Where can you find out your tax debts for individual entrepreneurs?

There are several ways to find out about your debt in a timely manner by contacting the office in person, or online at any convenient time. The second method is more convenient, it saves time and effort, but you need to find out important information correctly.

The tax code does not sleep

Website or branch of the Federal Tax Service

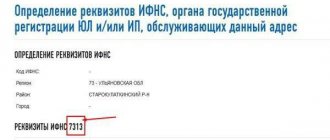

The Federal Tax Service is the most accurate source of information. You can find out about your debts first-hand in person or online. If you require a document reflecting the presence or absence of debts, it is better to contact the Federal Tax Service in person. You need to have your passport, INN and SNILS with you, just in case. A sample application must be provided by service employees. Upon request to the INFS, you can obtain three types of documents (the required one is indicated in the application):

- Statement of accounts is the most informative document. It indicates payments received during the reporting period and accrued amounts, debts and penalties on them (if any);

- certificate of fulfillment/non-fulfillment of the taxpayer’s obligation - it does not indicate specific figures, only information that taxes were paid on time or there is a debt;

- certificate of no debt - it is issued only if there really is no debt. If there is a debt, and the entrepreneur requests such a certificate, then a certificate of non-fulfillment of obligations or the status of accounts is issued.

You can also find out the tax debt of an individual entrepreneur on the website if you only need to know the status of accounts, but there is no need for official paper. The official website of the tax service is https://www.nalog.ru. To find out your debt, you need to register in your personal account. Access can be obtained at the Federal Tax Service branch, through the government services website or using an electronic signature if the individual entrepreneur has one. Also on the website you can find out whether counterparties have a debt if it has been transferred to the bailiff service for collection.

For your information! You can obtain information from the Federal Tax Service for entrepreneurs, individuals and legal entities, i.e. for any person or organization.

Tax notice from the Federal Tax Service

Public services portal

The public service portal allows you to manipulate documents online, and the data is collected in a single database. In your personal account, if the TIN number is specified, a notification about tax debts appears automatically. You can find out information for individuals and individual entrepreneurs, but not for organizations.

The website address is www.gosuslugi.ru, registration on it takes place in two stages: first you need to fill out a form on the website, then you need to confirm your account at service centers or through the mobile bank of Sberbank, Post Bank or Tinkoff. After registration, you can find out all the necessary data, but only related to the account owner, and not counterparties.

FSSP database

If the debt has been transferred to the bailiff service, you can find out about this on the FSSP website. The website address is https://fssprus.ru/, where you can find out the debt by entering the TIN of the enterprise or individual.

Check tax debts of individual entrepreneurs

When a person decides to start a business as an individual, he is required to register as an individual entrepreneur (abbreviated as IP). Without this registration, any activity aimed at systematically generating profit will be considered illegal, which may lead to tax, administrative and even criminal liability. It's no secret that as soon as you register as an individual entrepreneur, you automatically become payers of the appropriate taxes and contributions. But what specific taxes and contributions an individual entrepreneur should pay depends on the taxation system he uses.

In short, all individual entrepreneurs pay:

- Tax on income received (rates depend on the taxation system);

- Property tax, land tax, transport tax (provided that the individual entrepreneur uses real estate, transport or land plots for his commercial activities);

- Insurance premiums.

Main features of existing taxation systems for individual entrepreneurs:

General taxation system (OSNO)

When carrying out business activities on the general taxation system, an individual entrepreneur pays the following types of taxes:

- Personal income tax (13% of income);

- VAT (20% or another rate established by the Tax Code of the Russian Federation);

- property taxes: property, transport tax, land tax.

Simplified taxation system (STS)

Individual entrepreneurs using a simplified taxation system are required to pay income tax at the appropriate rate, the amount of which depends on the tax base:

- 6% of the amount of income;

- 15% from the difference “income minus expenses”.

The simplified tax system exempts individual entrepreneurs from paying personal income tax and VAT, but property taxes must be paid in the general manner.

Single tax on imputed income (UTII) or patent

Individual entrepreneurs on the UTII system pay tax at a rate of 15% of imputed income. The specified income is calculated as the amount of potential revenue of an individual entrepreneur for a specific type of activity. An individual entrepreneur operating on the basis of a patent pays the cost of the patent, which is equal to 6% of the amount of possible annual income for a certain type of activity. The amount of potential annual income by type of activity is established at the level of constituent entities of the Russian Federation and is enshrined in regional legislative acts. An individual entrepreneur operating under the UTII system or a patent does not pay personal income tax, VAT, or property tax used in business activities, with the exception of property tax, for which the tax is calculated from the cadastral value. Transport and land taxes are paid in the same way as under OSNO and simplified taxation system.

Employee payroll taxes and insurance premiums

If an individual entrepreneur hires employees, he receives the status of a tax agent: he is obliged to transfer personal income tax to the budget from their wages in the amount of 13%, as well as pay insurance premiums at legally established rates. If an individual entrepreneur works independently, then he is obliged to pay insurance premiums for himself. Contributions are paid regardless of whether the individual entrepreneur carries out his activities or not.

Responsibility of the taxpayer - individual entrepreneur

Late or incomplete payment of taxes by individual entrepreneurs can become a serious problem. The legislator has established the following sanctions for late payment, non-payment or incomplete payment of taxes by individual entrepreneurs:

- Penalty: For each day of delay in fulfilling the obligation to pay taxes, starting from the tax payment day following the day established by tax legislation, a penalty is charged equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time, and starting from the 31st calendar day of delay – 1/150 of the refinancing rate of the Central Bank of the Russian Federation.

- Fine: Non-payment or incomplete payment of tax amounts by an individual entrepreneur as a result of underestimation of the tax base, other incorrect calculation of tax or other unlawful actions (inaction) entails a fine of 20% of the unpaid tax amount. If this act was committed intentionally, the fine will be 40% of the unpaid tax amount.

- Criminal liability: For tax evasion or for concealing funds or property from which taxes should be collected (Article 198, 199.2 of the Criminal Code of the Russian Federation).

How to find out individual entrepreneur taxes and pay taxes online?

There are several ways to find out the tax debt of an individual entrepreneur and pay taxes online:

- Complex: the amount of tax and debt for it can be found out by contacting the tax authorities directly.

- Simple: quickly check taxes using your TIN and pay taxes online on our website. Attention!

Our advantages:

- Searching for taxes by TIN and paying taxes online is possible at any time of the day on the official website.

- The online resource works quickly and efficiently; the entire process from requesting a debt to paying it takes no more than 5 minutes. You will be sent the most current information on tax charges and existing debts (we receive information directly from the Federal Tax Service of Russia and GIS GIP).

- A convenient way to pay taxes, guarantees that paid taxes and debts will be written off.

Check by TIN

Find out the debt to the Pension Fund by TIN for individual entrepreneurs - what are the ways to check the debt

Search engines provide a large number of services offering to find out the debt of an individual entrepreneur by entering the Taxpayer Identification Number (TIN). Preference should be given to those that require registration on the Unified Portal of Public Services to operate, since the risk of fraud is much lower.

Note! State services do the TIN check automatically, so a notification about debts will definitely appear if there is a debt.

The methods listed above - the tax service, government services and the bailiff service - will provide the most reliable information. On other sites, there is a risk that personal information (TIN number) will be taken over by fraudsters, and debt information will be provided incorrectly.

However, commercial verification services can be useful in another case, if you need to find out not your debts, but the counterparty. Such information is not considered a trade secret, but the Federal Tax Service does not always release data to third parties. Commercial services help to find out in advance the reliability of the counterparty in order to avoid transactions with a willful defaulter.

Tax personal account - instructions on how to log in and register

In accordance with the requirements of the Tax Code of the Russian Federation on tax secrecy, access to information was made more closed. Now, to find out about your personal income tax debt, as well as current information on the amounts that were accrued and paid for other types of fees, receive payment documents and pay for them, contact the Federal Tax Service without visiting and much more, you can visit the Federal Tax Service website.

To do this, you must have access to the taxpayer’s personal account for individuals. To receive it you will have to register this very box.

This event will be preceded by a visit to the tax office, submission of documents and the corresponding application. The exception is inspections involved in centralized processing of data from the largest taxpayers and Federal Tax Service inspections in Russia. The tax office must provide an identification card and a certificate of registration of an individual or a notice of registration (original and copy). After checking them, they will issue a login and password to enter your personal account.

You can download the application to the Federal Tax Service to connect your personal account here:

How to log into your personal account using your TIN on the tax website?

The question of How to find out the debt by TIN on the tax website is very relevant, so let’s consider it in more detail.

Residents of many regions can find out their debt using their tax identification number, in particular: Tomsk, Nizhny Novgorod, Omsk, Novosibirsk, Chelyabinsk and some others. There are specialized sites for this. But the easiest way to do this is by using the TIN on the website of the Federal Tax Service or government services. Both services provide information free of charge and online. True, in the first case, access to your personal account is required, and in the second, registration on the official portal. The last option is a little simpler, but does not provide as complete information as tax information. In addition, there is an online calculator with which you can calculate current payments to the budget.

To obtain complete information on the debt, you need, as mentioned above, to contact the nearest tax office with a passport and an application to create a personal account. You will be given a login and password to enter the system there, after checking your personal data and TIN. You can change your login and password after logging into your account for the first time.

Login without a password to the taxpayer’s personal account

Without a password, such information can be obtained after registering on the government services website, but not on the tax website.

Personal tax account for legal entities

A legal entity can also find out the debt to the budget. The procedure is similar to registering an individual entrepreneur or individual. The main thing is to have a computer and visit the inspection once, taking your application and passport with you. After this, all relevant information regarding a specific enterprise or organization and its property is available to a legal entity after logging into your personal account on the tax portal.

Electronic services

For ease of service and prompt receipt of information from various government bodies, a portal of government electronic services has been created and is successfully functioning. Here you can find all the information regarding laws and regulations for doing business, changes in legislative acts, you can find out about existing debts on state duties, fines and fees. You can also calculate and pay for them online, obtain a license for security activities and much more.

Is it possible to access your personal account on the tax website by last name?

Knowing only your last name, first name and patronymic, you can only obtain information on debts on the electronic portal of the FSSP, but this is only possible if the case has already been transferred to them for execution. In other cases, additional information will be required: TIN, date of birth and other data that can help you log in to the system if your login and password are lost or forgotten.

Why do such debts arise?

How to find out what taxation system an individual entrepreneur is on - is it possible to check?

Debts arise due to the actions of the entrepreneur himself, errors by Federal Tax Service employees, or technical failures on both sides. The most common mistakes made by an individual entrepreneur are related to the fact that he did not study the payment schedule for his tax regime in a timely manner. Because of this, late payments occur, payment of an incomplete amount or non-payment of taxes, and penalties are charged on this amount. The reason may also be the dishonest behavior of the entrepreneur.

Federal Tax Service employees can also make mistakes and charge debts and penalties to bona fide entrepreneurs. In this case, the reason lies in the inattention, or less often in the malicious intent of the employee. You can prove an error or fraud if you keep all documents confirming the timely payment of taxes.

Technical failures may occur in the enterprise’s accounting department or in the Federal Tax Service database. In this case, saved documents on correct accruals will also help prove the absence of debts. To prevent errors in the actions of a Federal Tax Service employee or technical problems from leading to serious consequences, individual entrepreneurs need to independently check their tax account, this will help to notice the error in time.

Federal Tax Service warns about debts

Penalties and consequences of non-payment of debt

Tax amnesty for individual entrepreneurs - what is it, who will have their debts written off?

If the debt was not erroneous, but real, the Federal Tax Service has the right to apply various measures of influence on the debtor. All of them are established in court and can only be applied with a court order.

Note! If there is no such document, then no authorities, including bailiffs, can impose punishment.

Types of individual entrepreneur liability for tax debts:

- administrative. This is a fine, the size of which depends on the amount of debt. Provided for debts on taxes, state duties and insurance premiums. The fine is calculated separately from the amount of debt and penalties;

- seizure of individual entrepreneur’s property (personal and company-owned);

- forced debiting of money from an account to pay debts;

- blocking current accounts;

- subsidiary is an obligation to pay debts at the cost of one’s own property. Provided for debts to financial organizations, banks, and the budget. There is a mandatory inventory of the individual entrepreneur’s property, including his personal property and the common property of the spouses, after which the necessary part is sold at auction, and the amount is used to pay off debts. If there is not enough money from the sale of property, then the individual entrepreneur is obliged to pay the missing amount. The only housing, pets and professional tools are not subject to inventory and sale;

- criminal - provided for malicious tax evaders, as well as for individual entrepreneurs who deliberately hide information about their financial situation. There are fines, compulsory labor and imprisonment depending on the severity of the crime.

Important! The entrepreneur’s partners can also check the debt under an individual entrepreneur, and if he is found to have committed violations, this may affect his business reputation and financial well-being.

If an individual entrepreneur has been repeatedly punished for late payment of taxes, his activities may be suspended, and the owner may be prohibited from doing business for a certain time. In any case, financial losses from malicious non-payment of taxes are higher than from timely payments.

Forethought helps you avoid debt

Tax arrears

This is a debt to the budget of any level, which is formed in the absence of timely payment of obligations. Debt can also be formed as a result of receiving an erroneous tax refund in an inflated amount.

A legal or natural person has arrears:

- on the day following the established date for payment of obligations;

- at the time of actual crediting of excess funds to the current account as compensation;

- on the day the decision is made to offset tax liabilities, the amount of which is determined incorrectly.

Arrears are the amount of a tax or fee, as well as an insurance premium, which was not repaid by the taxpayer on time (Article 11 of the Tax Code of the Russian Federation). For each type of tax, the legislation sets the deadline for payment. The norm applies to all types of federal and local taxes and insurance premiums. The amount of accrued fines and penalties does not add up to the arrears.

Taxpayers who have a debt to the budget may be subject to the following penalties:

- penalty;

- penalty;

- measures of influence of criminal law (used in case of particularly large amounts of damage caused to the budget, in case of systematic repetition of the offense).

Tax arrears are an amount that may also arise due to an understatement of the tax base when preparing a tax return and calculating the liability for payment. In this situation, the taxpayer will be required to pay a fine in the amount of 20% of the amount of the debt (clause 1 of Article 122 of the Tax Code of the Russian Federation).

A penalty is charged in situations where the declaration forms were submitted on time and the results of the desk audit revealed no errors, but the tax was not transferred to the budget.

A large arrear is an amount of tax, for evasion of which criminal penalties may be applied to the taxpayer. Art. 199 of the Criminal Code of the Russian Federation provides for a fine of 100 to 300 thousand rubles, forced labor and even imprisonment. If the offense is committed for the first time and the guilty person has repaid the debt, the measures of Art. 199 of the Criminal Code of the Russian Federation may not be applied. A large amount of arrears is considered to be a debt to the budget in the amount of 15 million rubles, and a particularly large debt is considered to be a debt of 45 million rubles or more (without additional conditions).

Is it possible to see my partner's debts?

There is a concept of tax secrecy in legislation. It includes information about what taxes an individual entrepreneur, individual or organization is required to pay. It also includes any data received by the tax service or judicial authorities. You cannot view this data without a court order.

At the same time, information about debts - about the very fact of debt, its amount and the creditor - is not a secret. Also, the TIN number does not apply to it (it must be indicated on the documents). The website or branch of the Federal Tax Service, as well as commercial organizations can find data showing the integrity of the partner.

To use their services, it is not necessary to indicate the purpose of obtaining information. You need an application at the Federal Tax Service branch, registration on the website, commercial services provide services without additional conditions, but with payment.

Note! You can find out about your partner’s debts that were transferred to the Bailiff Service on their website.

What are the ways to obtain information about debt?

All methods of obtaining information about debts can be classified as follows:

- online verification through intermediary resources;

- checking on official websites;

- through a personal or written appeal to the Federal Tax Service inspectorate.

The first method is not recommended, since not only is there a fee for obtaining information, there are also no guarantees of its accuracy and completeness; official authorities will not accept a link to it. In addition, there is such a thing as tax secrecy, which includes information about tax payments. Therefore, this data cannot be made publicly available.

Such sites may offer to check the tax debt of an individual entrepreneur using the TIN, that is, it will be necessary to enter the 12-digit identifier assigned to the citizen. However, this method of taxpayer identification is used by most resources.

Tips for avoiding such situations

To prevent tax debt, an entrepreneur must take a number of measures:

- study the amounts and terms of payments under the chosen taxation regime before opening an individual entrepreneur;

- explore possible ways to reduce the tax burden - insurance premiums, voluntary payments, etc.;

- pay taxes on time in the prescribed amount;

- keep documents confirming payment of taxes for three years from the date of payment;

- regularly check the status of accounts in case of employee error or technical failure;

- If you identify erroneous charges, immediately contact the tax office, having supporting documents with you.

Compliance with these rules will not completely protect you from tax debts, but to a certain extent it will reduce the risks, and in case of incorrect accruals, it will help you prove your innocence.

How to check your debt

Verification methods

Come to the tax office in person and find out everything on the spot

Before visiting the tax office, it is better to make an appointment to save time.

The advantage of this method is the ability to receive information on the day of application. But you will have to:

- plan your day taking into account the opening hours of the inspection,

- spend time queuing, searching for the right office and filling out a written request.

Request a certificate from the tax office

If you submit reports electronically, it is very convenient to request a certificate from the service through which you submit the reports. This way you will learn about the status of settlements with the tax office within three working days and without visits.

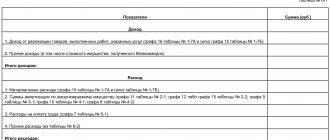

- A statement of the status of settlements shows only the debt or overpayment of taxes and contributions on a specific date. But to figure out where they came from, you will need another document - an extract of transactions for settlements with the budget.

- The statement of transactions for settlements with the budget shows the history of payments and accrued taxes and contributions for the selected period. Based on the statement, you will understand when the debt or overpayment arose and find out the reason for the discrepancies.

You can also submit a written request, but then you will have to take it to the tax office in person, through a representative, or send it by mail.

There is a special request form.

The tax office receives the request and, within five working days, issues a certificate for the date specified in the request. If there is no date in the request or it indicates a day that has not yet arrived, then the certificate will be issued on the date of registration of the request with the inspection.

Obtain information through services on departmental Internet resources

You can check your tax debt on the Federal Tax Service website, the government services portal or in the FSSP database of enforcement proceedings.

Federal Tax Service website

On the tax website, select the “Find out your debt” service.

To obtain information, register a taxpayer’s personal account or log in using a verified account on the State Services website.

A taxpayer’s personal account can only be registered by contacting the tax office in person.

After authorization, information about the tax debt, the amount of penalties and fines will appear in your account.

Public services portal

It also helps to find out about your debt. An individual entrepreneur can check his tax debt under the account of an individual. You do not need to log in as an individual entrepreneur or enter your TIN.

FSSP Enforcement Proceedings Database

The database includes cases that bailiffs are already working on. This happens after some time, so you won’t be able to immediately find out about the debt through this service.

Despite the fact that bailiffs can take upon themselves to fulfill the demands of the tax inspectorate without a court decision, the debt is not automatically included in their database.

If information about an individual entrepreneur appears in their database, you urgently need to repay the debt. FSSP sanctions go as far as description and seizure of property.

To check the debt, you do not need to enter a tax identification number; you just need to indicate your data in the form on the website: last name, first name, patronymic, region and date of birth.