Instructions for adjusting SZV-M

Is it possible to submit an adjustment to SZV-M and how to make an adjustment to SZV-M?

Sooner or later, all specialists whose responsibilities include the monthly preparation and submission of this report to the Pension Fund of Russia face such questions. If you need to correct SZV-M data, we suggest the following sequence of actions:

Step 1: preliminary

Before deciding how to adjust the SZV-M, make sure that the personalized accounting data that you are going to adjust has been accepted by the Pension Fund:

Previously, we talked about the ways in which SZV-M can be presented.

Step 2: Select Form Type

If you are convinced that the initial report has been accepted by the fund, you can proceed directly to the adjustment procedures.

The SZV-M adjustment in 2020 is made according to the same rules that were in force in previous periods.

First determine what needs to be done:

- supplement the information in the original SZV-M;

- cancel (zero) the information from the report submitted to the Pension Fund.

Depending on this, select the required type of SZV-M form for adjustment:

The “additional” form type is selected in the case when you forgot to reflect the data on the insured person (or several persons) in the original SZV-M, and all other information in the original report is correct (does not contain errors).

The “cancel” form type is used when the following is detected in the original SZV-M:

- unnecessary data (for example, data is provided for an employee who was fired a long time ago);

- erroneous/inaccurate information (for example, incorrect personal information of employees).

Step 3: Filling out the adjustment form

Once you have decided on the scope of corrections and selected the desired type of form, you can begin drawing up the adjustment SZV-M:

- in sections 1 and 2, fill in the details of the policyholder and the reporting period in the same way as the original SZV-M, which you are adjusting;

- in section 3 “Form type (code)” enter the selected form type (for example, you need to cancel previously submitted information):

Correction of information in SZV-M regarding personal data of insured persons is made in section 4 “Information about insured persons”. In this section, provide the information you want to cancel. For example, this is what section 4 of the adjustment report looks like if an extra employee is included in the original SZV-M:

In such a situation, you should duplicate the data on the extra employee from the original SZV-M.

If you need to correct erroneous information about an employee, you first need to submit the SZV-M form with the “cancel” type (similar to the sample presented above), and then the SZV-M form with the “additional” type, in which you indicate the correct information. This should be done, for example, if the reason for completing the SZV-M adjustment was an error in the surname of the insured person.

The corrective form SZV-M includes information only for those employees whose data is subject to correction. Information on the remaining employees included in the original SZV-M and initially indicated correctly does not need to be re-entered.

See how and what errors can be corrected in the SZV-M report.

Ways to resolve error code 50

To begin with, it is worth noting that any system has flaws and failures. But the human factor also plays an important role. It happens that they seem to have looked carefully and filled it out correctly, but the file was returned from the Pension Fund of Russia with a negative protocol and a description of the errors. The Foundation, like organizations, is interested in prompt and correct submission of the report. Therefore, a report with errors must be corrected and submitted again as soon as possible.

Using up-to-date software

If error 50 in SZV-STAZH occurs due to incorrect filling of the XML document or non-compliance with the XSD schema, then you need to check the installed software and use only those programs that update themselves. In this case, the format of the submitted reports will always be correct.

Correcting the situation with the electronic signature

If there was a failure in the electronic signature, or the information was submitted by a representative who did not have a power of attorney, then the report will also not be accepted. It is necessary to work out these points as soon as possible and solve the problem - sign a document with a valid electronic signature or send a representative’s power of attorney to the Pension Fund.

Adjusting the document structure

An error may also appear if the required block is missing in the document sent for verification. The report is returned with error code 50 and a message in the format “According to the DTD and schema, the contents of the element “{...}ZL” are incomplete. Required: “{...} Experience period.” The entire file is reviewed again and a block not found by the system with information about the length of service of employees is added.

TIN compliance

The Pension Fund program checks the TIN or company registration number for compliance with the information contained in the database. In case of discrepancies, the report is also returned for correction. It is urgent to check the information and send the report back.

Correct code setting

It happens that the employee responsible for submitting documents puts the code incorrectly in the “Form Type” line, and instead of the original form, a supplementary one is sent to the Pension Fund, which is also an error.

For the first time in a month, the original form with the “output” type is always submitted. In the case when additions and adjustments were made to the returned report, the type of information changes to “additional” (additional), and when the information is canceled - to “cancelled”. If an organization submits a monthly report with any type of information other than “output” for the first time, the fund will immediately return it with a negative report. This will help eliminate error 50 when submitting the SZV-STAZH report.

How to submit the corrective SZV-M and when?

After filling out the corrective report form, the next question arises: how to submit the SZV-M adjustment? It is submitted according to the same rules as the original report - in electronic or paper form (Clause 2, Article 8 of Law No. 27-FZ):

Find out what to do if the electronic SZV-M file does not match the XSD schema.

The deadline for submitting the corrective SZV-M is not regulated by law, but it is better not to delay this event and submit it immediately after errors are discovered, otherwise you may run into a fine.

Penalty for adjustment

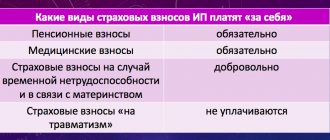

The employer can discover errors himself or learn about them from the Pension Fund notification. He is ready to correct the information, but he may have concerns: is it possible to adjust the SZV-M without a fine.

The information presented in the figure will help resolve this issue:

As you can see, there is a fine for adjusting SZV-M, but it is imposed only under certain circumstances. The amount of financial sanctions depends on the number of insured persons whose information you did not include in the SZV-M or did not correct on time - at the rate of 500 rubles. for each person (Article 17 of Law No. 27-FZ).

Look at what details to transfer the fine under SZV-M.

The employer has been liquidated - who corrects the data?

It is necessary to make adjustments to the SZV-M if inaccuracies and errors are identified in the source data. If this is not done, the personalized information generated on the personal accounts of the insured persons will be unreliable.

The right of employers as insurers to supplement and clarify information from SZV-M is enshrined in Art. 15 of the Law “On Individual (Personified) Accounting...” dated 04/01/1996 No. 27-FZ.

Employers clarify the information in the SZV-M after they independently discover incorrect or incomplete information in the original SZV-M, or after receiving a notification from the Pension Fund of the Russian Federation that the discrepancies identified by the fund's specialists during the inspection of the SZV-M have been eliminated.

Incomplete or unreliable information in personalized information is subject to mandatory correction even if, at the time of its discovery, the employer has already been liquidated or its activities have been terminated for reasons provided for by law. In such cases, clarifications to the personalized information are made by specialists of the Pension Fund (clause 17 of the Procedure, approved by Resolution of the Board of the Pension Fund of October 15, 2019 No. 519p).

SZV-STAZH error code 50: how to fix

To correct the error (check code 50), you need to resubmit SVZ-STAZH to the Pension Fund of Russia with the “Initial” information type, having first eliminated the incorrect data.

Of course, SZV-STAZH is submitted in one package with the EDV-1 form with the “original” type. In order to independently check the generated report, identify errors and correct them before sending the SZV-STAZH to the inspectors, the Pension Fund recommends installing free personalized reporting verification programs CheckPFR, CheckPO-PD, CheckXml, posted on the department’s website.

Please keep in mind that if inspectors discover errors or inconsistencies in personalized reporting forms, the policyholder is given five working days to correct these errors (paragraph 5 of Article 17 of Law No. 27-FZ of April 1, 1996).

For late submission of reports to the Pension Fund of the Russian Federation, as well as for the presence of errors in the submitted forms, a fine of 500 rubles is provided for each insured person (paragraph 3 of Article 17 of Law No. 27-FZ of April 1, 1996).

Read about how to correctly fill out the SZV-STAZH in a separate consultation.

Remember, the SZV-STAZH report for 2020 is presented on a new form approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p. Read about the new form of SZV-STAZH in a separate consultation.

We provided a detailed algorithm for correcting errors in information about experience in a separate article.

Results

SZV-M with incorrect, incomplete or missing data must be corrected. This should be done on a regular report form, indicating in section 3 the required type of form: “add” (additional) or “cancel” (cancelling). At the same time, section 4 reflects data on insured persons, which are subject to adjustment. There are no financial sanctions for submitting an adjustment report to the Pension Fund if the employer has identified and corrected the errors independently or no later than 5 working days from the date of receipt of the notification from the fund.

Sources:

- Federal Law No. 27-FZ dated 04/01/1996 (as amended on 04/01/2019) “On individual (personalized) accounting in the compulsory pension insurance system”

- Resolution of the Board of the Pension Fund of the Russian Federation dated October 15, 2019 No. 519p “On approval of the Procedure for adjusting individual (personalized) accounting information and making clarifications (additions) to an individual personal account”

- Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n “On approval of the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Addendum SZV-M

According to the resolution of the Board of the Pension Fund of Russia dated 01.02.2016 No. 83p, which approved the SZV-M form “Information on insured persons”, in its paragraph (section) 3 it is necessary to indicate the code that corresponds to its type.

So, “additional” means that it is a complementary form. It is submitted in order to supplement the information previously accepted by the Pension Fund about insured persons for a given reporting period (month).

There are no other rules governing the delivery of the supplementary SZV-M. This is also why numerous disputes arose between policyholders and the Pension Fund.

The situation for all employers is approximately the same. The first form SZV-M was submitted on time. After some time, the employer finds the “forgotten” employees and submits a supplementary report. But the Pension Fund of the Russian Federation believes that the reports regarding these employees were submitted untimely.