An agreement is concluded between two parties - the principal and the agent. The first is a company that provides certain services or sells goods.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The latter is a person who searches for customers, informs them about the product, and concludes transactions. The agent works only with forms provided by the principal.

Substance of the document

An agency agreement means that one of the parties is obligated to provide a certain type of service that the other party has entrusted to it.

This agreement refers to bilateral transactions that are of a compulsory nature and may interpret other agreements.

In the case where an agent performs services on behalf of a principal, such an agreement is similar to an agency agreement.

If the execution of orders is carried out on behalf of the agent, then this document is identified with the commission agreement.

The most popular is the agency agreement, the subject of which is the provision of intermediary services; it is used in the field of services.

Organizations that deal with real estate are also asking to look for new clients.

The main stages of creating such companies

Current laws allow the use of different organizational and legal forms for intermediary enterprises. Businessmen who want to work in this direction can register as “JSC”, “LLC” or “IP”. Each legal form has its own nuances that must be taken into account when creating a business. In the case where the entrepreneur’s services are aimed at other business entities, it is recommended to register as a legal entity. Creating a limited liability company allows you to demonstrate to potential partners the seriousness of a businessman’s intentions.

The intermediary business, examples of which were discussed above, requires mandatory registration with the tax service. In order to register your own company, an entrepreneur needs to fill out the appropriate application. When filling out the form, you must pay special attention to the selection of OKVED codes. Incorrect indication of economic activity codes can lead to various unpleasant consequences. It is important to understand that the current classifier does not have a code corresponding to intermediary services. This factor is explained by the fact that mediation is one of the types of trade.

When choosing a narrow specificity, you must indicate a special digital value provided for a specific area. This rule must be observed when working in the following areas:

- Securities trading.

- Work in the real estate market.

- Work on the stock exchange.

Gosstandart regularly makes various adjustments to the classifier of types of economic activities. At the time of company registration, it is recommended to carefully study the current edition of this directory. You can change the selected values only if the company is reprofiled or additional areas of activity are selected.

Nuances of value added tax (VAT)

The provision of intermediary services in Russia is subject to VAT if the intermediary is a VAT payer. The VAT declaration form is available.

The agent must charge VAT on the amount of his income, as well as other income received in carrying out this activity:

| As a general rule, an intermediary whose work is related to the sale of goods that are exempt from VAT under Art. 149 of the Tax Code of the Russian Federation | Obliged to pay VAT on the price of his services. The only exceptions are some medical products |

| The intermediary is obliged to add VAT to the amount of agency income on the day when he fulfills his obligations under the intermediary agreement | Usually this is the day the report is approved by the customer, or the day the document is agreed upon by both parties |

| From the date of execution of one of the agreements, the intermediary has five days to present an invoice for the amount of his reward to the principal | VAT is charged at a rate of 18%, although goods sold under the agreement may be subject to different VAT rates or not subject to VAT at all. |

| Amounts earned from the principal for the intermediary to fulfill its obligations with the VAT intermediary | They are not taxed and are not considered as income or expenses for income tax purposes. |

| VAT calculated on the income of the intermediary is paid as part of the total tax amount based on the results of the quarter | In equal installments no later than the 25th day of each of the three months following the last quarter |

Business idea for freight dispatcher services

- 1 How to start organizing a business using freight dispatcher services

- 2 How much can you earn?

- 3 How much money do you need to start a business?

- 4 How to choose equipment

- 5 Which OKVED code must be specified for cargo dispatcher services

- 6 What documents are needed to open

- 7 Which taxation system to choose for freight dispatcher services

- 8 Do I need permission to open?

- 9 Business technology

- 10 Newcomer to providing freight dispatcher services

The dispatcher in the field of cargo transportation is one of the central actors.

His responsibility is to assist the owner of the cargo in finding freight transport for transportation and, most importantly, this business idea does not require financial investments.

That is, the dispatcher is between the owner and the carrier, taking into account not only the specifics of the cargo, but also the nature of its transportation.

The specialist is obliged to provide the client with suitable transport in the shortest possible time, thereby providing the car owner with a profitable order.

In addition, the dispatcher assumes the obligation to organize interactions between several orders during the delivery of consolidated cargo.

Thus, joint activities with the dispatcher are beneficial for both senders and carrier companies.

Where to start organizing a business using freight dispatcher services

To properly organize a business, it is better to act simultaneously in several directions:

1. Registration of business as individual entrepreneur and LLC . Registering an LLC will allow you to work with legal entities who prefer to pay by bank transfer with VAT added. To cash out funds, you will need the services of a legally competent accountant.

At the same time, registering an individual entrepreneur will allow you to cooperate with carriers who work only in cash without VAT.

2. Workplace equipment . If you plan to work from home, you can organize a personal office for yourself, but it is still advisable to draw up a lease agreement and calmly move into the premises, bringing in furniture and the necessary equipment.

To operate the dispatcher you will need:

- permanent cellular connection with registration of a direct city number;

- landline telephone with the ability to receive and send faxes;

- PC or laptop with Internet connection;

- ready-made contract forms, invoices and waybills;

- manufactured seals and stamps for two enterprises: individual entrepreneur and LLC;

- office;

- automobile code of the Russian Federation, maps of roads and highways.

3. Finding clients usually does not cause much trouble . You need to send your data to several transport companies that have their own fleet of vehicles. Next, you can register on city or regional websites related to cargo transportation.

It would be a good idea to advertise through newspapers and radio. As time has shown, saving on advertising is undesirable. A well-executed advertising campaign will quickly pay off, and the first orders will soon begin to arrive.

The next step is to search for organizations whose activities may require the transportation of goods. Most of these enterprises have their own proven dispatchers, but they are often ready to take the data of newcomers for backup.

4.

Constant monitoring and assessment of the market allows us to collect available data on various transport companies or private enterprises.

This will allow you to analyze the key areas in the work of enterprises, their routes in the city and beyond. It will be important to familiarize yourself with the tariffs and be aware of their changes. All this data will help you respond as quickly as possible and offer the client several possible options. Speed and communication skills have a positive impact on the dispatcher’s reputation, which leads to an expansion of the client base.

5. Maintaining documentation . You should always start working with a customer by concluding a contract. This is a guarantee of decent wages. You need to take document management very seriously.

It is advisable to take into account all the little things so that serious problems and misunderstandings do not arise during work. In any case, if questions arise or doubt arises, it is necessary to clarify or ask again.

The documents drawn up must clearly indicate the following data: the type of car and its license plate number, the driver’s passport details, the name of the cargo, its quantity and type of packaging.

6. Own website . Creating and promoting your own website will allow you to find not only customers, but also performers (car owners). When operating this way, it is important to find decent drivers.

The principle of operation here will be the same as before: the driver, having received the order, delivers the cargo, unloads it and immediately calls the dispatcher, clarifying in which area of the city he is located. The dispatcher’s task is to find a load in the specified or nearby area and send his released driver there.

7. Payback . Profits will start flowing in within the first week. This is the maximum delivery time for cargo within the country. In many ways, your income will depend on the cost of transportation, but for fruitful work it is advisable to check prices on specialized websites.

Further work depends entirely on desire and capabilities. Do not forget that a business will regularly make a profit only if it plays fair.

There is a lot of competition in this field of activity, and few people will work with a poorly proven dispatcher.

How much can you earn

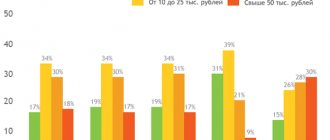

According to average data, the dispatcher keeps 7-15% from each order. More experienced enterprises in Moscow can request up to 20% of the amount of the completed order. Average earnings from a car can be 500 rubles per day.

If we agree with at least 10 regular drivers, we get 5,000 rubles per day or, accordingly, 100 - 120,000 rubles per month. However, this is subject to almost full load.

In practice, in the first year of operation you can count on no more than 50-70 thousand net profit.

How much money do you need to start a business?

You can start your activity in dispatching services in the field of cargo transportation with a relatively small investment. The main thing is the purchase of equipment, communications, rent and consumables, such as forms and stationery. Having 50-70,000 rubles in hand, you can easily try yourself in the field of freight transportation.

How to choose equipment

The following equipment must be purchased for a rented office:

- landline telephone with fax functions;

- dedicated Internet and telephone line;

- mobile communications;

- personal computer with printer;

- table and chair, calculator.

Which OKVED code must be specified for cargo dispatcher services?

Coding 63.21.2 “Other auxiliary activities of road transport” is suitable for this activity.

What documents are needed to open

To open a business for the services of a cargo dispatcher, you must fill out an application form P21001 and submit it to the state registrar (you can use a multifunctional registration services center) along with a copy of your passport and the stub of a receipt for payment of 800 rubles of state duty. Those who want to save time can contact specialized companies that will quickly help you collect a package of documents in a short time.

Which taxation system to choose for freight dispatcher services?

An entrepreneur can choose a single imputed tax, which will make it possible to pay a certain amount to the Federal Tax Service each month, or choose a simplified taxation scheme. According to it, it is more expedient for him to deduct 6% of the amount of all gross income received from truck drivers.

Do I need permission to open?

If you do not rent or purchase freight vehicles, you do not need to obtain special licenses for dispatch services. The only permission is to request from the landlord permission to work in the premises from the “fire department”.

Business technology

The activity relates to intermediary and logistics - investments are minimal, and the point is to find cargo for transport that is moving in the same direction. In this business, it is important to properly maintain documentation and file all contracts and invoices, since the main work is related to document flow and online monitoring of transport movements.

It will take time to develop a client base, and at first, advertising will help you find customers. It makes sense to send mailings to carriers, print your own business cards and distribute them to truck drivers.

The work itself is to organize the process of transporting various goods. In this case, the dispatcher plays the role of an intermediary between the customer company and the performing company. It must be remembered that he is responsible to two parties at once.

Newcomer to providing freight dispatcher services

(9 4,33 of 5) Loading...

Source: https://realybiz.ru/idei/biznes-ideya-uslugi-dispetchera-gruzoperevozok

How to fill out the sample correctly

The agency agreement for the provision of intermediary services for finding clients includes the following clauses:

- Subject of the agreement.

- Validity.

- The procedure for the agent to submit reports for all transactions performed.

- The amount and procedure for paying the agent's reward.

- Limitation of rights of participants. Grounds on which the document may be terminated.

- A clause regarding the impracticability or likelihood of signing a subagency agreement.

An agency agreement for the sale of goods has its own characteristics:

| The goods are with the principal until the sales period | The agent can only claim compensation |

| The agreement can set advertising standards | Customer Service Sequence |

| You can write in detail different features | Starting with the commitment to the previous preparation of the goods and ending with the registration of the point of sale |

| It is possible that the agent’s remuneration will change depending on what functions are assigned to him | Participants in the agreement can establish certain conditions that increase or decrease the amount of remuneration |

A form for an agency agreement for the provision of intermediary services for finding clients is available.

Limitation of the rights of the parties to the agreement

According to the analyzed agreement, the participants are the agent and the principal - this is the executor and the customer.

If the agent performs the actions established by the document on behalf of the principal, then, according to the agreement signed with the third party, the rights and obligations appear to the principal.

If an agent, on the instructions of the principal, acts on his own behalf, then the consequence of the transaction will be the acquisition of rights and obligations by the agent.

The rights of the parties to the agreement and their responsibilities differ depending on the intended agreement. Agent rights:

- Receive a power of attorney and carry out transactions at the request of the principal.

- Receive income from the principal, according to the document.

- Insist on payment of remuneration in the amount and sequence determined by business customs, when the agreement does not specify these issues.

- Sign subagency agreements in situations that are permitted by the main agreement.

- Refuse from an open-ended agreement without the right to request remuneration for unfulfilled orders.

The terms of the agreement under which the agent can sell goods, provide services or perform work only to a specified group of customers or buyers who are located or reside in a certain territory will be invalid.

Principal's rights:

- They have the right to request that the contractor prepare an agency report as part of the agreement.

- Provide disagreement on the report.

- Refuse from an open-ended agreement, but at the same time pay the other party all costs and fees.

- Request the agent to refrain from signing a similar document with other principals.

Termination

The rules for making changes or termination are within the jurisdiction of civil law.

Article 1010 of the Civil Code of the Russian Federation specifies norms that may serve as the basis for unilateral termination:

- if the agreement was signed for an indefinite period. The rules are not specified in Chapter 52 of the Civil Code of the Russian Federation, but on the basis of Art. 1011, 977, 1003 and 1004, the party to the transaction must notify the opposite party of the relevant decision at least a month in advance;

- in the event of the death of an agent or his official recognition as missing. In addition, the contract loses legal significance if the performer has lost legal capacity;

- if the agent is a private entrepreneur who is officially declared bankrupt, for which reason he cannot provide agency services.