Features of the UTII declaration

A UTII declaration is, in essence, a statement from the taxpayer about why he chose this taxation regime and what indicators he uses when calculating the tax. If a taxpayer pays UTII, he is obliged to submit a declaration for this tax (subclause 4, clause 1, article 23, clause 1, article 80 of the Tax Code of the Russian Federation).

At the same time, imputed income, which is the object of taxation under this regime, is calculated based on potentially possible, and not actually received, income (paragraph 2 of article 346.27, paragraph 1 of article 346.29 of the Tax Code of the Russian Federation). Consequently, the tax return must be completed taking into account possible income.

The presence or absence of real income of the “imputed” person does not affect the amount of UTII. In any case, the tax must be calculated on the basis of available physical indicators.

Thus, the UTII payer must pay a single tax, calculated in the declaration based on physical indicators.

Declaration on UTII for the 3rd quarter of 2020: sample of filling out a new form

Valid form (approved)

In order to simply not waste time and effort proving your case in court, it would be more advisable to submit an application to the Federal Tax Service at the place of registration within five days to remove the payer from the imputed tax. When drawing up an application, you should indicate the date of actual termination of the UTII details. by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/)Title pageBarcode0291 40150291 6019Section 1 “UTI amount subject to payment to the budget”Barcode0291 40220291 6026Page. 010 Code according to OKTMOStr. 020 Amount of UTII payableSection 2 “Calculation of the amount of UTII for certain types of activities”Barcode0291 40390291 6033Page 010Code of type of business activityPage. 020Address of place of business activitiesPage. 030 Code according to OKTMOStr. 040Base profitability per unit of physical indicator per monthPage.

050 Correction coefficient K1Str.

060 Correction coefficient K2Str.

070Tax base in the 1st month of the quarterPage. 080Tax base in the 2nd month of the quarterPage. 090Tax base in the 3rd month of the quarterPage.

100Tax base in totalPage. 105Tax ratePage.

110Amount of calculated UTIISection 3 “Calculation of the amount of UTII for the tax periodBarcode0291 40460291 6040Page. 005Taxpayer signPage.

Lack of activity by the “imputed” person is not a reason to submit a zero declaration

If the “imputed” person has ceased to conduct business, he needs to write an application to the tax office about deregistration as a UTII payer.

Look for forms in the article “Deregistration of UTII: conditions and terms.”

Without such an application, he will have to submit a UTII declaration, completed and with the tax calculated for payment. Since the taxpayer still has physical indicators, this is considered the basis for calculating imputed income and, accordingly, tax.

Filing a zero UTII declaration in this situation is illegal. This is the unanimous position of officials and judges (see letters of the Ministry of Finance dated July 2, 2012 No. 03-11-11/196, dated February 10, 2012 No. 03-11-06/3/8, resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 23, 2013 No. F03- 6469/2013, left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated February 26, 2014 No. VAS-1903/14).

How not to pay UTII if your business is stopped due to coronavirus, find out in the material from ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Zero declaration

Legal entities and individual entrepreneurs registered with the Federal Tax Service as payers of UTII submit a declaration quarterly. In 2020, a new declaration form was approved with amendments and modifications. There is no special form for zero reporting.

The actual income from the activity does not matter. The tax amount is based on established coefficients and physical indicators. It is this circumstance that creates controversy about the need to submit zero reporting. Even in the absence of activity, a single tax must be paid based on basic income and physical indicators.

There are no physical indicators: is it possible to submit a zero declaration?

If the UTII payer does not conduct business due to the loss of physical indicators (for example, when carrying out retail trade, he terminates the lease agreement for his retail space), when submitting the declaration, one must be guided by the explanations of the regulatory authorities. And they are ambiguous.

Thus, the Ministry of Finance insists that the filing of zero declarations on UTII is not provided for by the legislation of the Russian Federation. In his opinion, the “imputed person” must submit to the tax authorities a declaration with the amount of tax calculated for payment, even in the absence of physical indicators (letters dated 04/15/2014 No. 03-11-09/17087, dated 07/03/2012 No. 03-11-06/ 3/43).

In this case, the Ministry of Finance, in letter No. 03-11-09/53916 dated October 24, 2014 (hereinafter referred to as letter No. 03-11-09/53916), proposes to fill out a declaration based on the indicators specified in the last UTII declaration submitted to the tax authorities. This letter also provides an example of the procedure for filling out the declaration. So, if it is impossible to indicate in the declaration a physical indicator for the first month of the quarter (the lease agreement for the retail space was terminated), this indicator must be taken from the last submitted declaration. In the next months of the quarter, when the lease agreement has already been concluded, the indicators are reflected on the basis of the new agreement. Thus, physical indicators must be indicated in the UTII tax return for each month of the quarter.

The Federal Tax Service indicates the following: if the ownership or use of property necessary for this activity is terminated, then there are no physical indicators for calculating UTII. In this case, the amount of UTII payable for the corresponding tax period will be 0 rubles (see Information dated September 19, 2016).

You can learn about the calculation of physical indicators in retail trade from the material “How to calculate the area of a sales floor for the purposes of applying UTII?”.

What is a physical indicator for UTII, and how can it be missing?

The physical indicator is used to determine the quantitative parameters of activity under UTII. Depending on the type of activity, this could be:

- sales area - measured in sq. meters;

- number of seats - when transporting passengers;

- the number of vehicles involved - during cargo transportation;

- number of employees involved - courier delivery, veterinary services, etc.;

- number of vending machines;

- and etc.

In theory, if the physical indicator is zero, the individual entrepreneur cannot work. This means, in accordance with the position of the Ministry of Finance, the single tax payer must simply be deregistered on the basis of Article 346.28 of the Tax Code of the Russian Federation. From the moment registration is terminated, you don’t have to pay tax, and before that time you need to submit a UTII declaration, and not a zero one - the document needs to reflect the amount of tax calculated based on the value of the last valid physical indicator. (letters from the Ministry of Finance dated October 24, 2014 No. 03-11-09/53916, dated April 29, 2015 No. 03-11-11/24875).

But it turned out that if the physical indicator was reset not by the will of the payer, but against it, it is possible to submit a zero declaration. This can happen if the individual entrepreneur has lost the right to own or use the property necessary to conduct business on UTII. For example, breaking a lease agreement for a single retail pavilion at the initiative of the landlord. In such a situation, the Supreme Court allowed the individual entrepreneur to submit a zero declaration on UTII.

What are the risks of filing a zero UTII return to the tax authorities?

Based on the inconsistency of the above explanations, as well as established judicial practice, filing a zero UTII return is fraught with claims from the tax authorities.

Inspectors, following the explanations from letter No. 03-11-09/53916, will most likely charge additional tax based on the physical indicators given in the last submitted UTII declaration. In addition, they will charge penalties for late payment of taxes and may impose fines.

If the taxpayer’s physical indicators are preserved, then according to the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 157, the court decision will definitely be in favor of the tax authorities. In the absence of physical indicators, you can try to challenge the additional assessed tax amounts, but there is no guarantee that the court will side with the taxpayer. As examples of disputes won by taxpayers, let us cite, perhaps, the resolution of the Arbitration Court of the West Siberian District dated August 17, 2016 No. F04-3635/2016 and resolution 12 AAS dated November 21, 2014 3 A12-15103/2014.

Negative position of the courts on zero declaration

The negative position of the Supreme Arbitration Court was expressed:

These documents state that the absence of a taxable object cannot relieve the taxpayer from the obligation to file a zero return.

Important! The conclusion made in the review is clear. A temporary suspension of work or provision of services does not cancel the status of a UTII payer and does not eliminate the obligation to pay it.

Following the recommendations from letter No. 157, the courts began to make decisions not in favor of taxpayers. As an illustration we can give:

- appeal ruling of the Sverdlovsk Regional Court dated July 27, 2016 in case No. 33a-11886/2016;

- Resolution of the Federal Antimonopoly Service of the West Siberian District dated June 29, 2015 in case No. A31-7936/2014.

Note! The courts considered it legal even to issue an order to the taxpayer to correct the declaration, to draw it up according to the calculated indicators, if he, without removing the business from tax registration, did not actually conduct business and submitted a zero declaration in confirmation of this (resolution of the Arbitration Court of the Far Eastern District dated 10/08/2014 in the case No. A51-37897/2013).

Application for deregistration - solution to the problem

The most reliable way to avoid a conflict with regulatory authorities is to submit to the inspectorate, in the absence of activity, an application for deregistration as a UTII payer. Then no declarations will be required - neither zero, nor with accrued taxes.

You can read about how a taxpayer is deregistered in the article “What is the procedure for deregistering a UTII payer who has ceased activity?”

Many letters from officials and judicial acts were issued before 2013, when taxpayers were required to apply UTII if their activities met the criteria of this regime (Chapter 26.3 of the Tax Code of the Russian Federation). But it can be assumed that the conclusions made in these letters and decisions regarding the submission of a non-zero or zero UTII declaration in the absence of activity have not lost their relevance at the present time.

More information about the types of “nulls”

Zero balance sheet

Small businesses submit a special report entitled “Accounting (financial) reporting for small businesses.” This is a regular balance sheet and income statement, but more concise in form. However, it cannot indicate that . As a rule, the accountant indicates the authorized capital of the organization. A copy of the report must be sent to Rosstat.

Single simplified tax return

A simple two-page report. On the title page you need to indicate the details, and then fill out a table with a list of all taxes that the EUND replaces. It is necessary to observe the order of priority of the articles of the Tax Code of the Russian Federation, and indicate the article numbers themselves in the column on the right. When sending a declaration by mail, be sure to make an inventory of the attachment.

Zero income tax return

Declarations are submitted five times a year - based on the results of quarters and the year. In electronic and paper form, by mail or through the window. Only fill out the title page, and put dashes in sections 1 and 2. If income and expenses for the year are equal, profit and tax will be zero. However, in this case, the declaration is not considered “null” - it must be filled out as usual.

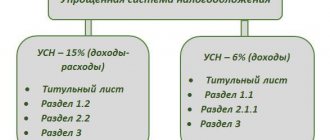

Zero declaration according to the simplified tax system

The title page and section 1 (KBK, OKTMO) are filled out. The tax office checks it most often. This is done using a regular request to the bank. They can check the card and account of an individual: if movement of large sums is recorded, most likely, you will be sent a request for explanation.

Report to the Pension Fund

Standard reporting according to the RSV-1 form. It contains the title page, sections 1 and 2. If hired employees were on maternity leave, maternity leave, leave without pay with the code “ADMINISTER”, individual information about the employees is submitted along with the RSV-1 form. The documents indicate the length of service of the staff and zero amounts of payments.

Report to the FSS

Standard report on Form 4-FSS. The accountant’s task is to fill out the title book, as well as tables No. 1, 3, 6 and 7.

UTII without employees and without income: what kind of reporting is submitted?

If the UTII payer did not receive income during the reporting period, can he submit a zero declaration form, which is typical for other taxation systems - OSN or USN? The Tax Code contains neither instructions on the possibility of filing zeros for UTII, nor a direct prohibition on this. Therefore, to resolve this issue, one must be guided by the explanations of officials. Today there are two points of view.

- For a long time, the Ministry of Finance has consistently adhered to the position that it is impossible to present a zero amount for UTII (letters from the Ministry of Finance dated September 22, 2009 No. 03-11-11/188, dated July 3, 2012 No. 03-11-06/3/43, letter from the Federal Tax Service dated 02/27/2017 No. SD-3-3/[email protected]). The fact is that zero in this case is a report with a zero physical indicator, and if this is so, then the economic entity, according to the department, should be deregistered as a UTII payer. If he is still registered, you need to submit a full declaration.

In the reference and legal system “ConsultantPlus” you can find explanations from officials on all issues of interest. Sign up for a free trial.Moreover, if, for example, in the 2nd quarter of 2020 there is really no activity, then the declaration for the corresponding reporting period contains the same physical indicator that was indicated in the UTII declaration for the 1st quarter of 2020 (letter of the Ministry of Finance dated April 29, 2015 No. 03 -11-11/24875).

- The Federal Tax Service previously allowed for scenarios in which the delivery of zero income on UTII is still possible. Thus, the information from the Federal Tax Service dated September 19, 2016 states that if the taxpayer, before the reporting period, stops using the property that forms a physical indicator, then the tax amount in this period will be zero. The use of zero in this case is considered legal by the courts (resolution of the Arbitration Court of the West Siberian District dated August 17, 2016 No. F04-3635/2016). But the loss of a physical indicator will have to be defended in court.

In 2020, tax authorities issued explanatory letters, for example letter dated 02/27/2017 No. SD-3-3/ [email protected] , where they clarified that the physical indicator for UTII cannot be zero.

The size of the staff of an economic entity can be a separate physical indicator (a complete list of such indicators is given in paragraph 3 of Article 346.29 of the Tax Code of the Russian Federation). However, it is absolutely not necessary that the UTII declaration without employees for 2020 will be zero. If there are no employees, then the physical indicator in this case will be equal to one, which corresponds to the individual entrepreneur or director of the organization. Obviously, a business owner can work independently if other physical indicators are available.

If questions arise when filling out a non-zero VAT return, you can turn to a ready-made solution prepared by experts of the K+ system. If you are not yet registered in the system, sign up for a free trial access to it.