The Tax Code of the Russian Federation obliges all individual entrepreneurs to make contributions for their insurance. Fixed payments for individual entrepreneurs in 2020 must be paid on time and in full. How much and when should I pay? Check if you did everything correctly, there is still time to pay.

You can read about fixed payments for individual entrepreneurs in 2020 here.

What should an individual entrepreneur pay for?

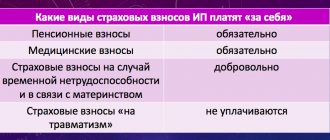

Article 430 of the Tax Code of the Russian Federation establishes that entrepreneurs must list for themselves:

- insurance contributions for compulsory pension insurance (OPI);

- insurance premiums for compulsory health insurance (CHI).

That is, individual entrepreneurs provide themselves with a pension and annual medical care at their own expense. But in order to receive sick leave or maternity leave, you need to register with the Social Insurance Fund and also transfer contributions to your social insurance. But these contributions are voluntary, so not all individual entrepreneurs pay them.

How much should an individual entrepreneur pay for himself?

Contributions for yourself are a known amount in advance, and it is also specified in the Tax Code. In 2020, you need to transfer 26,545 rubles to your pension insurance, and 5,840 rubles to medical insurance. Only 32,385 rubles, and this is the amount for a full year of activity of the individual entrepreneur.

If you have had the status of an individual entrepreneur for less than a year, the amount of mandatory contributions will be less - only for certain months and days. In such cases, it is convenient to calculate insurance premiums for individual entrepreneurs using our calculator.

For example, an entrepreneur was registered back in 2020, and on October 10, 2020, he was deregistered with the Federal Tax Service. The income received for this period was small - 280,000 rubles. We indicate the dates in the appropriate fields and receive the amount of contributions that this individual entrepreneur had to pay for less than a full year of activity.

You need to pay:

- contributions to compulsory pension insurance - 20,622.33 rubles;

- contributions for compulsory health insurance - 4,536.99 rubles.

Total 25,159.32 rubles.

But in addition to the mandatory amounts indicated above, entrepreneurs who have received an annual income of over 300,000 rubles must make an additional contribution. It goes only to pension insurance and amounts to 1% of income over 300,000 rubles.

Here is an example of calculating contributions we made using a calculator. The period of business activity remained the same, but income increased to 1.78 million rubles.

We get what we need to pay:

- contributions to compulsory pension insurance - 20,622.33 rubles;

- additional contributions for compulsory pension insurance - 14,800.00 rubles;

- contributions for compulsory health insurance - 4,536.99 rubles.

Total 39,959.32 rubles. The amount is increased by just 1% from income over 300,000 rubles per year, based on (1,780,000 – 300,000) * 1%) = 14,800 rubles.

The additional contribution to pension insurance has an upper limit. The maximum amount in 2020 is 185,815 rubles, and taking into account the mandatory contribution of 26,545 rubles, the transfer limit for individual entrepreneur pension insurance is 212,360 rubles.

Pension contributions of individual entrepreneurs from 2020: new sizes

From 2020, insurance premiums for compulsory pension insurance will be calculated in the following order:

- if the payer’s income for the billing period does not exceed 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period;

- if the payer’s income for the billing period exceeds 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period plus 1.0% of the amount of the payer’s income exceeding 300,000 rubles for the billing period.

Let's decipher the new meanings and give examples of calculations of amounts payable in various circumstances.

Fixed amount for income of 300 thousand rubles or less

As we have already said, in 2020, fixed pension contributions of individual entrepreneurs “for themselves” with incomes of less than 300,000 rubles amounted to 23,400 rubles. This amount was determined using a special formula based on the minimum wage and insurance premium rates. However, from 2020 the fixed amount of pension contributions will not depend on these values. It will simply be enshrined in law as 26,545 rubles.

Thus, since 2020, fixed pension contributions have increased by 3,145 rubles. (RUR 26,545 – RUR 23,400). From 2020, all individual entrepreneurs, regardless of whether they conduct business or receive income from business, will need to pay 26,545 rubles as mandatory pension contributions.

It is envisaged that the fixed amount of insurance contributions for compulsory pension insurance (26,545 rubles) from 2020 will be indexed annually by decision of the Government of the Russian Federation.

Next, we will consider examples when individual entrepreneurs will need to pay fixed pension contributions in a new (increased) amount.

Example 1. There were no activities in 2020

Individual entrepreneur Velichko A.B. was registered as an individual entrepreneur in 2020. Throughout 2020, he maintained the status of an entrepreneur, but did not conduct any activities and had no movements on his current accounts. But, despite this, for 2020 he still needs to transfer 26,545 rubles as fixed pension contributions.

Example 2. Income for 2020 is less than 300,000 rubles

For 2020, individual entrepreneur Kazantsev S.A. received an income of 278,000 rubles (that is, less than 300 thousand rubles). In such circumstances, for 2020 he also needs to transfer 26,545 rubles as fixed pension contributions.

If income is more than 300,000 rubles

If at the end of 2020 the income of an individual entrepreneur exceeds 300,000 rubles, then the individual entrepreneur will need to pay an additional plus 1.0% of the amount of the payer’s income exceeding 300,000 rubles for the billing period. There have been no changes in this part since 2020. This approach has been used previously.

Maximum amount of pension insurance contributions

Until 2020, there was a formula that calculated the maximum amount of pension contributions. There was no need to pay more than the amount calculated using this formula. Here is the formula:

The maximum amount of pension contributions of individual entrepreneurs for 2020, calculated using this formula, was 187,200 rubles. (8 x RUB 7,500 x 26% x 12 months).

However, from 2020, the procedure for establishing the maximum amount of pension contributions has changed. Try another formula:

As you can see, in 2020 the eight-fold limit will also apply, but not to the minimum wage, but to a fixed amount of 26,545 rubles. Thus, more than 212,360 rubles. (RUR 26,545 x in 2018 cannot be paid as pension contributions.

Thus, more than 212,360 rubles. (RUR 26,545 x in 2018 cannot be paid as pension contributions.

It turns out that the maximum amount of pension contributions payable since 2018 has increased by 25,160 rubles. (RUR 212,360 – RUR 187,200).

Example 3. Income over 300,000 rubles

For 2020, individual entrepreneur Kazantsev S.A. received income in the amount of 6,800,000 rubles. This amount is more than 300,000 rubles for 6,500,000 rubles. (RUR 6,800,000 – RUR 300,000), therefore pension contributions for 2020 will include:

- 26,545 rubles – fixed part of pension contributions;

- 65,000 rub. (6,500,000 rubles x 1%) is 1 percent of the amount of income exceeding 300,000 rubles.

In total, the total amount of pension contributions of individual entrepreneurs “for themselves” to be paid will be 91,545 rubles. (RUR 26,545 + RUR 65,000). This amount does not exceed the maximum amount (RUB 212,360), and therefore must be transferred to the budget in full.

What are fixed contributions

As you can see, the Tax Code deals with insurance premiums. Where did the concept of “fixed individual entrepreneur contributions” come from then? What are these payments?

In fact, fixed contributions and insurance premiums of individual entrepreneurs for themselves are one and the same thing. It’s just that this formulation began to be used after in one of its letters (dated October 6, 2015 No. 03-11-09/57011), the Ministry of Finance prohibited taking into account an additional contribution to reduce the tax on the simplified tax system.

Supposedly fixed, i.e. Only the amounts of mandatory contributions are predetermined, because they are the same for all individual entrepreneurs. But an additional contribution of 1% of income over 300,000 rubles, according to officials, “... cannot be considered a fixed amount of the insurance premium, since it is a variable value and depends on the amount of income of the insurance premium payer.” After this letter, mandatory contributions for oneself began to be called fixed payments for individual entrepreneurs.

But after two months the department changed its point of view. The letter dated December 7, 2020 No. 03-11-09/71357 acknowledges that since the additional contribution has a minimum and maximum allowable amount, it is also fixed and mandatory. This means that it corresponds to the wording of Article 346.32 of the Tax Code of the Russian Federation, which allows you to reduce the single tax on the simplified tax system at the expense of paid mandatory contributions.

Get a free tax consultation

The procedure for calculating fixed payments for individual entrepreneurs in 2016

The fixed payment of an individual entrepreneur consists of two parts: the first goes for pension insurance in the Pension Fund, the second for medical insurance in the Compulsory Medical Insurance Fund. Previously, contributions to the Pension Fund were divided into the insurance and funded parts of the pension. But the latter has been frozen by the government for several years, so all the money goes to the insurance part (payments to current pensioners, which are taken into account in the individual entrepreneur’s pension account).

Fixed contributions to the Pension Fund are calculated not on the basis of the entrepreneur’s actual income, but on the basis of the minimum wage. In January 2020 it was 6204 rubles. Every year, along with the increase in the minimum wage, insurance premiums also increase. This year they have grown quite insignificantly: by 745.68 rubles.

An important point: despite the fact that from July 2020 a new minimum wage of 7,500 rubles will be in effect, it will not affect contributions for yourself. This is due to the fact that individual entrepreneurs’ contributions to the Pension Fund of the Russian Federation have a fixed amount, which is determined based on the minimum wage in effect at the beginning of the year.

Individual entrepreneurs pay insurance premiums at the following rates: 26% to the Pension Fund and 5.1% to the Compulsory Medical Insurance Fund. They are the same for all businessmen, regardless of the tax regime they apply.

Thus, the amount of insurance premiums for individual entrepreneurs in 2020 will be 6204 * 26% * 12 = 19356.48 rubles. Another 3796.85 rub. must be transferred to the Compulsory Medical Insurance Fund (6204*12*5.1%). Those individual entrepreneurs whose income at the end of the year will be less than 300,000 rubles should not make any additional payments. RUB 23,153.33 – these are the minimum contributions to the Pension Fund, provided that the individual entrepreneur works throughout the year.

How to calculate the amount of insurance premiums for an incomplete period for those entrepreneurs who just registered their business in 2016 or decided to liquidate it before the end of the year? To calculate deductions for an incomplete period, the following formula is used: minimum wage * number of days of doing business / number of days in a month.

For example, an individual entrepreneur was registered on March 15 and deregistered on November 20. In March, activities were carried out for 16 days, in November - 20. The calculation of payment for March will be as follows: 16/31 * 6204 * 26% = 832.5 rubles; for November: 20/30*6204*26%=1075.4 rub. The individual entrepreneur worked for 7 full months. The payment for this period will be 7 * 6204.26% = 11291.3 rubles. Thus, during the period of his entrepreneurial activity, the individual entrepreneur is obliged to transfer 13,199.2 rubles.

Basis for calculating insurance premiums

Let us remind you that the mandatory contribution amount of 32,385 rubles (26,545 rubles for pension insurance and 5,840 rubles for medical insurance) is paid by all entrepreneurs. On any taxation system, with any income or loss, whether conducting or not conducting a real business. As soon as you have received the status of an individual entrepreneur, contributions begin to accrue to you, with the exception of some grace periods, which we will discuss below.

As for the additional contribution, the annual income that the entrepreneur receives is taken into account. Unfortunately, the procedure for calculating the base for paying this contribution established in the Tax Code can hardly be called fair.

The fact is that 430 of the Tax Code of the Russian Federation defines different procedures for accounting for income received by an entrepreneur, which depends on the chosen tax regime:

- for a simplified taxation system - sales and non-sales income excluding expenses;

- for the general taxation system - income received, reduced by business deductions;

- for the unified agricultural tax – sales and non-sales income excluding expenses;

- for a single tax on imputed income - imputed income calculated using the UTII formula;

- for the patent taxation system, the potential annual income specified in the law or local administration decree.

What is the result? Individual entrepreneurs on the simplified tax system Income minus expenses and unified agricultural tax have the largest base for calculating contributions - all income received excluding expenses. But these tax regimes are characterized by a high share of costs in revenue.

For example, a simplified wholesaler receives a sales income of 130 million rubles, but taking into account the costs of purchasing goods (let’s assume 110 million rubles), his real income is only 20 million rubles. Moreover, he must be charged a single tax on 20 million rubles, and an additional insurance premium on 130 million rubles. Agricultural tax payers find themselves in a similar situation.

This approach to calculating the base for an additional contribution has already been recognized by courts many times as unfair. And in private, payers of the simplified tax system Income minus expenses and the unified agricultural tax may well challenge in court the assessment of an additional contribution on all income without taking into account expenses. But if we talk about the general case, the Ministry of Finance and the Federal Tax Service categorically do not accept this option.

Once upon a time, payers of the general system also found themselves in the same situation - they also did not have their income reduced for business deductions. But after the Constitutional Court of the Russian Federation intervened in this story, the necessary changes were made to the Tax Code.

And a few words about UTII and PSN. In these regimes, the tax is calculated based not on the actual income received, but on the one calculated in advance by the state. It often turns out that the real income of entrepreneurs is greater than the established one, so the additional contribution is small.

Prepare a simplified taxation system declaration online

Contribution 1 to the Pension Fund

Advice from lawyers:

Is a disabled person of group 1 exempt from paying insurance contributions to the Pension Fund?

1 answer

I am a disabled person of the 1st group, the individual entrepreneur is not closed, should I pay contributions to the Pension Fund?

1 answer

I am a pensioner, I have been on maternity leave since October 2020,

1 answer

I am a pensioner and work under a contract for the provision of auto services. The employer pays 13% insurance premiums (according to the contract)

1 answer

How to correctly draw up a purchase and sale agreement for redemption (we are the buyers)

1 answer

An application form is required to file with the court. Situation: in the organization, upon inspection of the UPFR and the tax inspectorate, it was discovered that

2 answers

We bought housing on the secondary market with a mortgage using maternity capital in the form of a down payment.

1 answer

The employer did not pay contributions for hazardous working conditions to the Pension Fund, what should I do?

1 answer

I was on maternity leave. The child turns 3 years old on January 8th. I quit my job on December 29.

1 answer

I had an accident yesterday, the person at fault does not have insurance, I will have to sue him..

1 answer

My husband worked in hazardous work - blacksmith - list No. 1. But in the period from 2005-2009, the employer, by order, canceled the validity of lists No. 1,

1 answer

Am I required to notify the Pension Fund when closing or after closing an individual entrepreneur? There were no workers.

1 answer

1 I am a pensioner, I am 57, I am also an individual entrepreneur. Why are my contributions being withheld from the Pension Fund of the Russian Federation? I have already earned my pension for my pension. Are there any regulatory documents to avoid paying these contributions?

1 answer

I am the nominee director. The company has not paid the insurance premium to the Pension Fund and has not submitted reports for the last 1-5 years,

2 answers

Tax amnesty for individual entrepreneurs in 2020 Previously, there was an individual entrepreneur until 2020. The tax office and the Pension Fund of Russia issued a debt on 1)

1 answer

I am an individual entrepreneur with a rate of 6% on income. I pay contributions to the Pension Fund for myself; I have no employees.

1 answer

The Pension Fund of the Russian Federation says that insurance premiums will still be collected from individual entrepreneurs according to the formula 1 minimum wage * 26% * 12, regardless of the amnesty.

1 answer

My husband is an individual entrepreneur (without employees). He pays annual contributions to the tax office (PFR and FFOMS).

1 answer

I am the director of an LLC. And I'm the only employee. I have not paid any fees to the Pension Fund for 1.5 years.

1 answer

I am an individual entrepreneur. I live in the Chernobyl zone and am on maternity leave for up to 3 years. Can I avoid paying contributions to the Pension Fund only for up to 1.5 years, or up to 3?

1 answer

In 2007, she closed her individual entrepreneur, and in March 2008 she moved to another city. 18.

1 answer

DUE TO THE LACK OF INCOME ACCORDING TO PART 6 ART.14 OF LAW 212-FZ "ON INSURANCE PREMIUMS

1 answer

On April 1, 2020, an individual entrepreneur had a premature emergency birth and it was all over

2 answers

I plan to open an individual entrepreneur on October 1, when will I need to pay contributions to the Pension Fund and FFMs for the first time and how much will they be? It is planned to have a sole proprietorship on UTII without employees.

1 answer

Opened in my name as an individual entrepreneur under the simplified tax system (no activity since 2012, no income)

2 answers

I worked in a company for several years, now I decided to change my job and it turned out that this company has been gone for a long time,

1 answer

I am the wife of a former officer. Served in Baku from 1987 to 1992. Now, when applying for an old-age pension, they throw out 1 year and 5 months of work experience in the city.

2 answers

I have an individual entrepreneur, but I don’t conduct any activities. For 2020 and 2020, the Pension Fund of the Federal Compulsory Medical Insurance Fund did not pay contributions.

2 answers

»How can you avoid paying interest and mortgage insurance if maternity capital transfers PFR to the bank for 2 months?…

2 answers

If the pension is calculated at the equivalent of 7 metro tokens, since the Pension Fund did not consider it necessary to control insurance premiums,

1 answer

I am purchasing an apartment in a building under construction, with 1/4 shares for myself and my three children, and mat capital is also used (as a down payment).

1 answer

The individual entrepreneur, which was closed 1.5 years ago, is listed as active in the Pension Fund of the Russian Federation; they have calculated a large arrears in insurance premiums. How can I cancel them?

4 answers

While working, I took 1-2 days off as vacation during the period of work from 1980 to 1991.

1 answer

While working, I took 1-2 days off as vacation during the period of work from 1980 to 1991.

1 answer

I am an individual entrepreneur using the simplified tax system for income and expenses. After the ruling of the Supreme Court of the Russian Federation on April 18

2 answers

We really need your help! I am an individual entrepreneur (USN 6%, with an income of less than 300,000 thousand).

3 answers

We really need your help! I am an individual entrepreneur (USN 6%, with an income of less than 300,000 thousand).

1 answer

On March 30, 2017, I received a letter from the tax office demanding the payment of penalties for previous periods according to the Pension Fund of the Russian Federation, and the requirement was formed on 09.

1 answer

Question: Are there benefits for insurance premiums (PFR, Social Insurance Fund) based on our OKVED code?

1 answer

I am an individual entrepreneur with 6% simplified taxation system income. Paid the contribution to the Pension Fund for 2020 (1% of the amount exceeding 300 thousand.

2 answers

An individual entrepreneur was opened to collect insurance contributions to the Pension Fund, then it was closed in accordance with Article 46, part 1, paragraph.

1 answer

I opened an individual entrepreneur in 2014, it existed for only 1 month, did not bring any income, and I closed it.

2 answers

Individual entrepreneur was suspended on February 1, 2014, no activity was carried out, no deductions were made to the Pension Fund,

1 answer

In 2014 she opened an individual entrepreneur. closed after 1.5 months. I haven't worked a single day.

1 answer

About article 46,1,3 dated 09/09/2016 of the termination of the IP. It turns out that my IP was closed, right?

2 answers

The entrepreneur had an accident this year and received group 1 disabled status. The IP was closed only recently. Is it possible for him to be exempt from paying Pension Fund contributions this year?

1 answer

Our visiting accountant submits taxes and contributions every quarter (I see deductions in the 1 C program).

1 answer

I am an individual entrepreneur, I have a simplified tax system, at the end of the year I received an invoice (demand) for payment of 1% of income to the Pension Fund for insurance premiums. Can I not pay or somehow avoid this requirement?

1 answer

I am the employer of a disabled person of group 1. I transfer monthly insurance

1 answer

Please help 1) Individual entrepreneur without employees, closed in early October.

3 answers

The HOA is independently managed, (USN) does not conduct commercial activities,

1 answer

Is the length of service and the unpaid amount of contributions to the Pension Fund for 5 years included in the assignment of a pension,

3 answers

I care for a disabled person of group 1, and I am an individual entrepreneur.

1 answer

A municipal government agency entered into a civil contract for the provision of services with an individual (cleaning streets of snow with a tractor).

2 answers

When calculating insurance premiums based on income over 300 tr. According to the simplified tax system, the Pension Fund does not take into account expenses, citing changes in legislation.

2 answers

I am an individual entrepreneur, a UTII payer. From 2000 until July 1, 2020, it was an official employer.

2 answers

Vacation pay was calculated incorrectly in 2020 and 2020. (less than required).

1 answer

I want to clarify if I open only the delivery of sushi and rolls, register myself as an individual entrepreneur, and pay fixed contributions to the Pension Fund and Social Insurance Fund for myself.

1 answer

Tell me what to do in this situation, the Pension Fund of Russia is now presenting me with insurance premiums, I had my own individual entrepreneur in 2012, closed the store, but no individual entrepreneur, got a job starting at 9.

1 answer

I received a simple letter without notice from the bailiffs. The envelope is stamped with the date 18.

2 answers

In 2014, he worked as an individual entrepreneur under the general taxation scheme and paid insurance premiums as an employer.

1 answer

I paid the insurance premium to the Pension Fund on 04/04/2016. tax reduction when filing a return for 1 quarter.

1 answer

The topic is taxes, please do not pay any attention to pure lawyers... But the question is this: I am an individual entrepreneur, not an employer, on the OSN.

1 answer

Our organization hired an employee on December 30, 2020 for the position of 3rd category extruder.

1 answer

I submit zero declarations, can I suspend activities but not close the individual entrepreneur and not pay insurance premiums to the Pension Fund when I am caring for a child under 1.5 years old?

2 answers

I submit zero declarations, can I not pay insurance premiums to the Pension Fund when I am caring for a child under 1.5 years old?

1 answer

I am an individual entrepreneur submitting zero declarations, I am caring for a disabled mother of group 1, can I not pay insurance premiums to the Pension Fund of Russia?

1 answer

I registered as an individual entrepreneur in February 2020 USN-6% (without employees) 1. When should I pay contributions to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund?

1 answer

I learned ip on April 1st. The business did not pay off and suffered losses. We need to close the IP.

2 answers

Question about taxes. Please tell me. We opened an individual entrepreneur on the simplified tax system with an income of 6% without employees 25.

2 answers

I am an individual entrepreneur. A demand came from the Pension Fund for a debt of 121,000 rubles for payment of insurance premiums of 1% of the amount exceeding income of 300,000 for 2014.

1 answer

Individual entrepreneur works according to the simplified tax system, income, there are employees. What should be the amount of insurance contributions to the Pension Fund - 22%+10% (PFR) and 5.1% (Foms) or only 20% (PFR)

1 answer

We need your help urgently! The husband is obliged to pay 1/3 alimony for two children.

2 answers

The Pension Fund of the Russian Federation said that an individual entrepreneur can be exempt from contributions if he cares for a disabled person of group 1. Can an individual receive benefits to care for this disabled person?

1 answer

I have the following question: I am an individual entrepreneur using the simplified tax system for income. Income for the 1st quarter will be 160,000 rubles.

1 answer

I worked for my employer for 1 year and 9 months. salesman in a store. Yesterday the director announced that she was giving out her store for rent, and asked us to quit one day.

2 answers

I am an individual entrepreneur. on a universal basis. For insurance contributions to the Pension Fund of Russia over 300 tons.

1 answer

When an individual entrepreneur may not pay contributions for himself

The general rule for paying insurance premiums is that they must be paid as long as an individual has the status of an individual entrepreneur. There are no payment benefits for pensioners, disabled people, large families and other similar social categories. If an individual entrepreneur works for hire in parallel with his business, this also does not relieve him of the obligation to pay contributions.

But the Tax Code still establishes several grace periods during which an individual entrepreneur has the right not to pay contributions because he does not operate for the following reasons:

- cares for a child under 1.5 years old, an elderly person over 80 years old, a disabled person of the 1st group, a disabled child;

- serves in the Russian army by conscription;

- lives outside the Russian Federation with a spouse who is an employee of a consulate or diplomatic mission;

- is with a military spouse under contract in an area where there is no opportunity for doing business.

You must notify your Federal Tax Service in advance that you are temporarily stopping paying insurance premiums for yourself by submitting an application in the prescribed form.

Receipt for payment of insurance premiums to the Pension Fund

The most convenient way to pay insurance premiums is to generate a receipt yourself on the official website of the Pension Fund.

It's very easy to do. Step 1 . We follow the link: https://www.pfrf.ru/eservices/pay_docs/ and see the following:

Step 2 . We select the item “Insured”, our subject of the Russian Federation and then the item “Payment of insurance premiums by persons who voluntarily entered into legal relations under the compulsory insurance policy.”

A window will open with payment details:

Attention! The service has not yet introduced changes to the KBK part.

Step 3 . Next, enter your personal data in the “Generate receipt” block.

After entering the data, you can either print the receipt or download it in PDF format. This is what it should look like:

Such a receipt will not be suitable for direct payment at a bank due to the incorrect BCC. However, you can pay insurance premiums through Internet banking, the same Sberbank-Online, by filling out an electronic payment order based on the generated receipt. Or from your current account. The main thing is that the money comes to you, and where it came from, from which bank and account - it doesn’t matter.

Deadlines for payment of insurance premiums

Unlike insurance premiums for employees, which are paid every month, individual entrepreneurs must pay mandatory contributions for themselves at any time until the end of the current year. That is, it is quite possible to transfer the entire amount of contributions immediately on the last day of December 2018.

But in practice, it is more convenient for those who work on the simplified tax system for income and UTII to pay contributions by dividing the annual amount into quarterly payments. Read about why this is so in the following articles:

- How an individual entrepreneur can reduce the tax on insurance premiums by 6% using the simplified tax system

- How to reduce tax through individual entrepreneur contributions to UTII in 2020

An additional contribution to pension insurance can be paid as soon as the amount of income of an individual entrepreneur in 2020 exceeds 300,000 rubles. The deadline for paying the additional contribution is July 1 of the following year. That is, the individual entrepreneur can choose when to transfer this amount - before the end of 2018 or until mid-2020.

Deadlines

Let's consider the deadlines for paying fixed contributions to individual entrepreneurs . The deadline for payment of the indicated amounts is generally December 31, 2020. But there is an exception. One percent of profits over 300,000 rubles can be transferred to the Pension Fund a little later: until April 1, 2020 inclusive.

As you can see, the deadlines remain the same. However, if you check the calendar, they are subject to rescheduling to a later time. Thus, the total fixed amounts must be transferred before January 9, 2020 inclusive, and the excess payment to the Pension Fund must be transferred no later than April 3, 2017 (since April 1, 2017 falls on a Saturday).

Where to transfer insurance premiums

Not so long ago, mandatory payments from individual entrepreneurs were transferred to the Pension Fund, which is why they are still sometimes called contributions to the Pension Fund. But since 2017, these payments have been controlled by the Federal Tax Service, so the payment document must indicate the details of your tax office.

A sample receipt or payment order can be requested from the territorial Federal Tax Service or prepared on the Tax Service website. The BCCs for transferring individual entrepreneur contributions 2020 are as follows:

- for pension insurance – 182 1 0210 160;

- for health insurance – 182 1 0213 160.

Individual entrepreneur medical contributions from 2020: new sizes

The amount of medical insurance contributions to the FFOMS in 2020 did not depend on the income of the individual entrepreneur, but was also calculated based on the minimum wage. In 2017, the amount of medical contributions was 4,590 rubles. See “Insurance premiums for individual entrepreneurs in 2020.”

Since 2020, the amount of compulsory medical insurance contributions has been “untied” from the minimum wage and is fixed at 5,840 rubles for the billing period. How much have individual entrepreneur insurance premiums increased since 2020? The answer is 1250 rubles. (5840 rub. – 4590 rub.).

5840 rubles is a mandatory amount. Starting from 2020, all individual entrepreneurs must pay it for the billing period, regardless of the conduct of activities, movement of accounts and receipt of income.

Where did such amounts come from?

The rate of pension contributions from 2020 is fixed at 26,545 rubles, if the income of an individual entrepreneur does not exceed 300 thousand rubles. in a year. If the entrepreneur’s income exceeds 300 thousand rubles, then contributions to the Pension Fund will amount to 26,545 rubles. + 1% of income over 300 thousand rubles. For health insurance contributions, the payment is set at 5840 rubles. But where did these numbers come from? Unfortunately, the explanatory note to the bill did not explain in any way why the numbers are exactly as they are.