Hello! In this article we will discuss ways to reduce the imputed tax of individual entrepreneurs in 2020.

Today you will learn:

- What is it possible to reduce UTII;

- How does the reduction in insurance premiums occur?

- What are the current restrictions?

UTII

Let's remember how UTII differs from other special tax systems available to individual entrepreneurs:

- The amount of tax does not depend on profit, but on the specifics of the activity and various physical parameters (working area, number of employees);

- When calculating the tax, increasing coefficients are applied, depending on the economy in the country and in a particular region;

- Payment is made quarterly, before the 25th day of the first month in the next quarter;

- Individual entrepreneurs are exempt from personal income tax, property tax and VAT.

The Tax Code allows a reduction of UTII by the amount of insurance premiums paid by a businessman to state funds (PFR and Social Insurance Fund).

All legal provisions relating to UTII are prescribed in Article 26 of the Tax Code of the Russian Federation.

Reducing UTII

Before making a reduction, UTII needs to be calculated. The tax base and imputed income are not reduced. A reduction in the total amount is possible after the final settlement, and it depends on the insurance payments of the entrepreneur.

| Basis for deduction | Maximum deduction | |

| Self-employed individual entrepreneur | Minimum mandatory contributions to the Social Insurance Fund and Pension Fund | 100% |

| Individual entrepreneur | Insurance premiums for employees, individual entrepreneurs’ contributions for themselves | 50% tax amount |

How is the deduction formed?

When reducing, deductions made within the quarter for which the tax is paid are taken into account. Simply put, contributions made in the first quarter will go toward tax reduction in that first quarter.

It does not matter when the insurance premiums were calculated, the date on which they were paid is taken into account.

It is worth considering other nuances:

- Only contributions accrued to the entrepreneur when he was a UTII payer are used to reduce the amount of tax. For example, an individual entrepreneur switched to imputation in the middle of the quarter. Contributions accrued to him in the first half of the period, before he submitted an application for the application of UTII, will not be taken into account in the formation of the deduction.

- The deduction is formed only by contributions paid in accordance with the law. That is, erroneous overpayment will not be taken into account.

- Additional voluntary insurance for individual entrepreneurs is not considered.

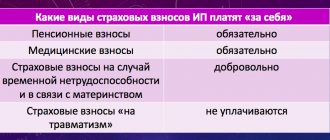

In total, an individual entrepreneur can save on tax by:

- Own pension insurance - 29,354 rubles with income up to 300,000 rubles per year and 1% of income above this limit.

- Own medical insurance – 6,884 rubles.

- Insurance premiums for employees.

- Days of incapacity for work and other benefits paid from the employer’s funds (the first three days of sick leave).

Deduction amount

A self-employed individual entrepreneur has a chance to reduce the amount of tax on all mandatory insurance contributions up to 100% of the tax itself.

An individual entrepreneur with the status of an employer makes more contributions, which can be used to reduce UTII (he pays not only for himself, but also for his employees), but the law does not allow him to reduce the tax by more than 50%.

If the amount paid by the entrepreneur to the FMOS and the Pension Fund of the Russian Federation exceeds the quarterly UTII, no recalculation will follow for the next period.

Example. The quarterly UTII of a self-employed individual entrepreneur is 18,000 rubles. In the first quarter, the individual entrepreneur transferred insurance contributions in the amount of 23,000 rubles to the tax office. He can reduce the tax to zero: 18,000 - 23,000 = -5,000 rubles. Deductions exceeding 5,000 rubles are not carried over to the next quarter. That is why it is so important to correctly divide all insurance premiums into periods.

Comments

View all Next »

Evgeny 03.23.2017 at 11:45 # Reply

Reducing UTII for individual entrepreneurs who have employees.

On what basis did you decide that an individual entrepreneur who has employees has the right to reduce UTII not only by the amount of insurance payments for employees, but also for himself in a fixed amount? paragraph 2.1, paragraph 4 has not changed its meaning. There, the concepts of the Pension Fund and the Federal Compulsory Medical Insurance Fund have only been replaced. In principle, the paragraph has not changed. It has changed only because now all contributions are paid to the tax office.

Natalia 03.23.2017 at 12:46 # Reply

Evgeniy, good afternoon. From January 1, 2020, individual employers can reduce UTII by insurance premiums paid both for employees and for themselves. This was decided not by us, but by Federal Law No. 178-FZ of June 2, 2016, which amended subparagraph 1 of paragraph 2 of Article 346.32 of the Tax Code of the Russian Federation. From January 1, 2020, the words “when the taxpayer pays benefits to employees” are excluded from this norm. Additional confirmation of this are the amendments made to the UTII declaration form (order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected] ). The new edition of the declaration form provides a formula for calculating the amount of the single tax paid by taxpayers making payments to individuals. It takes into account that from 2020, individual entrepreneurs with hired employees will be able to reduce the amount of UTII by the amount of insurance premiums paid for themselves.

Ivan 03/28/2017 at 07:59 pm # Reply

Hello. Can I make a deduction for fixed contributions of an individual entrepreneur for 2020 if the payment took place in 2020? If so, can an additional deduction from defined contributions for 2020 be added to this amount?

Natalia 03/28/2017 at 08:33 pm # Reply

Ivan, good afternoon. If you are not an employer, then you have the right to reduce your tax for the 1st quarter of 2020 by the entire amount of insurance premiums paid in the 1st quarter of 2020, no matter for what period these contributions are calculated. Those. in your case, you reduce the tax by the amount of contributions for 2020 paid in the 1st quarter of 2017, and by the contributions for 2020 paid in the 1st quarter of 2017.

Igor 03/28/2017 at 09:08 pm # Reply

Hello! I am an individual entrepreneur with two types of activities and two tax regimes: UTII and simplified tax system. The deduction amount should not exceed 50 percent of the accrued UTII amount. Is it possible to deduct the remaining amount when calculating the advance payment using the simplified tax system?

Natalia 03/29/2017 at 05:17 pm # Reply

Igor, good afternoon. When combining the simplified tax system and UTII in terms of reducing taxes on fixed contributions, payments are divided in accordance with the income received for each type of activity. It is necessary to calculate what percentage of income is under each taxation system. With UTII, you take imputed, not actual, income. Then calculate the %, respectively, for each taxation system, and reduce taxes by these amounts. To reduce contributions for employees, take into account the amount of contributions for employees for each tax system. When combining UTII and simplified tax system, it is necessary to keep separate records. The 50% rule applies to the simplified tax system and UTII if you are an employer.

Elena 04/05/2017 at 16:46 # Reply

Good afternoon Is it possible to reduce the UTII tax for 1 sq. 2020 for the amount of insurance premiums paid by individual entrepreneurs in the amount of 1% of the amount exceeding 300 tr of the imputed tax for 2020 paid in the 1st quarter of 2017?

Natalia 04/05/2017 at 17:43 # Reply

Elena, good afternoon. UTII is reduced by the amount of contributions paid in the reporting quarter. In which quarter you pay, you reduce it for that quarter. Those. For contributions paid in the 1st quarter of 2020, reduce UTII for the 1st quarter of 2020. Moreover, it does not matter for what period the contributions are calculated, it is important when they are paid.

Yulia Vladimirovna 04/17/2017 at 14:08 # Reply

Hello, what if in 2020? The individual entrepreneur was an employer, at the end of the year he was deregistered from all funds and continued his activities, 1% in the Pension Fund was calculated and paid in the 1st quarter of 2020, can it be taken as a deduction when calculating UTII?

Natalia 04/17/2017 at 04:17 pm # Reply

Yulia Vladimirovna, good afternoon. 1% for compulsory pension insurance refers to fixed contributions of individual entrepreneurs for themselves, therefore, the rule for reducing UTII is the same as for fixed contributions. In which period you pay, you reduce it. Contributions paid during the first quarter reduce the imputed tax for the 1st quarter, and it does not matter for what period the contributions are calculated.

Dmitry 04/17/2017 at 14:17 # Reply

Paid into pension for the year

I paid the pension immediately for 2020, the UTII tax is 6200 per quarter. Now they say that they will deduct only for the first quarter, and in the remaining three, the full tax will be paid. Is this true?

Natalia 04/17/2017 at 07:15 pm # Reply

Dmitry, good evening. In this situation, tax law - with UTII, distribution over tax periods (quarterly) of the amount of a lump sum paid fixed payment is not provided. There is also no provision for transferring to the next year part of the fixed payment amount that was not taken into account when reducing the amount of the single tax on imputed income due to the insufficiency of the calculated tax amount. This is stated in the letter of the Ministry of Finance of the Russian Federation, letter dated April 3, 2013, no. 03-11-11/136. This is due to the fact that the tax period for UTII is a quarter. You submit a quarterly declaration in which you indicate the calculated UTII and the insurance premiums paid in a given period, which are used to reduce the tax. Since you will not have to pay contributions in the second and subsequent quarters, there is no reason to reduce UTII.

Tatyana 04/18/2017 at 08:29 # Reply

Good afternoon, we have an individual entrepreneur on UTII with employees. Please tell me if we can reduce UTII for the 1st quarter of 2017. for fixed amounts. individual entrepreneur contributions for 2020 and 1% of insurance premiums for 2016, paid during the 1st quarter of 2020? or they relate to the past period and innovations in 2020. these fees are not applicable….

Natalia 04/18/2017 at 01:22 pm # Reply

Tatyana, good afternoon. Fixed contributions paid under UTII reduce the imputed tax for the quarter in which they were paid. This rule was in effect until 2020, and it has not changed in 2020. The amount of the single tax calculated for the tax period is reduced by the amount of: 1) insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases , paid (within the limits of calculated amounts) in a given tax period in accordance with the legislation of the Russian Federation; (as amended by Federal Laws dated June 25, 2012 N 94-FZ, dated June 2, 2016 N 178-FZ). There are no clarifications for what period contributions should be calculated, only the period in which they were paid is indicated. The only thing that confuses me about your question is that you are asking about fixed individual entrepreneur contributions for 2016. These contributions were due by December 31, 2016. If you have not paid them, now you need to calculate and pay the penalty.

07/20/2017 at 17:58 # Reply

Hello. What to do if the fixed payment in the quarter exceeded the UTII tax? For example: individual entrepreneur without employees. I paid contributions for the second and third quarters in June and therefore exceeded the UTII tax for the second quarter.

07/21/2017 at 15:50 # Reply

Hello. If the fixed contribution paid in the billing quarter exceeded the UTII tax, then the UTII tax is not paid in this quarter. When an individual entrepreneur operates without employees, UTII is reduced by the entire amount of fixed contributions paid for the period in which the contributions were paid. You paid your contributions during the 2nd quarter, therefore you can reduce UTII by the entire amount of contributions.

08/22/2017 at 06:33 pm # Reply

deadlines for payment of insurance premiums

Hello, I am an individual entrepreneur on UTII. For the 1st quarter of 2020, I paid insurance premiums on April 9, 2020. I indicated them in the declaration, i.e., I reduced the UTII. UTII payable is zero rubles. Now the tax office demands payment of UTII and a fine for late payment of insurance premiums. We can pay them once a year until December 31, 2017?

08/23/2017 at 09:35 # Reply

Good afternoon. You can reduce UTII only by the amount of contributions paid in the quarter for which UTII is calculated. Therefore, if you wanted to reduce UTII for the 1st quarter, then you had to pay the contributions before the end of the 1st quarter. You paid your fees on April 9, 2020, this is already the second quarter. Those. You did not have the right to reduce UTII in the first quarter by the amount of contributions paid on April 9. But if you do not plan to reduce the amount of UTII quarterly, then you can pay the contributions one-time before December 31, 2020 (Tax Code of the Russian Federation, Article 432, paragraph 2). Apparently the Federal Tax Service charged you a penalty for late payment of UTII, and not fixed contributions.

Zen.Kech. 10/04/2020 at 12:19 pm # Reply

So, in the last quarter, isn’t it possible to file an updated declaration and deduct the amount of insurance from the entire tax amount for the year and pay the difference according to the update, so they can correct the mistakes and shortcomings. Doesn’t the entrepreneur have the right to do this?

09.27.2017 at 18:19 # Reply

Hello. Individual entrepreneur on UTII with employees. In May, one of the employees was on sick leave. Insurance premiums are calculated using an offset system and, naturally, the premium amount for May is not paid. The accrued amount of the maternity contribution for May was included in the UTII deduction. The tax office forces you to pay this amount as unpaid tax on UTII, because This May amount is not in my personal account and they cannot accept it for deduction. What should I do? After all, the tax office is wrong.

View all Next »

Reducing UTII for individual entrepreneurs without employees

An entrepreneur without employees can completely reduce the tax by the amount of contributions paid; the procedure is completely legal, even if in the end the UTII is reduced to zero.

The UTII of an entrepreneur without hired employees can be reduced by contributions for himself, which he is obliged to pay for pension and health insurance.

In order to evenly reduce their expenses, a self-employed individual entrepreneur needs to pay insurance premiums in fractions, quarterly. That is, divide them into four approximately equal parts and pay them quarterly.

As a result, a businessman without hired employees must pay 7,338.50 rubles for pension insurance and 1,721 rubles for medical insurance once a quarter.

Dividing insurance premiums into quarters is necessary when the tax amount can be brought closer to zero.

Example. With annual insurance premiums of 36,238 rubles. a self-employed individual entrepreneur must pay 10,000 rubles. tax once a quarter. If he forgets to divide the insurance premiums and pays them at once, for example, in the 4th quarter, then, in this case, in three quarters he will spend 10,000 rubles on taxes, and in the fourth, after making contributions for 36 238 rubles, he will have the right to deduct them from the UTII tax for this quarter, reducing the tax to zero. Thus, an entrepreneur will pay for 2020: (10,000 * 3) + 36,238 = 66,238 rubles. But if he decided to pay insurance premiums in equal installments, 9,059.50 rubles each. per quarter and each time reduce the UTII on them to 940.50 rubles, then in a year he would spend (940.50 * 4) + (9,059.50 * 4) = 40,000 rubles.

For clarity, let's present this example in the form of a table:

| Time interval | Option 1 | Option 2 | ||

| Period | UTII (RUB) | Insurance premiums (RUB) | UTII (RUB) | Insurance premiums (RUB) |

| 1st quarter | 10 000 | 0 | 940,50 | 9 059,50 |

| 2nd quarter | 10 000 | 0 | 940,50 | 9 059,50 |

| 3rd quarter | 10 000 | 0 | 940,50 | 9 059,50 |

| 4th quarter | 0 | 36 238 | 940,50 | 9 059,50 |

| Total for 2020: | 66 238 rub. | 40,000 rub. | ||

Contribution rates

In 2020, for VNiM the maximum contribution amount will be 865,000 rubles, and for OPS the amount has been increased to 1,150,000 rubles. There is no single indicator for compulsory medical insurance.

Tariffs until 2020 for employers using the UTII system:

- 5.1% - according to compulsory medical insurance;

- 22% – according to compulsory pension insurance (the amount does not exceed the contribution limit);

- 10% – according to OPS if the maximum size is exceeded;

- 2.9% – for VNiM.

Pharmacy organizations provided preferential contribution rates. The amount is calculated based on the salaries and remunerations of employees officially employed in the pharmaceutical sector. The rate is equal to 20% compulsory medical insurance and 0% for VNIM and compulsory medical insurance. The amount of the accident insurance premium is determined by the occupational risk classes of the main field of activity of the enterprise.

Reducing UTII for individual entrepreneurs with employees

An individual entrepreneur with hired employees can reduce the tax by half due to insurance premiums for employees and for themselves. That is, even if contributions for employees cover the tax completely, the employer will have to pay 50% of it in any case.

Until January 1, 2020, the individual employer’s contributions for himself were not taken into account, but now, all insurance contributions are included in the amount of the reduction with employees.

Example. The amount of UTII for an individual entrepreneur with an employee is 23,000 rubles. Insurance premiums for employees - 11,000 rubles, for yourself - 9,059.50 rubles. An individual entrepreneur can reduce the tax amount by no more than 50%, which means in any case he will have to pay 11,500 rubles. It turns out that he will be able to deduct 11,000 rubles from the UTII. contributions for the employee and the remaining 500 rubles. from own fixed insurance payments.

It is important to understand that in this case an individual entrepreneur will be considered an employer not from the moment of concluding an employment contract with an employee, but from the moment of payment of the first salary.

For example, an individual entrepreneur on UTII hires his first employee on June 22. The first salary will be paid on July 10. This means that the second quarter (April, May, June), like the first, the individual entrepreneur will be recognized as self-employed and will be able to reduce UTII by 100% of contributions for himself. In the third quarter, the individual entrepreneur already acquires the status of employer.