Method 1: on the Federal Tax Service website

The easiest way is to go to the Federal Tax Service website. So, how to find out the Federal Tax Service code at the address in this case:

- Open the main page of the site, find the “Electronic Services” section. Click on the “All services” button.

- Among all the variety, you need to find “Address and details of your inspection” and select this service.

- The window that opens will illogically ask you to enter the code of the Federal Tax Service you need. Without entering anything, click “Next”.

- In the next window, enter your region. In the “district” field, you can enter the name of it, if this is appropriate; if not, then skip the line. Next, enter the name of the city. Then the name of a smaller settlement - village, hamlet, district center, if relevant. If you live in a large city, you must also indicate the street on which the inspection is located.

- Click on “Next” again.

- How can I find out the Federal Tax Service code now? In the next window, under the subheading “Federal Tax Inspectorate Details,” you will see the four-character code you need. That's all!

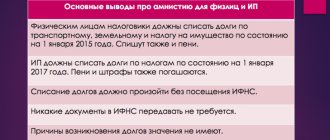

How to find out the new Federal Tax Service code if the tax office has been reorganized?

If your region has recently undergone a reorganization of the Federal Tax Service inspection, a directory of unique SOUN codes will help you find out its new unique code.

To find out the code of your territorial tax authority, you need:

- go to the website : https://pgu.skbkontur.ru/soun.aspx

- and enter the old territorial tax inspectorate code. If your territorial tax authority has been reorganized, a new code will appear on the monitor in front of you. The directory will also provide you with additional information about the Inspectorate of the Federal Tax Service - contact phone numbers and reception days.

The official website of the Federal Tax Service will also help you determine the details of the territorial tax authority using the service https://service.nalog.ru/addrno.do.

Method 2: by TIN

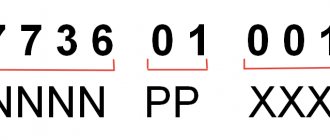

How to find out the Federal Tax Service code if you are filling out a declaration or other document for the tax service? There is another fairly simple way - take a look at your TIN, an individual number available to each taxpayer - private or legal entity. Its first four characters are the code of the inspection in which you are registered.

Of course, this is not a universal method - you can resolve your affairs far from your “native” branch of the Federal Tax Service in the tax office of a completely different region, so such information will be of no use to you. However, in some cases it is still useful.

Find out the tax authority code: detailed instructions

As we have already said, codes from one of the tax service departments are almost always used to fill out important papers, tax forms, declarations and other reporting forms to the system. They are represented by a certain set of numbers, there are four in total. Each service branch is assigned an individual combination, divided into two parts:

- the first two digits indicate the region in which the service branch is located;

- the second two digits are individual for each branch.

When filling out the declaration paper for reporting, the taxpayer enters inside the code of the service department to which he belongs according to:

- place of residence;

- conducting activities, etc.

So, what are the ways to find out the code of the tax office that you personally belong to? Let's look at the options we came up with and analyze each in detail.

According to the taxpayer's residential address

You can find out the code of the tax service department in order to enter it into the document according to your residential address.

Enter the address on the service website and find out the code

Step No. 1 – open the official website of the service

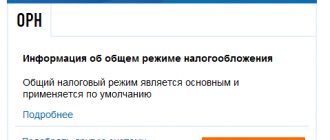

Let's go to the electronic resource of the tax service. This service helps taxpayers determine the details of the required Federal Tax Service inspection. With its help, you will receive the necessary information without leaving the walls of your home, and without even getting up from your desk.

Step No. 2 – enter the data into the form that opens

The data entry procedure has been simplified to the point of impossibility. First of all, you need to select the type of taxpayer, there are two options:

- entity;

- individual.

Then you need to indicate the address of the payer. An additional window will open in which you can fill in the following columns:

- index;

- subject of the Russian Federation (you can specify the region code with a number and the system will find the city automatically);

- address (Moscow, Lenina St.);

- House number;

- building body;

- apartment number.

As soon as the filling is completed, the column “IFTS code” will be automatically filled in, in which the four-digit code of the authority will appear.

Note! Depending on the selected type of taxpayer, the code may change due to a change in the person’s affiliation with the tax branch.

By taxpayer identification number

This number is assigned to each payer of contributions to the treasury individually; everyone has their own. When you receive the certificate containing it from the inspection, you also receive a tax registration, therefore, its code is also included in the required identification number.

You can find out the code using a certificate of assignment of an individual taxpayer number

Step No. 1 – find evidence

Just take it out of your folder or any other place where you keep important papers.

Step No. 2 – determine the inspection code

Please note the identification number. Its first four numeric values are the code of the tax office to which you belong. It is followed by six more - these are already personal, individual numbers for each individual. The remaining two mark the certificate itself and are needed to facilitate its finding in databases.

TIN structure, excerpt from the order of the Federal Tax Service of Russia N ММВ-7-6/435

Personal inspection visit

You can find out the inspection code the old fashioned way by visiting the tax office you went to before or the closest one. Even if you are not one of them, his staff will provide advice in any case.

Personal visit is another option for finding out the code

Step No. 1 – sign up for a consultation

It may not be possible to simply come to the service and get a consultation on a first-come, first-served basis; it is best to get an appointment by appointment. By the way, you don’t need to visit the tax office twice to do this. Just open the Internet, go to the official electronic resource of the Federal Tax Service, go to the appropriate section and sign up for the queue online by filling out the form.

It must indicate:

- what type of taxpayer you are;

- last name, first name, patronymic of the visitor;

- taxpayer identification number;

- cellular telephone;

- E-mail address.

Before planning a trip to a branch of the service, it is best to check on the same electronic resource what hours consultations are held, when it is lunch break, etc.

Step No. 2 – visit the inspection

On the day appointed for consultation, attend the inspection. If you don’t know where to go next, you can get information from the person at the reception or at the information desk. It is best not to be late, because this can anger the consultant and reduce his level of disposition towards you.

We make a call to the Unified Contact Center of the Tax Service

The last method, which also does not oblige you to leave your home to clarify the inspection code to which you belong, is to call the service’s Unified Contact Center from your phone. It is free for residents of any region since 2020.

Consultations provided by this number may relate to:

- time frame for payment of tax contributions;

- stages and nuances of the registration procedure;

- receiving tax deductions for taxes paid;

- using tax service services located on the Internet;

- work schedule of local inspection offices;

- inspection codes, etc.

As you can see, the list is quite extensive, therefore, in addition to the inspection code, you can ask many questions on other topics that interest you.

When working, contact center operators use not only their own knowledge, but also a federal information base, so you can be sure that the data received is correct.

Step No. 1 – call the Unified Contact Center

You can make a call to the Unified Contact Center from a cell phone or landline by dialing the following number: 8 800-222-22-22 . If all operators are busy at the time of the call, do not rush to hang up, wait a few minutes until one of the consultants is free.

Step #2 – ask a question

When you call, you have unlimited time to talk with the operator. Of course, there can be no talk of idle chatter, but there is no need to rush either. Find out the code, write it down on paper or on your phone, and then ask the remaining questions.

Video - How to find out tax details, find out tax office address and make an appointment

Method 3: according to the reference book

How to find out the Federal Tax Service code if you cannot use the service? In this case, downloading the SOUN directory containing tax authority codes, as well as other information useful to the taxpayer, will help you. In addition to the code you are looking for, in this collection you can find out the full name of the inspectorate or other organization of the Federal Tax Service, its address, current telephone number and information about the reorganization.

These are all the methods that help you find out the code of the Federal Tax Service inspection. It is also possible to obtain information about him by directly contacting her, calling there or the hotline, using the service’s SMS service.

How to find out tax details in case of reorganization?

There are situations when the tax service goes through a reorganization process and the code changes. In this case, you can find out updated information from the directory of unique codes.

How to find out the details of the Federal Tax Service? The algorithm is like this:

- Go to the official website of the Federal Tax Service.

- Find the information you are interested in using the algorithm described above.

Another option is to refer to the special directory gnivc.ru/. Here you can find the details of the Federal Tax Service you are interested in within a few minutes. Just go to the “Classifiers and reference books” section. If you select the option from gnivc.ru/, there are two options:

- Download and install the software on your PC.

- Install a ready-made SOUN base.

Federal Tax Service Inspectorate: functions, services

The Federal Tax Service Inspectorate monitors the correctness of accrual, withholding and timely transfer of funds to the budget, considers issues of granting deductions, and returns taxes paid.

The Federal Tax Service department registers new organizations and individual entrepreneurs, and issues certificates of TIN assignment to legal entities and individuals. The inspectorate can provide free information about current rates and the procedure for calculating fees, as well as the rights and responsibilities of tax agents.

Each organ has its own unique code. It consists of four digits. The first two indicate the subject of the federation in which the inspection is located (for example, for Moscow - 77, for the Moscow region - 50), the second pair indicates the serial number of the Federal Tax Service in this region.