Profit is the difference between a business's income and its expenses. If a commercial organization works “in plus”, i.e. makes a profit, she must pay tax. This article will tell you how income tax is calculated, what entries to use and how to avoid typical accounting mistakes.

Income tax calculation: postings

About income tax

“Profitable” tax belongs to the federal group of taxes. It was introduced by the fiscal service to improve control over the activities and revenue of commercial enterprises.

Who pays

Profit tax is required to be paid by:

- Russian commercial organizations;

- foreign commercial organizations that have their representative offices on the territory of the Russian Federation, as well as receiving income from sources located on Russian territory.

The following are exempt from income tax obligations:

- organizations participating in the Skolkovo project;

- taxpayers who own gambling businesses;

- persons applying one of the special regimes for paying taxes;

- persons paying agricultural taxes.

How much to pay

The lion's share of Russian companies deducts 20% of the resulting profit. But there are a number of organizations that apply other rates:

- An income tax of 13% is paid by domestic firms that receive revenue in the form of dividends.

- A rate of 15% is applied to foreign organizations that receive revenue in the form of dividends.

Video - Calculation and payment of corporate income tax

Recognition of expenses and income: two legal ways

The law allows businesses to recognize income and expenses in two ways:

- cash;

- accrual.

The first method assumes that the enterprise records the fact of income in its fiscal reports when:

- the cashier accepted the funds;

- there was a transfer to the company's bank account.

Expenses are recognized when payments are made from the cash register, property is disposed of, or money is written off from the company's bank account. This method can only be used by small organizations whose revenue over the last four months does not exceed one million rubles.

Companies using the second method, accrual, record expenses and income when those transactions occur. For example, when purchasing raw materials, tax documents will reflect the date of their transfer to production.

Income

Let's consider the features of calculating profitability for different categories of commercial organizations.

Category 1. Domestic companies calculate profit using the following formula:

Profit = Income – Production costs

Production costs are expenses that are directly related to the production of a product or service. Such costs include general production costs, purchase of materials, and labor costs.

Category 2. Companies whose central office is located abroad, but has a permanent representative office in Russia. Profit is calculated a little differently:

Profit = Income – Costs of a representative office of a foreign company in the Russian Federation.

On a note! Organizations that are not included in any of the previous groups are required to deduct tax on all income received in the Russian Federation.

The income that Russian firms receive is divided into two categories:

- Income that a company receives by selling goods or services.

- Income not related to the sale of goods or services (non-sales). This category includes revenue from the sale or purchase of foreign currency; dividends received from third-party legal entities; donated property; interest on loan; penalty for failure to comply with the terms of the contract by a partner or client.

On a note! When calculating tax, do not take into account amounts paid in excise taxes and VAT. If the money was accepted by the enterprise in foreign currency, this amount should be converted into rubles. It is necessary to calculate at the Central Bank exchange rate in effect at the time of revenue recognition.

simplified tax system

The use of a simplified system does not exempt an organization from paying water tax (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

If an organization applies a simplified tax system and pays a single tax on income, then when calculating the tax base, do not take into account the amount of water tax (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If you pay a single tax on the difference between income and expenses, include water tax in expenses (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). These payments will reduce the tax base on the day they are transferred to the budget (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Expenses

When calculating the “profitable” tax, you should take into account only justified and documented costs of the company. Spending by Russian companies is divided into two categories:

- costs associated with the manufacture of products and their sales;

- other expenses (for example, negative exchange rate differences).

There are several types of expenses that are never included in income tax calculations. These include repayment of loans, contributions to the authorized capital, payment of dividends, etc.

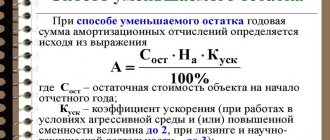

Labor costs, material costs, and depreciation are considered direct costs. Each month, firms must include them in the price of finished goods and in the cost of unfinished goods.

In other words, when taxing, this type of expense is taken into account as products are sold, the price of which includes them.

The second group of expenses is indirect expenses. These include renting premises, utilities, communications. In tax reporting, such expenses must appear in the period to which they relate. Indirect costs cannot be directly included in the cost of the final product.

Advertising costs: recognize and take into account

From the article you will learn:

1. What expenses are recognized as advertising expenses.

2. How to reflect advertising expenses in tax and accounting.

3. What are the features of accounting for certain types of advertising expenses?

Unfortunately, producing high-quality, competitive products (goods, works, services) for successful business is not enough: you also need to sell them. And in order to sell a product, potential buyers, at a minimum, must know about it and be interested in purchasing it. The key to solving this problem is advertising. Now everyone is advertised in a variety of ways, by placing advertising materials in magazines, on television, on the Internet, on transport, holding competitions with prizes, distributing leaflets, catalogues, etc. There are many types of advertising, and their number increases every year. How can an accountant determine which expenses can be classified as advertising and which cannot? Is it possible to take into account advertising expenses for tax purposes and how to do this? Let's find out in this article.

What counts as advertising?

To understand what expenses can be considered advertising expenses, let us turn to the Federal Law of March 13, 2006 No. 38-FZ “On Advertising”, which defines the concept of “advertising”:

- information disseminated in any way, in any form and using any means, addressed to an indefinite circle of people and aimed at attracting attention to the object of advertising, creating or maintaining interest in it and promoting it on the market

! Please note: An important criterion for advertising is that it is addressed to an indefinite number of people , that is, advertising should not contain indications of the persons to whom it is intended, and recipients of advertising information cannot be determined in advance. For example, gifts to customers and partners with a company logo are not advertising, since the recipients of such gifts are known in advance. Accordingly, expenses for such gifts cannot be classified as advertising expenses.

The Law “On Advertising” also establishes types of information that are not advertising , in particular:

- information the disclosure of which is mandatory in accordance with federal law;

- signs and indicators that do not contain advertising information;

- information about the product, its manufacturer, importer or exporter, placed on the product or its packaging;

- any elements of product design placed on the product or its packaging and not related to another product.

That is, information about the name, address, operating hours of the organization indicated on the sign is not advertising. Or, for example, information about the name, manufacturer, composition and characteristics of the product indicated on its packaging also does not apply to advertising.

Tax accounting of advertising expenses

Taxpayers have the right to take into account advertising expenses both when calculating income tax (clause 28, clause 1, article 264 of the Tax Code of the Russian Federation) and when calculating the single tax under the simplified tax system (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation). At the same time, taxpayers using the simplified taxation system take into account advertising expenses in the manner prescribed for calculating income tax (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). Let's take a closer look at this order.

For tax accounting purposes, advertising expenses are divided into standardized and non-standardized. Non-standardized advertising expenses are taken into account in full, while normalized ones reduce the tax base only within the established limit. So, non-standardized advertising expenses include (paragraph 1, paragraph 4, article 264 of the Tax Code of the Russian Federation):

- advertising costs through the media, information and telecommunication networks (Internet);

- outdoor advertising expenses;

- expenses for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms;

- for the discounting of goods that have completely or partially lost their original qualities during exhibition;

- production of advertising brochures and catalogs containing information about the goods sold (works, services), trademarks and service marks, and (or) about the organization itself.

The normalized advertising expenses include (paragraph 2, paragraph 4, article 264 of the Tax Code of the Russian Federation):

- expenses for the acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns;

- expenses for other types of advertising.

Standardized advertising expenses are taken into account for tax purposes in an amount not exceeding 1% of sales revenue (excluding VAT) for the reporting period. Under the simplified tax system, revenue paid by buyers and customers is taken. If the amount of revenue grows during the year, the standard for accounting for standardized expenses also increases accordingly. That is, advertising expenses not recognized in one reporting period can be transferred to another reporting period. However, normalized advertising expenses not taken into account at the end of the year are not carried over to the next year.

! Please note: “Input” VAT on the amount of standardized advertising expenses can be deducted only in that part that corresponds to expenses within the standard (Letter of the Ministry of Finance dated March 13, 2012 No. 03-07-11/68). If in the following reporting periods the remaining part of the standardized expenses is taken into account, accordingly, the “input” VAT on this part of the expenses can also be taken for deduction (Letter of the Ministry of Finance dated November 6, 2009 No. 03-07-11/285).

The process of calculating the amount of standardized advertising expenses accepted for accounting, as well as the amount of VAT to be deducted, is quite labor-intensive, especially if such expenses are of a regular nature. To make this task easier, I suggest you use a table in which you only need to enter your indicator values, and all calculations will be made “automatically” using formulas. In addition, based on the entered data, a ready-made accounting certificate is generated - calculation of the standard advertising expenses !

Download the table calculating the standard advertising expenses (Source: ATP “Consultant +”)

As I already wrote above, there are many different types of advertising expenses, and each of them has its own accounting features. I propose to dwell in more detail on the most “popular” advertising expenses.

Advertising expenses in the media, the Internet (non-standardized)

To confirm non-standardized expenses for advertising in the media, it is necessary to request a certificate of registration of the media from the party placing the advertisement. If there is no such evidence, then advertising costs will have to be normalized for tax accounting purposes.

Advertising expenses in print media. If an advertisement is published in a print publication that is not a specialized advertising publication (the volume of advertising material does not exceed 40% of the volume of the entire issue), such an advertisement must contain the mark “as an advertisement.” In the absence of such a note, the Ministry of Finance may challenge the legality of accepting advertising expenses for accounting (Letter of the Ministry of Finance of the Russian Federation dated June 15, 2011 No. 03-03-06/2/94). As confirmation, you must save the pages of printed publications containing the advertisement.

Costs for creating advertising audio and video clips. If an organization acquires exclusive rights to use advertising videos, and the period of their use exceeds 12 months, then such videos are accounted for as intangible assets. In this case, the costs of creating commercials are included in advertising costs as depreciation is calculated (for calculating income taxes).

Expenses for advertising on radio and television. When placing advertisements in this way, you need to pay special attention to supporting documents. Expenses can be justified, for example, by on-air certificates, acts signed by the organization and the advertising agency.

Internet advertising expenses. Non-standardized advertising expenses include the placement of advertising information about the organization, goods (works, services) in the form of banners, contextual advertising, advertising articles, etc. on Internet resources. In addition, advertising expenses include services for promoting websites on the Internet: optimization, design and configuration of the site for search engines, bringing the site to the first positions of search queries, priority placement in online directories, etc. (Letter of the Ministry of Finance of Russia dated 08.08.2012 No. 03-03-06/1/390). Confirmation of these expenses can be, for example, screenshots, statistical reports on the number of impressions of advertising materials, etc.

Outdoor advertising expenses (non-standardized)

Outdoor advertising includes advertising placed using advertising structures (boards, stands, banners, electronic displays, etc.) on and outside buildings, structures, as well as at bus stops (Article 19 of the Federal Law “On Advertising”).

Costs for the production of advertising structures. If the advertising structure is a fixed asset (use period is more than 12 months, cost is over 40 thousand rubles), then its cost cannot be taken into account in expenses when calculating income tax (Letter of the Ministry of Finance of Russia dated December 14, 2011 No. 03 -03-06/1/821). Such expenses should be taken into account gradually in the amount of depreciation charges.

Advertising placed on transport is an independent type of advertising that is not related to outdoor advertising (Article 20 of the Federal Law “On Advertising”). Therefore, advertising on transport is taken into account for tax purposes as “other types of advertising”, that is, the costs of its placement are regulated .

Advertising expenses for participation in exhibitions, fairs (non-standardized)

The Tax Code does not specify exactly what expenses are considered expenses for participation in exhibitions and fairs held for advertising purposes. However, based on an analysis of judicial practice, it is legitimate to include in such expenses:

- entrance fees for participation in exhibitions and fairs;

- rental of space and advertising stands in the exhibition hall;

- expenses for decorating shop windows and expositions;

- expenses for the production of uniforms for representatives of the organization at exhibitions and fairs.

Expenses for advertising brochures and catalogs (non-standardized)

The Tax Code lists only expenses for the production of advertising brochures and catalogs as non-standardized advertising expenses. However, the Ministry of Finance, in its explanations, also includes in this category the costs of producing booklets, leaflets, leaflets and flyers containing advertising information (Letters of the Ministry of Finance of the Russian Federation dated October 12, 2012 No. 03-03-06/1/544, dated November 2, 2011 No. 03- 03-06/3/11, dated 10/20/2011 No. 03-03-06/2/157). Thus, taxpayers have every right to include all of the listed types of printed materials in non-standardized advertising expenses.

From the cost of transferred advertising catalogues, brochures, booklets, etc. There is no need to charge VAT. In this case, input VAT upon purchase is taken into account in their cost. This conclusion is contained in Letters of the Ministry of Finance of Russia dated October 23, 2014 No. 03-07-11/53626, dated September 19, 2014 No. 03-07-11/46938.

Expenses on advertising products (standardized)

Costs for the production of advertising materials, with the exception of printed materials listed in the previous paragraph, taxpayers have the right to take into account for tax purposes, but as normalized advertising expenses. In this case, a mandatory requirement is the distribution of advertising products among an indefinite number of people.

The transfer of advertising products, with the exception of catalogs and brochures, which in themselves have consumer value and can be sold as goods (for example, notepads, pens, diaries, calendars, T-shirts, toys with advertising symbols) is subject to special VAT . According to the clarifications of the Ministry of Finance of the Russian Federation (Letters of the Ministry of Finance dated October 23, 2014 No. 03-07-11/53626, dated July 16, 2012 No. 03-07-07/64):

- If the price of a unit of advertising products does not exceed 100 rubles, VAT may not be charged on its cost. In this case, “input” VAT is taken into account in the cost of such products.

- If the price of a product unit is more than 100 rubles, VAT must be calculated from its cost. Input VAT on the purchase of such advertising products is deductible.

Expenses for other types of advertising (standardized)

Since the list of regulated advertising expenses established by the Tax Code of the Russian Federation is open, they may include any advertising expenses not directly mentioned in the Code. The key point here: expenses must correspond to all the characteristics of advertising, one of which is addressing an indefinite number of people. For example, expenses for tasting a product, making product samples, providing free services to attract customers, etc. can be classified as advertising only if the recipients are not known in advance.

Accounting for advertising expenses

In accounting, unlike tax accounting, advertising expenses are not standardized, but are reflected in full on the basis of supporting documents (agreements for the provision of advertising services, acts of provision of services, invoices for advertising products, etc.). Advertising expenses are reflected in account 44 “Sales expenses” or 26 “General business expenses”, depending on the specifics of the organization’s activities (trade, services). Accounting entries for recording advertising expenses may be different, depending on the specific type of advertising.

| Debit | Credit | Contents of operation |

| 44 “Sales expenses” (26 “General business expenses”) | 60 “Settlements with suppliers and contractors” (76 “Settlements with various debtors and creditors”) | The services of an advertising agency, services for advertising in the media, on the Internet and other services (work) of an advertising nature are reflected. |

| 10 "Materials" | Advertising products (catalogues, brochures, pens, notepads, etc.), billboards, banners and other advertising structures that are not fixed assets are written off as expenses. | |

| 02 “Depreciation of fixed assets” | The monthly depreciation amount of advertising structures accepted for accounting as fixed assets is written off as expenses. | |

| 05 “Amortization of intangible assets” | The monthly depreciation amount of audiovisual works of an advertising nature (television and radio commercials) accepted for accounting as intangible assets was written off as expenses. |

…

We have seen that there are a great many different types and methods of advertising, and, naturally, it is simply unrealistic to consider all possible advertising costs in one article. The main thing is that now you can accurately determine whether it is legal to classify certain expenses as advertising expenses, which advertising expenses are subject to standardization for tax purposes, and how to calculate the standard for accounting for advertising expenses. With the answers to these key questions, you can handle any advertising gimmicks, at least in terms of taking them into account.

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any comments or questions, write to us and we’ll discuss them!

Normative base

- Tax Code of the Russian Federation

- Federal Law of March 13, 2006 No. 38-FZ “On Advertising”

- Letters from the Russian Ministry of Finance

Find out how to read the official texts of these documents in the Useful sites section

Advance payments

All foreign and domestic commercial organizations in Russia pay income tax not in one amount, but in parts. Such regular contributions to the country's budget are called advance payments. Find out more about them in our article.

Table 1. Existing types of advances

| Advance type | Payment |

| Quarterly | They pay for commercial institutions whose sales income for one previous year does not exceed fifteen million rubles. |

| Monthly, calculated from real profits | Organizations switch to this tax payment schedule voluntarily. To pay tax monthly, you need to submit an application to the fiscal department. But it is important to make the transition before the reporting year. So, in order to switch to monthly payment from 2018, the application must be submitted before December 31, 2020. |

| Monthly, with additional payment of the balance every three months | This schedule is used by those commercial companies that the state does not give the right to use the first option, and they have not switched to the second on their own. |

On a note! Newly incorporated business companies pay advances every quarter. If, based on the results of three reporting months, the income of the new organization exceeds the limit established by the state, they begin to pay taxes every month. But, if the newly formed company initially chose the second option, it will pay advances monthly regardless of the amount of revenue received.

Deadlines for making advances

Contributions must be made at the end of the reporting period. With a monthly payment schedule, advances must be received by the tax department by the twenty-eighth day of the month following the reporting month. The quarterly schedule assumes that money must be transferred by the twenty-eighth day of the month following the reporting month. For example, the first quarterly payment for 2020 (for January, February and March) must be received by April twenty-eighth, 2018.

Organizations using a combined tax payment method must transfer funds every month before the twenty-eighth day. And the balance for the quarter must be paid before the twenty-eighth day of the month following the previous reporting quarter.

On a note! If the payment deadline falls on a Saturday, Sunday or holiday, the advance must be paid on the first day the tax office is open.

Penalties for late payment

A commercial organization cannot be fined for late payment of advances. But for every day of delay, tax authorities charge a penalty.

Postings, examples of tax calculation

In accounting, to reflect the fact of payment of any tax, there is a separate account - 68. Sub-accounts for each individual tax are attached to it - “Personal Income Tax”, “Property Tax”, etc.

The withholding of both the tax itself and advances is reflected as follows: D99 K68. When calculating, the figures are taken from the first section of the income tax return. The amount is calculated on an increasing basis. Those. the indicator will not be calculated from the profit received in each specific month, but by subtracting the amount of tax already paid from the tax on revenue received since the beginning of the year.

Accountants indicate the transfer of income tax to the budget using another entry: D68 K51.

Let's give an example of how to reflect tax payments that occur every three months. OJSC Victoria made a fiscal contribution in the amount of 150,000 rubles for the first quarter, and for six months the amount of the accrued advance amounted to 450,000 rubles. In the third time period - 1,000,000 rubles, and at the end of the year, the amount of advance contributions should be equal to 2,000,000 rubles. These numbers must be entered in the income tax return, line 180. The postings should look like this:

Income tax entries

If there was no profit

It is not uncommon for organizations to operate at a loss. At the same time, the advance payment for the current period is less than for the previous one. The accountant must correctly reflect this situation in the reporting documents.

Example. For the second quarter the advance amounted to 200,000 rubles, and for the third quarter it was less - 150,000 rubles. The wiring should look like this:

Postings when the organization was operating at a loss

Typical VAT transactions when returning goods

Since 2020, postings for returning goods depend on how the return occurs: within the framework of the original contract or as a resale under another contract, and does not depend on whether the goods are returned of high quality or defective.

If the item is returned under the original contract, the postings will be as follows.

Important! ConsultantPlus warns If you are returning a product for which “input” VAT was previously deducted, the tax must be restored. This is done on the basis of the seller's adjustment invoice or primary documents on the reduction in the value of goods shipped, whichever came first. See K+ for more details. Trial access is available for free.

From the buyer:

Debit 60 Credit 76 - adjustment of settlements with the seller.

Debit 76 Credit 41 - return of defective goods to the seller.

Debit 76 Credit 68 - restoration by the buyer of VAT previously accepted for deduction, attributable to the cost of the return.

From the seller:

Debit 62 Credit 90.1 - reversal of revenue.

Debit 90.2 Credit 41 - reversal of cost.

Debit 90.3 Credit 19 - reversal of accrued VAT on returned goods.

Debit 68 Credit 19 - deduction by the seller of VAT on the returned goods.

In case of reverse sale, taxation will be the same as for a regular sale, only the buyer and seller change places.

Example. Postings when returning goods of proper quality from ConsultantPlus The organization received 100 units of goods worth 120,000 rubles, including VAT - 20,000 rubles. Of these, 10 units were returned to the supplier for 12,000 rubles, including VAT - 2,000 rubles. You can view the entire example in K+, getting free full access.

Differences

Indicators in fiscal and accounting reports do not always coincide. Thus, the profit appearing in the tax return is often not equal to the amount of net profit obtained according to the accounting documents. This means that the tax that is payable and the tax according to accounting documents can have completely different values. To make them coincide, the state approved a rule called PBU 18/02.

Not all organizations are required to apply this rule. Credit and government institutions are exempt from it. Also, this rule is not applied by organizations working on simplified financial and accounting statements.

For those who use the rule

Differences between fiscal and accounting revenues can be temporary or permanent. The latter happens if costs or income are indicated in only one accounting - fiscal or accounting. This happens in the following situations:

- Costs or income cannot be included in the calculation of the base from which “profitable” tax is paid, but must be used in preparing financial statements.

- Costs or income appear only during taxation, but these amounts are not included in the accounting reports.

Constant expenses that are recorded only in one account and missed in another are called PNO. And the income due to which differences in the time group are obtained are called PNA.

PNO

The group of permanent non-profits includes, for example, expenses for a corporate event or the cost of property that was received free of charge.

The size of the PNO is calculated as follows:

PNO = amount of costs that are included only in tax reporting * tax rate (20%)

PNO = the amount of costs that are included only in the financial statements * tax rate (20%).

PNA

Permanent tax assets include, for example, state duty that was paid for real estate that was not acquired for subsequent resale.

This indicator can be calculated using the formulas:

PNA = the amount of costs that appear only in fiscal reporting * 20% (tax rate)

PNO = the amount of costs that appear only in accounting documents * 20%.

Permanent differences: postings and reporting

BUT of the permanent group is recorded in the debit account 99. In this case, the figure 68 is entered for the loan.

Constant BUTs must be written in reverse: the debit to the account is 68, and the credit to the account is 99.

On a note! Permanent differences in accounting are entered strictly in the month of their occurrence. Therefore, they should not be included in the balance sheet.

Let's give an example. OJSC “Snegovik” accepted free financial assistance in the amount of 200,000 rubles.

The accountant should reflect this transaction as follows:

D 51 K 9-1-1 200,000 rubles.

Money accepted free of charge is recognized among other income of the joint-stock company.

This operation is reflected in accounting documents, but does not need to be included in tax reporting. Since money received free of charge is not subject to taxation. Therefore it is necessary to do the wiring:

D 68 K 99 PNA 40,000 rubles (200,000 * 20%)

Accounting

Advertising expenses in accounting are taken into account in full, to the extent recorded in the primary documents. They are attributed, depending on the provisions of the accounting policy, to accounts 26, 44 or other similar ones.

Postings can be like this:

- Dt 10 Kt 60 - purchase of goods and materials for use for advertising purposes.

- Dt 44, 26 Kt 10 - write-off of advertising costs.

As mentioned above, within a year, advertising expenses can be taken into account not only in the past reporting period, but also in subsequent ones. This is done if in the past period the amount was above the norm, and in the subsequent period the volume of revenue allowed it to “fit” into the cost standard.

Therefore, temporary differences should be reflected - a deferred tax asset:

- Dt 09 Kt 68 - ONA is recognized, calculated based on the amount of excess advertising expenses.

- Dt 68 Kt 09 - ONA is written off in the next period.

Results

- Advertising expenses for NU purposes are divided into standardized and non-standardized. The list of non-standardized costs is closed, and the list of standardized costs is open. The latter means that standard advertising costs can include any expenses that comply with the Federal Law and have the attribute of advertising.

- Rationing of costs for NU purposes is carried out based on the volume of income for the period, in the amount of 1%. Due to an increase in revenue during the year, the amount of normalized advertising costs may change. The balance not included in expenses in the current year cannot be carried forward to the next year.

- Advertising costs for accounting purposes are not standardized. Accounting is maintained on accounts 44, 26 and other similar ones, in accordance with the company's accounting policies.

Temporary differences

This type of difference occurs when costs or revenues are recorded in fiscal and accounting reports at different time periods. They can be deductible or taxable.

The first category includes amounts that reduce the amount of tax in one or more upcoming periods. Taxable BP, on the contrary, makes this amount larger.

If income is recorded in accounting documents before fiscal ones, it is considered that income tax is deferred. In this case, the term IT is used.

Also, deferment of tax obligations occurs when costs are indicated in reports for tax authorities before in accounting reports.

To calculate the value of IT, you need to multiply the difference between fiscal and accounting net profit by twenty percent (the “profitable” tax rate). If we are talking about income, the difference between accounting and fiscal net profit is taken into account, which must be multiplied by the current tax rate.

As expenses (income) are paid off, IT will become less and less.

IT must be recorded in account 77, which is called “Deferred tax liabilities”.

IT is the amount of deferred tax, which in future reporting will entail a reduction in “profitable” tax. To find out what it is equal to, you need to multiply the amount of the temporary difference and the tax rate (currently 20%).

This part of the deferred “profitable” tax appears in accounting in account O9.

Typical VAT entries for purchased assets

VAT on purchased assets and services is accounted for using the following entries:

Debit 19 Credit 60 - reflection of the “input” VAT on purchased fixed assets, intangible assets, materials, goods, capital investments, works, services. Posting is done based on the received invoice.

Debit 68 Credit 19 - reflection of VAT deductible on inventories and services, including in the case of confirmation of the fact of export. Posting is done on the basis of invoices, and when confirming exports, after submitting the documents listed in Article 165 of the Tax Code of the Russian Federation to the Federal Tax Service and receiving the appropriate decision.

See also “What are VAT tax deductions?” .

In some cases, “input” VAT cannot be deducted.

For more information about situations when VAT deduction is impossible, and how to take it into account for tax purposes, read the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

In accounting, tax that is not deductible is written off to cost or financial results accounts:

Debit 20 (23, 25, 26, 29, 44) Credit 19 - write-off of VAT on acquired assets and services that will be used in transactions not subject to VAT. The posting is made on the basis of an accounting calculation prepared by a certificate.

Debit 91 Credit 19 - write-off of VAT on other expenses if the invoice from the supplier was not received, lost or filled out incorrectly.

See also the material “What are the grounds and how to write off VAT on 91 accounts?” .

Debit 20 (23, 29) Credit 68 - restoration of VAT previously claimed for reimbursement of inventories and services used for transactions not subject to VAT. The basis of the posting is again a reference calculation.

For reasons for restoring VAT, see the material “When to restore VAT” .

If you have made an advance payment to the supplier, you can see what transactions should be made for VAT in the Ready-made solution from ConsultantPlus experts. Get a free trial access to K+.

Common mistakes when calculating taxes

In order not to incur claims from tax authorities during an audit, you need to correctly take into account income and expenses, calculate profits and charge taxes. Here are some of the most common taxpayer mistakes:

- Debt on loans that have already expired is counted as income. The accountant must recognize the debt as income in the period in which the claim period expired. In tax accounting, an overdue creditor is also considered income. If there is a delay, the responsible person is obliged to write an accounting statement, add this amount to income, and calculate income tax from it.

- If an organization receives income from loans issued to other persons , it does not matter when exactly the interest was actually received and what terms are specified in the agreement. The accountant must calculate income tax in each reporting period (month, quarter) evenly.

- In orders for issuing bonuses, it is better not to indicate that the money is not given for labor merit. If a company plans to give bonuses to employees due to holidays, you need to find a good reason for this. Bonuses should be linked to employee performance achievements. Also, the possibility and procedure for paying bonuses must be specified in individual or collective labor contracts. Only under such conditions can bonuses be legally considered expenses.

- If you plan to pay employees going on vacation additional financial assistance , in all acts call it a regular additional payment to vacation pay. These amounts can be included in staff wage costs if several conditions are met. Firstly, additional payments to vacation pay must be specified in employment contracts (individual, collective). Secondly, the amount of payments directly depends on the employee’s compliance with the organization’s requirements and the employee’s salary. The amount of additional payment can be directly proportional to the salary, reduced in case of violations of discipline, etc.

Payment of transport tax

All provisions regarding payment regulations are specified in the Tax Code in Article 28. It indicates that the subjects of the Federation are authorized to establish the timing and amount of the tax, determine the criteria for providing benefits for full or partial exemption from the fee.

The tax period for legal entities is set as a calendar year, but the organization must submit a report to the local tax service quarterly.

For individuals, transport tax is calculated by the tax office. The traffic police provides all the necessary information for him. The owner provides information to the traffic police when registering the vehicle.

Typically, the tax office practices sending a notice of tax liability by mail. Legal entities are obligated to independently make calculations taking into account the individual tax base and interest rates for various categories of vehicles. The tax base is indicated in the registration certificate, and the rate is indicated in federal laws at the registration address.