Paying taxes if the individual entrepreneur does not work

Whether you will need to pay taxes if you have zero income depends on the chosen taxation system.

On the simplified tax system

Under the simplified system, the tax fee is calculated based on the income received or the difference between profit and expenses, depending on what type of simplified tax system the payer has chosen. If there is no salary, then there is no need to pay a fee.

Important! If there is no profit, you will still have to submit a declaration to the tax office, where you indicate the lack of income. Failure to submit will result in a fine.

On UTII

The tax on imputed income does not depend on the profit received. The fee is calculated based on the businessman’s estimated earnings, as established by local regulations. The tax office does not track whether an individual entrepreneur is working or not, so they will expect tax payment.

To avoid tax liability, you should submit an application to the Federal Tax Service with a request to deregister as UTII and switch to another regime, where tax payment depends on the availability of profit, or close the individual entrepreneur altogether.

On OSNO

Do I need to pay taxes for individual entrepreneurs if the general taxation system is used? OSNO is considered the most stringent regime. When applying it, you are required to pay two taxes - VAT and personal income tax. In the first case, everything depends on the availability of the implementation. If it is not there, then you do not need to pay.

Income tax depends on the receipt of income and is calculated based on its amount. At the same time, the businessman’s expenses are also taken into account. If a citizen registered, but did not engage in business, and therefore did not receive money, it means there is nothing to pay from. Therefore, no payments are needed.

It is still necessary to submit a zero declaration to the tax authority, otherwise prosecution may be possible.

Patent system

Under this regime, a businessman acquires a patent, allowing him to work in a certain field for a short period of time - no more than a year. The acquisition of a patent is not accompanied by additional tax.

Note! If the patent regime expires and the entrepreneur does not renew it, the tax office will automatically transfer the citizen to OSNO. In this case, you will not need to pay tax on zero income, but you will have to report to the Federal Tax Service.

What kind of work will there be without an individual entrepreneur | What is the penalty for working without an individual entrepreneur?

Definition of entrepreneurship in the Civil Code

According to the Civil Code, entrepreneurial activity is selling, providing services, leasing property and systematically receiving money for it. But the law, as always, remains silent. It is not clear from it what systematic profit making is - two hats or a hundred.

According to the law, for entrepreneurial activity you need to register as an individual entrepreneur. This is a guarantee that the state will receive taxes from the sale of a cake or knitted hat.

According to the Tax Code, a person cannot avoid paying taxes if he does not have an individual entrepreneur.

The law says this: if an individual conducts business without an individual entrepreneur, when performing his duties, he cannot refer to the fact that he works without an individual entrepreneur.

Essentially this means: if you conduct business, that means you are an entrepreneur and must pay taxes as an entrepreneur.

Signs of entrepreneurial activity were in the old tax letter from 2010:

- Letter from the tax office about the signs of entrepreneurial activity on the Guarantor’s website

- buy or make property for profit. For example, buy a truck and use money to help people move;

- keep records of transactions, count income and expenses, record debts;

- related transactions. For example, purchasing plastic windows from a manufacturer and then supplying them to customers;

- work with sellers, buyers, suppliers, landlords, advertising agents, courier services and anyone else who helps run a business.

The tax authorities and the court may provide other evidence that a person is conducting business. Since there is no exact definition, different interpretations can be given.

In general, the position is this: selling a hat once or cleaning pipes for money is not entrepreneurial activity. If you do this constantly, get money, look for clients, advertise, enter into contracts - entrepreneurial, you need at least an individual entrepreneur. Judicial practice is almost always on the side of the tax authorities.

What a punishment

Working without an individual entrepreneur faces administrative and criminal liability and reimbursement of taxes on income received by the entrepreneur.

Fines for working without an individual entrepreneur on the Consultant’s website

Administrative responsibility - for activities with little income. In court cases, this is income of up to a million rubles per year. The administrative fine for working without an individual entrepreneur is from 500 to 2000 rubles.

Overchenko gave a ride to a passenger in his car and received it for a hundred rubles. There was no permit or license for the taxi driver. The court found him guilty and awarded him a fine of 2,000 rubles. In this case, the fact that a taxi must have a license played a role, but Overchenko did not have one.

A court case

An administrative fine threatens everyone who constantly sells something without an individual entrepreneur.

Since the beginning of 2020, Tararina has been selling juices, water, and sausage in the store, but there was no individual entrepreneur. The tax office came, inspected the store, drew up a report, and issued a certificate. The court reviewed the protocol and certificate, Tatarina repented, the punishment was a fine of 2,000 rubles. If I hadn’t repented, there could have been more.

A court case

Amount of income for criminal liability on the Consultant’s website

There is criminal liability for illegal business activities. This is if the income was more serious than for a random passenger. The law calls this “large” and “especially large” income. According to the note to Article 170.2 of the Criminal Code:

- large income - from 1,250,000 rubles;

- especially large income - from 9 million rubles.

Criminal penalties for working without an individual entrepreneur:

Here the court is also on the side of the tax authorities

Myazitov supplied sand to the construction site. In six months, he earned a million rubles, but never opened an individual entrepreneur. Fine - 100,000 rubles.

A court case

The tax office may ask you to pay additional taxes on the income the entrepreneur earned. At the same time, she can calculate taxes as if the entrepreneur had been working on the general tax system all the time. This means you will have to pay VAT.

In 2020, the Supreme Court considered the case of Vats, who leased non-residential premises and land to the company. He didn't have an IP.

The court noted that Vats entered into lease agreements. In them, he indicated sanctions for failure to comply with the terms of the contract and took into account the risks. Based on these signs, the court found that Vats was conducting business and must pay VAT.

Judgment

How does the tax office find out?

The tax authorities are the same people who go for manicures, buy cakes and hire animators for a children's party. The inspector can go to Instagram, sign up for a manicure and check that the master is not registered as an individual entrepreneur.

The IRS conducted a raid on confectioners from the Internet - news on the IRS website

This happened in Tver. The tax office purchased cakes from a pastry chef on Instagram and discovered that he was working without an individual entrepreneur. The tax office asked me to submit an income tax return for two years. There is no news about additional tax assessments in this case yet. But twenty-nine other confectioners also came under the attention of the tax authorities.

Rospotrebnadzor intervened and said that buying cakes from unregistered confectioners is dangerous. No one checks the quality, the cream could have expired, and the pastry chef might have to work with dirty hands.

Anyone can complain about an illegal entrepreneur. Neighbors may notice and complain to Rospotrebnadzor.

What to do

How to register an individual entrepreneur in "Delo"

To work legally, open an individual entrepreneur. It's easier than it seems. According to the new rules, registration takes four days, and the tax office sends registration documents by email. We have written instructions about this.

If you open an individual entrepreneur at a simplified rate of 6%, the costs will be as follows:

- tax - 6% of income that comes to the account;

- contributions - 32,385 rubles per year;

- Bank service - 5880 rubles per year in Modulbank at the Optimal tariff.

Accounting for Modulbank clients: we calculate taxes, submit reports, and talk to the tax authorities ourselves. Free, for 11,000 rubles per year or for 21,000 rubles per quarter, depending on the complexity.

→ modulbank.ru/buhgalterya

Yes, this is an advertisement, but what is it?

Source: https://delo.modulbank.ru/all/out_law

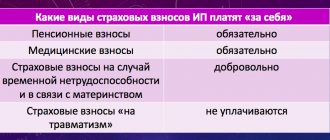

Do I need to pay insurance premiums?

There is no way to avoid paying insurance premiums to individual entrepreneurs for yourself if no activity was carried out. These payments are not calculated depending on the businessman’s profit as taxes, so it will not be possible to be exempt from them. Even if no activity was carried out, you will still have to make two mandatory contributions:

- pension;

- medical.

They are charged at a fixed rate set by the government authorities. The amount of payments changes annually. For 2020, the contribution to the Pension Fund of the Russian Federation is 29,354 rubles, to the Compulsory Medical Insurance Fund – 6,884 rubles.

Important! If a businessman’s annual income exceeds 300 thousand rubles, 1% of the profit is added to the fixed payment to the Pension Fund.

Entrepreneurs also have the right to pay contributions to the Social Insurance Fund. They are not mandatory; entrepreneurs pay them at their own discretion.

Property taxes

If an entrepreneur owns real estate, land or vehicles, he is obliged to pay property tax, land tax and transport tax. Moreover, this obligation arises from the moment of acquisition of property and does not cease in the absence of entrepreneurial activity.

- Personal property tax persons are calculated annually by the Federal Tax Service and sends receipts with the amount payable to the taxpayer’s address. When conducting commercial activities, individual entrepreneurs using the simplified tax system and UTII are exempt from paying this tax in relation to objects used for business. If no activity is carried out, the tax will again be calculated and must be paid. It must be paid before April of the year following the reporting year. The sole living space of an entrepreneur is exempt from tax if it does not exceed the size established by law. There are also a number of preferential categories of citizens who do not have to pay tax.

- Transport tax. It is also calculated by the tax office and the amount is sent as a receipt to the postal address.

It is paid regardless of the taxation system and the absence or presence of activity as an individual entrepreneur. The obligation to pay it arises when purchasing a vehicle and ends only when it is sold.

The amount of transport tax depends on the engine power of the vehicle. If the vehicle was purchased to run a business that has been suspended for a long period, selling it would be a smart move.

- Land tax. It is calculated similarly to the previous ones and is also paid regardless of the conduct of activity. It is worth noting that if you rent out land or other property, then this is also a business activity. In this case, it makes no sense to talk about suspending it.

Thus, it is clearly seen that it is unlikely for an individual entrepreneur to completely avoid paying taxes even in the absence of activity as such. If you plan to no longer do business at all, it is worth considering the possibility of liquidating the individual entrepreneur. In this case, you will avoid the need to pay fixed payments to the pension fund and compulsory health insurance fund.

Previous article: The need to use a cash register for individual entrepreneurs under the simplified tax system Next article: Sales receipt for individual entrepreneurs: purpose and filling rules

Could there be problems?

Taxes under the simplified tax system and OSNO depend on income. If it is not there, then there is no need to pay fees, and accordingly, no liability arises. But it is required to submit a zero declaration. If this is not done, the businessman faces a fine of 1 thousand rubles.

If a citizen is on UTII, has not officially suspended his activities and has not paid the tax, he will face a daily penalty. For each overdue day, 1/300 of the refinancing rate of the Central Bank of Russia of the debt amount is charged. A fine for non-payment is also imposed in the amount of 20-40% of the debt amount.

Note! When debt arises, problems arise with traveling outside of Russia. To do this, it is enough to have a debt of 10 thousand rubles.