What is included in closing documents for accounting - in 2020

In accounting, when making transactions, not only primary documents (i.e. checks, receipts, etc.) are important, but also secondary documents - closing documents.

They are no less important than the transaction agreement, and their correct execution will help to avoid problems during various inspections. In such papers it is usually written that one or another monetary transaction was carried out between two parties, all conditions were met and each party is satisfied with everything. It is these documents that confirm a fair transaction.

Only after they are closed is the transaction considered legally completed - everything was formalized and recorded according to the rules. Drawing up such documents is the problem of every accountant.

The entire registration procedure takes place during the transaction, before its completion. Signing occurs at the moment when it has already been completed and there is some confirmation.

When making a sale, acts and invoices are drawn up much earlier than the goods fall into the hands of the buyer, because at this time their assurance is already required. This rule applies to absolutely all documents that can be called primary.

As for storage, the period is 5 years, during all this time, before the destruction of documents, the tax organization has every right to check the availability and correctness of documents from both parties; in case of discrepancy, one or the other party will receive an administrative penalty, and in the case of more serious violations are criminal.

The destruction is carried out by a commission specially created for this purpose. All closing documents relating to the pension fund must be kept for 75 years.

| Accounting | All documents related to accounting of finances in the company, monetary transactions made (settlements, invoices, etc.). |

| Exculpatory | Those documents that can confirm that the transaction was completed, everything was drawn up according to the rules (invoices, written requirements, etc.). |

| Organizational or administrative | These include papers that regulate monetary relations within the company, such as: payment orders, orders to increase wages, etc. |

| By volume | These are either primary or summary. By summary we mean a list of primary documents. |

| By number of operations | It’s also simple here, either it’s one-time or cumulative. |

| Place of application | Between a company or between participants in a transaction. Internal ones include acts, invoices or advances, and external ones include invoices and contracts. |

| Design methods | Common forms or forms specially designed for a particular occasion. |

It is recommended to indicate there the entire list of documents necessary to close the transaction upon the partners’ fulfillment of their obligations. Each organization requires its accounting department to strictly record and monitor all procedures performed, as well as the availability of relevant papers. Any transaction related to money transfers must be documented and recorded. The presence of relevant papers confirms the fact that money has been received into the company’s account.

In this case, the counterparty organization is obliged to close the procedure for transferring funds with similar documents. The presence of closing documents is necessary so that the accountant has confirmation that the legal side of the transaction is completed and also paid.

This kind of documentation is precisely the physical (written) confirmation of this fact. Since transactions are of a very diverse nature, the documents closing them can be very different.

Types of primary documents

What is included in this class of papers? All reports on any financial activities . Based on the characteristics and characteristics of the forms of primary documents, they are divided into:

By purpose:

- administrative (instructions);

- performing (statements).

By filling method:

- combined (advance report);

- strict (coupons or tickets).

By volume:

- primary (cash orders);

- summary (statements of expenses).

By type of operation:

- one-time (reports);

- accumulative (limit-fence cards).

By place of compilation:

- internal (invoices or advance reports);

- external (supplier invoices, payment requirements).

They can be standard (registration of transactions) or specialized (for highly specialized transactions).

What applies to primary documents? Their list is as follows:

- bank and cash statements;

- money orders;

- advance payment reports (with attached receipts from hotels, travel cards, receipts for stationery, etc.);

- sales receipts;

- invoices;

- accounts;

- working time records;

- statements.

All these forms are used by any company that carries out any financial activity.

Time sheet

This is interesting! What is a raider takeover?

Requirements for the list of documents

At the moment, when initializing the procedure for closing an individual entrepreneur in 2019, the following documents must be submitted to the Federal Tax Service:

- application in the form established by law;

- a receipt with a stamp indicating payment of the state duty.

It must be remembered that if an entrepreneur visits the tax office in person, an identification document is required. In this case, it will be a civil passport.

If the papers are submitted to the inspectorate with the help of an intermediary, it will be necessary to issue a power of attorney certified by a notary to represent the interests of the entrepreneur.

And finally, when sending documents by Russian post by registered mail, a mandatory inventory of all documents is required.

Documents for closing an individual entrepreneur can also be submitted electronically, but in this case, the submitter must have a valid electronic signature key (EDS).

Place and period of storage

After completion, processing and registration, the primary form must be stored at the enterprise for at least 5 years. It is kept in the accounting department in special rooms or cabinets (the papers must be completed chronologically, numbered and filed), and then moved to the archive. The transfer of papers, and, if necessary, their issuance occurs only with the permission and under the control of the chief accountant .

Papers are stored:

- 1 year – correspondence about reporting,

- 5 years – documentation of all financial transactions quarterly,

- 10 years – balance sheets and inventories for the year,

- 75 years – financial settlements with employees.

Important! All types of primary documents can be destroyed, even after the deadline has expired, only by decision of a special commission.

Primary documents for individual entrepreneurs on the simplified tax system, contracts, acts, accounts, KUDIR

To receive income, you must have primary documentation, that is, you cannot receive money just like that, there must be a justification.

At first, this is very unusual, because when you work as an individual, there is no paperwork, but in practice everything is not as difficult as it seems.

The primary document confirms various events in the business: the sale or purchase of goods, the provision of services to clients, the payment of salaries to employees, and others.

Depending on the event, the list of documents to be completed varies. Let's consider a common situation - a transaction involving the sale of goods and the provision of services. It is customary that the documents are prepared by the supplier or contractor.

Article “how to deceive in contracts”

- The contract is the beginning of the transaction. In it, you and the client determine the terms of cooperation: what, for what price and in what time frame you do. If the client is a regular one, you can draw up one agreement for several transactions.

- The invoice contains the amount to be paid, a list of goods and services and the bank details of the seller. This is an optional document, but is usually used for convenience.

- A cash receipt, sales receipt or strict reporting form confirms payment. Give them to the client who pays in cash or by card. When paying by bank transfer, payment is confirmed by the payment order.

- Invoice is a document that the supplier issues to the buyer when shipping goods.

- An act of provision of services or completed work is a document that the customer and the contractor sign based on the results of the provision of services or completion of work.

- Invoice - usually issued by individual entrepreneurs and LLCs using the general taxation system, because they work with VAT. In rare cases, invoices are issued using the simplified tax system, UTII and patent - read more about this in the article.

Create documents in three clicks

Create contracts, invoices, acts and invoices based on templates. The service will automatically fill in all the necessary document details. It will be more convenient than in Word. Try 30 days free

Moreover, I have them there and store them in a completed form.

Invoices and acts are the same, but there are many different templates for contracts. I also keep KUDIR in My Business. The primary documents for the individual entrepreneur are my folder. So, before performing any work or providing a service, you need to conclude an agreement, sealed with the signatures of the parties and seals (the individual entrepreneur can only put a signature, a seal is not required).

The offer does not require signing by the parties and during registration (creating a personal account) you agree to it (accept).

Payment acceptance documents

There are several such documents, and the choice is made not at will, but depending on the working conditions.

Important! The only case when an individual entrepreneur should not give anything to the buyer when receiving funds from him is when he receives payment directly to a bank account . In this case, the buyer remains in possession of a document from the bank, which will confirm that he has made the payment.

Typically, legal entities and entrepreneurs pay each other through a bank. But settlements with buyers—individuals—must be supported by business entities with documents. This is necessary when accepting payment in cash, bank cards or electronic means of payment (Qiwi wallets, Yandex.Money and others). The document remains with the buyer and serves as confirmation of payment.

In most cases, an individual entrepreneur is deprived of the right to choose which document to draw up - everything is regulated by law. So, if an entrepreneur uses OSNO or the simplified tax system and trades at retail, then he is required to use a cash register. Accordingly, the buyer must be issued a cash receipt . If an individual entrepreneur applies UTII or buys a patent and at the same time is engaged in retail trade or works in the catering industry, the issue with the cash register is resolved as follows:

- if there are employees, CCP is mandatory from July 1, 2018 ;

- when working independently, CCP may not be used until July 1, 2020 .

As for the provision of services to the population, regardless of the availability of employees and the applied taxation system, you can work without a cash register until July 1, 2020. However, instead of a cash receipt, the buyer must be given a strictly reporting form (SSR). And always, and not just on demand. BSO can be ordered/purchased at a printing house, generated through an automated system, including online through a special service.

Attention! It is impossible to generate BSOs on a regular computer - they will not be valid.

What is a business activity?

In the current Civil Code of the Russian Federation, Article 2 enshrines the concept of entrepreneurial activity and lists the main signs in accordance with which it can be said whether a citizen carries out entrepreneurial or other activities. So, entrepreneurial activity means:

- independent;

- carried out at your own risk;

- aimed at systematically generating profit.

systematicity in making a profit and independence. Therefore, if a citizen systematically makes a profit by providing services, selling goods or using property that belongs to him, then he will be subject to additional tax charges, as well as fines and penalties. To do this, it is enough for tax authorities to document the fact that an individual who is not registered as an individual entrepreneur is conducting entrepreneurial activity.

In order for a businessman to have the status of an individual entrepreneur officially removed, tax authorities require him to submit a corresponding application on form P26001.

How to work as an individual entrepreneur with VAT

For those planning to apply VAT exemption, we recommend that you read the material. Organizations that apply special tax regimes (Unified Agricultural Tax, USN or UTII) are not VAT taxpayers and are not required to issue an invoice (clause

3 tbsp. 169 of the Tax Code of the Russian Federation). Also, organizations that carry out transactions that are not subject to VAT in accordance with Art.

The VAT that is missing from the seller’s documents is not taken into account by the buyer and is not calculated additionally.

In documents for payment to a seller working without VAT, the “Base of payment” field must contain the entry “Without tax (VAT).”

At the end of the reporting quarter, based on the entries from the sales book and the purchase book, he displays the difference between input and output taxes, obtaining the amount that must be paid to the budget.

Among the advantages of working for OSN for an entrepreneur, one can only name the opportunity to deal with large companies, which, as a rule, is associated with long-term contracts for large sums.

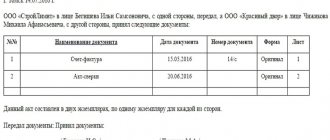

What closing documentation is required?

In order to provide legal certification of the fact of a sales transaction or the provision of services, the specifics of which are indicated in the contract, it is necessary to have written confirmation in the form of a closing document. Such papers provided to the accounting department include the following types:

- an act confirming the completion of certain actions/work. It indicates that the obligations under the contract have been fulfilled and the expected result has been achieved;

- invoice.

Closing documentation in the form of an invoice must be drawn up in at least 2 copies, which are provided to each of the two parties involved in the operation. This is required to ensure that the parties to the contractual agreement are able to record the completion of the transaction in their accounts. This type of form can be used exclusively when making deliveries of goods (purchase and sale).

Receipt for payment of state duty

The next required document is a receipt for closing an individual entrepreneur, which will confirm payment by the entrepreneur of the state fee. The cost in 2014 is one hundred and sixty rubles, the same as in the past. The receipt form is shaped and paid in the same way as any other payment to the budget.

You can find out the details to fill out:

- at the tax authority;

- on the Federal Tax Service website.

The budget classification code for closure of individual entrepreneurs in 2014 has the following number: 182 1 0800 110.

Forms: personal or ready-made

You can develop an invoice form for individual entrepreneurs yourself. It is important to remember that there is a list of data that must be included in the document.

These include:

- document number and date of its preparation;

- data on the recipient or sender of the cargo;

- on what basis (invoice or agreement) the purchase takes place;

- how much product is sold and at what cost;

- position, initials of the person who released the goods from the warehouse;

- seal of the business entity;

- If an individual entrepreneur has an invoice without VAT, then this must be indicated and zeros must be entered.

Often, when checking by the tax service, a correctly filled invoice for individual entrepreneurs will save you. A sample form can be found at the Federal Tax Service office or downloaded on the Internet. If the goods are delivered by another company, you must indicate its details, name and contract number.

A consignment note for individual entrepreneurs without VAT is required when goods are sold, released or received. The form is filled out in the same way as the standard version of the document. A sample of an individual entrepreneur's invoice without VAT can be found on specialized websites along with instructions for filling it out. For an individual entrepreneur, the document serves as the basis for determining the amount of tax deductions.

To reduce tax due to transportation costs, you will need an individual entrepreneur’s invoice. Usually fill out the existing TTN form No. 1-T. Some businessmen fill out the document in four copies. Two are intended for the consignee and the shipper, and another 2 are kept by the transport company.

The individual entrepreneur's invoice without VAT on the simplified tax system is filled out, like a regular one, in two copies. That is, each participant in the transaction is entitled to one copy. A sample of filling out invoices for individual entrepreneurs will help you fill out the form without errors. If the document displays inaccuracies, the businessman may be denied VAT exemption.

If an entrepreneur’s invoice for UTII is issued, the tax authorities usually talk about a violation of the use of a special regime. The inspector believes that the invoice confirms the use of the goods not for personal purposes, but for business activities. This means that the seller does not pay a single tax, but personal income tax plus VAT.

Entrepreneurial activity on UTII can take place without a cash register. The individual entrepreneur, at the buyer’s request, issues an invoice in order to be able to accept cash from the client for a service or product.

On video: Documentation of the transport process

Invoice for individual entrepreneurs without VAT

If you are not a VAT payer or are exempt from tax, you can issue VAT-free invoices for individual entrepreneurs or companies:

- at their request;

- due to the requirements of tax legislation.

According to paragraph

5 tbsp. 168 of the Tax Code of the Russian Federation, exempt from VAT under Art. 145 of the Tax Code of the Russian Federation, the taxpayer is obliged to draw up invoices without highlighting the amount of tax, but with the inscription or stamp “Without tax (VAT)”.

In these columns, instead of numerical values, Manufacturer LLC put the inscription “Without VAT”.

This is what a sample invoice might look like:

activities directly aimed at generating income. At the same time, the Tax Code of the Russian Federation establishes the same rules for individual entrepreneurs who pay VAT as for legal entities.

Firstly, individual entrepreneurs are required to register with the tax authorities, after which the entrepreneur automatically acquires the status of a VAT payer, with the exception of those who have chosen one of the special tax regimes. Secondly, if you choose the Unified Agricultural Tax, the simplified tax system or the UTII, the individual entrepreneur is not a VAT payer.

Thirdly, an entrepreneur, as well as legal entities, may be exempt from the obligation to pay VAT in terms of calculation and payment of tax, provided that he complies with the established requirements of the Tax Code of the Russian Federation. Fourthly, the presence of an entrepreneur legally granted exemption from the duties of a VAT payer does not apply to operations for the import of goods into the territory of the Russian Federation and does not affect the fulfillment of the duties of an individual entrepreneur as a tax agent for VAT! In addition, all cases when an individual entrepreneur can be recognized as a tax agent for VAT are listed in Article 161 of the Tax Code of the Russian Federation.

Closing documents

Maintaining documentation, in addition to preparing primary and secondary forms, also implies the presence of closing forms . Closing documents are papers confirming the completion of a transaction by both partners and the full fulfillment of all obligations. These forms are recorded in the accounting department and filed so that they can be referred to later.

They are necessary for the transaction to be legally legal and final. And in order to avoid misunderstandings among partners, special attention is paid not only to carefully spelling out all obligations and recording them in the contract, but also to the correct execution of closing forms. For example, they describe in great detail the proposed checks and statements.

They are divided into different types depending on the type of transaction:

- Act;

- invoice;

- waybill (consignment note or goods bill).

It is important to know ! Only originals have legal force; copies cannot be used for legal actions.

If an error is made in such forms, this will not only negatively affect the reputation of the enterprise , but will also bring financial losses - the tax office imposes serious fines and additional taxes for such violations.

Invoice

Difficulties in preparing documents

We can confidently state the fact that for a businessman who submits reports on time and pays all necessary payments, the procedure for collecting documents does not cause any difficulties. The main thing that you should pay attention to is fulfilling all the requirements for filling out an application for closing an individual entrepreneur and accurately filling out the receipt details. Therefore, it is recommended to carefully follow the presented samples, or consult the territorial tax office.

As already mentioned, it is necessary to carefully check the receipt for closing an individual entrepreneur, since the most common mistake is incorrectly entering the KBK number due to its frequent changes. In other matters, difficulties should not arise, of course, if the business was conducted openly and in accordance with the law

The considered list of documents for closing an individual entrepreneur is mandatory and the same for everyone.

Additional procedure tips

Recently, reforms have been carried out that make closing an individual entrepreneur much easier. The procedure is possible even if the entrepreneur has debts. But we must remember that the debt does not go away; it remains with the citizen until he pays off. The type of debt determines the rules for liquidation.

- Debt to the Social Insurance Fund.

- Debt to the Pension Fund.

- To creditors and employees.

It is permissible to pay off debts after the entrepreneur has completed liquidation. But after this, the responsibility to pay passes to the individual. Interested parties have the right to sue if it becomes clear that funds are not being transferred.

Closing an individual entrepreneur online is acceptable if the citizen has a so-called digital signature. The list of documents and requirements are standard; they are simply submitted not in person, but through the official website of the organization. After receiving the application, tax inspectors send responses by email. At the last stage, the citizen is given an extract from the Unified State Register of Individual Entrepreneurs, which confirms the absence of the official status of an entrepreneur. At this stage, interaction with the Federal Tax Service ends.

You can also use postal services when you need to stop your business. The prepared documentation is simply submitted in the form of a registered letter. But in this case, you will need to contact a notary to additionally certify the signature and confirm its authenticity. A certified copy of the identity document is also submitted. After that, all that remains is to wait until the answer arrives.

Above we discussed the papers that are submitted to the Federal Tax Service by every entrepreneur closing his business. As noted earlier, the list of documents for closing an individual entrepreneur is influenced by the specific situation, ranging from the circumstances of the termination of business activity to its specifics. Therefore, a businessman must take into account all these subtleties when collecting documents.

The list of required papers can be expanded to include documents confirming the delivery of licenses and other documents that were received by the businessman when carrying out certain types of activities.

You may also need mandatory confirmation from the Federal Tax Service about the deregistration of the cash register, if it was used in the process of work. A bank certificate confirming the closure of a current account is submitted to the tax office only if the account was canceled while the business was still in operation.

In general, liquidating an enterprise in 2020 is not a very complicated process, and the necessary documents can be completed quickly if desired.

If the businessman was previously an employer of hired workers, the list of documents will be supplemented by a certificate from the Pension Fund. If the individual entrepreneur did not have employees, then confirmation of the absence of debt from the Pension Fund of the Russian Federation is provided at the request of the entrepreneur, since, in accordance with the law, it is possible to pay off debts while already being an individual.

The tax service is obliged to register the closure of an individual entrepreneur, regardless of the existence or absence of debts.

Only after the mandatory and additional papers for terminating the activities of an individual entrepreneur have been collected, the entire set can be safely submitted to the registration authority.