Form RSV-1 is a calculation of insurance premiums that all employers must submit to the tax office. You can check the correctness of filling out using the list of critical errors compiled by the Federal Tax Service.

Just a few years ago, all employers (enterprises and individual entrepreneurs) were required to submit a quarterly form RSV-1 (PFR) to the Pension Fund of Russia in relation to all individuals working for them under employment contracts. Since legislation changes periodically and the Federal Tax Service of the Russian Federation is now administering insurance premiums, the name and addressee of the form have changed. The announcement that the DAM form is now submitted to the tax office was made by the regulatory authorities in advance, but contribution payers are still experiencing difficulties in this matter, because part of the reporting is still submitted to the Pension Fund of the Russian Federation, SVZ, for example. Now the form is called the Unified Calculation of Insurance Premiums, and it is still submitted every quarter by all employer-insurers, but this time to the Federal Tax Service of Russia. This report now includes not only pension contributions, but also social and compulsory health insurance contributions. Therefore, the form, as before, can be called RSV, the decoding of the abbreviation allows: “calculation of insurance premiums.”

Let's take a closer look at some of the nuances that the modified, rather large, form of RSV-1 (2020) hides. Detailed instructions for filling it out can be found in the article “Sample of filling out the DAM form for the 3rd quarter of 2020.”

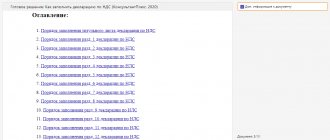

And the form itself looks like this.

Terms and procedure for provision

The deadline for submitting the calculation is the same for all employers - the form must be sent to the territorial body of the Federal Tax Service at the place of registration of the insurance premium payer no later than the 30th day of the month following the reporting period. In this case, the calculation period for contributions is a calendar year, and the reporting periods are:

- I quarter;

- half year;

- 9 months.

The deadlines for submitting the report in 2020 are as follows:

- for the first quarter of 2020 - until 05/03/2019;

- for the first half of 2020 - until July 30, 2019;

- for 9 months of 2020 - until October 30, 2019;

- for the billing period (2020) - until 01/30/2019.

How to report on insurance premiums from the first quarter of 2020

When do you need to report In what form - on paper or via the Internet How to report to separate divisions How the Federal Tax Service will check the calculation What has changed in the calculation form and the procedure for filling out Title page Section 1 Section 2 Section 3 How to fill out the adjustment

When do you need to report?

Insurers who pay individuals submit a calculation of insurance premiums once a quarter no later than the 30th day of the month following the billing period (clause 7 of Article 431 of the Tax Code of the Russian Federation).

Thus, the deadline for submitting the calculation for the first quarter should have been April 30. But due to the coronavirus pandemic, it was extended until May 15 (Resolution of the Government of the Russian Federation dated April 2, 2020 No. 409).

The deadlines for submitting the following reports remain unchanged:

- for half a year - until July 30;

- nine months before October 30;

- for a year - until February 1, 2021.

Heads of peasant farms submit accounts for the year no later than January 30 of the year following the accounting year. They will need to report for 2020 no later than February 1, 2021, since January 30 falls on a Saturday.

In what form - on paper or via the Internet?

The threshold for the number of employees, over which a company must submit the DAM only via the Internet, has been lowered (clause 4 of Article 80, clause 10 of Article 431 of the Tax Code of the Russian Federation). From January 1, 2020, the following must report via the Internet with a qualified electronic signature:

- companies with an average number of employees for the previous billing period of more than 10 people (previously more than 25 people);

- newly created companies (including through reorganization) with more than 10 employees (previously more than 25).

The rest can choose the method of submitting the calculation: via the Internet with the EPC or on paper - in person, through a representative or by mail with a list of the attachments.

How to report to separate departments

If a separate division (SB) pays payments to individuals and has a current account, then the calculation of insurance premiums must be submitted to the location of this SB (Clause 11, Article 431 of the Tax Code of the Russian Federation).

Having a current account has become a requirement since January 1, 2020. Legislators brought the Tax Code into compliance with the law on compulsory pension insurance, according to which OPs are registered as policyholders if they have a current account (clause 3, clause 1, article 11 of the Federal Law of December 15, 2001 No. 167-FZ) .

If your company has an OP without a current account and in 2017-2019 they had the authority to charge payments to individuals and submit DAM at their location, then in 2020 there are two options:

- or open an account for them so that they continue to report on their own;

- or submit to the Federal Tax Service a message about the deprivation of the OP’s powers and submit a single calculation from the company (including for the OP’s employees).

How will the Federal Tax Service check the calculation?

The Federal Tax Service has changed the control ratios for checking the DAM (letter of the Federal Tax Service dated 02/07/2020 No. BS-4-11/ [email protected] ). There are many changes, all of them are given in the letter from the Federal Tax Service in the form of a table.

In Kontur.Externe, checks for new control ratios are already built in: if an error is detected, the system will not allow you to send the calculation.

What has changed in the calculation form and filling procedure

From the first quarter of 2020, calculations for insurance premiums must be submitted using a new form (order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11 / [email protected] ). Let's see what has changed.

Section 2

Section 2 is filled out by the heads of peasant (farm) households. It has changed Appendix 1. Now in the personal data of the head and each member of the household it will be necessary to indicate the full date of birth, gender and passport data.

New codes of insured persons in subsection 3.2.2

Code Name

| 110 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, for payments for which an additional tariff is applied (clause 1 of Article 428 of the Tax Code of the Russian Federation) |

| 120 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, for payments for which an additional tariff is applied (clause 2 of Article 428 of the Tax Code of the Russian Federation) |

| 131 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.1 |

| 132 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.2 |

| 133 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.3 |

| 134 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.4 |

| 140 | Those employed in the types of work specified in clause 1, part 1, art. 30 400-FZ, class of working conditions - dangerous, subclass of working conditions - 4 |

| 231 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.1 |

| 232 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.2 |

| 233 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.3 |

| 234 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - harmful, subclass of working conditions - 3.4 |

| 240 | Those employed in the types of work specified in clauses 2–18, part 1, art. 30 400-FZ, class of working conditions - dangerous, subclass of working conditions - 4 |

How to fill out an adjustment

The updated calculation includes only those sections of the calculation with attachments that the payer previously submitted (with the exception of Section 3). You only need to fill out other sections and appendices if additions are made to them.

When filling out the “Adjustment number” field in the updated calculation for the corresponding billing (reporting) period, indicate the adjustment number (for example, “1–”, “2–” and so on).

Section 3 is included in the adjustment if there are employees for whom clarifications (additions) have been made. Here's how it's done:

- If you need to cancel previously submitted information about an individual, then in section 3 in the updated calculation in line 010 you need to put “1” - a sign of cancellation, and put dashes in lines 130 -170, 190 - 210.

- If you need to correct previously submitted information on an individual with an error in SNILS and full name (lines 030 - 060), then two sections 3 should be included in the updated calculation: The first - with cancellation sign 1, with the values of SNILS and full name, as in the primary calculation (erroneous ), with dashes in subsection 3.2:

- The second - without a sign of cancellation, with the correct SNILS and full name, with the amounts in subsection 3.2:

If you need to correct other errors (except for SNILS and full name) in the previously submitted information on an individual, include Section 3 with the correct values in the updated calculation. In this case, you need to fill out all the fields of the form - both those that you are correcting and those that do not require correction.

Elena Kulakova, Kontur.Externa expert on insurance premiums and accounting

Source: https://kontur.ru/articles/5745

RSV submission form

If the average number of employees of an organization for the previous reporting (calculation) period exceeds 25 people, then the policyholder can only submit an electronic DAM; paper version is not required. The accounting department knows very well what this is: you need to generate a report in a special program, certify it with an electronic signature and send it to the tax service via the Internet. A similar requirement applies to all newly created organizations with more than 25 employees. All other companies can report on paper.

We must not forget that failure to comply with the procedure for submitting the DAM form threatens the payer with a fine of 200 rubles under Article 119.1 of the Tax Code of the Russian Federation.

Filling procedure and features

When filling out DAM forms, you still need to follow certain rules. Information about them can be found both in administrative and explanatory acts of the Federal Tax Service. The current form for a single calculation for insurance premiums and the procedure for filling it out are approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] KND code 1151111. Second source: letters and official explanations. The Russian Federal Tax Service constantly publishes various explanations on how to fill out this report. For example, the Letter of the Federal Tax Service of the Russian Federation dated April 12, 2017 No. BS-4-11 / [email protected] states who must fill out which section. These data are shown in the table:

| Category of employer-insurer | What you need to fill out |

| All insurers (legal entities and individual entrepreneurs, except heads of peasant farms) |

|

| Additionally, these employers must fill out if they fall into the following categories: | |

|

|

|

|

|

|

At the same time, policyholders are required to submit a “zero” DAM. In letter No. BS-4-11/4859 dated March 17, 2017, tax officials reminded that if employees were not paid wages in the reporting quarter, then subsection 3.2 of Section 3 does not need to be filled out. There are also opinions that if an organization does not make payments in favor of individuals, and therefore no insurance premiums during the billing (reporting) period, it is still obliged to provide a calculation with zero indicators. This, in particular, is stated in the Letter of the Ministry of Finance of the Russian Federation dated March 24, 2017 No. 03-15-07/17273.

Let's look at a few more important explanations about the features of filling out this form in more detail.

DAM procedure for the 1st quarter of 2019

The procedure for filling out the RSV-1 form in 2020 does not entail any difficulties, but there are some features that are required to be studied.

For the latest changes in the certification of teaching staff in St. Petersburg in 2020, see the article: latest changes in the certification of teaching staff.

About the payment order for payment of penalties for personal income tax, .

Thanks to this, you can eliminate the possibility of making mistakes, which will entail numerous consequences. For this reason, it is advisable to consider them in more detail.

Instructions for drawing up a new form

In the form in question, it is mandatory to indicate data regarding:

- personal details of each individual employee;

- insurance contributions that were transferred to the Pension Fund and the Compulsory Medical Insurance Fund in particular;

- completed recalculations for payments - must be indicated in section 4;

- amendments to the amounts, taking into account specially established rates, must be indicated in section 2.4.

In addition, it is necessary to pay attention to the fact that the amendment information must be transmitted and generated on paper, and on forms that are relevant for the reporting period.

The corresponding reporting on the form in question was compiled from sections, parts of which are not subject to mandatory completion by certain categories of taxpayers.

At the same time, in accordance with the rules of Russian legislation, the following are considered mandatory to fill out:

- title page;

- as well as sections such as: 1, 2.1, 2.5.1 and 6.

It should be remembered that for those taxpayers who use additional rates, parts such as:

- 2.2;

- 2.3;

- 2.4.

If the company applies a reduced rate in full compliance with Federal Law No. 212, then an obligation arises to fill out part 3.

If students have official employment at the enterprise, it becomes necessary to fill out the fifth section.

The corresponding adjustment data must be entered in such parts as:

- 2.5.2;

- and 4.

Before starting the process of forming the key sections of the document in question, there is a need, as noted earlier, to fill out the title page.

In accordance with the approved rules, it must necessarily include:

| Full name | Insured |

| Employer personal tax number | TIN |

| employer checkpoint | — |

| Corresponding registration number | Which was previously issued by authorized persons of the Pension Fund |

| OKVED | It is obligatory provided by the structural unit of the tax authority during company registration |

| Current mobile phone number | For feedback |

After this, in the RSV-1 form under consideration, it becomes necessary to indicate the period for which the calculation will need to be submitted and the year.

It will be necessary to display the average number of hired employees and enter:

- personal signature of the originator;

- date of formation.

Without exception, all fields on the title page must be filled out properly. If there is at least one omission, the document is considered invalid with all the ensuing consequences.

After this, you need to proceed to the formation of the first section, called “Calculation of accrued and paid insurance premiums.”

During the formation of the first section of reporting, in most cases, authorized officials of the employer do not experience any difficulties. The main thing is to enter current data.

In the first section of the form in question, it will be necessary to indicate the total amounts that were previously paid for all hired employees without exception.

Without exception, all information that is to be entered in the first section must be taken from the sixth.

It is for this reason that in the RSV-1 form, section 6 is interconnected. Let's consider what needs to be indicated in the sixth section, referred to as “Data on insured citizens”.

Video: RSV and 4-FSS

In accordance with developed and approved rules, personal information for each individual officially employed employee must be entered in this section.

In particular, the following information is required to be indicated in section 6 of the RSV-1 form:

- full initials of the insured citizens;

- SNILS of an officially employed employee;

- all contributions, without exception, that were transferred by a qualified specialist of the company;

- the amount of contribution that was transferred for a specific worker.

It should be remembered that, without exception, all generated sheets of the RSV-1 form must be certified by the personal signature of the company’s management.

Report submission deadline

It is extremely important to remember that the deadlines for submitting the reporting form in question vary.

If the number of officially employed employees is less than 25 people, then the document can be submitted on paper, and the deadline for submitting this type of document is the 15th day of the reporting quarter.

If the form in question is generated in electronic format, then it becomes necessary to submit it to the authorized body on the 20th.

This date is set for those categories of policyholders whose official staff exceeds 25 people.

According to the rules of Russian legislation, it is strictly forbidden to be late with the established periods for submitting documentation. If the specified deadlines are ignored, the company will be subject to administrative liability.

In this case we are talking about such types of punishment as:

| If the report is not submitted in the prescribed form provided for the company. For example, not in electronic format, but on paper | The fine is only 300 rubles |

| In case of submission of reports after the deadline | Then administrative liability manifests itself in the form of a fine, which is 5% of the total amount of contributions, while the amount of the penalty cannot be less than 1 thousand rubles, but not more than 30% |

Let's look at the situation using a specific example. PJSC “Proletary” submitted the necessary payment in electronic format on November 23, despite the deadline until the 21st.

In this case, the delay was less than a calendar month. The contribution amounts were:

| Pension | 35 thousand rubles |

| Medical | 7.5 thousand rubles |

In this case, the amount of the fine will be 35 thousand + 7.5 thousand * 5% = 2.1 thousand rubles.

Find out the features of the transition of an LLC from the simplified tax system to OSNO in 2020 from the article: features of the transition from the simplified tax system to OSNO.

How to buy a used car in installments from the owner.

Is it necessary to work 2 weeks upon dismissal?

Sample filling

As noted earlier, there are no difficulties in the process of generating the calculation. An example of filling out the DAM for the 1st quarter of 2020 can be downloaded from.

Finally, we can say that the formation of RSV-1 is not difficult, but it is extremely important to observe the features discussed in the article.

Thanks to this, you can eliminate the possibility of making mistakes.

Reflection of expenses not subject to insurance premiums

The Federal Tax Service of Russia, in Letter No. GD-4-11/ [email protected] , explained how the payer must reflect in the DAM the amount of expenses and payments in favor of employees who are not subject to contributions. Such expenses are listed in Article 422 of the Tax Code of the Russian Federation and they must be included in reporting if they are recognized as an object of contributions. And all payments that are not subject to taxation do not need to be indicated in the calculation.

As a result, the policyholder must determine the taxable base as the difference between payments accrued in favor of individuals, subject to insurance premiums, and amounts exempt from them. This is the value that needs to be entered into the report to avoid errors. An example of such payments is a child care allowance for up to 1.5 years; the employer must indicate it. Since, according to the provisions of Article 420 of the Tax Code of the Russian Federation, such a payment is subject to compulsory social insurance, but according to the provisions of Article 422 of the Tax Code of the Russian Federation, it is exempt from taxation.

Filling out the DAM by employers on UTII or simplified tax system

Organizations or individual entrepreneurs that operate under a simplified taxation system or are payers of a single tax on imputed income may also have employees, which means they are required to submit calculations on a general basis, and they are concerned about the question of how to correctly fill out the RSV certificate. 1. What are these features that simplifiers need to take into account? Tax officials spoke about this in Letter No. GD-4-11 dated December 28, 2017 / [email protected] It, in particular, says that organizations that pay contributions at the general rate and at the same time apply the simplified tax system or UTII must fill out Appendix 1 to Section 1 of the RSV indicating one payer tariff code from those listed below:

- «01»,

- «02»,

- «03»,

since they correspond to the same category code of the insured person “NR”. Tax officials also explain that all tariff codes used by payers are specified in Appendix No. 5 to the procedure for filling out the form. It is also necessary to take into account that in field 200 of section 3 it is necessary to indicate the category code of the insured person in accordance with Appendix No. 8 to the filling procedure. The tariff code and the category code of the insured person must correspond to each other.

Critical errors in reporting

The Federal Tax Service accepts reporting with some types of errors, and some are considered critical, so if they were made, the tax authorities will recognize the calculation as not provided. Such errors, in the case of RSV in particular, include:

- discrepancy between the data on the total amount of insurance contributions for pension insurance and the data on the amount of calculated contributions for each insured person for the reporting period. That is, in the RSV, line 061 in columns 3–5 of Appendix 1 of Section 1 of the calculation must coincide with the data in line 240 of Section 3;

- inaccurate personal data of the insured persons (SNILS, TIN (if available) and full name).

In addition, critical errors include incorrectly specified information in section 3 by line:

- 210 - the amount of payments and other remuneration for each of the last three months of the reporting or billing period;

- 220 - the base for calculating pension contributions within the limit for the same months;

- 240 - the amount of calculated pension contributions within the limit for the same months;

- 250 - totals for columns 210, 220 and 240;

- 280 - the base for calculating pension contributions at the additional tariff for each of the last three months of the reporting or billing period;

- 290 - the amount of calculated pension contributions at the additional tariff for the same months;

- 300 - totals for columns 280, 290.

Such errors can be corrected by submitting a new calculation with the correct data within the established time frame. Otherwise you will have to pay a fine.

Strict deadlines for submitting calculations to the Pension Fund

There are strict deadlines for passing the RSV-1. Due to the fact that the report is provided quarterly, you will have to report for each period no later than the 20th day of the second month after the end of the quarter. For those who report on paper, this date comes five days earlier, namely the 15th of the second month. At first glance, the legislation sets a rather long period in order to have time to fill out the form, but in practice it often turns out that the number of overdue reports does not decrease. Therefore, the Pension Fund, in order to avoid penalties, strongly recommends switching to electronic reporting and paying close attention to deadlines, especially if they fall on holidays or weekends. The DAM report is considered submitted from the moment of receipt of the operator’s response via electronic channel or the mail mark on the attachment inventory.

Responsibility for late submission and errors

If an organization or individual entrepreneur untimely sends the DAM to the Federal Tax Service, it faces a fine under Article 119 of the Tax Code of the Russian Federation. Its amount is 5% of the amount of insurance premiums not paid on time based on the data provided by the calculation. The maximum penalty is 30% of the amount of contributions. If there is no underpayment, the employer who is late with reporting will still be fined 1,000 rubles. In addition, if the payment is not provided within 10 days after the due date, in accordance with the new edition of Article 76 of the Tax Code of the Russian Federation, tax authorities have the right to block transactions on the bank account of the paying organization.

Also responsible in this case will be the officials of the insured organization, as a rule, the director. According to the provisions of Article 15.5 of the Code of Administrative Offenses of the Russian Federation, in this case, a warning or an administrative fine in the amount of 300 to 500 rubles is provided.

Errors and fines in 2020

Since the reporting period for insurance premiums is a quarter, and the settlement period is a year, the tax authorities will punish for untimely submission of information on insurance transfers depending on which calculation was submitted late. If for a quarter, half a year or 9 months, then, by virtue of Article 126 of the Tax Code of the Russian Federation, the fine for errors in a single calculation of contributions is only 200 rubles for the reporting form itself, and not for the number of persons included in it. Tax legislation does not yet provide for such a “per capita” type of fine.

If the payment for the year is not submitted on time, you will have to pay 5% of the amount of insurance payments that were indicated in the document for each full or partial month of delay. The maximum amount of sanctions in this case, as defined by Article 119 of the Tax Code of the Russian Federation, is no more than 30% of the amount of contributions payable, but not less than 1000 rubles. This means that if there are no obligations in the calculation, a fine of 1000 will still be imposed.

In addition, Article 76 of the Tax Code of the Russian Federation gives the tax service the opportunity to block transactions on the current account of taxpayers who do not submit reports. Tax officials believe that this rule now applies to social security payers. But the Ministry of Finance so far claims the opposite and allows the blocking of accounts only for failure to submit declarations.