Important in reporting in 2017

- The first three months of 2020 will be the reporting campaign for 2016. It will end in April with the submission of Form 2-NDFL.

- Since 2020, the administrator of insurance premiums is changing, so Form 4-FSS may be canceled.

- For the first quarter of 2020, companies will submit calculations of contributions to the tax office.

Connect reporting

Create a tax payment schedule based on the specified deadlines and taxation system.

BASIC

Organizations on the OSN submit tax returns and other reports to the Federal Tax Service and extra-budgetary funds.

Tax returns:

- VAT

- Profit

- Property

- Transport

- Earth

Reporting to extra-budgetary funds:

- 4-FSS

- Confirmation of main activity

- RSV-1

- SZV-M

Other reporting to the Federal Tax Service:

- For insurance premiums

- Average headcount

- 2-NDFL

- 6-NDFL

- Financial statements

VAT declaration

Companies report on VAT quarterly (Article 174 of the Tax Code of the Russian Federation).

Deadlines for VAT returns in 2020

- for the fourth quarter of 2020 - until January 25

- for the first quarter of 2020 - until April 25

- for the second quarter of 2020 - until July 25

- for the third quarter of 2020 - until October 25

Most Russian businesses report VAT electronically. Only certain categories of VAT payers can submit a printed declaration (clause 5 of Article 174 of the Tax Code of the Russian Federation).

Income tax return

Unlike VAT, income tax is considered an accrual total; accordingly, the declaration is submitted for the first quarter, six months, 9 months and a year (Article 285 of the Tax Code of the Russian Federation). During reporting periods, advance payments are made, and at the end of the year, the Federal Tax Service budget replenishes the tax minus the transferred advances (Article 287 of the Tax Code of the Russian Federation). If the company makes a loss, you will not have to pay tax.

Deadlines for income tax returns in 2020

- for 2020 - until March 28

- for the first quarter of 2020 - until April 28

- for the first half of 2020 - until July 28

- for 9 months of 2020 - until October 30 (the deadline is shifted due to holidays)

If the average quarterly income is more than 15 million rubles, the taxpayer reports and pays advances every month (clause 3 of Article 286, Article 287 of the Tax Code of the Russian Federation).

Declaration on property tax of organizations

Companies that own property are recognized as payers of property tax.

Each subject of the Russian Federation determines its own procedure and terms for transferring taxes and advance payments (Article 383 of the Tax Code of the Russian Federation). Everyone, without exception, should report for the year.

Tax calculations are submitted for January - March, January - June and January - September, and a declaration is submitted at the end of the year.

Attention!

Subjects of the Russian Federation can cancel interim settlements (Article 379 of the Tax Code of the Russian Federation).

Deadlines for corporate property tax declarations

The property declaration for 2020 must be submitted by March 30, 2017 (Article 386 of the Tax Code of the Russian Federation).

Transport tax declaration

The transport tax affects companies that have vehicles registered with the State Traffic Safety Inspectorate (Article 357 of the Tax Code of the Russian Federation). Accordingly, these same organizations submit a declaration once a year.

Deadlines for transport tax returns in 2020

In 2020, you need to report before 02/01/2017 (Article 363.1 of the Tax Code of the Russian Federation).

Land tax declaration

If the company owns land, it is necessary to report on land tax (Article 388 of the Tax Code of the Russian Federation).

Deadlines for land tax returns in 2020

The declaration for 2020 must be submitted before 02/01/2017 (Article 398 of the Tax Code of the Russian Federation).

Information on the average number of employees

At the end of the year, companies report the average number of employees to the Federal Tax Service. The form is light and consists of one sheet.

Deadline for submitting information on the average number of employees in 2020

The deadline for submitting information is January 20, 2017 (Clause 3, Article 80 of the Tax Code of the Russian Federation).

Form 4-FSS

Since 2020, the administrator of insurance premiums is changing, so Form 4-FSS may be canceled.

Deadline for submitting 4-FSS in 2020

But for 2020 you will need to report using the current Form 4-FSS by 01/20/2017 (on paper) and by 01/25/2017 (electronically).

Confirmation of main activity

Every year, companies determine the type of activity that has the greatest share. The data is submitted to the Social Insurance Fund (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55).

Deadlines for confirmation of the main activity in 2017

Until April 15, 2017, all companies submit a set of three components:

- Application indicating one leading type of activity

- Certificate confirming the main type of economic activity (with detailed calculations)

- A copy of the explanatory note to the balance sheet for 2020 (the note is not submitted by small businesses).

Form RSV-1 PFR

In 2020, instead of RSV-1, there will be a single calculation of insurance premiums.

At the moment, the new calculation has not yet been approved, and the RSV-1 form has not been canceled.

For 2020 you need to pass RSV-1

- until 02/15/2017 (on paper with a number of people not reaching 25 people)

- until 02/20/2017 (electronically)

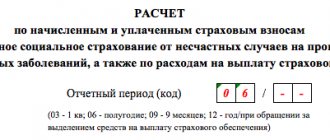

Calculation of insurance premiums

For the first quarter of 2020, companies will submit calculations of contributions to the tax office. According to the project, the calculation consists of 24 sheets. It combines two calculations - 4-FSS and RSV-1.

Deadlines for submitting calculations for insurance premiums in 2020

- for the first quarter of 2020 - until May 2 (due to the May holidays the deadline is shifted);

- for the first half of 2020 - until July 31 (the deadline is postponed due to a holiday);

- for 9 months of 2020 - until October 30.

SZV-M

In 2020, the form is also valid, but policyholders have more time to prepare it. Starting from the new year, the form must be submitted by the 15th day of the month following the reporting month (Article 2 of Federal Law No. 250-FZ dated July 3, 2016). This rule comes into force with reporting for December, that is, the December SZV-M must be submitted by 01/15/2017.

Reporting income of individuals

Once a quarter, form 6-NDFL is submitted to the Federal Tax Service (Clause 2 of Article 230 of the Tax Code of the Russian Federation)

Deadlines for submitting form 6-NDFL in 2020

- for 2020 - until April 3 (due to weekends, the deadline is delayed);

- for the first quarter of 2020 - until May 2 (due to weekends and May holidays, the deadline is postponed);

- for the first half of 2020 - until July 31;

- for 9 months of 2020 - until October 31.

Financial statements

Companies disclose information about their financial condition, debt, reserves, and capital in their annual financial statements. The Federal Tax Service and Rosstat are waiting for a copy of such reporting from payers.

Deadlines for submitting financial statements in 2020

For 2020, reports must be submitted by March 31, 2017 (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, clause 2, article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

Responsibility for failure to pass 4-FSS

What fine is provided for policyholders who do not submit injury reports on time? Liability is regulated in stat. 26.3 of Law No. 125-FZ, which defines the following amount of sanctions:

- Violation of the federal deadlines for submitting Form 4-FSS - a fine of 5% of the insurance premiums accrued over the last 3 months of the period. For failure to submit a zero report, a fine of 1000 rubles will be charged. (Clause 1 of Article 26.3 of the Law).

- Failure to comply with the EDI procedure is a fine of 200 rubles. (Clause 2 of Article 26.3 of the Law).

Additional liability is provided for by the Code of Administrative Offenses (Part 2, Article 15.33) - a fine of 300-500 rubles is levied on managers. The exception is individual entrepreneurs, to whom this rule does not apply (note to this article).

simplified tax system

Simplified people do not pay the most complex taxes: VAT, income tax and property tax. Only in exceptional cases can simplifiers become payers of these taxes (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

All workers and employees must submit data on insurance premiums. This means that they, just like companies on OSNO, will submit a new calculation to the Federal Tax Service in 2017.

Simplified workers also submit to the Federal Tax Service information on the average number of employees, accounting statements and income reports of employees and other individuals. persons according to forms 2-NDFL and 6-NDFL.

Connect reporting

Land and transport taxes are paid by those companies that have these taxable objects.

A specific report in this case is the annual declaration under the simplified tax system

.

Deadlines for the annual declaration under the simplified tax system in 2020

In order to meet the deadlines, you must send taxes and declare your activities before March 31, 2017 (Article 346.23 of the Tax Code of the Russian Federation).

Simplified tax advances are transferred to the account of the Federal Tax Service (Clause 7, Article 346.21 of the Tax Code of the Russian Federation):

- for the first quarter of 2020 - until April 25;

- for the first half of 2020 - until July 25;

- for 9 months of 2020 - until October 25.

Calculation of contributions and payments for 2020: who donates

Insurance premiums accrued for payments to individuals must be reported at the end of each quarter. For these purposes, a calculation is formed, approved by Order of the Federal Tax Service of Russia dated October 10, 2020 No. ММВ-7-11/551. The calculation of insurance premiums is intended to provide information to the tax authorities on the amounts of accrued and paid insurance premiums for health insurance, compulsory medical insurance, and VNIM (clause 3 of article 8, clause 7 of article 431 of the Tax Code of the Russian Federation). All policyholders submit calculations of insurance premiums to the Federal Tax Service, in particular:

- organizations and their separate divisions;

- individual entrepreneurs (IP);

- individuals who are not entrepreneurs;

- heads of peasant (farm) households.

It is important to say that if an organization or individual entrepreneur does not conduct any activities and does not pay salaries, and the only employee is the director, then it is also necessary to report and submit to the Federal Tax Service the calculation of insurance premiums for the 4th quarter of 2020. In such conditions, you need to submit a zero calculation. Otherwise, a fine is possible.

Annual calculation for the founding director

If the organization has at least one employee (for example, the general director is the only founder), then the calculation of insurance premiums for the 4th quarter of 2020 must be submitted. It’s just that accruals in favor of individuals in annual calculations for 2020 will be zero.

UTII

It is easier for companies in this special regime to maintain tax records, because the legislation allows them not to pay a number of taxes: on profit, on property and VAT (clause 4 of Article 346.26 of the Tax Code of the Russian Federation). Other taxes are paid on a general basis.

In addition to standard reports (see the list in the example about OSNO), they fill out a UTII declaration and send it to the Federal Tax Service.

Deadlines for UTII declaration in 2020

- for the fourth quarter of 2020 - until January 20;

- for the first quarter of 2020 - until April 20;

- for the second quarter of 2020 - until July 20;

- for the third quarter of 2020 - until October 20.

Advance payments are made quarterly before the 25th day of the month following the reporting period.

FSS

Since the FSS continues to administer contributions for “injuries”, the new calculation form (Appendix No. 1 to the order of the FSS of the Russian Federation dated September 26, 2020 No. 381) must be submitted to the FSS by 04/20/2017 on paper, by 04/25/2017 in electronic form .

Also, a mandatory annual report, which is submitted before April 17, 2017 , is confirmation of the type of activity (OKVED). After submitting an application and a certificate confirming the type of activity, the FSS sets the rate of insurance premiums “for injuries” Important! You must indicate the old OKVED.

What is zero ERSV?

Strictly speaking, there is no such thing as a 100% zero ERSV report. Even if there are dashes in the columns with salary accruals and contributions, the sheets with personalized information about employees will still be filled out. Even if there is only one employee, and that is the director.

This accounting data will be needed in the future by the Pension Fund for calculating length of service when assigning pensions to employees. This is also why you should pay close attention to filling out the zero ERSV.

Timely submission of the calculation will allow you to avoid a fine from the tax authorities: an ERSV not submitted or submitted on time will cost you 1,000 rubles.

Thus, a zero ERSV means a report that in the period for which the payer is reporting, taxable income to individuals was not accrued or paid. At the same time, there were individual workers themselves, and individual information was provided on them.

Features of filling out 6-NDFL

According to Art. 230 of the Tax Code of the Russian Federation, tax agents submit to the tax authority at the place of their registration the Calculation of the amounts of tax on personal income calculated and withheld by the tax agent (Form 6-NDFL). This document is provided within a certain time frame:

| Reporting period | Submission deadline |

| For the first quarter | No later than the last day of the month following the relevant period |

| For half a year | |

| In nine months | |

| In a year | No later than April 1 of the year following the expired tax period |

In the Calculation of the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the following data is indicated:

· income of individuals;

· tax deductions;

· Personal income tax.

In order to accurately fill out the Calculation of the amounts of personal income tax calculated and withheld by the tax agent (form 6-NDFL) for the 4th quarter of 2020, you need to pay attention to a number of factors:

| What should you pay attention to? | A comment |

| Form | Form 6-NDFL must be provided, current at that time |

| Tax period code | 34 |

| Transaction codes | Must be consistent with the operations performed |

| Sections of the declaration | Must be filled in with correct information |

| Registration of 6-NDFL | For each separate division - its own 6-NDFL form |

| Delivery method |

|

| Submission deadline | Until 04/01/2020 |

In accordance with Letter of the Ministry of Finance of the Russian Federation dated March 23, 2020 No. BS-4-11/4901 “On filling out and submitting calculations in Form 6-NDFL by a separate division of a Russian organization,” if a separate division of a Russian organization does not pay income to individuals, then There is no obligation to submit a calculation in Form 6-NDFL .