Every family has its own budget, which people manage at their own discretion. At the same time, any state also has its own funds, which, as a rule, are spent on the development of cities. Where does the money come from? This amount is formed from taxes, and among them there is one confusing option that will make even an experienced accountant tremble. What is VAT in simple words? This type of tax is quite difficult to understand, however, it is very important for the formation of the budget of each individual state.

Thanks to its existence, government bodies can regulate the flow of funds into the treasury, not only from legal entities, but also from non-residents of the country where goods are produced or sold, or services are provided. Let's try to understand this complex intricacy and understand, if not all, then at least some of its features.

Characteristic feature of the tax

This type of tax is used in many developed countries of the world, including Russia. Here it was introduced for the first time since 1992. The transfer of this tax to the budget, as well as its payment, is regulated by numerous regulatory documents. But characteristically, there is one feature that can confuse many people.

Those who are familiar with the conduct of government affairs know that the so-called duty can be direct or indirect. Value added tax refers to the second option. At the same time, if we state the essence of VAT in simple words, then it all comes down to the fact that it seems that only entrepreneurs are subject to it. But ultimately, it is the country's citizens who pay this tax when making purchases in stores or ordering necessary services. How is this possible?

Other features include:

- The tax is levied on each product only once, resulting in a reduction in its final cost.

- For exporters, this is a chance to be exempt from paying national tax.

- In most cases, before any product gets from the manufacturer to the final consumer, it goes through several intermediaries. Due to the VAT payment scheme, the government risks less in terms of tax evasion. And somewhere you still can’t do without paying.

Many people have heard about this tax, but not everyone understands exactly what it is and what nuances there may be. Meanwhile, everything here is not as clear as it might seem at first glance. And any domestic citizen is at least to some extent interested in what VAT is in simple words in Russia? But let’s not get ahead of ourselves and remember another type of tax that existed earlier.

How VAT is deciphered, the history of the tax

VAT is an abbreviation for “value added tax.”

In other words, it is the amount of tax that the seller must pay to the government on the difference between the price of the product at which the final consumer purchased it and the price that the retailer paid to the wholesale supplier.

In the past, instead of this fee, there was a tax on the sales price of the goods, without taking into account the funds that the seller spent on purchasing the goods from the supplier or manufacturer.

The application of sales duties led to repeated taxation in the process of production, storage, and delivery of goods. When the same tax is levied several times on the same product, the result is a consistent increase in the cost of the product to the end consumer.

It is clear that such a situation does not contribute to economic development, leads to increased inflation and stimulates participants in the production and commercial chain to search for ways to evade taxes.

In order to stimulate the economy and minimize tax violations, Maurice Loret, director of the Directorate of Taxes and Duties of the Ministry of Economy of the Republic of France, in 1954 proposed an improved version of the sales tax - value added tax.

A significant advantage of BAT is that each participant in the economic process pays duty only specifically on added value. That is, the amount that the seller adds to his own costs for purchasing the goods.

Thus, VAT eliminates multiple taxation, reduces the tax burden on entrepreneurs, and contributes to more complete tax collection. After all, even if one of the participants in the trade chain manages to evade paying VAT, other payers will be forced to pay off the arrears.

Alternative option

Back in 1930, when the Union of Soviet Socialist Republics (USSR) still existed, turnover taxes began to be levied. But after reforms were carried out during the NEP period, thanks to the efforts of the Soviet government, the excise tax system was restored. However, it did not stay long, and soon the turnover tax became popular again.

This type of taxation was calculated as the difference between the wholesale and market value. The subjects of taxation were organizations and entrepreneurs in almost any industry. Moreover, the volume of this taxation was proportional to the turnover of any company. At that time, the tax had the main goal of starting vertical integration. That is, producing goods within the company itself was a more profitable solution than purchasing them from outside suppliers.

Before you understand what VAT is in simple words for Russia, it is worth considering that at that time there was a mechanism in place that made it possible to receive a large amount of tax. This was a huge part of the state budget and made it possible to ensure a stable and sustainable replenishment of the state treasury. After all, in essence, the tax was an obligation that was strictly regulated by the timing and form of payment.

Now it has been replaced by another type of taxation – VAT. It's worth starting to study it.

VAT made simple

The three letters so popular all over the world stand for: value added tax. We all go to stores for groceries or other goods and unwittingly see these magical three letters on the price tags. But we do not produce this product and do not sell it through retail outlets - we just purchase it for our needs.

What is VAT in simple words? The decoding is as follows - this is that part of the funds that constitutes the value added tax of a product or service, which is sent to the state budget. If the enterprise has not created it, that is, the final price of the product is less than the initial cost, then there are no VAT obligations.

There is no escape from payment, since it is through this and other taxes that the treasury of any state is replenished. And it is worth noting that this is the most powerful source of financing.

VAT tax period: key aspects

The tax period for VAT is determined by the Tax Code in force in Russia:

- In accordance with the regulations of this regulatory legal act (Article 163 of the Tax Code of the Russian Federation), in 2020 the period for calculating tax liabilities for VAT will be a quarter (applies to all business entities).

- Those individual entrepreneurs and commercial organizations that received the status of value added tax payer after January 1, 2020 should consider the start date of the tax period to be the day of official registration with the regulatory authorities. This procedure is regulated by the Tax Code of Russia (clause 2 of Article 55)

- For the category of taxpayers who are undergoing a reorganization or liquidation procedure, it is necessary to consider the last day of the tax period as the date of deregistration (the day on which the entry was made in the Unified Register of Individuals or Legal Entities). This procedure is determined by the Tax Code of the Russian Federation (clause 3 of Article 55).

VAT calculation

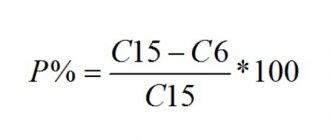

To determine the amount that will go to the state budget, you must first determine the tax base and tax deduction. The difference between the accrued VAT and the deduction will be exactly the amount that companies are required to transfer to the treasury.

The price of any product (C) consists of the cost price (A) and the tax amount (B), that is, C=A+B. In this case, the tax itself is calculated by multiplying the cost of the product (A) by the interest rate (K) on the tax and dividing by 100: B=A*K/100.

The best way to understand the essence of VAT is in simple words with an example. Let’s say the price of a product is 700 rubles, the VAT rate is determined to be 18%, and then it will be equal to 126 rubles. That is, 700*18/100=126. The total cost will be equal to: 700+126=826 rubles.

In some cases, it is possible to calculate VAT when the final cost of the goods (C) and the tax interest rate are known: B=C/(100+K)*K. For example, C=300 rubles, and K=18%, then B=300/(100+18)*18=45.76 rubles - this is exactly the amount that will be credited to the state budget.

If there are a huge number of operations to be performed, then no one is immune from making a simple mistake in calculations. For such cases, simple and convenient online calculators are provided.

Documentary proof of input VAT

The document that confirms input VAT is an invoice. This document must be addressed specifically to the buyer; for this, the correct name and all details must be indicated in the “Buyer” line. The invoice is the first thing asked for during a tax audit, so the document must be perfect. There are various guidelines on how to correctly issue an invoice. Empty fields or sections with errors or typos are not allowed. Such a document will not pass verification and the VAT amount will not be credited, and this will lead to high fines and arrears. Officials may be held criminally liable for VAT fraud.

When applying the simplified taxation system, VAT paid to the supplier can be written off as expenses if supporting documents are available.

Reporting

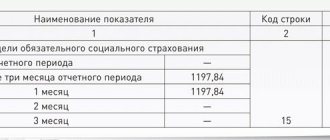

All taxpayers are required to submit reports to the tax authorities at the end of the quarter. This is done no later than the 25th day of the next month following the end of the quarter. Otherwise, you can learn from personal experience what VAT is in simple words. When filling it out, you need to specify the following values:

- VAT tax base.

- Input VAT (deduction amount).

- The tax amount to be reimbursed.

The VAT tax base is all funds that were received during the sale of manufactured products, provision of services or work.

Deduction refers to those funds that are used to pay suppliers, which constitutes the total cost of goods or services purchased by the company. This amount may slightly reduce the tax rate according to the declaration. Only for this you need to meet certain conditions:

- All purchased items are subject to tax.

- The company has correctly completed invoices, as well as invoices that are provided by suppliers (here it is also necessary to ensure that the documentation is filled out correctly).

- All the company's products have undergone accounting.

For manufacturers, tax deductions are the most costly, and therefore every detail must be taken into account. For example, if a product was purchased without presenting an invoice, then you should not expect VAT to be deducted.

Now, regarding VAT refund in simple words. If during the calculations the value of the tax deduction exceeds the amount of the calculated tax, then this is an actual overpayment of tax. Then the company has the right to reimbursement of the overpayment from the state treasury. To do this, you need to submit a declaration, after which the tax office will carry out careful calculations, and also check the presence of all necessary documents and the correctness of their completion. A decision will then be made whether to grant or reject the request.

Basic VAT rate 20%

In paragraph 1 of the Letter, the tax service reminded that the new rate of 20% applies to goods (work, services), property rights shipped (performed, rendered), transferred from 01/01/2019, regardless of the date and conditions of the conclusion of contracts. Moreover, according to the Federal Tax Service of Russia, changing the VAT rate does not require amendments to contracts concluded before 01/01/2019. At the same time, the parties have the right to clarify the payment procedure and the cost of goods (work, services) sold and property rights.

Despite the approval of the Federal Tax Service of Russia, if the contract price is determined, for example, in the amount of 118,000.00 rubles. (including VAT 18%), then it is still advisable to clarify:

- Will the contract price remain in the amount of RUB 118,000.00? (including VAT 20%) by reducing the cost of goods sold (work, services), property rights, which in this case will no longer be 100,000.00 rubles, but 98,333.33 rubles. (RUB 118,000.00 x 100/120);

- Will the cost of goods sold (work, services), property rights remain in the amount of RUB 100,000.00? when the contract price increases to RUB 120,000.00. (including VAT 20%).

In this Letter, the tax authority does not say anything about the possibility of additional payment of VAT in the amount of 2% (20% - 18%) at the expense of the seller’s own funds. Apparently, this is due to the fact that VAT is an indirect tax, obliging the seller to present the accrued amount of VAT for payment to the buyer (clause 1 of Article 168 of the Tax Code of the Russian Federation).

Clause 1.1 of the Letter contains methodological recommendations on the application of VAT for cases when goods (work, services, property rights) are shipped from 01/01/2019 on account of advance payment received before 01/01/2019. Thus, the seller calculates VAT at the rate of 18/118 on the prepayment amount received. After shipment of the relevant goods from 01/01/2019, the seller charges VAT at a rate of 20% and claims a tax deduction for the amount of VAT previously calculated on the prepayment amount at the tax rate of 18/118.

The buyer also performs mirror actions. From the prepayment amount transferred before 01/01/2019, he can deduct the amount of VAT calculated by the seller at the rate of 18/118. After purchasing the goods, the buyer has the right to claim for deduction the amount of VAT presented by the seller, accrued at a rate of 20%, with the simultaneous restoration of the amount of VAT previously declared for deduction from the prepayment, calculated at the rate of 18/118.

Example 1

| In December 2020, the seller received an advance payment amount of RUB 118,000.00. and calculated VAT at a rate of RUB 18,000.00. (RUB 118,000.00 x 18/118). In January 2020, the seller shipped goods worth RUB 100,000.00 and charged VAT at a rate of 20% in the amount of RUB 20,000.00. (RUB 100,000.00 x 20%) and made a tax deduction of the VAT amount from the prepayment in the amount of RUB 18,000.00. |

The buyer, who transferred the prepayment amount in December 2020, claimed a tax deduction in the amount of RUB 18,000.00. After purchasing goods in January 2020, I claimed RUB 20,000.00 as a deduction. with simultaneous restoration of RUB 18,000.00. by prepayment.

Obviously, an additional payment of 2% made after shipment of goods will not affect the application of VAT in any way. The situation is more complicated when such an additional payment of 2% is made by the buyer before the goods are shipped.

If the buyer makes an additional payment in 2020, but before the goods are shipped, then the Federal Tax Service of Russia proposes to consider this amount not as an additional payment of the cost with VAT calculation at the calculated rate of 20/120, but as an additional payment of exactly the amount of VAT in the amount of 2% (20% - 18 %). It follows from this that the seller must transfer the entire tax surcharge received to the budget.

To reflect in tax reports the received amount of additional tax payment in the amount of 2%, the tax authority recommends using a special invoice - an adjustment invoice for the amount of additional VAT payment, which is drawn up for the invoice issued for the amount of the advance payment received in 2020.

However, we recall that according to paragraph 3 of Article 168 of the Tax Code of the Russian Federation, an adjustment invoice (the form and procedure for filling out which is given in Appendix No. 2 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, hereinafter referred to as Resolution No. 1137) is issued when the cost of shipped goods changes (work performed, services provided), transferred property rights in the event of a change in their price (tariff) or clarification of quantity (volume). Now this type of invoice is acquiring new functions not established by law. It is in the absence of regulatory regulation that the Federal Tax Service of Russia, in Appendix No. 1 to the Letter, provided an option for filling out such an adjustment invoice for the amount of additional VAT payment.

Therefore, to reflect the 2% VAT surcharge, the seller will record this adjustment invoice in the sales ledger. The difference between the tax amounts indicated in such an adjustment invoice will be reflected on line 070 in column 5 of the VAT tax return and taken into account when calculating the total tax amount for the tax period. In this case, on line 070 in column 3 of the VAT tax return, you must indicate the number “0” (zero).

After shipping the relevant goods at a rate of 20% to claim a tax deduction, the seller will register in the purchase book both an advance invoice issued for the amount of the advance payment received in 2020, on which VAT was calculated at the rate of 18/118, and an adjustment invoice - invoice for additional tax payment issued in 2020.

If such additional payment is made by VAT non-payers and (or) taxpayers exempt from fulfilling the duties of a taxpayer, to whom invoices were not issued, then the amount of additional tax payment in the sales book is reflected on the basis of a separate adjustment document containing summary (consolidated) data on all cases of additional payments tax received by the seller during a calendar month (quarter) regardless of the readings of cash register equipment.

Probably, this procedure is understandable and applicable if in the payment order, when transferring the additional payment of tax, the buyer makes an appropriate note in the purpose of payment that he is transferring exactly “an additional payment of VAT in the amount of 2%.”

However, it is extremely difficult to imagine the seller’s course of action if he receives some payment from the buyer in 2020, possibly including both the amount of additional VAT payment and the amount of the prepayment under the contract.

Example 2

| In 2020, the seller and buyer entered into an agreement for the supply of goods in 2020 in the amount of RUB 472,000.00. (including VAT 18%) on 100% prepayment terms. In December 2020, the seller received a partial prepayment amount of RUB 118,000.00. and calculated VAT on this amount at the rate of 18/118 in the amount of 18,000.00 rubles. (RUB 118,000.00 x 18/118). By mutual agreement of the parties to the transaction, in connection with the increase in the VAT rate in 2019, the contract price was increased to RUB 480,000.00. (including VAT 20%). In January 2020, the seller received another part of the advance payment under the contract in the amount of RUB 240,000.00. How, guided by the explanations of the Federal Tax Service of Russia, the amount received should be considered: a) as an advance payment including VAT at the rate of 20/120 in the amount of RUB 40,000.00. (RUB 240,000.00 x 20/120); b) as an amount that includes both the additional VAT payment for the 2018 prepayment and the next part of the prepayment. With this approach, the seller needs to: — transfer VAT in the amount of RUB 2,000.00 to the budget by drawing up an adjustment invoice for additional VAT payment; — calculate from the remaining amount in the amount of RUB 238,000.00. (RUB 240,000.00 - RUB 2,000.00) VAT at the rate of 20/120 in the amount of RUB 39,666.67. (RUB 238,000.00 x 20/120). Agree that option “b” gives rise to many problems, both purely arithmetic and normative. |

Therefore, in our opinion, the use of an adjustment invoice for the amount of the additional payment can be justified if an obvious additional payment of 2% of the VAT amount is made on the basis of a separate payment order containing the corresponding note in the purpose of payment.

Next, the Federal Tax Service of Russia considers the situation when the buyer pays an additional 2% VAT to the seller on account of shipments in 2020, but before 01/01/2019.

Quite rightly, in this case, the Federal Tax Service of Russia calls this amount precisely the amount of additional payment for the cost and proposes to calculate tax on it using a rate of 18/118.

Example 3

| In 2020, the seller and buyer entered into an agreement for the supply of goods in 2020 in the amount of RUB 118,000.00. (including VAT 18%). In November 2020, the seller received an advance payment amount of RUB 118,000.00. and calculated VAT at the rate of 18/118 in the amount of RUB 18,000.00. (118,000.00 x 18/118). In December 2020, by mutual agreement of the parties to the transaction, due to an increase in the VAT rate, the contract price was increased to RUB 120,000.00. (including VAT 20%). In December 2020, the seller received an additional payment under the contract in the amount of RUB 2,000.00. (120,000.00 rubles - 118,000.00 rubles) and calculated VAT on the received amount in the amount of 305.09 rubles. using the settlement rate 18/118 (RUB 2,000.00 x 18/118). |

In January, the seller shipped goods worth RUB 100,000.00 and charged VAT in the amount of RUB 20,000.00. (RUB 100,000.00 x 20%) and deducted VAT calculated on the prepayment amounts received in the amount of RUB 18,305.09. (RUB 18,000.00 + RUB 305.09).

This method of reflecting VAT charges in tax reports seems somewhat strange, but it is fully consistent with tax legislation. Instead of the standard mechanism for issuing an “advance” invoice for the amount of additional payment received under the contract, and in this situation, the tax authority also proposes to use an adjustment invoice, which is drawn up for the invoice issued for the amount of the 2018 prepayment.

The procedure for filling out such an extraordinary adjustment invoice is given in Appendix No. 2 to the Letter.

The use of an adjustment invoice seems even less logical against the backdrop of further clarifications from the Federal Tax Service of Russia. So, if the buyer in 2020 immediately transfers an advance payment taking into account the increased VAT rate for shipment in 2020, then in relation to such an advance payment the tax authority recommends the general procedure for calculating VAT using a rate of 18/118 based on a regular “advance” invoice - invoices (i.e. without applying a correction invoice).

Example 4

| In 2020, the seller and buyer entered into an agreement for the supply of goods in 2020 in the amount of RUB 120,000.00. (including VAT 20%) on the terms of 100% prepayment. In December 2020, the seller received a prepayment amount of RUB 120,000.00. and calculated VAT on this amount at the rate of 18/118 in the amount of 18,305.08 rubles. (RUB 120,000.00 x 18/118). In January 2020, the seller shipped goods worth RUB 100,000.00 and charged VAT at a rate of 20% in the amount of RUB 20,000.00. (RUB 100,000.00 x 20%) and made a tax deduction for the amount of VAT calculated on the prepayment in the amount of RUB 18,305.08. |

Paragraphs 1.2 and 1.3 of the Letter contain clarifications on the application of the VAT rate when issuing adjustment and amended invoices in 2020 to invoices issued for the shipment of goods (work, services), property rights in 2018.

As is quite rightly stated in these paragraphs of the Letter, the corrective and corrected invoices must indicate the VAT rate that was applied in the invoices issued for the shipment of these goods (works, services), property rights.

This means that if, when goods were shipped before 01/01/2019, a VAT rate of 18% (18/118) was indicated, then a corrected or adjustment invoice drawn up after 01/01/2019 will also contain a VAT rate of 18% (18/118 ).

Unfortunately, this statement does not fit with the procedure for filling out an adjustment invoice for the amount of additional tax payment under paragraph 1.1 of the Letter, since Appendix No. 1 to the Letter proposes to indicate in column 7 “Tax rate” in line “A (before change)” a rate of 18 /118, and in line “B (after change)” - a bet of 20/120.

Clause 1.4 of the Letter changes the procedure for applying VAT when returning goods.

Let us recall that until January 1, 2019, the mechanism for applying VAT depended on several factors: whether or not the buyer is a VAT payer; whether the returned goods were accepted for accounting; Part of the goods or the entire batch is returned.

From 01/01/2019, according to the recommendations of the Federal Tax Service of Russia, in all cases of return a single mechanism will be applied, in which the seller who issued an invoice to the buyer upon shipment will always issue an adjustment invoice. This adjustment invoice will serve as the basis for the application of a tax deduction by the seller (clause 13 of article 171, clause 10 of article 172 of the Tax Code of the Russian Federation) and the restoration of VAT by the buyer if the buyer has accepted for deduction of VAT on goods accepted for registration (clause 4 Clause 3 of Article 170 of the Tax Code of the Russian Federation).

Moreover, the proposed procedure will apply regardless of when the returned goods were shipped - before 01/01/2019 or after.

Let us remind you that until January 1, 2019, a similar procedure was applied only in cases where:

- the VAT payer returned part of the goods not accepted for accounting;

- the VAT evader returned part of the goods, both accepted and not accepted for accounting.

If the buyer was a VAT payer and returned the goods accepted for accounting (part or the entire batch), then the buyer himself would issue an invoice for the returned goods, as if they were sold.

And if the entire batch of goods was returned by a VAT non-payer or by a VAT payer, but before being accepted for accounting, then the seller claimed a deduction based on his own invoice issued upon shipment.

Uniformity in the application of VAT when returning goods is certainly a progressive step, but it is not yet consistent with the current provisions of Resolution No. 1137.

In addition, it will be necessary to get used to adjustment invoices, in which the number “0” (zero) will be entered in line “B (after change)”.

It should also be taken into account that from 01.01.2019, when returning goods by persons who are not VAT taxpayers and (or) taxpayers exempt from duties, to whom invoices are not issued, the seller will register an adjustment document in the purchase book containing summary (consolidated) ) data on return transactions made during the calendar month (quarter), regardless of the readings of cash register equipment.

In paragraph 2 of the Letter, the Federal Tax Service of Russia explained the procedure for applying VAT to certain categories of taxpayers.

Thus, paragraph 2.1 of the Letter is devoted to tax agents named in Art. 161 Tax Code of the Russian Federation.

If the obligation of a tax agent arises for the buyer in connection with the purchase of goods (work, services), the place of sale of which is recognized as the territory of the Russian Federation, from a foreign person who is not registered with the tax authorities of the Russian Federation as taxpayers (clauses 1, 2 of Art. 161 of the Tax Code of the Russian Federation), or in connection with the lease of federal property, property of constituent entities of the Russian Federation and municipal property (clause 3 of Article 161 of the Tax Code of the Russian Federation), then during the transition period, according to the recommendations of the Federal Tax Service of Russia, the procedure for the actions of the tax agent should be as follows:

- if an advance payment is made before 01/01/2019 for goods (work, services) that will be shipped from 01/01/2019 at a rate of 20%, then VAT is calculated on the date of the advance payment using the rate 18/118;

- if after 01/01/2019 payment is transferred for goods (work, services) shipped before 01/01/2019, then VAT is calculated by the tax agent on the date of payment also using the rate 18/118.

In this case, the tax agents specified in paragraphs 4, 5, 5.1 and 8 of Article 161 of the Tax Code of the Russian Federation calculate VAT in the manner prescribed in paragraphs 1, 1.1-1.4 of the Letter of the Federal Tax Service of Russia.

Benefits of VAT

Each entrepreneur reacts to such a tax in his own way. If you wish, here you can both see the pros and discover the cons. Representatives of large or small businesses have plenty to choose from. The main advantage of VAT is as follows.

Companies can count on a tax deduction, and here we can talk about duality of character. Not only the company itself, but also all its partners who purchase goods or services are entitled to a VAT refund. But only within the amount spent. What is VAT deduction was discussed above in simple words.

Most large companies prefer to deal only with business partners who pay value added tax. If an entrepreneur evades taxes, this will put him in an unfavorable light, since there is a high probability of refusal from potential clients or suppliers.

Therefore, you begin to involuntarily think about increasing your competitiveness. In addition, it is worth considering that any large organization represents the main source of funding for any state.

Taxable period

Value added tax is an indirect form of taxation, according to which part of the cost of a product or service is transferred to the budget as the product or service is sold.

A tax period is a period of time that applies to individual tax deductions. At the end of this time period, the total tax base is calculated, from which the amount of contributions to the tax service that must be paid is calculated.

In accordance with the provisions of Article 285 of the Tax Code of the Russian Federation, the tax period is a calendar year. In this case, the entire period is divided into several stages, after which it is necessary to report to the tax office. Such reporting periods are six months and 9 months. If the taxpayer makes payments monthly, based on actual profit, then the reporting period for him will occur every month, once every 2 and 3 months.

Based on the explanations of the Federal Tax Service specified in letter No. 3-1-11-730 dated September 14, 2009, the total amount of value added tax is recognized as actual if it is calculated from the current tax base that has developed for a specific period of time. However, this applies only in situations where the total tax indicator is displayed in the declaration that the payer submits to the tax service.

Article 163 of the Tax Code of the Russian Federation establishes that for all taxpayers the tax period is established as a quarter. Thus, contributions to the budget must be made quarterly, and must be supported by the relevant data specified in the declaration.

There are also disadvantages

Now it’s worth touching on the shortcomings, which, unfortunately, cannot be avoided. Perhaps, in our world, everything has strengths and weaknesses, and nothing else. The main disadvantage, according to all opponents of VAT, is the need to pay it. In addition, all companies that replenish the state budget in this way, in addition to accounting, must also maintain tax accounting. And this is just a huge scope of work:

- suppliers need to be checked;

- verify incoming primary documentation;

- keep books of sales and purchases;

- prepare and submit tax returns (and much more).

These shortcomings and some others will tell everything about VAT in simple words.

For those organizations operating under a simplified taxation system, where the object of taxation is income minus expenses, it is more profitable to deal with suppliers who pay VAT. Then the input tax can be regarded as a certain part of own expenses.

In the case when the object is the income of the enterprise, then deduction of VAT is impossible and even an invoice does not contribute to this. Typically, companies whose activities are connected with the general taxation system often come into contact with tax officials, and in most cases they are very picky.

It’s rare that it can lead to this, and any mistake on the part of the taxpayer results not only in penalties, but also in large penalties. Those who work in a simplified manner are already insured against such risks.

VAT included in taxpayer accounting

When purchasing goods (work, services), the taxpayer receives from the supplier primary documents and invoices, which reflect the input VAT.

When importing goods, input VAT is calculated on the value reflected in the customs declaration. After receiving the documents, incoming VAT is reflected in accounting by posting: D-t 19 K-t 60(76).

Thus, input VAT is the tax imposed on the taxpayer when purchasing goods and services. It is accumulated in the debit of account 19, and is subsequently accepted for deduction if the conditions provided for in Art. 172 of the Tax Code of the Russian Federation.

Read what VAT deductions are here.

Why is VAT needed?

In simple words, we can say that any state needs financial resources that allow it to carry out its direct responsibilities. The source of financing, as is now clear, is taxes, including VAT. Moreover, this income is stable and constant. The Tax Code has a whole article that is devoted to indirect tax, and it is paid by almost all citizens of each specific state:

- Representatives providing various services to the population (construction, repairs, rental of real estate).

- Sellers of consumer goods.

- Persons responsible for the production of goods.

- Ordinary consumers.

That's why VAT is an indirect type of tax. In order not to incur financial losses, the state must administer any type of tax. This process is complicated, but it is much more difficult to evade paying them.

The distinctive feature of VAT from turnover tax or income tax is that it in no way affects the economy of the state. That is, the number of transactions during the production of goods or provision of services is not limited in any way. And this is especially important for modern products or services that are complex. For this reason, VAT has become the most common type of tax in many countries around the world.

Overview of main risks

When using aggressive optimization schemes, taxpayers face tax, financial and reputational risks.

1. Additional VAT, penalties, fines

The Tax Code established a presumption of taxpayer guilt back in 2020. And now the company’s tax debts for dubious transactions are being recovered from the director. However, companies buying VAT still rely on promises from sellers of “paper” VAT or, in other words, sellers (from the English seller - seller, trader) that their declaration will be audited and inspectors will not remove deductions and will not be asked to pay additional taxes and penalties.

It is possible that the tax office will not immediately show interest in suspicious transactions - even taking into account the automation of control measures, it takes time to unwind the chain and detect tax gaps.

However, lack of interest does not mean that the risks are over. Tax authorities have the right to make additional assessments after 3 years, after the technical company:

- will cease to exist (at best);

- will be excluded from the Unified State Register of Legal Entities by decision of the Federal Tax Service, for example, due to unreliable information (if this happens, this will be an additional argument for additional tax assessment, then in court you will prove that the transaction was real).

Important!

In 2020, for buyers of “paper” VAT, the years 2016–2018 still pose a danger – such is the depth of the on-site tax audit.

2. Loss of major buyers

If you used “gray” VAT optimization , you may lose contracts with large buyers. The tax office is looking for a beneficiary; accordingly, when checking the “chain” or if “breaks” in the chain are detected, it can send a request to your buyer to provide explanations. The buyer, in turn, if such situations arise, can choose a more reliable supplier rather than waste his time proving the reality of the transaction with your company.

What to do if tax authorities ask for clarification of discrepancies

More details

VAT rate

To finally understand what VAT is, it is necessary to explain interest rates in simple words. And, according to the Tax Code of the Russian Federation, there are three of them:

- A 0% rate applies to products supplied outside the country of origin, including international transportation services. Article 165 of the Tax Code is devoted to this.

- A rate of 10% is charged in accordance with Article 164 of the Tax Code of the Russian Federation. As a rule, this includes children's and medical products.

- A rate of 18% applies to all other goods and services.

In European countries the rate is even higher and is equal to 25%. In Russia it was 28% in 1992 and then dropped to 20%. Since January 1, 2004, the rate has become constant, and to this day it is 18%.

Input VAT under simplified tax system

According to paragraph 2 of Art. 346.11 of the Tax Code of the Russian Federation, taxpayers using the simplified taxation system are not VAT payers - the only exception is the payment of VAT when importing goods into the territory of the Russian Federation and the purchase of goods (work, services) within the framework of a simple partnership (Article 174.1 of the Tax Code of the Russian Federation). Input VAT reflected in invoices when purchasing goods (works, services) is taken into account by simplifiers as expenses - this is provided for in clause 8 of Art. 346.16 Tax Code of the Russian Federation.

Find out more about how to take into account input VAT under the simplified tax system here.

VAT monitoring

Any state has the right to control the timely receipt of funds into the budget, for which fiscal authorities are involved. Their main task is to control tax payment. That is, these people ensure that taxpayers properly fulfill their responsibilities. Penalties are imposed in the event of:

- There was a delay in submitting the declaration. In this case, it is up to 5% of the monthly tax amount.

- Failure to pay may result in penalties of up to 40%.

- Everyone makes mistakes, but penalties are only assessed if they result in an underpayment of tax.

Therefore, it is extremely important not only to pay VAT on time, but also to carefully fill out all the documentation. This will prevent you from losing money.