Many entrepreneurs know that the Russian tax code provides for the opportunity to work under several tax regimes at once. Of course, this is convenient, especially if the company is developing in several directions at once and has different degrees of income in them. In this material we will consider the question of whether it is possible to combine the Simplified Tax Regime with UTII and, if so, under what conditions and which of the businessmen will be most beneficial.

What is the difference between UTII and “simplified”

If you avoid complex terms and speak in simple and accessible language, then UTII is a very common, generally accepted special tax system in which tax payments are made not from the income of the enterprise, but from the types of its activities.

That is, instead of a whole complex of various taxes, such as VAT, personal income tax, income tax, property tax, etc. An organization can pay only one, which greatly simplifies the maintenance of accounting records.

Moreover, the size of the company’s turnover and profit does not matter at all when calculating UTII - the amount of tax is paid based on its estimated, potentially possible income.

Until 2013, UTII was one of the main types of tax and was mandatory for some enterprises and organizations; since 2013 it has become voluntary.

The types of activities subject to this tax are determined at the level of local municipal and district authorities and vary depending on a particular region of the Russian Federation. To clarify the list of activities falling under UTII, entrepreneurs need to consult the tax office at the place of registration.

The simplified taxation system implies the basic tax regime, which is also very popular among small and medium-sized businesses.

Its main meaning, which also explains its high demand, is that with relatively small tax fees and deductions, the simplified tax system significantly simplifies accounting support, that is, the burden of tax and accounting reporting is quite small.

With “simplified” tax rates, two options are possible: 6% on income and 15% on income minus expenses. The first option is beneficial when the organization’s current expenses are low, the second is especially relevant at the stage of formation of the enterprise, when the highest costs occur. A huge advantage of organizations working under the simplified tax system is that they are rarely checked by representatives of tax services.

Attention! The main difference between UTII and the “simplified taxation scheme” is that the enterprise switches completely to the Simplified taxation scheme, but under the “imputation scheme” it can operate partially, since only certain types of activities can fall under it.

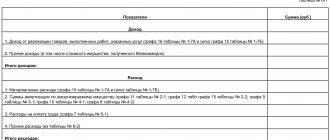

Income accounting for expenses distribution

Situation: how to determine income when drawing up proportions for the distribution of general business expenses: accrual method or cash method? The organization combines simplified taxation and UTII

Organizations combining simplified taxation and UTII must:

- keep separate records of income and expenses for each of these special regimes. Expenses that cannot be attributed to activities within the framework of a particular tax regime must be distributed in proportion to the share of income from each type of activity in the total income (clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation);

- maintain accounting (Article 2, 6 of the Law of December 6, 2011 No. 402-FZ);

- keep a book of income and expenses for operations that relate to simplified activities (Article 346.24 of the Tax Code of the Russian Federation).

The procedure for determining the total amount of income for the distribution of general business (general production) expenses between different types of activities is not established by law. In letters of the Ministry of Finance of Russia dated April 28, 2010 No. 03-11-11/121, dated November 23, 2009 No. 03-11-06/3/271 and dated November 17, 2008 No. 03-11-02/130 it is said that income from activities transferred to UTII should be determined according to accounting data, but taking into account two additional features.

Firstly, you need to be guided by the provisions of Articles 249, 250 and 251 of the Tax Code of the Russian Federation. That is, in the calculation of the proportion it is necessary to include not only sales revenue, but also non-operating income. At the same time, income that does not increase the tax base for income tax is not taken into account in the amount of income from activities on UTII.

Secondly, income from activities on UTII must be determined as payment is made. That is, to calculate the proportion from income reflected in accounting on an accrual basis, the accountant must exclude all unpaid income.

Situation: how to determine the total amount of income when combining simplified taxation and UTII - accrual method or cash method? The total amount of income is necessary to correctly allocate deductions (sickness benefits and insurance premiums) to employees engaged in both types of activities. When simplified, the organization pays a single tax on income

The procedure for determining the total amount of income for the distribution of deductions between different types of activities when combining special tax regimes is not established by law.

The amount of UTII accrued for the quarter can be reduced:

- on the amount of insurance premiums actually paid (within the accrued amounts) in the quarter for which the single tax was assessed;

- the amount of contributions under voluntary personal insurance contracts concluded in favor of employees in the event of their temporary disability (subject to certain conditions being met);

- for the amount of hospital benefits paid at the expense of the organization for the first three days of incapacity for work in the part not covered by insurance payments under voluntary insurance contracts.

This procedure is provided for in paragraph 2 of Article 346.32 of the Tax Code of the Russian Federation.

The amount of the single tax (advance payment) during simplification can be reduced by the amount:

- insurance premiums actually paid (within the accrued amounts) in the quarter for which the single tax was accrued (advance payment);

- contributions under voluntary personal insurance contracts concluded in favor of employees in the event of their temporary disability (subject to certain conditions);

- paid at the expense of the organization's hospital benefits for the first three days of incapacity for work in the part not covered by insurance payments under voluntary insurance contracts.

This is stated in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation.

At the same time, the total amount of deduction both for UTII and for the single tax under simplification cannot exceed 50 percent of the amount of the accrued tax (advance payment for the single tax under simplification) (clause 2.1 of article 346.32, clause 3.1 of article 346.21 of the Tax Code of the Russian Federation ).

To calculate deductions for insurance premiums and sick leave benefits accrued to employees who are simultaneously engaged in both types of activities, these amounts must be distributed. Insurance premiums and sick leave benefits should be distributed in proportion to the share of income from each type of activity in the total income of the organization (clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated October 20, 2011 No. 03-11-06/2/143.

An example of determining the amount of tax deductions for UTII and single tax with simplification. Sick leave benefits and insurance premiums accrued from the income of an employee simultaneously employed in both types of activities are eligible for deduction. When simplified, the organization pays a single tax on income

Alpha LLC combines simplified taxation (the object of taxation is income) and UTII. Alpha’s accounting policy for tax purposes states that the amounts of tax deductions are distributed in proportion to the share of income from each type of activity in total income. At the same time, income from activities on UTII is determined according to accounting data (only paid income is accepted), income from activities on a simplified basis - according to the book of income and expenses.

The organization has one employee engaged in both types of activities simultaneously. In March, at the expense of its own funds, the organization paid this employee a sick leave benefit in the amount of 10,000 rubles, and also transferred for him contributions to compulsory pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases in a total amount of 30,000 rubles.

For March, Alpha's income amounted to:

- from activities on UTII - 1,100,000 rubles, including unpaid income - 100,000 rubles;

- from simplified activities - 2,000,000 rubles.

To determine the amount of deductions, the accountant calculated the share of income from each type of activity in the total income of the organization.

The share of income from activities on UTII was: (1,100,000 rubles – 100,000 rubles): (1,100,000 rubles – 100,000 rubles + 2,000,000 rubles) = 0.33.

The accountant calculated the amount of deduction for UTII as follows: (10,000 rubles + 30,000 rubles) × 0.33 = 13,200 rubles.

The total amount of UTII accrued for the first quarter was 20,000 rubles. 50 percent of this amount is 10,000 rubles. (RUB 20,000 × 50%). Since the amount of deduction calculated based on the proportion exceeds 50 percent of the tax amount, the amount of UTII can only be reduced by 10,000 rubles.

The amount of deduction for the single tax under simplification was: 40,000 rubles. – 13,200 rub. = 26,800 rub.

The amount of the advance payment for the single tax under simplification for the first quarter amounted to 120,000 rubles. (2,000,000 × 6%). 50 percent of the advance payment amount – 60,000 rubles. (RUB 120,000 × 50%). Since the amount of the deduction calculated based on the proportion does not exceed 50 percent of the amount of the advance tax payment, the accountant reduced the amount of the advance payment by 26,800 rubles.

Restrictions for working under UTII and simplified tax system

• Let's start with the simplified tax system. A company wishing to operate under the “simplified” system should not have more than 100 employees on its staff. In addition, there are restrictions in the financial part: its annual income should not exceed 60 million rubles. and the residual value of intangible assets and fixed assets cannot exceed 100 million rubles. Another limit is related to the share of other legal entities in the authorized capital of the enterprise - this figure is limited to 25%. • Not everyone can work under UTII either. In particular, there is the same prohibition for enterprises and organizations with more than 100 employees and shares in the authorized capital of other legal entities exceeding 25%.

A taboo on the use of UTII is also imposed on those trade organizations and catering establishments whose customer service areas exceed 150 square meters in area. meters.

In addition, state budgetary institutions that are obliged to organize public catering as part of their activities do not have the right to operate under UTII.

Important: Both the simplified tax system and the UTII have a number of subtleties when applied. To know for sure whether it is possible to use each of these tax systems for a particular enterprise, it is advisable to carefully study the section of the Tax Code of the Russian Federation on this part or consult the nearest tax office.

Tax on previously received income

Situation: should a simplified organization pay a single tax on income received from the sale of goods last year, if last year the organization was engaged only in wholesale trade, and this year the organization began to engage in retail trade, which is subject to UTII?

Answer: yes, it should.

If this year the organization has not lost the right to use the simplified tax regime, it must pay a single tax on payments received for goods that were sold in bulk last year. The payment amount must be included in income in the tax period in which the funds were received into its current account or cash register. That is, this year. This conclusion follows from the provisions of paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated July 24, 2008 No. 03-11-04/2/113.

How to combine two modes: simplified tax system and UTII

In fact, the procedure for combining these two modes is quite simple. First of all, you should write a justification for combining these tax schemes, that is, document how the company’s activities will be distributed between them in terms of transactions, operations and various postings. Next stage: procedure for notifying tax authorities :

- If the enterprise, before combining tax systems, worked on the simplified tax system, then it is necessary, within five days from the moment of the start of work and provision of services falling under UTII, to contact the tax office at the place of registration of the enterprise with an application filled out in a certain form. Tax payments for UTII are calculated quarterly;

- If previously the company kept records and paid taxes according to UTII, then it will be possible to start working on the simplified tax system only from the beginning of the next calendar year. To do this, the Notification of the simplified taxation system must be submitted to the territorial tax service before December 31 of the current year inclusive.

If you don’t want to wait for the new year, then, as a last resort, you can close the enterprise and open it again, with the opportunity to work under the simplified tax system and UTII at the same time.

Attention! You cannot use the simplified tax system and UTII for the same type of activity. It is better to calculate everything in advance and decide for which line of business a particular tax tariff is beneficial.

Separate accounting: UTII and simplified tax system

It is necessary to take into account that when operating under two tax regimes, the company will be required to maintain separate accounting records.

That is, despite simplified accounting support for each of these tax systems separately, when they are combined, the burden on accounting will increase.

In more detail, you will have to distribute the profits and expenses of the organization into different groups. In terms of income, these will be those groups that are obtained on the basis of UTII and those that are calculated based on the simplified tax system. Based on costs, they will have to be divided into groups associated with operations separately according to UTII, separately according to the simplified tax system and according to costs simultaneously for types of activities falling under both of these tax systems.

Pros and cons of the simplified tax system for individual entrepreneurs

When using the simplified tax system, an entrepreneur has the right to pay tax not on the expected fixed income, but on the funds actually earned. The choice of option for calculating taxable items is carried out by the taxpayer independently, taking into account the specifics of the business - “income” or “income minus expenses”. In this case, first of all, one should take into account the amount of revenue and expenses of the individual entrepreneur for the period.

The declaration is submitted not quarterly as with imputation, but annually. During reporting periods, no forms are submitted to the Federal Tax Service; the simplifier only transfers tax advances to the budget. According to legal requirements, all individual entrepreneurs can use the simplified tax system, subject to regulatory restrictions. But the list of activities does not in any way affect the right to use the simplified form. If an entrepreneur works in different areas, some of which fall under UTII, he will have to combine the two modes and ensure separate accounting.

To accurately understand the benefits and disadvantages, you need to weigh all the pros and cons in detail and carefully calculate the size of the tax burden. When comparing, three options are used - UTII, simplified taxation system “Income” and simplified taxation system “income minus expenses”. Make calculations for a quarter, or better yet, a year. At the same time, do not forget to take into account which OKVED you are going to work for, as well as how many hired personnel you will have to hire.

Subtleties of taxation when using the simplified tax system and UTII at the same time

As is already clear from the title of the section, when combining UTII and simplified tax system for entrepreneurs, a number of features arise:

- In terms of document management: at the end of the tax period you will have to submit two declarations at once: one according to the simplified tax system, the other according to UTII;

- Variability appears in the area of tax assessment: if necessary, you can use the tax regime that is most interesting and profitable;

- Possibility of reducing VAT through contributions to social funds.

To summarize: combining the simplified tax system and UTII is possible. In order to start working simultaneously using both of these systems, an enterprise must meet certain parameters and follow certain rules. If all the requirements of the law are taken into account, there will be no obstacle to such tax combination.

Example of income distribution calculation

Not all types of businesses have the opportunity to switch to a simplified system. For example, banks or credit organizations cannot take advantage of this. Another limitation relates to the composition of the firm's founders. If among them the share of legal entities exceeds 25%, the prohibition in question also exists for them.

Baking bakery products and selling them in your own retail store are considered. Production uses the simplified tax system, and the store uses UTII. The bakery’s income is 40 thousand rubles, the store’s is 140 thousand rubles.

Renting the premises cost the individual entrepreneur 29 thousand rubles. How to distribute expenses between two directions?

First, the percentage of income from the bakery is determined.

It is equal to (40000/(40000+140000))*100% = 22%. Store income will be 78%. Taking the corresponding parts of the cost amount, we find that the rent for a store is 22,620 rubles, for a bakery - 6,670 rubles.

It should be noted that in a store, the cash register when combining the simplified tax system and UTII does not require a cash register.