At the end of the tax period, individual entrepreneurs, as a rule, submit declarations to the tax office. In particular, individual entrepreneurs using the simplified tax system fill out a declaration regardless of whether income was received or not. This service can significantly simplify the maintenance of the simplified tax system. We recommend trying it to minimize risks and save your time.

If there is no income, entrepreneurs using the simplified tax regime submit a so-called zero declaration.

In our publication today, we will look at who can submit a zero declaration under the simplified tax system in 2020 for 2020, the rules and procedure for filling it out.

The essence of a zero declaration under the simplified tax system

In the legislation of the Russian Federation there is no such term as “zero declaration”. This concept is used among individual entrepreneurs.

A zero declaration under the simplified tax system for individual entrepreneurs is a document that reflects data for the tax period during which there was no movement of funds through the individual entrepreneur’s accounts. As a result, the formation of a tax base for calculating payments to the state is excluded.

Refusal to submit a declaration to the Federal Tax Service faces penalties, even if the individual entrepreneur did not operate.

A zero declaration under the simplified tax system is not an empty document. Calculation of tax according to the simplified tax system taking into account “net” income (when all expenses are taken away) leads to the formation of losses (for the past year). Despite the presence of losses, the individual entrepreneur will still have to pay a tax of 1% (of income).

The only exception can be an individual entrepreneur who uses income as an object of taxation. Lack of income in this case does not imply payment of individual entrepreneur tax.

Despite the lack of income, the individual entrepreneur is obliged to make certain payments to the budget in any case. Such payments include mandatory fixed contributions of individual entrepreneurs for themselves for pension and health insurance.

The amount of these payments increases annually with the following dynamics:

- In 2020, the amount of fixed contributions for these purposes was 32,385 rubles. Including 26,545 rubles for pension insurance and 5,840 rubles for medical insurance.

- In 2020, the amount of fixed contributions increased and was already 36,238 rubles (29,354 for pension insurance; 6,884 for medical insurance).

- In 2020, there will be another increase in the size of fixed contributions. The total amount of contributions payable in 2020 will be 40,874 rubles, including 32,448 rubles for pension insurance and 8,426 rubles for medical insurance.

What are the deadlines and methods for submitting zero reporting?

The deadlines for submitting a zero declaration under the simplified tax system are the same as for submitting a regular declaration that has data to fill out. That is, the declaration for 2020 must be submitted by:

- companies - until March 31, 2020;

- IP - until April 30.

NOTE! In connection with the introduction of a non-working day regime from March 30 to April 30, 2020, the deadline for submitting a declaration under the simplified tax system for 2019 was extended until 06/30/2020 for organizations and until 07/30/2020 for individual entrepreneurs (see Government Decree dated 04/02/2020 No. 409). Read more about this here.

Read more about the deadlines for submitting a declaration under the simplified tax system here.

How to submit a zero declaration 2020 for an individual entrepreneur using the simplified tax system or a legal entity using the same regime? In the usual way, choosing any of the available methods:

- electronic;

See: “Procedure for submitting tax reports via the Internet.”

- by post;

- personally.

When sending it in person, a copy is made, on which the inspector receiving the report affixes a stamp confirming its timely submission.

Instructions for filling out a zero declaration of the simplified tax system

Please note that when filling out a declaration under the simplified tax system in the event of no income, calculation of the total amounts is not provided. Paid insurance fixed contributions for medical and pension insurance are not reflected in the zero declaration of the simplified tax system.

General rules for filling out declarations, including a zero declaration of the simplified tax system:

- all words are written in capital block letters; when generating a report on a computer, Courier New font (16-18 height) is used;

- monetary amounts are indicated exclusively in full rubles without kopecks (rounding according to the arithmetic rule);

- use black paste;

- blots and corrections are unacceptable;

- each letter is written in a separate box;

- put dashes in unfilled cells;

- if the amount is zero, a dash “-” is also added;

- The report cannot be flashed.

Filling out page 1:

1. First, fill out the “TIN and KPP” columns (individual entrepreneurs fill out only the TIN column).

2. In the “Adjustment number” column, enter “0” if the declaration for the tax period is submitted for the first time; "1", "2", etc. — put if the previously submitted declaration is updated;

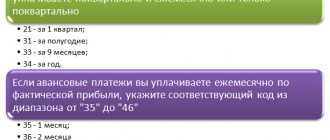

3. In the “Tax period” column the following is entered:

- "34" (meaning year);

- “50” – if the individual entrepreneur ceases business;

- “95” – if the individual entrepreneur switches to another taxation system;

- “96” - if the individual entrepreneur ceases the activity in relation to which the simplified tax system was applied, but will not cease its activity at all.

4. In the column “Reporting year” the year of filing the declaration is indicated.

5. Next, indicate the tax authority code.

6. The full name of the individual entrepreneur is indicated (if an organization, indicate its name).

7. Rosstat data is entered in the “OKVED” column.

8. In the “Reliability...” section, information about the director of the enterprise is entered.

9. The “Date” column is filled in and signed by the responsible person.

10. A stamp is placed (on the title page).

COMPLETING SECTION 1.1

SECTION 1.1 - “the amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (object of taxation - income), subject to payment (reduction), according to the taxpayer,” is filled out by individual entrepreneurs who pay % of total income. The maximum tax rate is 6%.

1. "TIN". Enter the individual entrepreneur's TIN from the taxpayer's registration certificate. 2. Page number 002. 3. Code according to OKTMO - line code 010. The code of the locality in which the entrepreneur lives is indicated, according to the all-Russian classifier of municipal territories. There are eleven cells in this field. but, if the code is eight-digit, then dashes are placed in the remaining three cells. 4. Lines 020 – 110 - dashes are added in each cell. 5. At the bottom of the page, the individual entrepreneur or his representative puts a signature and date.

COMPLETING SECTION 1.2

Section 1.2 - “the amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (the object of taxation is income reduced by the amount of expenses), and the minimum tax subject to payment (reduction), according to the taxpayer.” Fill out individual entrepreneurs who work on the simplified tax system for income minus expenses. Maximum rate 15%.

1. “TIN” is entered into the individual entrepreneur’s TIN from the taxpayer’s registration certificate. 2. Page number 002. 3. OKTMO code - line code 010. indicates the code of the locality in which the entrepreneur lives, according to the all-Russian classifier of municipal territories. There are eleven cells in this field. but, if the code is eight-digit, then dashes are placed in the remaining three cells. 4. Lines 020 – 110 - dashes are added in each cell. 5. At the bottom of the page, the individual entrepreneur or his representative puts a signature and date.

COMPLETING SECTION 2.1.1

SECTION 2.1.1 - “calculation of tax paid in connection with the application of the simplified taxation system (object of taxation - income).” This is the third sheet of the declaration. It must be filled out by individual entrepreneurs using the simplified tax system for income.

1. We also put down the TIN at the top, with dashes on the checkpoint line; 2. Page number “3”; 3. Line 102 – taxpayer attribute:

- “1”—the individual entrepreneur hired workers in the reporting year;

- “2” - the individual entrepreneur did not use hired labor.

4. Lines 110 – 113, 130 – 133, 140-143 - add dashes;

5. Lines 120 - 123 - you must enter the tax rate (maximum 6).

COMPLETING SECTION 2.1.2

Section 2.1.2 - “calculation of the amount of trade tax that reduces the amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (object of taxation - income), calculated based on the results of the tax (reporting) period for the object of taxation depending on the type of business activities in respect of which a trade tax has been established in accordance with Chapter 33 of the Tax Code of the Russian Federation.” Fill out individual entrepreneurs on the simplified tax system for income.

This section contains 2 sheets. Similarly with the previous sheets, indicate the TIN and dashes in the checkpoint line. The page numbers are “4” and “5” respectively. Next, put dashes in all lines.

COMPLETING SECTION 2.2

Section 2.2 - “calculation of the tax paid in connection with the application of the simplified taxation system and the minimum tax (the object of taxation is income reduced by the amount of expenses).” Filled out by individual entrepreneurs who use the simplified tax system for income minus expenses.

Similarly with the previous sheets, indicate the TIN and dashes in the checkpoint line.

- in lines 210-253, 270 – 280 - put dashes;

- in lines 260 – 263 - indicate the tax rate (maximum 15%).

What is the penalty for failing to submit a zero declaration?

At first glance, the fine for not filing a zero declaration is small - 1000 rubles. Moreover, Article 119 of the Tax Code of the Russian Federation provides for a more serious sanction for violating the deadline for submitting tax reports - from 5% to 30% of the amount of tax unpaid according to the declaration. And considering that there is no data on income in the zero declaration of the simplified tax system, then there is no arrears here.

But the fact is that if the delay in submitting reports exceeds 10 days, the Federal Tax Service has the right to suspend operations on the individual entrepreneur’s current account. Of course, this measure is not particularly effective if the entrepreneur’s business does not work or there is no current account at all.

It’s worse if an individual entrepreneur operates on a different taxation system and has a valid current account. Then an unsubmitted zero return under the simplified tax system will greatly complicate running a business, even if the entrepreneur reported on time under another tax regime.

In addition, until 2020, the Pension Fund of Russia issued an invoice for the maximum possible amount of insurance premiums to an entrepreneur from whom a declaration was not received. For example, for 2020 it was the amount of 154,851 rubles. Now this norm has been abolished, but it cannot be guaranteed that the Federal Tax Service will not introduce it again to discipline taxpayers.

This might also be useful:

- The procedure for filling out a zero declaration according to the simplified tax system for individual entrepreneurs

- Unified simplified tax return 2020

- Rules for filling out the UTII declaration for individual entrepreneurs in 2020

- What taxes does the individual entrepreneur pay?

- simplified tax system for individual entrepreneurs in 2020

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

General rules for filling out reports

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

Reports submitted by taxpayers are scanned and automatically entered into a special program. To simplify the program’s recognition of data, tax authorities have made recommendations regarding filling out reporting forms. You need to familiarize yourself with them before filling out a zero declaration for an individual entrepreneur.

These rules are as follows:

- all words are written in capital block letters; if the report is prepared using computer technology, choose the Courier New font (16-18 height);

- amounts are indicated exclusively in full rubles;

- It is advisable to use black paste, but blue (purple) will also work;

- blots and corrections are unacceptable, corrector cannot be used;

- each letter is written in a separate box;

- put dashes in unfilled cells;

- if the amount is zero, then instead of “0” also put a dash “-”;

- The report cannot be flashed.

You can download the zero declaration form for individual entrepreneurs 2020 on our website. Depending on the taxation system, entrepreneurs are provided with:

- declaration according to the simplified tax system;

- UTII declaration;

- OSNO declaration;

- VAT declaration.

Comments

View all Next »

Alina 04/29/2015 at 05:46 pm # Reply

020 - indicate: object of taxation “income” - 182 1 05 01011 01 1000 110; object of taxation “income minus expenses” - 182 1 0500 110. And in the declaration: 020 this is “The amount of the advance payment due no later than the twenty-fifth of April of the reporting year p. 130 - p. 140 section. 2.1"

Olga 12/07/2015 at 02:08 # Reply

Good afternoon When filling out a zero declaration, the Russian language changes to symbols. How to fill it out correctly? Thank you

Natalia 12/07/2015 at 10:09 am # Reply

Olga, download in Excel format, I just checked, it is filled out in Russian.

Makism 03/07/2016 at 10:42 am # Reply

Hello! Can you help me if the declaration has not been filed for 4 years due to circumstances that the tax office does not understand (personal). How can I submit a zero declaration for all these years (the individual entrepreneur collapsed long ago, so there were no income or expenses, debts only accumulated in the pension). The tax filing date for all years will be fresh, that is, this year, but for all 4 or you need to register exactly the 13th year, 14th, 15th, 16th (that is, it turns out retroactively). And can you submit, for example, 1 declaration per year or will there be several of them per year (do you need to write down all the details quarterly)?

Natalia 03/08/2016 at 09:53 # Reply

Maxim, good afternoon. It is necessary to submit a separate declaration for each year, indicating in each of them the year for which it is submitted: 2013, 2014, etc., it is too early to submit for 2020. The simplified tax system declaration is submitted once a year until April 30 of the year following the reporting year. The filing date in each declaration is set to the date on which you will file. For each failed declaration, you will need to pay a fine of 1,000 rubles. If the declaration is zero, then there will be no penalty.

ALINA 03/12/2016 at 05:39 pm # Reply

Good afternoon. When filling out the simplified tax system declaration for 2020, the following picture is obtained: line 130=2310; str131=6210; str132=15990; p133=21210. Line 140=5568 (contributions to the Pension Fund); str141=11136; str142=16704; line 143=32272 (contributions to the Pension Fund + advance payment according to the simplified tax system). Accordingly, when calculating str020=-3258. What should I reflect on line 20 and how should I fill in all the other lines?

Regita 03/19/2016 at 12:47 # Reply

Hello. I have the following question for you: is it necessary to file a declaration if you were registered as an individual entrepreneur on 08/03/2015 and immediately after receiving the individual entrepreneur certificate, you filed an application for a patent, which was received only on 09/01/2015? There was no activity in August. Thank you.

Natalia 03/19/2016 at 01:57 pm # Reply

Regita, good afternoon. If you have not submitted an application for the application of the simplified tax system, if you have submitted an application for the PSN no later than 30 days after the date of registration of the individual entrepreneur, then you do not need to submit a declaration. If before submitting an application for the simplified tax system you submitted an application for the use of the simplified tax system, then you must submit a declaration of the simplified tax system by 04/30/2016. If the application for PSN was submitted by you after 30 days from the date of registration of the individual entrepreneur, this means that before receiving the patent you were registered on OSNO, therefore, you must submit 3-NDFL and a VAT return.

Elena 03/23/2016 at 10:04 # Reply

Natalia, good afternoon. And I have an almost similar situation. patent since February 2, individual entrepreneur registered since January 10. As I understand it, I need to submit a declaration - there were no activities in January, an application was written for the simplified tax system. So the question is: submit a zero declaration? or write for the whole of 2020 (there was a patent since February)?

Natalia 03.23.2016 at 14:15 # Reply

Elena, you need to submit a zero declaration for the entire 2015.

Albert 03/23/2016 at 08:44 pm # Reply

Which TIN should I put?

Hello! Tell me, please, is the tax authority’s TIN and KPP entered on all sheets or your own?

Natalia 03.23.2016 at 21:58 # Reply

Albert, good evening. You put your TIN on all sheets of the declaration, but the individual entrepreneur does not have a checkpoint.

Svetlana 03/24/2016 at 14:09 # Reply

Hello!

The individual entrepreneur had no activities, no income, the system produced income. Contributions to the Pension Fund were paid, do they need to be reflected in the declaration?

Natalia 03.24.2016 at 18:52 # Reply

Hello Svetlana! No, you do not need to report contributions on your return.

Tatyana 04/06/2016 at 09:52 # Reply

Hello. An LLC was opened in January 2020. simplified tax system 6%. No activity yet. You need to submit quarterly zero reporting. Please tell me which form to fill out.

Natalia 06/27/2016 at 16:59 # Reply

Tatyana, the simplified tax system declaration is submitted once a year, and not quarterly.

Elena 04/18/2016 at 12:34 pm # Reply

Hello. Please tell me if the individual entrepreneur did not conduct business, but paid expenses on the current account into the current account. How to fill out the declaration correctly. Income - expenses system. Thank you

Natalia 06/27/2016 at 16:56 # Reply

Elena, how to fill out the declaration correctly is written in the article to which you wrote a comment. If there is no income, put “0”. But you had to pay your contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund on time.

Svetlana 05/22/2016 at 01:30 pm # Reply

Where in your form 020 - indicate: the object of taxation “income” - 182 1 0500 110; object of taxation “income minus expenses” - 182 1 0500 110? You don’t have a line for KBK in your declaration!!! Neither in Excel nor in PDF

Natalia 06/27/2016 at 16:52 # Reply

Svetlana, good afternoon. The object of taxation is indicated in section 1.1, line code 001. BCC is not indicated in the declaration.

View all Next »

General filling recommendations

Tax return for individual entrepreneurs simplified 2020 zero is filled out in accordance with the established rules, including those that are generally accepted when preparing reports of any form:

- enter information only in printed capital letters (when filling out manually) or Courier New font size 18 (when filling out electronically);

- amounts must be indicated in full (general mathematical rules are used when rounding), without kopecks;

- black ink is used for filling;

- It is prohibited to correct errors or make mistakes;

- a separate cell is provided for each letter;

- Empty cells cannot be left; empty cells must be filled in with dashes;

- the field for entering checkpoints is filled in with dashes;

- if the amount is zero, a dash is entered;

- pages are numbered on a continuous basis;

- no flashing required.

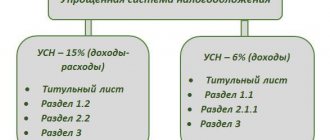

Entrepreneurs using the simplified tax system “income” fill out sections 1.1 and 2.1.1- 2.1.2, and the simplified tax system “income minus expenses” – 1.2 and 2.2. All entrepreneurs fill out the title page.

A common question is whether a stamp is needed on an individual entrepreneur’s declaration. Entrepreneurs are allowed to carry out activities without using a seal; therefore, even taking into account the presence of a seal in the declaration, the individual entrepreneur has the right to affix only a signature.

What does zero reporting include?

The need to submit zero reporting for individual entrepreneurs is due to the fact that it is on the basis of these documents, drawn up by the entrepreneur himself, that the state, represented by the inspections of the Federal Tax Service (FTS), determines whether he has correctly calculated and paid the tax.

The recipient of zero reporting is the tax office

Entrepreneurs often think that if they have no profit and the base on which the tax is determined is zero, then they have nothing to report. However, it is not.

Zero reporting usually means tax reporting . An entrepreneur must report to the Federal Tax Service on taxes and insurance contributions. And it is also necessary to submit calculations to the Pension Fund (PFR), Social Insurance Fund (SIF), and in some cases, statistical authorities. But these forms have their own specifics, as a result of which there is no need to talk about zero reporting in relation to them:

- An entrepreneur is required to make payments for himself to the Pension Fund and submit reports on them, regardless of the financial result, and the amount of payments for businessmen with an income from zero to 300,000 rubles per year is fixed;

- obligations to make contributions to the Pension Fund and the Social Insurance Fund for hired workers and to report on this are determined solely by the availability of personnel, and if there is none, there is nothing to report on.

In turn, the set of documents that includes the tax reporting of an entrepreneur is determined by the taxation system he applies.

Today, the following tax system options are available to individual entrepreneurs:

- general (OSNO);

- simplified (USN);

- unified tax on imputed income (UTII);

- single agricultural tax (USAT);

- patent.

Zero reporting is usually submitted by individual entrepreneurs to OSNO and simplified tax system

A complete set of reports may include:

- declarations on taxes paid in accordance with the chosen taxation system;

- book of income and expenses.

The income and expense accounting book is filled out by all entrepreneurs, except UTII payers. In 2020, KUDiR can be maintained electronically and does not need to be certified by the tax office. But be prepared to present the KUDiR in printed form at the first request of the tax office. It is not necessary to certify the paper version with the IP seal.

In a narrow sense, tax reporting in general and zero reporting in particular means only documents that are subject to submission to the Federal Tax Service inspection within the prescribed period, that is, tax returns. But it is also necessary to keep a book of income and expenses.

In 2020, entrepreneurs using OSNO and simplified tax systems are recommended to maintain KUDiR

Zero reporting forms

There are no separate forms for zero reporting of individual entrepreneurs in 2020. Most often, a standard declaration form is used for the corresponding type of tax, but the columns allocated to indicate income reflect their absence.

To submit zero reporting, a standard tax return form is used.

However, if the entrepreneur:

- is recognized as a taxpayer for one or more taxes;

- does not carry out operations that result in the movement of funds in his bank accounts (at the organization’s cash desk);

- and has no objects of taxation for these taxes...

... then he can submit a single (simplified) tax return for these taxes.

With the book of income and expenses for those who must fill it out, the situation is similar: it also reflects the lack of income.

The Tax Code of the Russian Federation does not contain the concept of zero reporting at all. And in everyday life, this phrase means a declaration with zero income indicators.

Zero reporting on OSNO

An individual entrepreneur using the general taxation system must submit two documents to the tax office:

- declaration on payment of personal income tax form 3-NDFL;

- value added tax (VAT) declaration.

If the reporting is submitted as zero, only the title page is filled out in both declarations. In section 1, the following are indicated in the appropriate columns OKTMO and KBK: 18210301000011000110 for VAT and 18210102020011000110 for personal income tax. The remaining lines must be filled with dashes.

The VAT return is submitted quarterly by the 25th day of the first month of the new quarter. Form 3-NDFL - once a year until April 30 of the following year.

Zero reporting under simplified tax system

With a simplified taxation system, tax reporting subject to submission to the Federal Tax Service is limited to a single tax declaration in connection with the application of the simplified tax system. It is submitted once a year - until April 30 of the following year.

The procedure for filling out a zero declaration is the same as for individual entrepreneurs on the general system:

- the title page is filled out;

- OKTMO is entered in section 1.1 and the taxpayer attribute and the rate for the object in section 1.2 for those paying 6% of income;

- those paying 15% of the difference between income and expenses indicate OKTMO in section 1.2 and the tax rate in the corresponding paragraphs of section 2.2;

- dashes are placed in all other columns.

Zero reporting for UTII and patent

A feature of these tax regimes is that zero reporting is impossible in principle. After all, the specificity of UTII and patents is that entrepreneurs using these taxation systems transfer UTII or the cost of the patent to the budget, regardless of their financial results.

An individual entrepreneur with a patent does not have to submit any tax returns. His obligations in this regard are limited to timely payment of the cost of the patent and maintaining a ledger of income and expenses. With its help, tax authorities will be able, if necessary, to check whether the income of such an entrepreneur has not exceeded the maximum barrier, after which the right to use the patent is lost.

As for UTII payers, they are required to submit a declaration every quarter before the 20th day of the first month of the next quarter and transfer tax to the budget by the 25th. Including for reporting periods in which they had no profits or did not operate.

Let us emphasize: even if no activity was actually carried out and real income for the period was zero, the single tax is paid based on the potential income received (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Accordingly, it is impossible to submit a zero declaration and not pay UTII (Letters of the Ministry of Finance dated September 14, 2009 No. 03–11–06/3/233, dated July 2, 2012 No. 03–11–11/196).

Photo gallery: UTII declaration for individual entrepreneurs

Sheet 1 of the UTII declaration is the title page; the full name of the entrepreneur and address are indicated on it

UTII declaration: sheet 2 contains the amount of imputed tax broken down by OKATO codes

UTII declaration: sheet 3 shows the calculation of tax amounts for certain types of activities

UTII declaration: sheet 4 shows the amount of insurance contributions by which the amount of tax payable is reduced

General rules for filling out the declaration

Reporting when closing an individual entrepreneur - how to submit it to the Federal Tax Service

There are general rules for filling out the declaration. Initially, you need to know that a zero declaration is not submitted if employees work in an individual enterprise. Be sure to carefully indicate the entrepreneur’s identification data:

- Personal data of an individual entrepreneur.

- OKTMO, INN, KBK, KPP - identifiers.

- Registered OGRNIP or OGRN numbers.

- Codification according to OKVED.

- Declaration sequence number (for example, primary - 0).

- The period for which the report is provided (50 if the enterprise is liquidated, 34 for the full year).

- Code of the tax service department to which the report is submitted. They are listed on the Federal Tax Service portal.

- The direct object for which tax is paid.

Note! Dash marks must be placed in those chapters that are intended for the results of financial and economic activities.

It is worth noting that the tax rate is still indicated according to the current taxation scheme.

The second sheet contains information about the applicant, respectively, about the individual entrepreneur.

Each new sheet is endorsed by the signature of the individual entrepreneur. The date must be included. Submission is also possible in electronic form, but for this you need to use an electronic digital signature.

Sample filling