Need for use

The first legislative act within which these code designations were introduced was Order No. 5 of Rosstat, Federal Tax Service of the Russian Federation dated January 18, 2008 No. 5/MM-3-11/ [email protected] The purpose of issuing this legal act was to optimize cooperation between departmental structures . Just at this time, active work began to create a network space at the state level.

The Federal Tax Service, in turn, shared information about organizations that are taxpayers with Russian statistical authorities. In response to this, Rosstat sent a report submitted by these legal entities.

In order to ensure interaction at the regional level, each department received a code in accordance with the number of the Federal Tax Service at the territorial level. Currently, its use is widespread for providing electronic accounting reporting.

Pre-filling of forms is carried out in 1C. The TOGS code designation is displayed in the program interface directly in the card where the details are written.

The goal is to send reports to the required territorial unit and the possibility of acceptance by Russian statistical authorities. In most cases, the affixing of TOGS codes occurs automatically, based on the place of registration of the legal entity. If an error occurs, the system will notify you about it by sending the phrase “Recipient address not found .

This inaccuracy can be corrected as follows :

- Go to the “Directories and Accounting Settings” menu.

- Select the section called “Organizations”.

- Find the required company in the list.

- Select the “Statistics Codes” tab.

- Enter information about the required parameter.

- Save the entered information.

If reporting is submitted in paper format or in person, entering data on the TOGS code is not required.

How and where to find out the number

The legislation does not have separate regulatory frameworks containing all code designations of territorial structures. Order No. 5/MM-3-11/ [email protected] contains certain data, but it is not presented in full. For example, it does not take into account the fact that some departments are subsequently separated and form autonomous units. There is also no data on respondents from Crimea and Sevastopol.

Despite the lack of a list of current information, you can obtain information using several methods :

- Make a call to the territorial service of the Russian statistics body. The phone number is on the regional website of the FSGS structure.

- Contact the same organization in person. The address is registered on the official web resource.

- Visit the website of the regional division. This can be done by going from the main portal, finding it on the map, or entering the subject of the Russian Federation manually. After this, all you have to do is select the section with reports and the subsection with electronic documents. The next tab is “Providing statistics...”. The code can be on the page or in a file that can be downloaded.

- Apply the table indicating the TOGS codes. You can find it on the official Rosstat resource related to a particular territorial body.

- Call the support operator.

- Use a specialized service that includes a list of codes. The programs easily integrate with the 1C service.

If automatic code entry does not occur, a system error has occurred. You can fix it by contacting the operator's support service.

Change of place of registration of an organization

If a company changes its official registration address and moves to another constituent entity of the Russian Federation, the territorial division of Rosstat changes . In accordance with the norms of current legislation, a change of address is carried out through the Federal Tax Service. After completing this procedure, the new tax office informs Rosstat of the respondent’s arrival within 5 days.

If reporting is submitted to a new address, a different region code is indicated. Adjustments are reflected in 1C. Most often, firms agree to renegotiate the agreement, and the telecom operator synchronizes its client's accounting transactions with its own software.

If reporting is submitted on the FSGS website, the change is carried out independently. When changing the registration address within one subject of the Russian Federation, the code designation remains the same.

How to get statistics codes online by TIN for individual entrepreneurs and organizations? The answer is below in the instructions.

How to find out Rosstat department code

When the registration procedure is completed, the new entrepreneur or organization is assigned TIN statistics codes.

How can I find out my statistics codes? It’s not difficult to find out your codes. One way to find out this information is to submit a corresponding request to the tax office. When registering a new business, you can ask the tax office if they have the ability to issue this type of information.

In addition, you can find out the OKTMO code from the Notification of Codes issued by the territorial body of Rosstat. It can be generated online using the service posted on the Rosstat website.

You can find the website of the Rosstat authority for your subject of the Russian Federation in our directory (see link at the bottom of the page).

What do financial statements in TOGS consist of?

Accounting statements in TOGS are a package of documents, which include:

- Balance sheet;

- Income statement;

- Additional attachments to the above forms.

The list of reports required to be submitted is specified in Art. 14 No. 402-FZ, as well as in the Procedure approved by Rosstat Order No. 220 dated March 31, 2014.

Important! If the financial statements require a mandatory audit, then an audit report must also be submitted along with the specified documents. If a report to TOGS is provided by an NPO, then you will additionally need to attach a Report on the intended use of funds.

Who submits financial statements to TOGS

The obligation to submit reports to state statistics bodies is established by law dated December 6, 2011 No. 402-FZ “On Accounting” (Article 18). This regulatory act determines that all economic entities conducting accounting (except for the Bank of the Russian Federation and government institutions) must provide a copy of the report to TOGS.

The obligation to keep accounting is also regulated by Law No. 402-FZ (Article 6). Only individual entrepreneurs and branches (representative offices) of foreign organizations are exempt from accounting, subject to maintaining tax accounting.

Thus, those who submit financial statements to TOGS are all Russian legal entities (except for government agencies and the Central Bank of the Russian Federation).

As for entrepreneurs, they can keep records and submit reports to the tax authorities on a voluntary basis. This may be necessary, for example, if you need to provide a report to a bank or other investor. But in this case they do not have the obligation to submit a copy of the report to TOGS.

Financial reporting in TOGS - what is it?

The list of reporting forms submitted to statistics depends on the category of the company. In general, this is a balance sheet and a statement of financial results (Form 2) with appendices.

The currently valid forms of financial statements are approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Non-profit organizations, instead of Form 2, fill out a report on the intended use of funds.

The format of reports and the number of applications may also differ depending on the category of the enterprise. The following types of legal entities have the right to conduct accounting and submit reports in a simplified form:

- Small businesses.

- Non-profit organizations.

- Participants of the Skolkovo project.

These categories of enterprises have the right to fill out the balance sheet and Form 2 in a simplified form and not make attachments to them. However, the use of simplified accounting does not cancel the general requirements for reporting, in particular, for its completeness and reliability. Therefore, if two reporting forms are not enough for full disclosure of information about the company, the corresponding appendices should also be filled out.

In addition, there are a number of categories of legal entities whose reporting is subject to mandatory audit. They are listed in Art. 5 of the Law of December 30, 2008 No. 307-FZ “On Auditing Activities”.

- Joint stock companies.

- Companies whose securities are traded in organized trading.

- Organizations engaged in certain types of activities (for example, banks, insurance companies, non-state pension funds)

- Organizations providing consolidated reporting.

- Companies whose financial indicators exceed the following values:

- revenue for the year preceding the reporting year - more than 400 million rubles;

- balance sheet assets at the end of the year preceding the reporting year - more than 60 million rubles.

All listed organizations must include an auditor's report in their financial statements in TOGS for 2020.

Deadlines, procedure for provision, responsibility

The deadline for submitting reports to statistics is the same as to the tax authorities, i.e. three months after the end of the reporting year. Reports for 2017 must be submitted by 04/02/2018 due to postponement due to weekends.

The auditor's report may be prepared significantly later than the financial statements themselves. This is understandable - auditors need time to check, and if the company is large, then the verification process can be very lengthy. Therefore, the conclusion can be submitted “when ready” - within 10 days from the date of its signing. However, the law still sets a time limit for the work of auditors - the report must be submitted no later than December 31 following the reporting year.

The procedure for submitting reports to TOGS was approved by Rosstat order No. 220 dated March 31, 2014. This document provides for the following options for submitting a report:

- Directly to the statistical authorities.

- By mail (registered mail with acknowledgment of delivery).

- In electronic form via telecommunication channels (if the company has an electronic digital signature).

Regardless of the presentation format, reporting must contain the organization’s contact information.

Sanctions for violations of the procedure for submitting reports to TOGS are provided for in Art. 19.7 Code of Administrative Offenses of the Russian Federation. An organization is subject to a fine of 3 to 5 thousand rubles, and an official - from 300 to 500 rubles.

Rosstat Statistics codes: how to get them, why they are needed, how to use them

Obtaining statistics codes is not a mandatory procedure, and the notification itself is for informational and reference purposes only.

To receive a ready-made information letter with statistics codes, you must stand in line for an indefinite amount of time at two offices. Documents required to obtain statistics codes: TIN certificate, OGRN certificate, extract from the Unified State Register of Legal Entities, certified power of attorney from the general director of the LLC (if not received by the general director himself).

Statistical reporting helps businessmen in choosing reliable counterparties with a high level of profitability. With the help of Rosstat, companies receive data on the average salary in the industry, tax burdens, and maximum revenue amounts.

The money that the pension fund receives as contributions must be placed in state and commercial banks at cumulative interest. This allows you to receive income from activities, which is approximately 11% per annum.

Thanks to the successful activities of Rosstat, every resident of the Russian Federation has the opportunity to observe the progress of the country’s development, the ongoing transformations in it, the deterioration or improvement of the general situation in the state.

By contacting the territorial office of Rosstat. If tax inspectorate specialists have not issued the required notification, it is permissible to write a corresponding application to the statistics agency. It should be accompanied by copies of documents on state registration (they do not need to be certified), on the assignment of a TIN, as well as information from the Unified State Register. The founder’s responsibility is to provide a copy of the company’s Charter.

Date of approval of statements in the balance sheet

The electronic form of the balance sheet recommended by the Federal Tax Service contains the line “Date of approval of statements.” What date should I indicate in this line?

As you know, financial statements must be submitted to the Federal Tax Service and Tax Service no later than three months after the end of the reporting year (Clause 5, Clause 1, Article 23 of the Tax Code of the Russian Federation, Part 2, Article 18 of the Federal Law of December 6, 2011 N 402-FZ), i.e. no later than March 31 of the year following the reporting year. If March 31 falls on a weekend, the reporting deadline is postponed to the first working day following this date (clause 7, article 6.1 of the Tax Code of the Russian Federation, clause

7 of the Order, approved. Order of Rosstat dated March 31, 2014 N 220). So, for example, in 2020, financial statements must be submitted no later than 04/02/2018 (March 31 – Saturday). Consequently, if the organization manages to approve it before submitting the reporting to the regulatory authorities, then the date of approval is indicated in the corresponding line of the balance sheet. If the reporting has not yet been approved, then the line “Date of approval of reporting” does not need to be filled out.

Code of the territorial body of Rosstat Moscow

It follows from this that the demands of the above-mentioned organizations to provide information from state statistics bodies about OK TEI codes are unlawful.

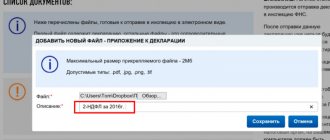

Submission of electronic reporting involves its generation in 1C, then uploading to the website of the Federal Service or to a special operator program.

Documents required to obtain statistics codes: TIN certificate, OGRN certificate, extract from the Unified State Register of Legal Entities, certified power of attorney from the general director of the LLC (if not received by the general director himself).

Republic of the Republic of Chuvashia 21-00 Chuvashstat Altai Territory 22-00 TOFSGS for the Altai Territory (Altaikraistat) Krasnodar Territory 23-00 Krasnodarstat (Krasnodar and Sochi) 23-99 Krasnodarstat (all areas except Krasnodar and Sochi)

Dzerzhinsky 50-12 Department of state statistics TOGS MO No. 12 (Egorievsk) Moscow region Egoryevsk 50-13 Department of state statistics TOGS MO No. 13 (Kotelniki) Moscow region Kotelniki 50-15 Department of state statistics TOGS MO No. 15 (city .

This can also be done through special services that connect to the official websites of the State Statistics Service. To do this, it is enough to know only the TIN, as well as the region in which the LLC or individual entrepreneur is registered.

To submit reports, you must register in the WEB collection system and download the necessary programs from the website of your territorial state statistics office.

Statistics codes are needed in many situations. For example, opening an account, opening a branch of an organization, changing its name or legal address. Statistics codes are also required when submitting reports, filling out receipts and payment orders. Also, the FSGS territorial body code will be needed when changing OKPO or TOGS in Moscow, for which you will need to indicate the new TOGS number.

Where to take it

Another frequently asked question is which statistical body to submit reports to? According to the rules, it must be submitted to the territorial statistics office at the place of registration of the legal entity. But very often the legal and actual addresses of the company are different, so another rule applies here: documents must be submitted at the address where the management body is located at the time of submission. If there is no governing body, then it is submitted to the location of another governing body.

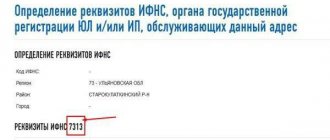

How to find out the code of the territorial body of Rosstat

According to No. 282-FZ of November 29, 2007, organizations, their branches and representative offices, individual entrepreneurs, authorities and management bodies are required to submit reports to the Federal State Statistics Service (Rosstat) at the place of registration. It is preferable to do this online, via telecommunication channels.

Most often, legal entities enter into an agreement with an intermediary operator and submit reports through it. If there is an enhanced digital signature, the company can send information independently using a web form on the Rosstat website.

Submission of electronic reporting involves its generation in 1C, then uploading to the website of the Federal Service or to a special operator program. The forms must contain the details of the organization, including the code of the territorial unit of Rosstat (TOGS, TOFSGS) to which the information is addressed. Related to this is the most common question that accountants have when preparing reports - how to find out the TOGS code?

Audit of financial statements

The financial statements of some organizations are subject to mandatory audit (Part 1, Article 5 of Federal Law No. 307-FZ of December 30, 2008). Such organizations, for example, include insurance companies. A complete list of cases of mandatory audit of financial statements for 2020 can be found in the Information of the Ministry of Finance.

If the accounting records of an organization are subject to mandatory audit, then in addition to the financial statements themselves, you must also submit an audit report to your Rosstat department (Part 2, Article 18 of Federal Law No. 402-FZ of December 6, 2011). It is served:

- or together with financial statements;

- or no later than 10 business days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year.

There is no need to submit an audit report to the Federal Tax Service.

Preparation of financial statements

Some organizations (for example, those related to SMEs) are allowed to present financial statements in a simplified form (Part 4 of Article 6 of the Federal Law of December 6, 2011 N 402-FZ). In this regard, financial statements can be divided into two types: regular and simplified.

Having received the organization’s financial statements, tax authorities analyze them. For example, the indicators of the income statement are compared with the data of the annual income tax return. Indeed, sometimes identified discrepancies may indicate that an organization has underestimated its income or overstated its expenses for tax purposes.

In addition, the balance of the organization is studied. So, for example, if an organization is a candidate for inclusion in the on-site inspection plan, inspectors look to see if the organization has fixed assets and other property from which it will be possible to recover the arrears that arose as a result of additional accruals based on the results of the inspection.

Often, many company managers have doubts about their partners in business projects, etc. You can find out how reliable a counterparty is by the information contained in its accounting reports. But how to get this information?

Let us remind you that legal entities report to tax authorities and State Statistics. The tax authority does not provide information about counterparties, but are financial statements contained on the Rosstat website and is it possible to obtain them? Yes, on the Rosstat portal you can obtain reliable financial information about the counterparty. To do this, you need to enter the partner’s data in the appropriate fields:

- taxable period;

- TIN;

- OKPO.

How to find out the Rosstat division code for individual entrepreneurs

If you would like to receive official clarification on an issue of statistical reporting that interests you, you can contact your department of the statistical agency or directly Rosstat. The request can be submitted in person to the office or sent by registered mail with a list of attachments. In the Krasnodar Territory, Kemerovo, Moscow, Rostov, and Saratov regions, there are several divisions of State Statistics (different codes) that control individual areas of the region.

This is due to the creation of information and reference products and is not organizational and administrative documentation OKUD (All-Russian Classifier of Management Documentation).

For the purpose of regional interaction, each FSGS department was assigned a code equivalent to the number of the territorial Federal Tax Service.

Types of classifiers

For the uninitiated citizen, these are just sets of letters. In fact, all these abbreviations mean different classifiers. They divide entrepreneurs into different categories.

The following classifiers exist:

- OKVED - types of activities that the management of each company must select when registering with the tax authorities. The tax regime, the need to obtain licenses and much more depend on this choice. Used to collect data by activity.

- OKATO - indicates the place where the business is located. This is the “registration” of the company. It is used to conduct statistical studies of enterprises in a specific region.

- OKTMO is the same as OKATO, it only divides enterprises according to their affiliation with municipalities.

- OKOGU are state enterprises.

- OKFS - diagnoses the form of ownership. This could be an individual entrepreneur or an organization.

- OKOPF - gives a classification of a company as a form of ownership. For organizations this can be LLC, CJSC, OJSC, etc.

- OKPO - shows the industry in which the organization operates. OKPO can only be changed if the organization’s profile is completely replaced.

As mentioned above, the state body Rosstat is responsible for all this data. Therefore, you need to go there for information. Rosstat databases are updated twice a month: in the middle of the month - on the 15th and at the end - on the 30th or 31st.

OKPO

Using this eight to ten digit number, it is easy to determine which industry the enterprise belongs to.

OKATO

It is easy to find out the location of the enterprise. The number has from 8 to 11 digits, which are used to gradually indicate territorial affiliation.

OKTMO

These numbers help speed up the processing of received information.

OKOGU

Here 5 symbols serve for trouble-free systematization of information about government departments.

OKOPF

This combination is intended to determine the legal form. It facilitates the analysis of information, serves as the basis for forecasting economic processes and developing proportional recommendations.

OKVED

Necessary to determine the specific type of activity of an organization or individual entrepreneur.

The main purpose of the all-Russian classifier of types of economic activities (this is how OKVED stands for) is to classify and code the economic direction in which the activities of a registered person will be carried out.

Be sure to read it! How to increase your pension: popular ways in 2020

This number is needed when collecting and analyzing information about activities in a certain area, to calculate the rates of collected taxes. Unlike other classifiers, legal entities and entrepreneurs select OKVED simultaneously with the collection of a full package of documents for registration.

Statistical codes are a specific digital combination from which you can obtain comprehensive information about an enterprise (as well as about an individual entrepreneur). All codes, grouped by class, are in one registry. Any number contains 5 or 6 digits. Using the codes, you can find out the main and additional types of work, regulate areas of the economy, and conduct statistical research.

Find out statistics codes online for free

Petrozavodsk 11-00 FSGS maintenance for the Komi Republic Komi Republic Syktyvkar 12-00 FSGS maintenance for the Mari El Republic Mari El Republic

On our website you will find all Rosstat statistics codes! Select your region in the menu on the left to receive statistics codes and print Notifications for your constituent entity of the Russian Federation (focus on the codes officially assigned to the regions).

You can request the necessary codes from the statistical reporting operator or the certification center where the company issued an electronic digital signature for sending documents via the Internet. Some of the operators post convenient interfaces on their websites with which you can find the required TOGS code.

Objective information about various processes can be obtained by statistics that systematize, generalize and compare various data. If the collection, recording, processing and analysis of information is carried out competently, then it becomes possible to look at situations from the most acute angle. In this case, physical, mathematical and economic methods are used.

It is preferable to do this online, via telecommunication channels. Most often, legal entities enter into an agreement with an intermediary operator and submit reports through it.