Why is it needed and who should have a cashier-operator book (form KM-4)

The cashier-operator's journal was approved by Decree of the State Statistics Committee of December 25, 1998 No. 132 (hereinafter referred to as Decree No. 132), it is also called the unified form KM-4.

The obligation to keep a journal when using cash registers is enshrined in the standard rules contained in the letter of the Ministry of Finance dated August 30, 1993 No. 104. But these rules have lost relevance due to the adoption of a new law on the use of cash registers, according to which most business entities are required to use updated cash register models from July 1, 2017 technology capable of transmitting information to tax authorities about payments to customers online. Read about the use of online cash registers by simplified taxation system payers in this article.

In the new edition of the law “On cash registers” there is no information about the need to use unified forms, and therefore the use of a cashier-operator’s book when working with an online cash register is not necessary. The Ministry of Finance expressed the same opinion in its letter dated June 16, 2017 No. 03-01-15/37692. But companies and individual entrepreneurs have the right to independently maintain this register to account for and control received revenue.

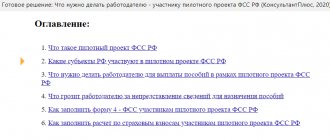

You can find out what documents need to be completed when working with online cash register systems in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

Resolution No. 132 provided that the journal is filled out by an employee working at the cash register who serves clients (accepts money from them as payment for goods or services) using a cash register machine (hereinafter referred to as the cash register). The same document stipulated that it should be kept by the manager (manager) or chief (senior) accountant, and given to the cashier before the start of the shift.

You can download the KM-4 log form on our website.

In this register, the cashier had to record the readings taken from the cash register on a daily basis. This journal also served to control the correspondence of the balance in the cash register with what is listed in the car.

Definition and role of the journal

Another name for the cashier’s book is the KM-4 form. It has been mandatory since December 25, 1998 according to Resolution No. 132 of the State Statistics Committee. For each cash register (cash register), one such summary document is required. Maintaining this journal is the responsibility of the operator, cashier, serving customers using cash registers and accepting cash from the latter as payment for products, services, work, etc. This book is the primary accounting documentation for accounting of incoming funds.

In KM-4, readings taken from the cash register and the amount of money passed through the cash register are recorded daily. At the beginning and end of the day, the employee writes down the readings of the cash register counters (the so-called Z-report) - the difference between them will be considered revenue for the current day. The main role of the cashier's journal is to reconcile the actual balance of money in the cash register with what the cash register has counted.

The need for mandatory maintenance of the KM-4 form is indicated by the letter of the Ministry of Finance No. 104 (08/30/1993) and the letter of the Federal Tax Service No. ED-4-2 / [email protected] (06/23/2014).

When and how to fill out the cashier-operator logbook correctly

When and how to fill out the 2020 cashier-operator logbook? We believe that organizations and individual entrepreneurs that use online cash registers and have decided to fill out the cashier-operator’s journal can independently establish rules for filling it out. In this case, you can rely on the instructions for filling it out, established by Resolution No. 132. The description for the KM-4 register states that the journal is filled out daily by the responsible employee - the cashier.

Entries in the journal should be made using a blue ballpoint/ink pen without marks. If a correction occurs, the entry made by the cashier is certified by the director and chief accountant.

Before using online cash registers, before starting to operate it, it had to be numbered, laced and registered with the Federal Tax Service. Since, as mentioned above, when using online cash registers, regulatory authorities do not feel the need for a log, then there is no need to register it with the INFS. Organizations and individual entrepreneurs can make the decision on the need to number and lace them independently based on internal rules. According to the instructions for filling out KM-4, the journal should have been filled out by the cashier immediately after the Z-report was taken. In online cash registers, when work is completed, a shift closing report is taken, the data of which can be transferred to KM-4.

For more information about where and how to fill out the cashier-operator’s log, read the article “Unified form No. KM-4 - form and sample” .

Journal functions

An organization can have only one main cash register and many operating rooms. The function of the main cash register is to receive funds (revenue) from operating rooms, each of which has its own journal. With its help, records are kept of cash receipts and expenditures (revenue) for each cash register of the organization.

This journal is a control and registration document of meter readings. It is led by a cashier-operator. Entries are entered in chronological order using ballpoint pen or ink. On one line, transactions for one shift or working day of the cashier are noted. Z-reports, which are taken from cash registers, are the basis for records.

The journal is prepared for work in the same way as the cash book. It must be numbered, laced, signed by the chief accountant and head of the organization, tax inspector. In addition, the document must bear the seal of the enterprise (organization). The last sheet contains the total number of pages, as well as a record that the magazine is numbered, laced and contains a certain number of sheets.

An example of filling out a cashier-operator log

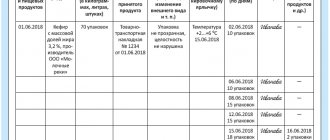

Let's take a step-by-step look at how to fill out the cashier-operator's journal. So, the cashier who passed the shift usually takes a report on the closure of the shift. The data from this document is used when filling out column 4 (report serial number), column 5 (the previous entry is duplicated here), column 6 (counter indicator) and column 10 (daily revenue). Column 9 displays data from the report taken at the end of the shift.

Columns 1–3 indicate: date, department number, cashier’s full name. In columns 7–8, 16–18, the signatures of the cashier, administrator and senior cashier are affixed, if these are 3 different people, and when combining positions, 1 signature is sufficient.

Column 11 displays the amount of cash, column 12 - the number of non-cash payments, column 13 - the non-cash amount, column 14 - the amount minus returns, column 15 - the total value of refunds from the cash register to customers.

It is very easy to check the correctness of the entered data - to do this, compare the readings from the Z-report (column 10 of the register = column 14) and the total values from columns 11–12 minus column 15.

Some more test formulas:

- column 11 = column 10 – column 13 – (column 15);

- column 14 = column 11 + column 13;

- Column 10 = Column 9 – Column 6.

Let's look at a sample of filling out a cashier-operator's book.

How to fill out the KM-5 form

Let us dwell in detail on filling out each of the announced forms. Let's start with the KM-5 form.

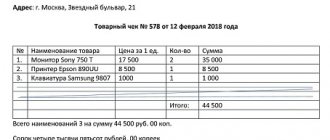

It is important not only to correctly enter data on monetary transactions, but also to the general design of the journal. Thus, the book must be laced, numbering of all pages, signatures of management, tax inspector and chief accountant are required. The cover must display the following information:

- Full name of the company and branch (if it is a branch), OKPO code, INN of the enterprise.

- Full name and position of the employee who is responsible for maintaining the journal.

- Information from what to what date is recorded in this journal.

Most often, the person responsible for filling out is the employee who works directly with the cash register. As already mentioned, filling is done daily. A ballpoint or ink pen is used.

When leaving for a shift, the employee enters the date, department number and his full name.

Mistakes are strictly prohibited. If they did occur, the correction must be made in a special way. First, you need to inform the manager. Secondly, the correction is certified by the cashier and the manager.

At the end of the shift, a record is made of the amount of money received and cash register statements. Only after this the money is handed over, which is also displayed in the records.

If discrepancies are identified between actual and documented data, a superior person conducts an internal investigation to determine the reasons. Information about these discrepancies is entered in a special journal column.

Results

Organizations and individual entrepreneurs, when making payments using online cash registers, may not fill out the cashier-operator log.

But if they decided to continue maintaining this register to fulfill internal tasks, then they are recommended to establish the procedure for maintaining it. When using online cash registers, registration of the cashier-operator's journal with the tax authorities is not required. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to fill out the KM-4 form

This form contains information about the money received in the cash register. There are some peculiarities in maintaining this form.

The journal must be recorded at the tax office. Before this, just like the KM-5 form, it must be laced and numbered, which is recorded at the end of the document, namely: how many pages were numbered and laced. This is certified by the signatures of the responsible persons.

Only those cash flows that pass directly through the cash register are subject to recording. By making a “zed report” at the end of a work shift, data on money movements is entered. Reconciliation of data as of morning and evening shows the amount of revenue.

A new journal cannot be started until the pages of the current one run out or it is unintentionally damaged.

When making corrections, it is not allowed to use a corrector or write over incorrect data. Errors should be crossed out with a straight line and marked with the word “corrected”; only then can the correct readings be written down next to them. Of course, signatures of responsible persons are required.

Important points

The cashier-operator's journal is an accounting document; its content and storage must be determined by legislative and local acts.

The book must be kept close to the cash register or in the accounting department, but in any case, inaccessible to prying eyes.

After the document expires, it is transferred to the archive, where its storage period is 3 years. After this period, the magazine must be disposed of in strict compliance with the regulations for such a procedure.

Before the introduction of online cash registers, the magazine required mandatory firmware, numbering and registration with the supervisory authority.

Now there is no need to register with the tax office; numbering and lacing is carried out at the personal request of the legal entity.

This right arises upon the final transition to online cash registers.

One of the advantages of an online cash register is the ability to issue receipts when making purchases through online stores in just a few minutes, which was not always possible with conventional cash registers.

Now, after making a purchase, the buyer is sent a check to the designated email address indicating the seller’s details and information about the product.

You can ask for a similar document in a regular store; the seller’s responsibility is to issue it.

A special software package for online cash registers allows you to analyze consumer behavior, take into account the sale of products, and also work with securities.

With its help, you can identify products that are in greatest demand and products that are stale on the shelves, the sales of which can increase if their price decreases.

The nuances of journaling

When replacing the EKLZ, 3 z-reports are closed, which are reflected in the log: before removal, verification (equal to 1 ruble 11 kopecks) and after replacing the memory.

According to the law, the use of cash registers can occur both when receiving and issuing funds from the cash register (purchasing scrap metal from the population). In this case, it is advisable to buy devices separately for reception and delivery. In this case, the reflection of the latter in the journal occurs in the usual manner; it is simply necessary to reflect in the order that the transactions are expenses.

If an error is made when filling out this register, the correction must be made by crossing out the incorrect entry with one line (so that it can be read) and making a new one. This must be endorsed by the cashier, chief accountant, and head of the company.