Hello, dear readers of the magazine “Richpro.ru”! Today we will talk about the patent taxation system (PTS), namely what it is and what types of activities that fall under the patent are relevant at the moment.

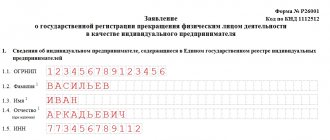

The number of individual entrepreneurs (IEs) in Russia is already more than 5 (five) million people working in this segment, and every year there are more and more of them, which undoubtedly requires special attention from the state. By the way, we wrote in the last issue how to open an individual entrepreneur and what documents are required to register an individual business.

There are many aspects of regulation of this type of activity; even the criminal law provides for liability for violation of the law when conducting business.

However, in this article we will talk about the moment that allows the formation of the state budget, namely the taxation of individual entrepreneurs.

The Tax Code of the Russian Federation fixes a simplified system in order to provide individual entrepreneurs with the most comfortable conditions for carrying out their activities and calls it the patent taxation system.

From this article you will learn:

- What is a patent for an individual entrepreneur - the types of activities that fall under this system;

- Features of running an individual entrepreneur on the patent taxation system;

- Nuances and features of PSN.

What is a patent for individual entrepreneurs (PSN), why and when is this taxation system applied, what types of activities are covered by PSN and much more, read on