When an entrepreneur switches to a single tax on imputed income (UTII), as well as filling out a declaration, it is necessary to indicate the code of the type of entrepreneurial activity. This is a mandatory detail that must be filled out in strict accordance with the approved classifier.

What is the UTII code? The coding of the entrepreneur's activities is a two-digit number. The digital designation was approved by Order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/ [email protected] in Appendix No. 5 to the Procedure for filling out the UTII declaration. The corresponding code can only be applied if the activity complies with the parameters prescribed in clause 3 of Art. 346.29 of the Internal Revenue Code.

Differences from OKVED

It is considered incorrect to draw analogies between these codes, since UTII codes have a generalized concept, and OKVED deciphers the type of activity in more detail.

For example, code 01 corresponds to several OKVED codes (laundry and dry cleaning 93.01, photographic services 74.81, etc.).

The OKVED classifier is much larger, more complex and more meaningful. It collects all types of economic activities of a business and structures it into a complex reference book. Therefore, OKVED codes can contain up to six characters. Whereas UTII codes are limited to only two and cover only 22 types of activities.

This is explained by the fact that not all types of taxation such as “imputation” can be applied. The legislation sets the framework for physical indicators and basic monthly profitability. If business activity corresponds to them, then there is a transition to the use of UTII.

When submitting an application for the application of a single tax on imputed income, an individual entrepreneur or LLC must indicate the type of activity in accordance with the classifier of codes for UTII, i.e. two-digit code.

What is basic income for UTII

Basic profitability in UTII represents the planned level of income, which is expected to be generated by the corresponding physical indicator (number of employees, hall area, number of vehicles, etc.). It is considered one of the fundamental indicators on the basis of which tax is calculated.

Based on it, the potential income of the activity according to UTII for the month is calculated. To take into account the population of territories and inflation, this calculation also includes deflator coefficients (set by the federal authorities) and by type of activity depending on the population of the municipality (fixed by local laws).

Attention! The basic profitability is determined in the Tax Code of the Russian Federation in Article 346.29, and is unchanged throughout the country. It is defined for each grouped type of activity, that is, each code corresponds to a fixed basic profitability. Moreover, different types of activities have different total values.

Table of codes for types of entrepreneurial activity for UTII in 2020

Current 2020 codes by type of activity for UTII with decoding.

| Code | Kind of activity |

| 01 | Provision of household services. |

| 02 | Providing veterinary services. |

| 03 | Providing repair, maintenance and washing services for motor vehicles. |

| 04 | Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots. |

| 05 | Providing motor transport services for the transportation of goods. |

| 06 | Provision of motor transport services for the transportation of passengers. |

| 07 | Retail trade carried out through stationary retail chain facilities with trading floors. |

| 08 | Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters. |

| 09 | Retail trade carried out through stationary retail chain facilities that do not have sales floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters. |

| 10 | Delivery and distribution retail trade. |

| 11 | Providing catering services through a catering facility that has a customer service hall. |

| 12 | Providing catering services through a catering facility that does not have a customer service hall. |

| 13 | Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays). |

| 14 | Distribution of outdoor advertising using advertising structures with automatic image changes. |

| 15 | Distribution of outdoor advertising using electronic signs. |

| 16 | Advertising using the external and internal surfaces of vehicles. |

| 17 | Provision of temporary accommodation and accommodation services. |

| 18 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters. |

| 19 | Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they exceed 5 square meters. |

| 20 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters. |

| 21 | Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters. |

| 22 | Sales of goods using vending machines. |

UTII activity codes and basic profitability in 2020

The coefficients indicated below are applied both when calculating the imputation and when filling out the UTII declaration, in this case:

- The type of activity code (UTII codes) will be required mainly for filling out reports.

- The types of UTII activities indicated in the 2nd column of the table describe the types of activities falling under UTII in 2020 for individual entrepreneurs and LLCs.

- The physical indicator of UTII is determined based on the type of business activity. So it can be calculated from the number of people, area in square meters or from the number of objects.

- The amount of basic UTII profitability is a monetary indicator that is involved in the tax calculation formula, the unit of measurement is rubles.

These codes are indicated in Appendix No. 5 to the procedure for filling out the UTII declaration.

Peculiarities

The table of codes includes only 22 types of business, to which a special tax regime can be applied - UTII. The range of such activities is very limited, since tax legislation establishes certain conditions for its application.

In a number of cases, entrepreneurs confuse UTII codes with OKVED codes. But it should be taken into account that they are regulated by different legislative acts.

Let us clarify the following points:

- Household services provided to the population are listed in the Appendices to Government Order No. 2496-r dated November 24, 2016. They list OKVED codes, respectively, these types of activities can be correlated with code 01;

- It is prohibited to use UTII retail trade in relation to excisable goods and products of own production;

- payers of UTII can be organizations or individual entrepreneurs engaged in passenger and cargo transportation (code 05 or 06), if the fleet of vehicles for such services does not exceed 20 units;

- repair and maintenance services (code 03) do not include warranty repairs or refueling of vehicles.

UTII: cargo transportation and restrictions

In order to be able to apply imputed taxation for cargo transportation, the taxpayer must meet a number of criteria:

- not have more than 100 employees (average number for the reporting period);

- if this is an organization, then not have a share of participation in the authorized capital of other organizations of more than 25%;

- not to work under a simple partnership agreement or a property trust agreement;

- not to be the largest taxpayer.

All this applies equally to cargo transportation. In addition, the right to apply “imputation” ends from the moment of acquisition of 21 vehicles. It should also be taken into account that a single tax can be calculated only on permitted types of activities. Therefore, if, at the same time as cargo transportation, an organization or individual entrepreneur is engaged in something else, then this system can be combined with a simplified or general one.

Where are the activity codes for UTII indicated?

The codes must be included in the following documents submitted to the tax authority:

- Declaration on calculation of UTII tax for the reporting period (in line 10);

- Statement for organizations (LLC):

- about registration - UTII-1;

- on deregistration - UTII-3;

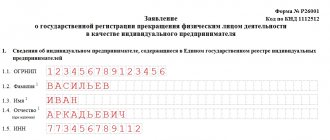

- statement for entrepreneurs (IP):

- on tax registration - UTII-2;

- about withdrawal - UTII-4.

For those organizations and individual entrepreneurs who operate in two different areas using imputation, declarations for each type should be completed separately. Line 10 will have its own code in each case.

Where are UTII codes indicated?

Entrepreneurs must indicate the code for the type of entrepreneurial activity according to UTII in the following documentation:

- in the tax return submitted during the reporting period;

- in applications drawn up in the form of UTII 1 and UTII 3 (for LLC);

- in applications of individual entrepreneurs (UTII form 2 and UTII 4).

The tax report for UTII must include the following data:

- Name of the type of economic activity.

- Its UTII code (see Appendix 3 to the Order of the Federal Tax Service of the Russian Federation).

- Physical parameters of activity, if they are specified in the legislative act.

UTII - types of activities and OKVED codes

To select the appropriate OKVED for UTII, you need to know the features of constructing the classifier hierarchy. The directory consists of sections, classes, subclasses, groups, subgroups and types. The section reflects the general name of the economic sphere, followed by division into areas of activity with specification down to the name of operations.

We recommend reading: Electric train benefits for Chernobyl victims

Carrying out transactions that do not comply with the specified OKVED data may result in the imposition of penalties by regulatory authorities. Clause 4 art. 14.25 of the Code of Administrative Offenses of the Russian Federation establishes a fine of 5,000 to 10,000 rubles for failure to provide information or providing false information regarding information contained in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. To avoid a fine, it is necessary to promptly submit information about changes to the payer’s registration data.

Decoding codes

The structure of business activity codes is a simple list, where each digital combination corresponds to a business line. Decoding is not difficult, it comes down to choosing the appropriate number for the selected type of work.

A complete list of codes can be found in the relevant order of the Federal Tax Service. Some activities included in this list:

- 01 - household services;

- 03 - repair, maintenance and washing of cars and other vehicles;

- 05 — services for the transportation of goods by road;

- 09 - retail trade outside stationary facilities;

- 10 - retail trade of a peddling and delivery nature;

- 11 - organization of catering in the service hall.

Important! The item with code 01 looks controversial. The interpretation of the term “household services” has changed several times in recent years. To avoid problems, you should consult with tax authorities before choosing an identifier.

It should also be taken into account that retail trade (UTII code 07 or 08) does not involve the sale of goods subject to excise taxes, and the list of vehicles approved for transporting people is limited to cars and buses.

List of household services

Most often, questions about the possibility of applying the imputed regime arose and arise in relation to household services to the population. Thus, to clarify the issue of determining what is considered household in connection with the new classifiers, the Federal Tax Service of Russia issued Letter No. SD-4-3/ [email protected] and instructed the Federal Tax Service for the subjects to initiate work to amend the legislative acts of local authorities, in which the list of household services is established in accordance with the no longer valid classifier.

In addition, in a letter dated November 30, 2016 No. SD-4-3/ [email protected] , the Federal Tax Service reported that regulations establishing a list of household works for the purpose of applying the provisions of Chapters 26.2, 26.3 and 26.5 of the Tax Code of the Russian Federation in accordance with the new list, published after 12/31/2016, may be applied from 01/01/2017, if expressly provided for.

Thus, in order to be able to apply UTII in relation to household services, from 01/01/2017, local authorities had to make appropriate changes to their regulatory documents. In particular, they must correspond to some type of business activity code (UTII 2020) according to the new classifiers.

Order of the Federal Tax Service of Russia dated July 4, 2014 N ММВ-7-3/ [email protected] contains the following codes.