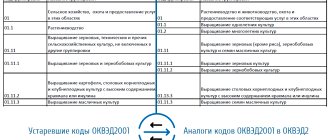

How to find the required code in OKVED

The OKVED classifier is, in fact, an ordinary reference book that contains several sections, and in them each type of activity is assigned its own unique code.

This is a huge document, which is quite difficult for a beginner to navigate. Select OKVED codes for free in a special web service

Those who decide to work with the directory on their own should do so. First, in the classifier you need to find the section that corresponds to your field of activity, for example, “Construction”, “Wholesale and retail trade”, “Transportation and storage”, etc. Then, inside the section, you need to step by step reach the desired group and code for a specific type of activity.

Retail trade is classified primarily by types of trading enterprises:

- retail trade in general assortment stores - subclasses from OKVED 47.1 to subclass OKVED 47.7;

- retail trade outside of stores - subclasses from OKVED 47.8 to subclass OKVED 47.9.

1) For retail sales in department stores further distinguish:

- retail sales in specialized stores: subclasses from OKVED 47.2 to subclass OKVED 47.7;

- retail sales in non-specialized stores: subclass OKVED 47.1

Retail trade in stores with a universal range of goods includes retail sales of used goods (group OKVED 47.79).

The above-mentioned groups are further subdivided according to the range of products sold.

2) Sales other than through general merchandise stores are divided according to forms of trade, such as:

- retail sales in tents and markets: subclass OKVED 47.8;

- other retail sales not through department stores. For example: trade by mail, with door-to-door delivery of goods, through vending machines, etc. (subclass OKVED 47.9).

The range of goods in this group is limited to goods usually referred to as consumer goods or retail goods. Therefore, goods that are not usually sold in retail trade, such as cereal grains, ores, industrial equipment, etc. are not included in this group.

Class OKVED 47 refers to “Section G - Wholesale and retail trade; repair of motor vehicles and motorcycles" of the 2020 OKVED-2 classifier.

How many characters should the code contain?

OKVED codes must be selected with details of at least 4 first characters. For example, code 47.11 - “Retail trade primarily in food products, including drinks, and tobacco products in non-specialized stores.” If the entire group of an activity type is suitable, then the codes included in it do not need to be indicated. If you need to characterize your activity in more detail, then you should choose a code of a lower class, 5 or 6 characters. For example, code 47.11.3 - “Retail trade activities with a large assortment of goods with a predominance of food products in non-specialized stores.”

Here is a small list of possible OKVED codes for common types of activities among individual entrepreneurs:

Retail sale of products:

- 47.11 — Retail trade primarily in food products, including drinks, and tobacco products in non-specialized stores;

- 47.19 — Other retail trade in non-specialized stores.

Online store:

- 47.91 — Retail trade by mail or via the Internet information and communication network;

- 47.91.1 - Retail trade by mail;

- 47.91.2 - Retail trade carried out directly using the information and communication network Internet;

- 47.91.3 — Retail trade through Internet auctions.

Cargo transportation:

- 49.41 — Activities of road freight transport;

- 52.29 - Other auxiliary activities related to transportation;

- 53.20.3 - Courier activities;

- 52.21.2 - Auxiliary activities related to road transport.

Taxi:

- 49.32 — Taxi activities.

Restaurants and cafes:

- 56.10 — Activities of restaurants and food delivery services;

- 56.30 - Serving drinks;

- 56.29 — Activities of public catering establishments for other types of catering.

Hairdressers and beauty salons:

- 96.02 — Provision of services by hairdressing and beauty salons;

- 96.04 — Physical education and health activities;

- 96.09 — Provision of other personal services not included in other categories.

Please note: the OKEVD code can be selected for free in a special service created by the developers of Kontur.Elbe. In the service, you just need to enter the name of the planned type of activity and receive a list of suitable OKVED codes.

Select OKVED codes for free in a special web service

Selection of codes

47.41 Retail sale of computers, peripheral devices for them and software in specialized stores

47.41.1 Retail sale of computers in specialized stores

47.41.2 Retail sale of software in specialized stores

47.41.3 Retail sale of peripheral devices in specialized stores

47.41.4 Retail trade of office machines and equipment in specialized stores

47.42 Retail trade in telecommunications equipment, including retail trade in mobile phones, in specialized stores

47.43 Retail trade of audio and video equipment in specialized stores

47.54 Retail trade of household electrical goods in specialized stores

47.63.2 Retail sale of tapes and discs without records in specialized stores

47.78.1 Retail sale of photographic equipment, optical instruments and measuring instruments, except glasses, in specialized stores

The codes correspond to the new edition of OKVED 2

FILES

See also all OKVED codes with decoding and other collections of OKVED codes

How many codes to choose

OKVED codes should be selected for those types of activities that the individual entrepreneur plans to carry out in the near future. If you select several suitable codes, then during state registration of an individual entrepreneur one of them should be indicated as the main one, and the rest as additional ones (we will talk about why this is necessary below). Tax authorities do not limit the maximum number of codes for one individual entrepreneur, but you should not indicate too many codes. It is best to choose no more than 20. After registering as an individual entrepreneur, you can add or remove extra ones.

Register as an individual entrepreneur and keep accounts for a year and submit all reports for free

OKVED for online trading

Before choosing codes, you need to study all sections of the OKVED directory. To do this, you need to take into account a bunch of details; deciding on the direction of the business is a small part of the worries.

To save time and effort, use the following recommendations:

- Open section “G”, which includes wholesale and retail trade, as well as services related to sales;

- If you plan to trade in wholesale quantities, use class “46”, there you will select numbers that suit the assortment sold in bulk;

- If you sell retail, excluding sales of motor vehicles and cars, class “47” is suitable.

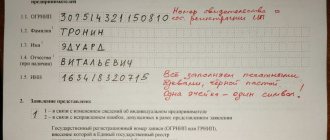

Step-by-step action plan for changing OKVED codes for individual entrepreneurs

- Fill out the title page and sheets “E” and “G” in the application form P24001. On the first page of sheet “E” you should indicate the codes that are added, and on the second - those that are deleted.

- Number and print only completed application sheets.

- On sheet “F”, enter the surname, first name and patronymic of the individual entrepreneur by hand. Do not sign the application yet - the signature must be affixed at the time of submission of the application.

- Take the application to the tax office and present your passport. The application can be sent by mail or submitted through a representative by proxy. But then the application will have to be certified by a notary.

Here is a sample of a correctly completed application on form P24001.

What does the main OKVED code affect?

The taxation system, the amount of taxes and the number of reports submitted do not depend on the selected OKVED codes. However, those individual entrepreneurs who plan to hire workers need to pay attention to the main OKVED code.

The fact is that insurance contributions “for injuries” are deducted from employees’ salaries to the Social Insurance Fund. And the Social Insurance Fund sets the rate of such contributions based on the main activities of the individual entrepreneur. The more risky the type of activity according to OKVED, the higher the contribution rate will be. For more information, see “The classification of activities by occupational risk classes has been updated.”

Keep records and submit all individual entrepreneur reports via the Internet

OKVED for retail trade in food products in specialized stores

47.21 Retail trade of fruits and vegetables in specialized stores

47.21.1 Retail sale of fresh fruits, vegetables, potatoes and nuts in specialized stores

47.21.2 Retail sale of canned fruits and vegetables and nuts in specialized stores

47.22 Retail trade of meat and meat products in specialized stores

47.22.1 Retail trade in meat and poultry meat, including offal in specialized stores

47.22.2 Retail sale of meat and poultry products in specialized stores

47.22.3 Retail sale of canned meat and poultry in specialized stores

47.23 Retail trade in fish, crustaceans and molluscs in specialized stores

47.23.1 Retail trade in fish and seafood in specialized stores

47.23.2 Retail sale of canned fish and seafood in specialized stores

47.24 Retail trade of bread and bakery products and confectionery products in specialized stores

47.24.1 Retail sale of bread and bakery products in specialized stores

47.24.2 Retail sale of confectionery products in specialized stores

47.24.21 Retail sale of flour confectionery products in specialized stores

47.24.22 Retail trade in confectionery products, including chocolate, in specialized stores

47.24.3 Retail sale of ice cream and frozen desserts in specialized stores

47.29 Retail trade of other food products in specialized stores

47.29.1 Retail trade of dairy products and eggs in specialized stores

47.29.11 Retail trade of dairy products in specialized stores

47.29.12 Retail sale of eggs in specialized stores

47.29.2 Retail trade of edible oils and fats in specialized stores

47.29.21 Retail trade of animal oils and fats in specialized stores

47.29.22 Retail trade of vegetable oils in specialized stores

47.29.3 Retail trade of other food products in specialized stores

47.29.31 Retail trade of flour and pasta in specialized stores

47.29.32 Retail trade in cereals in specialized stores

47.29.33 Retail sale of sugar in specialized stores

47.29.34 Retail sale of salt in specialized stores

47.29.35 Retail trade in tea, coffee, cocoa in specialized stores

47.29.36 Retail trade in homogenized food products, baby food and diet food in specialized stores

47.29.39 Retail trade of other food products in specialized stores, not included in other groups

What happens if the OKVED code diverges from real activities

An individual entrepreneur does not have to operate under all OKVED codes specified during state registration. After all, the list of OKVED codes included in the Unified State Register of Individual Entrepreneurs (USRIP) is a list of activities that an entrepreneur is likely to be engaged in currently or will engage in in the future.

If an individual entrepreneur has a business for which the OKVED code is not included in the Unified State Register of Individual Entrepreneurs, it’s okay, there is no special responsibility for this. However, the Code of Administrative Offenses of the Russian Federation provides for liability for failure to provide information about a legal entity or an individual entrepreneur to the body that carries out state registration of legal entities and individual entrepreneurs in the form of a fine of 5,000 to 10,000 rubles (clause 4 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation). Therefore, to prevent inspectors from trying to recover this amount, it is better to supplement the list with current OKVED codes.

Please note: newly registered entrepreneurs (or their accountants) can use a special accounting program for individual entrepreneurs for free for a year. This is a web service “Kontur.Elba”, which allows you to keep track of income and expenses, calculate the amount of fixed contributions and taxes under the simplified tax system and UTII, prepare reports and submit them via the Internet. Those individual entrepreneurs can work in the program for free if less than three months have passed from the date of registration as an entrepreneur to registration in Kontur.Elbe.