What the law says

In accordance with the current fiscal legislation, the tax base is defined as the characteristics of a taxable object according to its key elements: quantitative, physical, cost, property and others.

Consequently, the object of taxation and the tax base are closely related. Since the object determines what is subject to taxation, and NB is defined as a specific feature of the object. In other words, for each fiscal obligation, the issue of the object of taxation must have a specific characteristic. For example, personal income tax or corporate income tax, determined by value. That is, the National Bank recognizes the value (monetary) expression of the income received by an individual or the profit of a company for the reporting period.

Let us note that the national standard for taxes is determined not only by the Tax Code of the Russian Federation. For regional and local fiscal obligations, the specifics of the formation of the tax base are established by the legislative authorities of the relevant subject and (or) municipality.

How is the tax base calculated?

Drawing up such a calculation is the responsibility of the taxpayer; he must provide it for each reporting tax period on an accrual basis from the beginning of the reporting year. The tax base for different taxes is calculated differently; for each tax, which is calculated taking into account the tax base, it is different. So, to calculate the tax base for income tax, the calculation provides the following data: - the amount of income from sales received during the reporting period, this includes, for example, income from the sale of goods and services produced or provided by the enterprise, as well as from the sale of securities , property, fixed assets, etc.; - the amount of expenses by which the amount of income will be reduced, these include expenses directly for production and those associated with the sale of sources of income; - profit or loss from sales - the amount of income and expenses; — the amount of non-operating income (from financial transactions of futures transactions); — the amount of non-operating expenses (for financial transactions of futures transactions); — profit or loss from non-operating income and expense transactions; — the total amount, which is the tax base. The amount of profit received that is subject to taxation is calculated as the difference between the amount of the tax base received and the amount of loss subject to transfer.

Determination methods

The Tax Code of the Russian Federation provides for only two methods of forming the tax base:

- Cash method, in which NB is calculated on the basis of cash transactions. For example, the amount of income is calculated on the basis of cash receipts made to the company’s bank account for goods shipped, work performed, and services performed. Only those expenses that were actually paid in the reporting period are recognized as expenses. In other words, this method reflects the real (actual) transactions of the taxpayer.

- The accrual or cumulative method, in which the date of actual receipt of income or execution of an expense transaction does not matter. Those transactions that were accrued and accumulated during the reporting period are taken into account for calculation. For example, accrued amounts of income are taken into account without taking into account the facts of payment. In this case, all accepted obligations are recognized as expenses, regardless of the payment made.

Please note that the taxpayer has the right to determine his own method of calculating NB. The only exception is personal income tax. To calculate income tax, only the cash method is used, that is, personal income tax is calculated according to the date of payment and receipt of income.

Tax base and its components

The taxable base is payments and remuneration that are accrued to workers recognized as objects of taxation during the payment period, and to those who were not subject to taxation. In addition, these are benefits available to some payers. The tax base is calculated for each employee separately. In this case, income received from other employers will not be included, and taxation will be calculated by each of them separately. When calculating, all categories of mercenaries must be taken into account, as well as the material benefits received from the entrepreneur by them or members of their family. The accrued amount of certain remunerations and payments is not subject to taxation.

There are several types of them, among which it is possible to determine those that are not subject to taxation. You should familiarize yourself with them.

The first type includes payments made on the basis of copyright, labor, licensing or civil law contracts. Compensations related to:

- compensation for harm associated with any damage to health;

- unpaid accommodation or receipt of utilities;

- payment in kind;

- dismissal of workers and compensation for unused vacation;

- performing various job duties.

In addition, the tax base for income tax does not include payment for travel from the Far North to the vacation destination for workers in this territory and their families, the cost of issued uniforms or uniforms, as well as the amount of travel benefits.

The next type of payment is social and material benefits. The tax base does not include financial assistance provided to employees by organizations, as well as to employees who quit due to disability or in connection with retirement, if it amounts to no more than two thousand rubles per individual per year. Amounts of one-time financial assistance provided by entrepreneurs are not subject to taxation: victims of terrorist attacks on the territory of the Russian Federation, family members of a deceased employee, as well as in case of support to victims of natural disasters and other emergency circumstances.

If we talk about insurance payments, the tax base does not contain the amount of contributions under the contract of compulsory and voluntary insurance of mercenaries, which provides for payments to compensate for harm caused to their health or life. It also does not include payment of medical expenses to individuals with the condition that such payments were not made.

The tax base, in addition to the main types of amounts subject to taxation, also does not include state benefits that are paid in accordance with the legislation of the Russian Federation and the decision of local governments. These include amounts issued in the amount of no more than ten thousand rubles once every three months to each member of the trade union at the expense of appropriate membership fees.

Methods of calculation

Officials have established the following types of determination of the tax base:

- The direct method is the simplest and most common. The idea is that national security is calculated on the basis of data from primary documentation, accounting registers and accounting and tax reporting.

- Indirect, or calculation by analogy. It is used when it is impossible to directly calculate the amount of the fiscal liability in the current period. In this case, the calculation is carried out on the basis of data from the NU and BU of similar enterprises.

- Conditional, or presumptive method, in which NB is calculated based on the conditional characteristics of the taxable object. An example of this method is the calculation of NB for UTII.

- Lump sum is a method of calculation in which the size of the fiscal liability is determined based on secondary characteristics. For example, in some European countries, a certain category of citizens is charged a tax of 12% of the amount of living expenses incurred.

In most cases, NB is determined by the cumulative total from the beginning of the billing period. For example, profits are summarized monthly from the beginning of the calendar year. The income of an individual or entrepreneur under a simplified tax regime is summed up in the same way.

But there are exceptions: the tax base for property liabilities is not determined on an accrual basis. For example, the property tax of individuals in the National Bank is defined as the value of a property at a specific date. For transport fees, NB is calculated based on the capacity of the vehicle. Land encumbrance is calculated similarly.

Now we will determine the procedure for forming the tax base using a specific example.

Let's start with definitions

The tax base is a certain characteristic of the taxable object. Key characteristic features may be:

- Cost, that is, calculated in monetary terms. It is used when calculating the amounts of revenue or profit received - for income tax or the simplified tax system, the income of an individual - for personal income tax, the amounts of products sold, services - for VAT.

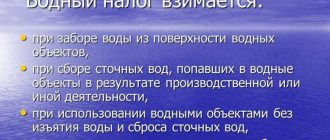

- Physical, calculated in quantitative terms. For example, it is determined based on the volume of consumed taxable resource. Let’s say they are calculating the volume of water taken from a water body to calculate the water tax.

- Other characteristics that allow you to determine the procedure and method for calculating the tax base. For example, the power of the vehicle to determine the size of the key rate for transport tax.

The current procedure for calculating the tax base is enshrined at the federal level, namely in the Tax Code of the Russian Federation. Please note that an individual calculation procedure has been established for each fiscal liability.

For regional and local taxes and fees, representatives of the legislative authorities of constituent entities and municipalities have the right to establish additional rules for determining the tax base. For example, local or regional authorities may expand the list of fiscal benefits or, conversely, reduce them. For example, regional authorities independently approve the list of taxable objects for property tax.

Tax base, example for personal income tax

As is known, the tax base of legal entities and individual entrepreneurs is calculated in a special manner for each fiscal obligation. Let us determine the key features of calculating the national security for income tax.

When taxing personal income, the tax rate is applied to the National Bank, determined in accordance with Chapter 23 of the Tax Code of the Russian Federation. Therefore, the taxable amount of income is the tax base for calculating income tax. Please note that not all income received by a Russian or foreign citizen is subject to taxation. Officials have determined a list of income that is not taken into account when determining the tax base.

In addition to the list of excluded income, legislators also provided a number of fiscal benefits and concessions. For example, for personal income tax, these are tax deductions (property, social, standard, investment and professional).

Elements that reduce the tax base

Naturally, for the taxpayer, from a financial point of view, it is more profitable for the tax base to be as small as possible, then a smaller amount of taxes will be paid from it. The law allows you to reduce the amount to be multiplied by the tax rate by the following economic values:

- tax deductions – it is allowed not to include categories of amounts specified by law in the taxable amount (these include standard deductions, pension, charitable, “children’s” and some others);

- tax benefits - financial advantages for certain categories established by the Government (lower tax amount, reduction of the tax rate, establishment of a minimum that is not subject to taxation, complete abolition of payment of a particular tax).

So, if we express the tax base as a formula, it will look like this:

NB = SD – V – L

Where:

- NB – tax base;

- B – tax deductions provided for by law and applicable to a given taxpayer;

- L – tax benefits valid for a given tax and category of payers.

Example for corporate income tax

The NB for income tax is calculated using a similar method. All company income received during the reporting period is taken into account. Moreover, the amount is determined by the method that the company independently chose and established in its accounting policies. For example, under the cash method, all revenue actually credited to current accounts and cash received are considered.

Note that for income tax, legislators also determined a list of non-taxable income. Thus, when calculating the tax base, income specified in Art. 251 Tax Code of the Russian Federation. They need to be excluded from the calculation.

Then the total amount of taxable revenue is reduced by expenses actually paid or according to the volume of obligations assumed. The result obtained is the NB for corporate income tax.

Concept of tax base

The basis used to calculate tax is called the tax base. It is to this, the tax base, that the tax rate is applied. This is a physical, cost or some other characteristic of an object that is subject to taxation. The tax base is established, as well as the procedure for its calculation by the Tax Code of the Russian Federation. The tax base is calculated by taxpayer organizations, individual entrepreneurs and taxpayers - individuals. True, each of these categories has its own accrual rules.

simplified tax system

The simplified taxation system is a special regime that is used in most cases by entrepreneurs and some organizations. To switch to the simplified version, you will have to meet specific requirements.

The procedure for determining NB according to the simplified tax system depends on the chosen taxation method. There are two of them:

- “Revenue”, in which the NB is equal to all revenue received during the reporting period.

- “Income minus expenses”, in which the NB is calculated similarly to the corporate income tax: revenue is reduced by the amount of allowed expenses incurred in the reporting period.

For example, the tax base of an individual entrepreneur under the simplified tax system “Income” is equal to the amount of revenue received from taxable income transactions.

General calculation standards

The tax base is calculated at the end of each tax period. Such rules are established not only for all taxpayers, but also for agents. If reporting periods are provided for a specific fiscal obligation, then the calculation of the indicator is carried out based on the results of all reporting periods.

There is no single procedure for finding the tax base, since it is determined individually depending on the type of tax, the level of legislative power, and the tax regime of the payer.

Thus, the tax base is determined - the calculation formula:

- For personal income tax: the total amount of income received (accrued) - income excluded from the calculation - tax deductions.

- For income tax: taxable income – permitted types of expenses and expenses.

- For VAT: the amount of goods, works, services sold in the reporting period - provided deductions.

- According to the simplified tax system: the total amount of income or the difference between revenue and costs.

- For property fees: the value of property, land, determined as of a specific date.

Let us note that in each case, legislators have provided an exclusive list of benefits, concessions and deductions that can significantly reduce the volume of the tax base when calculating the amounts of fiscal burden.