Federal Law 63 establishes a clear list of documents that are submitted to the certification center when receiving an electronic signature. It differs somewhat for legal entities, individuals and individual entrepreneurs. For example, for owners of commercial companies it is mandatory to submit an extract from the register of entrepreneurs to the certification center, while for individuals this is not necessary. So what documents are needed to obtain an electronic signature (EDS); does the certification center have the right to provide any additional data about the applicant?

Read in the article

How does a digital signature work for legal entities?

An electronic digital signature is a set of encrypted data (digital or alphabetic combination, graphic or cryptographic image) and is used for:

- certification of contracts, payment orders, legal and notarial papers;

- ordering and paying for government services;

- participation in electronic tenders and auctions;

- maintaining electronic reports of all types.

An electronic signature is unique and solves three problems: it confirms authorship, authenticity (the indisputability of the fact of a particular person’s visa) and integrity, that is, the absence of unauthorized changes or forgeries.

EDS is issued by accredited certification centers (CA) and consists of three interrelated elements:

- ES means - E-token (Rutoken) in the form of a set of crypto-algorithms on a flash memory card, USB drive or smart card;

- two keys (public and private), which are algorithmically linked to each other and are used to encrypt and decrypt digital signatures;

- key (public) authentication certificate (KKPEP).

How it works?

- With the private key, the Sender, that is, the owner of the digital signature, generates and encrypts the electronic signature.

- The open (public) key along with the document is sent to the Recipient.

- The recipient activates the electronic signature using the public key, verifies its correctness and the integrity of the document itself.

The certificate (SKPEP) confirms that the verification key belongs to the Sender, that is, the “author” of the electronic signature. It contains all the information about its owner and the CA that issued the key, the scope of application and the validity period of the signature (usually 12 months).

That is, several levels of protection and identification of digital signatures have been created, which practically exclude forgery or substitution of the signature and the document endorsed by it.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Algorithm for obtaining an electronic signature

I decided to start my article with a description of the sequence of steps that you need to complete to obtain an electronic signature.

- Select which electronic signature (ES) you need.

- Select Certification Authority (CA).

- Fill out and send the application to the CA.

- Receive an invoice and pay it.

- Provide all necessary documents (scans) to the CA.

- Come to the CA with original documents to receive an electronic signature.

Let us now take you through each step in detail.

Enhanced qualified electronic signature for legal entities: advantages

Electronic digital signatures, as noted above, can be different, with different capabilities and degrees of protection.

Simple - created on the basis of simple cryptographic encoding with a public key, followed by embedding the code in the file information or linking a signature with a separate file to a document. It is convenient for the internal document flow of an enterprise, has no legal significance and can be recognized in external EDI only by mutual agreement with counterparties. Not suitable for transmitting important or secret documents.

Strengthened - created by converting data using a complex cryptographic algorithm of a private key. It has more complex protection and several degrees of legal status.

- Unqualified (NEP) - allows you to establish the authorship of the document, its integrity and, possibly, subsequent changes made. It can be issued by non-accredited CAs, is designed for internal corporate document flow, is not recognized by courts, and can be recognized between organizations only upon the conclusion of an additional agreement. Since 2020, it is not used in EDI.

- Qualified (QEP) - requires only a private key when generating a signature and a certificate with a public verification key. It has the highest level of protection, is issued only by accredited CAs, has the legal status of a personal signature and is accepted by organizations of all levels.

When it becomes necessary to obtain an electronic signature for legal entities, most representatives of commercial companies prefer an enhanced qualified signature, which provides maximum protection for electronic documents.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

What is it, its types

The digital signature is issued to the employee of the organization who is responsible for maintaining electronic document management.

Apart from him, no one has the right to use the key. The law defines three types of digital signature:

- Simple . It can only be used to confirm the identity of the person sending the message.

- Reinforced . It makes it possible not only to establish the identity of the sender, but also to change the content of the document after signing. It can be used for internal document flow.

- Qualified . Issued only in accredited centers. Used for any documents, except in cases where the law requires the presence of a paper copy. It is used more often than other types, as it provides the most reliable information protection.

Its use allows:

- Confirm the authorship of the document. To sign the generated report, you need a private key. It is held only by the owner of the certificate, which ensures absolute confidence in the authorship.

- Integrity control. The created digital signature is valid only for the original document. If the information inside the report changes, the signature becomes invalid.

- Change protection. Information integrity control also ensures the absence of forgeries. If the report was changed after the encryption was created, this will be known to the recipient.

You can watch the process of setting up and using a signature on your computer in the following video:

Who needs to obtain an electronic signature for legal entities

Obtaining an electronic digital signature for legal entities is more of a necessity than an obligation. However, if your business is represented on the Internet, and document flow is carried out electronically, then you simply must obtain an electronic signature in order to avoid problems with confirming the authenticity of transmitted and received online documents within the company and when working with partners, contractors and clients.

Why does a legal entity need an electronic signature? It is necessary for:

- rapid exchange of information and reporting with state regulatory authorities (EIAS, Federal Tax Service, Social Insurance Fund, EFRSB, PFL, EFRSDYUL);

- remote use of government services and interaction with authorities;

- remote payments and credit and financial transactions through banking organizations;

- remote management of third-party offices and divisions of the company;

- maintaining the entire volume of electronic document management online;

- exchange of corporate and legal documents with external partners;

- participation in electronic auctions, government orders, auctions and tenders.

Due to the fact that only EDS has the highest legal status (accepted by state and judicial authorities) and level of protection, and the storage period for documents endorsed by this EDS is practically unlimited in a number of professional fields of activity (for example, EDS for customs for legal entities , for notaries, bailiffs, etc.) CEP replaces other types of document certification.

We will select an electronic digital signature for your business, install and configure it in 1 hour!

Leave a request and receive a consultation within 5 minutes.

Documents for foreign legal entities

For foreign legal entities, the list of documents for obtaining an electronic signature consists of:

- an application filled out on site for registration and receipt of an electronic signature;

- copies of the document on permission to operate for a foreign legal entity (certified by a notary or on the spot upon presentation of the original);

- copies of a document confirming taxpayer status (certified by a notary or on the spot upon presentation of the original);

- a document confirming the presence of the company in the State Register of Accredited Foreign Legal Entities (valid for 30 days);

- passports and copies of the passport of the person for whom the digital signature is issued (for company managers - a power of attorney from a foreign organization to the head of the department);

- for a person authorized to sign company documents, a certificate confirming such authority, with the signature of the manager and the wet seal of the company;

- if a representative of the person for whom the digital signature is issued will receive the key, a power of attorney to receive an electronic signature and a copy of the representative’s passport are required;

- consent to the processing of personal data.

Conclusion: EDS is a universal tool for ensuring the operation of electronic document management, ensuring the reliability and authenticity of electronic documentation. The electronic certificate is issued by special certification centers and is valid for a year. If you provide the entire package of documents, the procedure for obtaining an electronic signature is extremely simple, and the convenience of its use is difficult to overestimate.

Obtaining an electronic signature for legal entities: registration procedure

How to issue an electronic signature for legal entities, how complex and lengthy is this process? Like most digital services these days, the procedure is simple and takes minimal time. The only difference from the procedure for individuals is that owners of commercial companies will need documents confirming their legal status.

A digital signature for legal entities has the following algorithm for obtaining:

- Choose a signature type that is universal for your specific business.

- Check the status of the authorized center (to obtain the CEP, you must contact an accredited CA).

- Complete and submit an application with an accompanying package of papers.

- You pay the state fee.

- You receive an electronic signature.

The electronic signature issued by most CAs has a shelf life of 12-24 months, after which a re-application to the center is required for re-issue. Likewise, you will need to contact the center to obtain a new digital signature if the current one is lost (the application procedure is the same).

- Qualified electronic signature

2 900 ₽

2900

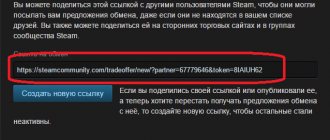

https://online-kassa.ru/kupit/kvalifitsirovannaya-elektronnaya-podpis/

OrderMore detailsIn stock

- Enhanced electronic signature

2 900 ₽

2900

https://online-kassa.ru/kupit/usilennaya-elektronnaya-podpis/

OrderMore detailsIn stock

- Electronic signature for government services

2 900 ₽

2900

https://online-kassa.ru/kupit/elektronnaya-podpis-dlya-gosuslug/

OrderMore detailsIn stock

How to get an electronic signature

What type of electronic signature to choose

How to issue an electronic signature? First of all, you need to decide for what purpose an electronic digital signature is issued for a legal entity. Its cost depends on this. The problem is that an electronic signature is not universal.

That is, you cannot make one CEP and use it on any government portals or electronic platforms. For example, if an electronic signature is needed for the sale of alcoholic beverages, then it will not be possible to submit reports with it to the Federal Tax Service - this requires a different signature. If a CEP is drawn up for electronic trading, then you should think in advance which platforms should accept it.

| ☑ Many certification centers have developed lines of electronic signatures for different areas of application. You can take the basic electronic signature in your area and supplement it with the necessary capabilities. It’s not worth overpaying for too wide a set of functions “just in case” - the signature is valid for 1 year, then it needs to be reissued. |

Where to get an electronic signature

Certification centers (CAs) are responsible for issuing electronic signatures. You need to choose one of them. The validity of the CA accreditation should be checked in the information system of the Ministry of Telecom and Mass Communications.

Whose electronic signature will be used?

An electronic signature for legal entities is issued to a representative - someone who is authorized to sign specific documents on behalf of the company. This could be a manager, accountant, purchasing specialist or other employee.

We need to choose who will be the signatory. You can issue as many electronic signatures as you like for one organization.

What documents are needed to obtain an electronic signature?

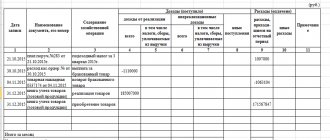

The set of documents for registration of the CEP includes:

- Application for signature release

- Extract from the Unified State Register of Legal Entities (often CAs receive it in electronic form directly from the Register)

- Certificate of registration of a legal entity

- TIN certificate

- Passport and SNILS of the individual - the owner of the signature

- Order of appointment to a position

- A power of attorney giving an employee of the organization the right to sign documents (except for the manager)

- Power of attorney for the specialist who will interact with the CA when completing the signature (if this is not the applicant himself)

Time frame for producing an electronic signature

Registration of an electronic signature usually takes 1-2 days. The applicant registers on the website of the certification center, fills out an application for signature and uploads scans of the necessary documents. The certification center checks them and issues an invoice. After confirmation of payment, the CA specialist informs the applicant when the completed electronic signature can be picked up. To receive it, you need to take all the original documents with you, remembering to print and sign the application.

If the electronic signature has been lost

Issuing an electronic signature imposes new responsibilities on the owner. He must ensure the safety of the media with files so that unauthorized persons cannot use it against the will of the owner. The law prohibits the use of digital signatures if there is a suspicion that the confidentiality of the keys has been violated. Therefore, if you lose your flash card, you must immediately contact the certification center.

Now you know what an electronic signature is for legal entities, what types there are, why such a signature is needed and how to obtain an electronic signature for an LLC. Subscribe to our newsletter to stay up to date with all the news for small businesses in the Russian Federation:

How much does EDS cost for legal entities?

How much does an electronic signature cost for legal entities? The price will be affected by:

- selected type of signature (simple or enhanced);

- goals and objectives of using a signature (for tenders, government services, judicial authorities, etc.);

- type of keys and availability of authentication certificates;

- expiration date of the signature;

- presence of digital signature carrier.

How much does an enhanced qualified digital signature cost for legal entities? Since this is a generic digital prop option, the cost will be slightly higher than lower status signatures.

What documents are needed to obtain

The package of documents for issuing an electronic signature for a legal entity consists of:

- copies of a document confirming the existence of this legal entity (certified by a notary or on the spot upon presentation of the original);

- copies of a document confirming taxpayer status (certified by a notary or on the spot upon presentation of the original);

- a document confirming the presence of the company in the State Register of Legal Entities (valid for 30 days);

- an application for a certificate completed on site;

- passports and copies of the passport of the person for whom the digital signature is issued (for company managers - a copy of documents on taking office, certified by a notary);

- for a person authorized to sign company documents, a certificate confirming such authority, with the signature of the manager and the wet seal of the company;

- if the key will be received by a representative of the person for whom the digital signature is issued, a power of attorney for receipt and a copy of the representative’s passport are required;

- permission to process personal data.

Summary

So, a qualified electronic signature for legal entities is guaranteed document protection and maximum legal status. However, when choosing a CEP option for a business, it is important to clearly understand that:

- Each type of digital signature has its own specific capabilities and limitations.

- It is necessary to select an electronic signature taking into account the features and structure of the existing electronic document document.

- The correct choice of electronic signature status is an additional incentive for the development and expansion of your online business.

Do you need an EDS? We will select the appropriate type of electronic signature for your business in 5 minutes.

Leave a request and get a consultation.