Document flow rules

Apart from the general recommendations specified in the office work instructions, there are no established guidelines for stapling documents. Tax authorities require that financial documents be protected from the possibility of loss and forgery. Such requirements are not imposed on documents such as balance sheets and order journals, since they are, in fact, secondary.

But the primary documentation must undergo a binding procedure. The cash book and income book must be stitched. But how to bind a book if the law does not prescribe the rules?

The cash book is considered a significant tool in the field of recording cash flows, so it must be maintained within the framework of strict discipline. The cash book is compiled in a single copy, and all enterprises, as well as individual entrepreneurs, if they work with cash, must have it.

Periods for storing documents in the archive

The storage periods for documentation are regulated by the legislation of the Russian Federation; they depend on the type of documents:

- 75 years - storage period for business books, notarial records, documents related to personnel or privatization;

- 20 years is the shelf life of patent documentation for inventions, documents on capital construction and design activities;

- 15 years - shelf life of scientific works and research;

- 5 years is the storage period for archival documentation of an agricultural organization;

- 5 years - storage period for documents related to film and photography activities;

- 3 years is the period for which photographic and video documents are stored.

At first glance, the procedure for stitching documents looks complicated, but once you study all the rules, the process will no longer seem difficult.

Author of the article: Ekaterina Moguchaya

To reduce the number of paper documents and think less about their firmware and storage, keep records in the web service for small businesses Kontur.Accounting. Here you can work with legally significant electronic documents: take them into account, exchange them with counterparties and send them to regulatory authorities. Our service includes simple accounting, payment of taxes, salaries and contributions, and sending reports via the Internet. The first 5 days of work are free.

General questions about maintaining a cash book

If the company has several divisions, then the original cash books are stored at the place of work with cash. Only copies of primary documents are provided to the head office. You can maintain a cash book:

- in an accounting program;

- on a unified form electronically or by hand.

According to the rules of cash discipline, the book is maintained throughout the year on an increasing basis. Order numbers start from one every year. Continuous numbering is used. The person in charge must print the sheets in two copies - for the cashier’s report and the cash book. Each sheet must be numbered.

If the cash register is maintained in an accounting program, then these actions are not difficult. The program automatically numbers pages, assigns numbers to documents in order, and prints the finished sheet according to a unified form. The program generates the title page of the book, which must contain the required attributes:

- OKPO company;

- company name or full name of individual entrepreneur;

- a period of time;

- name of the department, if available.

CD storage

The manager organizes and carries out the process, determines storage locations and approves the procedure for the formation and storage of cash documents in the organization. He must ensure such storage conditions that the documents are safe for the entire period established by law.

General requirements regarding storage periods are established in the Federal Law “On Bukh. accounting”, according to which primary documents and CD registers are stored in the archive for at least 5 years. After the expiration of the established period, they can be destroyed, but provided that there are no disputes or ongoing legal proceedings regarding them.

It should be noted that the period of 5 years is counted from the date of creation of the document, but from the date of the reporting year in which they were generated.

Storage can be organized both in the archive at the enterprise and with the involvement of specialized companies. They provide storage on a contractual and paid basis for as many years as you need.

The above-mentioned law establishes that when conducting cash transactions in electronic form, the shelf life of electronic media should also be the same as that of paper media - no less than 5 years. The exception is payroll, according to which employees receive their salaries. They are stored for 75 years.

CD storage must be carried out on the basis of the following rules:

- Documents must be stapled on a daily basis. The deadline for stitching is no later than the next working day.

- Inside the stitching, CDs must be selected according to the following order: in ascending order of accounting account numbers. In the sequence, first of all, according to Dt of the account, and then according to Kt.

- All sheets of stitching are subject to numbering.

- When transferred to the archive, an inventory is generated indicating the quantity and name of the CD stitching; an article can be entered in accordance with the nomenclature approved by the organization.

For what period should the cash book be stitched?

When thinking about how to stitch together a cash book for the year, you first need to decide whether there is a need to set such a time period. Depending on the amount of turnover, the cash book can be stitched together for different periods:

- Monthly.

- Quarterly.

- Once a year.

This is due to the convenience of work, since there is no point in putting everything into one heavy volume if there are many operations. The enormous thickness will turn the action “how to sew a book with your own hands” into hard work. The subtleties of working with documentation should be spelled out in the organization’s accounting policies and in orders to establish cash discipline.

If an organization’s time period is not a year, but a month or a quarter, then the numbering of pages in the cash book should begin from the very beginning upon the arrival of the reporting period. This rule does not apply to the numbering of cash orders.

Cash documents

Cash documents are those documents that the cashier is required to draw up in connection with the movement of cash in the cash register. From this article you will learn what cash documents exist and their main features.

https://www.youtube.com/watch?v=5si-YoCM9kg

Cash documents include the following:

- Receipt order;

- Withdrawal slip;

- Journal of registration of papers for receipts and expenses;

- Cash book;

- A book that records money issued and received by the cashier;

- Advance reporting;

- Payroll;

- Cashier-operator reporting;

- Data on cash register counter readings to profit;

- A journal kept by a cashier-operator.

Let's look at each of them in more detail.

Cash orders

There are two types of orders: for receipts and for expenses. As you might guess from the name, receipts are used when money is received, and expenses are used when money is issued. The order is drawn up in one copy by an accounting employee and signed either by the chief accountant or an authorized employee.

A check is attached to the receipt, which must be signed by the cashier and accountant. Also, it must be affixed with the organization's seal. It is issued to the person who deposited money into the cash register.

Read more about the receipt order in the article.

Read more about the expense order in the article.

See also: What is an unsecured loan?

Register of documents

Cash receipts and expenses must be recorded in a special journal. It registers both orders and documents replacing them (pay slips, applications for the issuance of funds, etc.). The journal form can be found in the article.

Cash book

This book is necessary in order to take into account the issuance of money and its receipt. All pages of the book must be numbered, and the book itself must be laced and stamped. The last page records the total number of sheets of the book.

Each page is divided into two parts. One, which has a horizontal line, is filled in as the first copy, and the other as the second. Both copies have the same number. The first remains in the book, and the second is detachable, it is a reporting cash document.

Recording of cash transactions begins on the front side of the permanent part after the column “balance at the beginning of the day.” First, the sheet is folded along the cutting line, placing the tear-off sheet under the sheet that remains in the book.

Read more about maintaining a cash book in the article.

Cash book

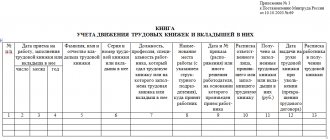

This book keeps records of money issued and received. It is also used for accounting of cash papers.

Advance reporting

This reporting is needed in order to take into account the money that is issued for business expenses. This document is drawn up by the accounting employee and the reporting employee in one copy.

The reverse side of the report should include a list of documents that can confirm that the expenses were incurred. These can be various receipts, transport tickets, and so on. Also, these documents must be attached to the report and numbered in the sequence in which they are listed in the reporting.

Payroll

This statement is drawn up when paying salaries to company employees. It is compiled by accounting employees in one copy. Employees are paid wages according to the information specified in the primary documents for recording time worked.

Cashier's report

This reporting is prepared by the cashier-operator. He enters information about the cash register readings and revenue for the day. Cashiers must prepare such a report every day. After drawing up the report, it is signed and, together with all the proceeds, it is handed over to the manager of the company.

If the company is small, cashiers hand over money to collectors. When transferring funds, the appropriate bank documents must be drawn up.

More complete information about the cashier's report can be found in the article.

Information about KKM counter readings

This information is necessary to generate summary reporting on KKM meter readings. Such a summary report must be prepared every day; it will be an appendix to the cashier’s certificate report. It is compiled by the senior cashier and transferred to the company’s accounting department along with a certificate report and orders.

Cashier's journal

This journal keeps records of incoming and outgoing transactions for each cash register. In a magazine, each page must be numbered, and the magazine itself must be completely laced. Only cashiers-operators can make entries in such a journal. Entries must be made in chronological order using a ballpoint pen and without corrections.

Tips for filling

- If the amount must be indicated in words, it must be done in capital letters. Kopecks are written in numbers.

- Documents can be filled out either on a computer or manually.

- Incorrectly filled in information in cash register papers can be corrected.

This is how it is done. An incorrect entry is crossed out with a neat line. The correct entry is made above or next to it. Here they write “believe what is corrected.” The company manager and chief accountant must sign next to this entry. - If a document contains blots, clerical errors or corrections by a proofreader, it is considered invalid.

How long should you keep cash documents?

In accounting and tax legislation, there are different opinions regarding the storage period for cash documents.

In accordance with tax law, cash records must be kept in the company's archives for four years. Accounting legislation states that such papers must be kept for at least five years. The Ministry of Culture has also established a storage period for documents of five years.

Thus, based on the maximum period, cash register papers must be stored in the archive for at least five years. It is worth considering that documents can only be destroyed if an audit has been carried out over these five years. If it was not there, the papers cannot be destroyed even after five years.

The storage periods for cash documents must be observed, since the following fines are provided for their violation:

- For employees responsible for storage – from two to three thousand rubles;

- For citizens - from two hundred to three hundred rubles.

Source: https://okbuh.ru/kassovye-operatsii/kassovye-dokumenty

How to sew everything yourself?

It is definitely forbidden to fasten the book with glue, tape or staples; only threads are allowed. How to stitch a cash book correctly if it is maintained in an accounting program? You need to print out a loose leaf sheet and a cashier's report every day. Loose sheets make up the cash book, but they must be sewn together at the end of the reporting period.

It is necessary to fold all the sheets in order, attach a properly executed title on top and pick up:

- igloo;

- awl;

- hole puncher.

Which tool to use depends on the thickness of the bundle being fastened. The threads used are harsh. If they are not strong enough, the book may fall apart.

Book firmware

At the end of the reporting period, on the last sheet of the cash book, the cashier is required to make a note about the number of completed sheets. They must be checked, signed and kept for a year. Bookleting and stitching of sheets is carried out after the completion of the book or at the end of the year (the period of document maintenance).

The stitching thread coming out of the last sheet of the book must be sealed with a seal on which it is necessary:

Sign the chief accountant (or head of the organization).

How many holes are needed?

There are different opinions about how many holes to make in a book. In principle, if you are not sure that the brochure will be reliable, then you can pierce 5 holes. But it is not forbidden to make 3 holes. Many organizations make do with two holes made with a hole punch. However, such a design makes it possible to easily replace sheets in the book, and therefore does not meet with enthusiasm from inspectors.

So, the sheets must be folded in an even stack so that the book has an orderly appearance. The holes are made on the left side strictly vertically. Then thread or twine is pulled through the holes twice so that the ends are on the wrong side. An example of how to sew a cash book can be seen in the photo above. The ends of the threads are tied with a strong knot several times so that everything is held securely.

How to fasten what is sewn

In Word or any other analogue, a sticker is created on the back of the book. The contents of the sticker should be as follows: “in the package there are numbered, laced, signed and sealed _____ sheets.” The line below contains a description of the position and signatures of the authorized person and the chief accountant.

The sticker should not be too big or small. Its size should be enough to cover the knots and some of the threads. The ends of the threads stick out slightly from under the sticker. It is advisable to use good office glue so that it is difficult to change the label. After the number of sheets and the signature of the authorized person are indicated on the sticker, a seal is placed on top so that part of the imprint is on the book and on the sticker.

How to sew a cash book if it is not maintained in an accounting program? The procedure will be the same, only you will have to number each sheet by hand and fill out the title. When you need to stitch together a cashier’s report, you must remember that not only the sheet with the turnover in the cash register is numbered, but also all orders with attachments.

Basic design requirements

Due to the fact that the approved and mentioned above design documentation differ from each other, let us consider the rules for drawing up each.

Design features of the PKO:

- the essence of the operation is entered in the line “Base”;

- the total amount of VAT is entered in the line “Incl.” in digital terms. This line cannot be empty. If tax is not applied, enter the phrase “without (VAT)”;

- data on additional supporting documents (if any) are entered into the PQR in the “Appendix” line.

When filling out the cash register, you must take into account the following nuances::

- the presence of additional documents (for example, a power of attorney) is entered in the “Appendix” line with the obligatory indication of the date and number;

- the line “Base” suggests reflecting the content of the expense transaction;

- the signature of the manager is not necessary if it is present on the attached document. For example, if the signature of the director of the enterprise is present on the order along with the resolution “I authorize” or “Agreed,” then the RKO can be accepted for work without his signature.

We will separately consider the issue of requirements for affixing stamps to RKO and PKO. According to the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014 on the conduct of cash transactions, there are no mandatory requirements for stamp imprinting, as was the case before 2014. Previously, the stamps “Paid” were used on the incoming order and “Repaid” on the outgoing order. The current rules only imply the mandatory affixing of a stamp on the tear-off receipt for the PKO. Thus, the “Paid” stamp can be affixed to the receipt for the PKO. The presence of the “Paid” stamp is confirmation of the actual deposit of money and its posting.

As for the “Redeemed” stamp:

- it is placed on statements, for example, when issuing salaries to employees;

- can be used instead of “Paid”, for example, if the stamp is lost or missing for another reason.

There are 3 basic rules for registering a CC:

- Sew.

- Number. The bottom line: each sheet is numbered (consecutive number).

- Seal. The bottom line: you need to indicate how many sheets are contained in the CC according to the numbering and certify this inscription. This inscription is placed at the end of the book and is considered certified if there are signatures of the director and chief accountant.

The QC form assumes the presence of 2 parts. Moreover, the second part is detachable. It serves as the cashier's report at the end of the day and can only be torn off after all transactions have been completed.

Journal of registration of incoming and outgoing cash documents

The name itself answers the question of what this form is intended for, namely the assignment of serial registration numbers to cash documents.

Involves filling out such information:

- No. PKO/RKO, date and amount in Russian rubles in digital terms;

- The “Note” columns are filled in if necessary.

Filling out the KVD is justified if the organization has several cashier positions on its staff, including a senior one.

Features of the design of the KVD:

- the amount transferred by the senior cashier to the subordinate employee is reflected in the line “Issued” or “Transferred”;

- It is mandatory to put the signatures of both persons in the lines “Money received”.

What mandatory rules and requirements must be followed when drawing up primary CDs:

- Signatures of the chief accountant and cashier are mandatory.

- The mandatory stamp on the tear-off receipt is “Paid.”

- A seal (stamp) is not affixed to the cash register, but the recipient’s signature is required.

- The design documentation can be completed on paper or electronically.

- The electronic version of the document is prepared using special equipment (computer, printer).

- The paper version is filled out manually with a ballpoint pen, ink or using a typewriter.

- Blank lines that do not contain information are marked with a dash.

The chief accountant is the responsible person in the matter of drawing up the design documentation. In his absence, the manager becomes the person responsible for the preparation of cash documents, which is carried out under his control.

If the book is kept manually

If the cash book is maintained without the help of a computer, then a standard journal is purchased for these purposes. The question of how to stitch a book filled out manually does not arise, since the magazine is already stitched. All sheets are numbered and sealed at the beginning of the book. Inside the magazine there is a loose leaf and a cashier's report located horizontally. Before recording begins, the cashier's report is torn off, and the entries on it are duplicated from a loose-leaf sheet as a carbon copy. Of course, you will have to flash the cashier’s report yourself.

If the process of binding a book is very labor-intensive, you can use printing services. The cardboard cover and hard binding will give the cash book additional safety. In addition, it will be impossible to cut the binding to replace sheets. The risk of changing sheets cannot be eliminated when a book is self-bound. Eventually, the threads can be pulled out and the whole thing put back together.

Is it necessary to staple for electronic document management?

Recently, organizations have begun to actively switch to electronic document management in order to reduce paperwork. Electronic document management has a number of advantages:

- no need to carry papers to sign;

- there is no need to spend money on large amounts of paper and toner;

- no need to deliver documents.

But this raises the question of maintaining cash discipline. How to bind a book if a digital signature is used? The cash book produced in the electronic circulation system is not printed or stapled. There are technical means by which the book is protected from interference and digitally signed.

Especially for individual entrepreneurs

Individual entrepreneurs using the simplified taxation system are required to keep a book of income and expenses. This accounting format is used to calculate the tax base. By law, entrepreneurs are prohibited from changing data in the accounting book, as this may lead to a distortion of the taxable amount.

The law clearly regulates how to properly stitch together a ledger of income and expenses. There is a special order of the Ministry of Finance that approves accounting and reporting forms for individual entrepreneurs working on a simplified and patent system. The order states that the book of income and expenses must be laced, numbered, signed and sealed, if any.

The book can be kept by hand or electronically. It is also possible to maintain it in an accounting program. If the book is kept electronically, it is printed at the end of the year. All sheets are numbered, folded into a neat pile and stitched. The title page should come first.

It is noteworthy that the blank sheets of the book must also be printed and stitched in a common row. Even if an organization or individual entrepreneur submits zero balances and does not conduct activities, they will still have to print out the book and staple it. The form must be sealed and signed by the manager (entrepreneur) on the last sheet. To do this, use a sticker containing the same data on sheet counting as on the cash book.

Book firmware

At the end of the reporting period, on the last sheet of the cash book, the cashier is required to make a note about the number of completed sheets. They must be checked, signed and kept for a year. Bookleting and stitching of sheets is carried out after the completion of the book or at the end of the year (the period of document maintenance).

The stitching thread coming out of the last sheet of the book must be sealed with a seal on which it is necessary:

- Indicate the total number of sheets stitched.

- Sign the chief accountant (or head of the organization).

- Certify with a seal (its imprint should partially overlap the page of the book and the seal).

Registration form for patent activities

If entrepreneurs use the patent system, then he only needs to keep a book of income. This form of accounting is used only to reflect income from patents at the time they are received. The question of how to stitch a book of income can be avoided if you know the principles of stitching previously studied documents. The order is no different. The book can also be kept in electronic or handwritten form throughout the year. She must:

- be numbered;

- stitch together;

- sealed with the signature and seal of the director.

If an individual entrepreneur, in addition to patent activities, has other areas of work, then in parallel he must keep a book of income and expenses. It will reflect all transactions except income from patents.

Features of submitting documents to the archive

Preparation of documentation consists of:

- systematization of documents;

- numbering;

- stapling documentation into one folder;

- filling out the inventory;

- document cover design.

This procedure for filing documentation is considered normal and provides for its storage for at least 25 years. If the papers will be stored for more than 25 years, a cardboard cover will be placed on the set of documents to protect the file. The cover indicates: name of the organization, name of the case (orders, invoices, acts), structural unit, shelf life. If an organization has changed its name for any reason, both names must be reflected on the cover of the document, with the previous one indicated in brackets.