Payments

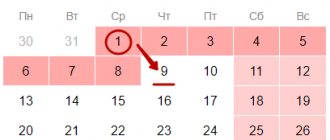

Important in reporting in 2017 The first three months of 2020 will be a reporting campaign

Report on the intended use of funds received or Form 6: which is correct? As part of the recommended

How much insurance premiums will an individual entrepreneur need to pay “for himself” in 2020? What changed

What is a tax register Registers are elements of tax accounting. They are run by companies

A tax notice allows us, ordinary citizens, to pay taxes on time and in full.

Who may need consulting services and when? How to conclude a consulting services agreement? What consulting

Paying taxes if an individual entrepreneur does not work. Will you need to pay taxes if you have zero income?

Simplified form of balance sheet (STS) A simplified form of balance sheet is given in Appendix 5 to the order

What is statistical reporting? Statistical reporting is a set of company reports compiled according to approved forms,

Paper Soviet traditions of collecting waste paper, oddly enough, are still alive today. Recently