For example, a long-term, unreasonable deferment of payment for a large contract for a new client will be suspicious from a tax point of view, but installment plans with monthly payments and interest are normal.

- Don’t leave accounts receivable to chance. This means: writing letters of claim if sanctions are provided (fines, penalties), calculating them and demanding payment, going to court, joining the ranks of creditors in bankruptcy.

- Pay attention to the execution of transactions and promptly (without delay!) resolve issues with errors, inaccuracies and incomplete completion in documents confirming expenses and invoices.

Note! In the provision on personal data, provide for cases of transfer of information to third parties. An example is passes to the closed territory of the supplier. Because they are manufactured by another party, it is necessary to obtain the consent of employees in advance. It is not necessary, but it is advisable to request written guarantees from the counterparty that the data will be used exclusively for the specified purposes.

Example: the supplier indicated the old legal address on the invoice, the manager immediately noticed the error, but did not send it for correction, the document was submitted for verification. The tax income will not be deducted for the supplier, the maximum that awaits him is a reprimand, but for the buyer, a refusal to deduct VAT is a real possibility.

The more careful you are in dealing with transaction security, the more reliably you are protected from tax claims. Now let’s look at what to demand from the counterparty and what signs should ring a bell.

Interpretation of the information received

Experts advise dividing the information received about the counterparty into several groups. Firstly, this is the volume of activity of the organization at the moment. Secondly, these are existing controversial issues. Finally, a thorough risk analysis must be carried out. It is worth noting that the financial vector of the organization indicates what is happening - growth or stagnation.

Analyzing the above, it becomes clear that checking the trustworthiness of a potential partner is a labor-intensive and quite complicated matter, especially for a novice entrepreneur.

Therefore, it is advisable to use the services of the specialized service “Contour Focus”. This service will instantly check your counterparty.

Benefits of the service

Information about a particular company is searched based on the contact details of the manager, tax identification number or any other parameter. The service allows you to obtain all the above information in the shortest possible time in a clearly presented form.

The organization card issued by the service, in addition to the described data, provides information about the nature of the counterparty’s mentions on the global network. In addition, the user becomes aware of the nature of reviews about the organization’s activities from the World Wide Web.

Any user of the service can monitor the activities of several hundred companies simultaneously. At the same time, any significant changes will not go unnoticed; they will immediately become known. The user will instantly receive appropriate notifications. The service has flexible user settings. You can regulate the criteria by which the organization's activities will be monitored.

A few additional points to note. In addition to the main online check, it is worth visiting the organization’s office in person to assess the company’s status with your own eyes. You need to make sure that the organization is located at the stated address. Talk to a manager or representative from the organization. During the conversation, you can not only resolve any business issues, but also evaluate the personal qualities of the manager. An inspection of an organization’s office to some extent allows one to draw conclusions about the financial condition of a legal entity. This fact is important when deciding on the possibility of cooperation.