Self-employment is a form of receiving money for your work from customers. This concept began to be applied in legislation in 2020. As part of the experiment, persons who carry out such activities must pay a tax of 4% when working with individuals and 6% when working with organizations. Now the relevant question is what a check from a self-employed person looks like and is it always necessary to issue it.

Is it appropriate to issue a sales receipt when providing services?

When selling goods or providing services, it is necessary to prepare documents such as a strict reporting form and a cash receipt. A sales receipt for services is an additional way to confirm payment made.

This is an accounting document that has legally confirmed details. In essence, it is a “decoding” of a cash receipt. Despite the fact that the name of this check contains the word “sales”, its issuance when confirming the provision of services is acceptable.

However, beginning individual entrepreneurs often ask the question: “When is it appropriate to write a sales receipt for services?” There is a very definite answer to this in the legislation - it is issued at the request of the purchaser of a product or service. Also, an individual entrepreneur has the right to hand it over to each of his clients at will.

This form is needed to confirm payment made for the service provided. And an accounting act is necessary for accountable persons. The sales receipt serves as the basis for writing off funds during advance payment. This form also contains information about the service provided to the client that is not available on the cash receipt.

How to create a check for the self-employed

Self-employed people have the right not to use the online cash register. However, they need to generate an analogue of the document. The fiscal authority maintains a register of operator data.

There are some rules on how to generate a check for a self-employed person, which are reflected in the legislation. When performing calculations that are related to the receipt of income, the payer is obliged to transfer information about completed transactions with money to the tax authority.

How can I do that:

- using the “My Tax” application;

- through the operator of the electronic platform;

- through a banking organization.

Responsibilities include issuing receipts for services, rent, goods sold and work performed.

The buyer can receive a receipt in paper or electronic form. Before issuing it, it is recommended to check whether all the necessary information is provided. If the check is issued electronically, it can be sent to your phone or mail. A paper receipt can be generated immediately.

Legislative basis

Mention of the obligation to provide a sales receipt for services at the request of a buyer or client is contained in Article 2 of Federal Law 54. It explains that in this document it is necessary to indicate the details that are a criterion for the validity of this form.

In addition, information under the sales receipt as an accounting document can be found in the 55th Government Resolution. The 11th paragraph of this resolution states that it is in this act that information about the shortcomings of a service or product, if any, must be reflected in writing. And in paragraph 20 it is explained that a sales receipt is considered the basis for confirming the fact of signing an agreement between the client and the entrepreneur. In addition, you need to pay attention to the information contained in such paragraphs of this resolution as 46, 51, 60, 69, 80, 101, 111, 117, 124.

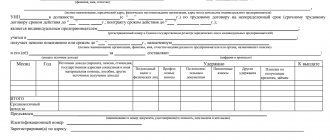

A sample sales receipt for services is presented below.

Federal Law No. 2300-1 states that if a consumer complains about a product or service for inadequate quality, then his claim will be considered if he presents a sales or cash receipt.

In civil legislation there is also a mention of this accounting document. For example, Article 493 states that the purchase and sale agreement will be officially recognized as executed and entered into force at the moment when the buyer accepts the goods or cash form from the seller.

How to hand over a check to a client

When making payments from a self-employed person to customers or clients, the citizen providing services is required to fill out a payment document. The action is performed using the “My Tax” application through your personal account. You need to use the add new sale function.

Before issuing a document, you need to check whether all the data is displayed in it. The name of the product, cost, and tax identification number must be indicated. After confirmation of the data, they are transferred to the Federal Tax Service.

There are several ways to transfer a document to a customer or buyer:

- sending by email;

- transmission in paper form;

- reading using a QR code via smartphone.

The income received should be reflected immediately after calculation. However, according to the law, income can be reflected in later periods.

What should a sales receipt form for services contain?

The legislation does not contain information about the exact form in which a sales receipt should be issued. However, regulations prescribe mandatory details that must be indicated in the document. The Federal Law lists what must be indicated in the sales receipt for services (the sample filling will help with this):

- title of the act;

- sales receipt number;

- time, date of issue;

- name of the selling organization and its tax identification number;

- name of the service or product;

- the quantity of goods supplied or services provided;

- cost of a service or product;

- personal signature of the entrepreneur.

The legislator has not established a rule according to which it is mandatory to affix this act with a seal belonging to an organization or individual entrepreneur. Therefore, its absence is not a reason to invalidate such a check.

What are the deadlines established by law for issuing cash receipts? When should they be issued?

According to legislative data that has legal significance, a receipt should be generated and provided to the buyer immediately when payment for services is made in cash or using an electronic payment method.

If other forms of payment are provided, and the funds are transferred to the self-employed employee in non-cash form, the document is generated and transmitted no later than the ninth day of the month that follows the tax period when the payments were made.

Important! According to the law on self-employment No. 422-FZ, there is no need to use an online cash register. In this case, the document can be issued through the tax service application. The document can be issued in paper or electronic form. So, when a self-employed person must cut a check depends on the payment option.

How is it processed?

An entrepreneur can independently produce a sales receipt for the provision or order it from a printing house. In addition, ready-made forms can be found on sale. If the form is made to order, then in preparing its form you can take into account the specific features of the given business and the specifics of the services provided.

Filling out a sales receipt form for services is not difficult. Forms must be lined for each column separately. The entrepreneur filling out the form must clearly and accurately enter information on the service provided - its name, quantity, and the total amount. There should be no corrections on the sales receipt.

Differences in documents confirming payment

There are documents that can be given to the buyer - cash receipt, invoice, receipt, cash order. Each of them serves its own purpose.

So, can a sales receipt be provided instead of a cash receipt if an entrepreneur is required to use a cash register? The answer is clear - no. Only if the individual entrepreneur is relieved of this obligation. The sales receipt and invoice act as evidence of the provision of services and payment. The first is issued to individuals, and the second to individual entrepreneurs or LLCs.

A sales receipt is an additional document confirming the fact of a transaction. In this form you can indicate both services and goods.

Can be provided by individual entrepreneurs and companies. Issued upon buyer's request. Violation of this duty is subject to liability in the form of a fine or warning.

Previous article: Is it possible for an individual entrepreneur to trade without a cash register? Next article: Sales receipt without providing a cash register: legality and registration requirements

When the form does not contain all the information

In cases where there is not enough space on one check to fully indicate the necessary information, the entrepreneur can resort to one of the following methods:

- Fill out 2 forms, but on the second one indicate that it is a continuation of the first. In this case, the total amount needs to be entered only in the last form.

- Prepare forms for different groups of services. In this case, the total amount must be indicated for each of these groups separately.

It is not mandatory to use a seal when issuing a sales receipt for a service.

How to issue a receipt if I sold a handmade product via the Internet to a foreigner

Self-employed people do not have the right to resell goods; this action is illegal and is subject to liability. However, it is not prohibited to sell products of your own production, including handmade ones.

Important! The amount in the check must be in rubles at the appropriate exchange rate of the Central Bank.

You can generate a check for clients abroad using the “My Tax” application; the user will be able to receive it by email or via phone number.

The time of receipt of money will be the date of receipt of funds into the account of the person providing services or selling goods.

Adviсe

This form has serious significance in business processes. As a rule, entrepreneurs do not imagine the dangers that are fraught with the uncontrolled issuance of this official paper to assistants. They hand over blank forms of sales receipts with their signature and seal of the company. And on the basis of these documents, significant amounts of money are written off without any real basis. And the claims are then presented to the individual entrepreneur or organization. In this case, judicial practice takes the side of clients.

There is a convenient way out of this situation. Each of the forms should be numbered, and sellers should be required to make copies each time they are issued. The entrepreneur himself records each fact of issuing a sales receipt in a special accounting book. This method allows you to insure an individual entrepreneur against illegal issuance to a consumer.

A sales receipt for taxi services can also be provided.

The driver of a passenger vehicle, when making cash payments for the service provided, has the obligation, in accordance with the generally established procedure, to give passengers at the end of the trip either a cash register receipt printed by a cash register machine, or a receipt (strict reporting form), which contains certain details.

The law establishes the obligation of enterprises to use cash register equipment in cash payments and (or) payments with payment cards when selling goods, performing work or providing services.

The receipt must contain the following details:

- name, series and number of the receipt for taxi payment;

- name of the freighter;

- date of issue of the receipt for taxi payment;

- cost of use;

- Full name and signature of the person authorized to make payments.

If a self-employed person does not hand over a check, you can complain

Each professional income tax payer must provide clients with receipts for transactions performed or goods sold. If the self-employed person did not hand over the check, most likely it was not generated, that is, the person hid his income from the fiscal authorities.

For the first time, the fine for violation may be 20% of income, for subsequent violations - 100%. To avoid the lack of documents, legal entities and individual entrepreneurs can draw up an agreement so that the contractor is responsible for the checks. In addition, the contract can include provisions for penalties for violations.

Thus, the legislator establishes exact deadlines for issuing a cash receipt. It must be generated immediately after payment in cash or electronic payment for services. For non-cash payments, it is acceptable to send a check before the 9th day of the next month. A receipt is generated in the “My Tax” application.

Incorrect design

Another problem is their incorrect design. This is due to the fact that there is no strict form for this form. However, the mandatory details are listed in the legislation, and this requirement should not be ignored. Otherwise, the organization issuing the form (or individual entrepreneur) may have problematic situations with clients or counterparties. This problem can be solved by training employees on the rules for drawing up the form, as well as regularly monitoring their actions related to it.

Online magazine for accountants

When firms or private entrepreneurs conduct numerous trade transactions, the question sometimes arises: where should the check number be on a cash register receipt ? After all, this detail is required; without it, the document is considered invalid. Therefore, it is important to do everything correctly, in compliance with legal regulations.

A cash receipt is an accounting document obtained using cash register equipment. It is intended to confirm the fact of purchase and sale made when paying in cash. A check allows you to record the amount that passed through the cash register during the reporting period.

Is an entrepreneur required to have a cash register?

The use of a cash register is the responsibility of organizations and individual entrepreneurs. However, the law also contains exceptions to this rule. They primarily concern those who do business on UTII and PSN, as well as entrepreneurs who sell certain goods or provide certain services.

Is it possible to issue a sales receipt for services? Not only is it possible, but it is also necessary.

The law also allows you to issue a sales receipt without a cash register. However, in this case, the entrepreneur must be extremely careful in developing his own form of the document, and, above all, in the part where information on the service and its cost is indicated.

What if I canceled a check by mistake?

You cannot return a canceled check, but you can generate the document again with the same data and amount. The newly generated document must be transferred to the client.

Important! If you do not renew a check, there is a risk of fines being assessed when the tax office checks, so it is recommended that you work carefully in the application to avoid mistakes.

Rules

So, if an individual entrepreneur does not use a cash register, then he must adhere to the following rules:

- His sales receipt will be the basis for confirming the payment made only if it contains the details.

- The form must clearly indicate the name of the service and the quantity of it provided.

- The total amount must be indicated in a separate column, and it is recommended to indicate it both in numbers and in words.

- It is imperative to cross out all remaining empty lines, this will eliminate the possibility of illegally entering false data about services and goods.

- The form must be completed in two copies, one of which must be given to the buyer, the second to the seller.

If the buyer requested a sales receipt for a service, but the organization or entrepreneur did not provide it, then liability for this offense will be settled in accordance with the content of Article 14 of the Code of Administrative Offenses of the Russian Federation. This can be either a warning or a fine: up to 2 thousand rubles - if we are talking about an individual entrepreneur, and up to 40 thousand - if we are talking about an organization.

We considered whether it is possible to issue a sales receipt for services.

Postings in organizations using BSO for calculations

If an organization uses a strict reporting form instead of a cash receipt, then such a form must be stored and accounted for according to the rules established by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359. Strict reporting forms are kept in the appropriate journal (stitched and numbered). To control the movement of such material assets, an accounting card is created.

Typical transactions when using BSO in an organization are as follows:

| Debit | Credit | The essence of the operation |

| 10 | 60 | Purchase from the BSO printing house, posting them to the organization |

| 19 | 60 | VAT has been allocated from the amount of purchased forms |

| 68 (VAT) | 19 | Value added tax on purchased forms is accepted for deduction |

| 20 | 10 | BSO were transferred to the relevant units or financially responsible persons |

In addition, BSO are reflected on the balance sheet in account 006. Its use allows you to keep track of the receipt and write-off of forms by departments and financially responsible persons (MRP). Thus, the debit of account 006 reflects the receipt of forms to the corresponding department and to a certain MOL. According to the credit of account 006, strict reporting forms are written off from the unit or MOL upon their disposal (use, damage).

The identified shortage is documented in an act drawn up by an authorized commission. The write-off of BSO in case of damage is also carried out by an act.

BSO is stored in safes or fireproof cabinets designed for storing such documents. BSO inventory is carried out regularly (at least once a year).

Read more about accounting and inventory of BSO in the article “What applies to strict reporting forms (requirements)?” .

Requirements for an online cash register receipt

Federal Law No. 54 allows you to include other details in the check - based on the characteristics of the specific sphere of economic activity of the business entity. For example, this could be the organization’s logo, information about certain promotions, or other information useful to the buyer.

Actually, the use of online cash registers in such areas is carried out within the framework of a separate mechanism - which involves a significant simplification of the work of retail outlets. The list of regions where simplified trading rules using the cash registers in question are in force is established by law.

Mandatory details of cash receipt and BSO in 2020

Switching to online cash registers is not just about buying new cash register equipment. To register a cash register with the tax office, you will have to connect to the OFD. Product names are now required on receipts, so you need a cash register program. From us you can purchase a complete solution: cash register with financial tax, CFD for a year and a cash program.

- Document's name.

- Document number, consisting of six digits.

- The name and form of ownership of the organization issuing the check.

- Company address.

- TIN of the company that issued the document.

- Type of service provided to the client.

- Service cost.

- The amount paid by the client.

- Position and full name of the employee who accepted the payment.

- Other characteristics of the service (optional).

Why indicate the check number?

- The main information is the name of the enterprise. It must match the data specified in the registration certificate. If the company belongs to an individual entrepreneur, the surname of the owner is indicated.

- Next, enter the taxpayer identification number. It is issued by the tax office at the time of registration and is a 12-digit value.

- After this is the number assigned to the cash register after its registration.

- When indicating a serial number, verbal designations (Check, Account, Number), as well as the symbols No. and # can be used.

- Be sure to write down the date and time of purchase on the document. First the day is written, and then the month and year.

- The required information is the cost of the purchased product.

- The receipt indicates that the mode used is fiscal. This can be done by the name of the same name or the abbreviation FP.

This section also defines their composition. Reflects the goods sold, price value, number of items purchased and payment amount. The result of the basis is the total purchase amount expressing the type of payment made, shares and change given to the user. The document ends with registration data.

26 Jun 2020 stopurist 599

Share this post

- Related Posts

- What is included in the common property of an apartment building

- How do I know if I have been deprived of my rights or not?

- Is it possible for one person to get 2 Transport Social Cards?

- Registration of an apartment with a mortgage