To generate documents for registration of an individual entrepreneur or LLC, you can use free online services (for individual entrepreneurs, for LLCs) directly on our website. With their help, you will be able to prepare a package of documents that meets all the requirements for completion and legislation of the Russian Federation.

When registering with the state, the future entrepreneur must declare what exactly he plans to do. Suitable types of activities are selected in a special document - the OKVED classifier.

But you need to know that in certain areas only legal entities can conduct business; this is prohibited for an entrepreneur. There are also activities that can only be carried out after obtaining additional permits or licenses. In addition, the choice of OKVED codes can affect taxes and contributions, which will ultimately affect the income of the entrepreneur. Let's figure out how an individual entrepreneur should act when choosing types of activities, and what restrictions there are in this sense.

Activity classifier

Every future individual entrepreneur knows what type of business he will engage in. But during registration you need to inform the Tax Service about this. To do this, the entrepreneur must select a specific activity included in the All-Russian Classifier of Types of Economic Activities. This classifier was approved by order of Rosstandart dated January 31, 2014 No. 14-st and is officially called OK 029-2014 (NACE Rev. 2). But for simplicity, it is usually called OKVED or OKVED-2, since its second edition is now in effect.

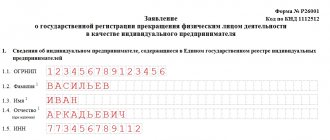

From OKVED you need to select the main type of activity of the individual entrepreneur, and, if necessary, several additional ones. These codes must be entered into the application for registration of an entrepreneur using form P21001, approved by order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected]

The law does not in any way limit individual entrepreneurs in choosing areas of activity based on their number. It is not at all necessary to deal with everything that is selected at once, so you can indicate OKVED codes in anticipation of the future. But there is also no need to select unnecessary codes. Subsequently, the types of activities can be expanded or replaced by submitting form P24001 to the Federal Tax Service. This must be done within 3 days after the individual entrepreneur began engaging in new activities.

Free selection of OKVED

Types of individual entrepreneur activities that require a license

For certain types of activities, an individual entrepreneur must obtain a special permit - a license. Otherwise, entrepreneurship will be illegal, and individual entrepreneurs may be held accountable, even criminally.

An individual entrepreneur license must be obtained to engage in pharmaceutical, medical, educational activities, road transportation and other types of activities.

We discussed the issue of business licensing in detail in this article.

Selecting OKVED for individual entrepreneurs

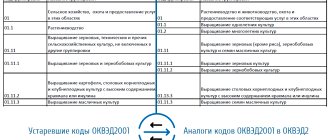

Now let's look at how to use OKVED. All activities in it are divided into sections, designated by the letters of the Latin alphabet AU. Within each section, activities are detailed in the form of a hierarchical list. As an example, let’s select a code for a bakery and confectionery store that an individual entrepreneur is going to open.

All trade activities are in section G: “Wholesale and retail trade; repair of vehicles and motorcycles." It includes 3 classes:

- 45: Wholesale and retail trade in motor vehicles and motorcycles and their repair;

- 46: Wholesale trade, except for wholesale trade of motor vehicles and motorcycles;

- 47: Retail trade, except trade in motor vehicles and motorcycles.

We are interested in class 47, which contains many subclasses:

- 47.1: Retail trade in non-specialized stores;

- 47.2: Retail trade of food products, drinks and tobacco products in specialized stores;

- …

- 47.9: Retail trade outside shops, tents, markets.

The types of activities of the individual entrepreneur from the example are suitable for OKVED codes of subclass 47.2, since he will trade in food products. This subclass contains activity groups that describe the trade in various food products, as well as tobacco. They look like this:

- 47.21: Retail trade of fruits and vegetables in specialized stores;

- …

- 47.29: Retail trade of other food products in specialized stores.

Group 47.24 “Retail trade in bread and bakery products and confectionery products in specialized stores” is suitable for a bakery and confectionery store. It has 3 subgroups, each of which is dedicated to one type of product:

- 47.24.1 - bread and bakery products;

- 47.24.2 - confectionery products;

- 47.24.3 - ice cream and frozen desserts.

However, when choosing a code, there is no point in going deeper than the group, because to indicate P21001 in the application, you need a code consisting of at least 4 characters. So let's focus on group 47.24. At the same time, the store will be able to sell not only confectionery and bread, but also ice cream and frozen desserts, since group 47.24 includes all OKVED codes of subgroups 47.24.1-47.24.3.

This example shows that there is nothing complicated in choosing OKVED. True, there are nuances that an individual entrepreneur should be aware of before registering. The bottom line is that in the status of an individual entrepreneur you can not engage in any activity.

We also looked at an example of how to select OKVED codes for individual entrepreneurs: cargo transportation.

Free registration consultation

In what cases must an individual entrepreneur notify about the start of business activities?

In relation to the following types of activities, individual entrepreneurs are required to notify the authorized body about the start of business activities. The notification must be made after registration of the individual entrepreneur, but before the start of the relevant type of activity. Otherwise, the entrepreneur may be fined.

These types of activities include:

hotel services; repair and tailoring of shoes and clothes; services of photo studios, hairdressing salons and baths; retail and wholesale trade, etc. In all these cases, Rospotrebnadzor must be notified about the start of activity. In some cases, it is necessary to notify Rostransnadzor (when starting travel agency activities), Rostrud (in the production of personal protective equipment) and other authorized bodies. You can read more about the procedure for notifying the start of activities, types of activities and authorized bodies in this article.

Do's and Don'ts for an Entrepreneur

Many simple and common areas of business are available to individual entrepreneurs without any restrictions. An entrepreneur can provide most services and sell wholesale or retail many (but not all) goods. Manufacturing activities, as well as agriculture, are available for individual entrepreneurs.

But some lines of business involve increased responsibility or risk. The state must be sure that consumers or the environment will not be harmed, so it sets additional rules. These more complex activities can be divided into several groups:

- Activities requiring permission. It cannot be carried out without agreement with regulatory authorities or inspection organizations. For example, in order to open a cafe or store, as well as provide some household services to the population, you will have to obtain permission from Rospotrebnadzor. And to carry out certain construction work, permission from a self-regulatory organization (SRO) will be required.

- Activities requiring a license. An individual entrepreneur can obtain a license for private investigation activities and passenger transportation of 8 or more people. If an entrepreneur has specialized education and work experience, he also has access to licenses to provide services in medicine, pharmaceuticals and education.

- Activities prohibited for individual entrepreneurs. The entrepreneur will not be able to carry out most of the licensed activities. Among them are the production and sale of alcoholic beverages (individual entrepreneurs can only sell beer), the production of medicines, the organization of pawn shops, and the issuance of microloans to the population. Also prohibited are activities related to military affairs, harmful and dangerous substances, air, sea and rail transportation, banking and financial services (including insurance, investing) and some others. All this requires quite large financial investments and is associated with high risks, so the state does not trust this area to small businesses.

So, before choosing suitable IP OKVED codes, you need to make sure that the desired type of activity is available. If you have chosen a line of business that requires a license, then it is better to immediately clarify the conditions for obtaining it. You may have to register a legal entity instead of an individual entrepreneur. Licensed activities are listed in Article 12 of Law No. 99-FZ of May 4, 2011. In addition, there are about 10 more industry laws that regulate licensing in a particular area.

What types of economic activities does an individual entrepreneur have the right to carry out?

An individual entrepreneur has the right to engage in almost any business, with the exception of those types of activities that can only be carried out by organizations.

These types of activities include:

- private security activities (individual entrepreneurs acting as a bodyguard are not allowed under our laws);

- activities related to weapons and military equipment (individual entrepreneurs will not be able to supply weapons and repair military equipment);

- production and trade of alcohol;

- production of medicines;

- activities related to trafficking in drugs and psychotropic substances;

as well as other specific types of activities (nuclear energy; insurance; clearing activities; activities related to the protection of state secrets; space activities; production of aircraft equipment, etc.).

All of these types of activities are not available to individual entrepreneurs. Organizations in various organizational and legal forms (LLC, PJSC, etc.) have the right to engage in them, provided that the organization meets the requirements established by law.

Activities and taxes

The choice of OKVED also affects what taxes and at what rates the entrepreneur will have to pay. The Russian tax system has 5 tax regimes, 4 of which are preferential and intended for small businesses. For the application of each of them, different conditions have been introduced, for example, the maximum number of employees, the maximum annual income. This choice directly depends on the type of activity. These tax regimes are:

- Basic system (OSNO). An entrepreneur can use it for any activity. You will have to pay tax on income minus expenses at a rate of 13%, as well as VAT at a rate of up to 20%, which is often unprofitable.

- Simplified system (STS). You can choose one of two options - pay 6% on all income or 15% on the difference between income and expenses. The types of activities of individual entrepreneurs under the simplified taxation system can be almost any, although there are still minor restrictions (clause 3 of Article 346.12 of the Tax Code of the Russian Federation). The simplified tax system cannot be used in the production of excisable goods, extraction and sale of minerals, with the exception of common ones. This system is also not used in financial activities - banking, insurance, investment, pawnshop, microcredit. But we have already said that for individual entrepreneurs all this activity is prohibited in any case.

- Unified tax on imputed income (UTII). Paid at a rate of 15% of the amount of theoretical income from a specific activity, calculated using a special formula. The benefit here is that the tax amount does not depend on income. However, UTII can only be applied to strictly defined activities, the general list of which is given in paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation. In addition, the imputed tax does not apply everywhere; it is introduced by decision of local authorities. In Moscow, for example, it does not exist.

- Patent system (PSN). As with UTII, the tax does not depend on the amount of income, but on the type of activity. The cost of a patent is calculated at a rate of 6% of the potential income of an individual entrepreneur in the chosen field. The list of activities for which the patent system is suitable is given in Article 346.43 of the Tax Code of the Russian Federation. PSN is introduced by the municipal authorities of the constituent entity of the Russian Federation, so it is necessary to take into account the peculiarities of regional legislation.

- Unified Agricultural Tax (USAT). Applicable only to agricultural producers. These are organizations and individual entrepreneurs that are engaged in livestock farming, crop production, as well as industrial processing of agricultural products. The details of the activities for which the unified agricultural tax can be applied are given in Article 346.2 of the Tax Code of the Russian Federation. The tax rate is 6% of the difference between income and expenses, but in addition to this, from 2020 you need to pay VAT.

So, the possibility of applying preferential tax regimes, as well as the size of UTII and the cost of a patent, directly depends on the type of activity. In addition, for individual entrepreneurs using the simplified tax system and special tax system, regional authorities can introduce “tax holidays” - reducing the tax rate to zero. Again, the ability to take advantage of the benefit depends on the type of activity. Vacations are allowed only for entrepreneurs in the production, scientific and social spheres, as well as in the sphere of consumer services.

What is an individual entrepreneur allowed to do?

Conventionally, permitted types of activities can be divided into 3 groups:

- Not requiring any permits or licenses.

- Requiring approval or permission from individual regulatory authorities.

- Requiring licenses.

Activities that do not require any permits can be carried out immediately after registration. At the same time, there is no need to obtain a license or go around authorities to obtain approval. You can start working right away.

Such activities include, for example, the provision of personal services (except for hairdressing and cosmetology services), creative and publishing activities, intermediary, legal and consulting services, rental and rental services, wholesale trade of goods, with the exception of those goods that are limited in circulation or prohibited, advertising and transportation (except for freight over 3.5 tons).

In relation to the implementation of certain types of activities, the consent of individual authorities or obtaining a special permit - license may be required. See below for more details.

OKVED and insurance premiums

The main type of activity of an individual entrepreneur influences the rate of insurance premiums for injuries. This is the short name for contributions for insurance of employees against accidents at work and occupational diseases, which all employers are required to pay.

To determine the insurance rate, all activities are divided into classes depending on the risk it poses for workers (Order of the Ministry of Labor of Russia dated December 30, 2020 No. 851n). For example, retail trade is included in the safest activity group, while coal and ore mining has the highest risk. The higher the occupational risk class, the higher the rate of insurance premiums for injuries. This means that the larger amounts individual entrepreneurs will have to pay to the Social Insurance Fund. To determine the tariff, it is necessary to timely confirm the professional risk class of the main activity.

Not so long ago, the types of activities of individual entrepreneurs under the simplified taxation system were also important for other insurance premiums. In 2017-2018, certain “simplified” activities were subject to contributions at a reduced rate of 20%. The same benefit was valid for individual entrepreneurs on UTII with a pharmaceutical license, as well as all entrepreneurs who worked on a patent. But as of 2020, this rule does not apply. So now all entrepreneurs pay insurance premiums for employees at standard rates - a total of 30% without taking into account contributions for injuries.

In conclusion, a few words about violations of the rules associated with activity codes. If an individual entrepreneur carries out operations that do not fit into his OKVED codes, he may face a fine under Article 14.25 of the Code of Administrative Offenses in the amount of 5 thousand rubles. But there may be other consequences - disputes with the Tax Service. For example, the Federal Tax Service can charge an entrepreneur with a preferential regime personal income tax at a rate of 13% on income from transactions that he carried out without the corresponding OKVED code. Inspectors believe that since there are no codes, it means that the citizen received income outside the scope of entrepreneurial activity. To avoid such troubles, we recommend that you take a responsible approach to choosing codes and, if necessary, add them in a timely manner.

conclusions

It's time to draw some conclusions. So, although an individual entrepreneur can engage in many types of activities, not all of them. The state significantly limits the scope of work for individual entrepreneurs. This is caused both by the specifics of these industries (for example, space or weapons), and by the capabilities of the business entity. At the same time, in Russia there is no single law that would clearly indicate areas of work that are not available to individual entrepreneurs. Therefore, a person has to manually review dozens and hundreds of documents to understand whether he can engage in a particular activity.

It should also be noted that many licensed areas of activity are also inaccessible to an individual entrepreneur. Moreover, he can only find out about this by contacting the relevant industry body or raising departmental regulations.

And finally, the choice of activity itself is a certain difficulty for an inexperienced person. After all, the decision about what an individual entrepreneur will do depends not only on his skills and abilities, but also on the tax regime that he will use. In addition, competition in the field of activity that the individual entrepreneur declared during registration may also play a certain role. He may even have to “change the rules of the game on the fly” and start doing something he never intended to do. Consequently, it will be necessary to enter additional types of activities into the Unified State Register of Enterprises and abandon the previous ones. Failure to comply with this requirement may result in administrative penalties and fines.

As a result, the seemingly simplest task of choosing a type of activity turns into a real equation with many unknowns. Therefore, we recommend that those who are planning to register as an individual entrepreneur (or want to change the type of their activity) seek legal assistance from professional specialists. They will select the correct OKVED codes, give recommendations on licensing and help avoid many negative consequences.