The concept and principles of tax secrecy

The concept of tax secrecy was introduced into the Tax Code of the Russian Federation relatively recently. Tax secret is special information in the field of tax law, the content and receipt of which, in accordance with the requirements of the Tax Code of the Russian Federation, should be available only to certain authorized persons.

Tax secrets consist of certain information that, for established reasons, is recognized as information not subject to disclosure.

For example, information about the taxpayer’s documents, information about his income and expenses reflected in the submitted declaration, about the current financial and property situation, etc.

In addition, information constituting a tax secret may relate to taxes paid or dividends, as well as personal commercial information, the receipt and access of which by unauthorized persons is prohibited.

The principles of tax secrecy are based, first of all, on the current Constitution and the provisions of the Tax Code of the Russian Federation, on the protection of the rights and freedoms of citizens. The interests of the taxpayer are the main criterion for protection.

Tax secrecy is also aimed at maximizing the elimination of financial and other risks for the taxpayer associated with the unlawful dissemination of certain information.

In addition, the concept and principles of tax law are based on current norms and rules that make it possible to ensure the protection of information in the most lawful way possible, without committing violations.

Another important principle is the consent of the person whose tax information constitutes a tax secret. In some cases, official consent gives the right to disseminate certain information if such a need really exists.

Consent must be formalized in writing, with the signature of an individual and other necessary information established by the current tax legislation.

Concept

According to Art. 102 of the Tax Code of the Russian Federation, any information about a person who is a taxpayer, which is received by various departments involved in collecting taxes, as well as by law enforcement agencies, is secret. All information about the taxpayer is protected by a regime of special secrecy. By law, access to them cannot be determined by a person's legal status.

Information that the taxpayer disclosed himself or gave his consent to does not apply to tax secrets. The identification number (TIN) and information about violations of articles establishing the procedure and amount of tax payments are also freely available. If there are agreements on cooperation between tax services of different countries, information specified in international agreements is removed from the category of secrets. Information about the income and their sources of persons running for any public office is also not a tax secret. The same rule applies to relatives of such persons.

Information not related to tax secrets

The provisions of the Tax Code of the Russian Federation establish that not all information and information related to the features and established procedure of taxation are tax secrets and are included in this concept. This information includes the following:

- information on the average number of employees of a particular institution, organization, etc.;

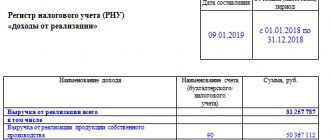

- information about certain amounts of taxes and established fees that were paid by a particular organization for a certain time period equal to one calendar year;

- financial information on the recorded amounts of income and expenses of an enterprise or institution for the past calendar year.

This list may also include other additional information for which the current tax legislation of the Russian Federation does not provide for a tax secrecy regime.

All this information is not included in the concept of tax secrets; therefore, its disclosure will not constitute a legal violation and, in accordance with the provisions of the Tax Code of the Russian Federation, the very fact of disclosure cannot incur absolutely no liability.

Access to this information will not be limited to a certain circle of authorized persons, and consent to the disclosure of this information will not be required.

Changes in legislation regarding tax secrecy in 2018-2019

In recent years, there have been changes in tax legislation regarding tax secrecy. The State Duma adopted Federal Law No. 134-FZ dated May 1, 2016 “On Amendments to Article 102 of Part One of the Tax Code of the Russian Federation.” This law expanded the list of data that is not subject to tax secrecy. The law came into force on June 1, 2020.

With the entry into force of the law, the following information no longer applies to tax secrets:

- average number of employees;

- the amount of taxes and fees paid (except for the amounts of payments paid for the import of goods into the territory of the Eurasian Union (EAEU);

- the amount of income and expenses of the organization displayed in the financial statements.

This data will be made publicly available, so investigative and judicial authorities, as well as counterparties, will no longer have to make requests for this data. The procedure for obtaining information that remains a tax secret does not change.

To publish the data, the Transparent Business information system has been created, which will be available on the website of the Federal Tax Service. The launch dates for the system have been postponed - at first it was planned to start operating the system in July 2020, then the date was indicated as June 1, 2020, after which the launch was postponed to August 1, and even later - to August 10, 2020.

Publication of data is planned in accordance with a specific schedule approved by Order of the Federal Tax Service of Russia dated December 29, 2016 No. ММВ-7-14/ [email protected] and shown in the table:

| Publication dates | ||

| Every month on the 25th | Every year on July 25 | Every year on February 25 |

|

|

|

Data published annually refer to the previous year, while data published monthly are current as of the 1st of the month.

The law makes an exception: innovations do not apply to strategic enterprises, organizations of the military-industrial complex and organizations that are considered the largest taxpayers. Information about such taxpayers will be published starting from 2020.

The law allows that legal entities may voluntarily disclose information about themselves that constitutes a tax secret. Conscientious taxpayers are expected to voluntarily disclose information in order to increase the transparency of their business to counterparties.

However, as of 2020, the concept of “tax secret” has lost most of its meaning, because the bulk of the information has been removed from the category of secret, and the remaining data is not of significant interest.

Disclosure of tax secrets

The concept of “disclosure of tax secrets,” in accordance with the current provisions of the Tax Code of the Russian Federation, means the dissemination of certain information that is a tax secret, entailing a violation of existing norms and non-compliance with the interests of the taxpayer.

The disclosure itself and non-compliance with tax law entail a certain responsibility, depending on the severity of the offense committed and the seriousness of the consequences for the taxpayer.

Responsibility for disclosure can be both administrative and criminal. Administrative liability for violation and disclosure of tax secrets is expressed in the imposition of a monetary fine, the amount of which depends on the specific case and additional circumstances.

Criminal liability for disclosure is applied much less frequently, only in cases where the interests or financial position of the taxpayer have suffered truly serious damage, which was a consequence of the fact that the disclosure of this information was carried out in an unlawful manner.

Tax secrets and their disclosure are the most important point in the current Tax Code of the Russian Federation; access to it should be provided only under conditions of full compliance with existing standards.

Banking secrecy

The Tax Code of the Russian Federation gives the relevant authorities the right to request from banks information on the taxpayer’s fulfillment of payment obligations, that is, payment of due amounts of taxes and penalties, if any. However, by law, banks are required to keep secret all information about financial transactions carried out by their clients, unless they contradict the law.

The situation is ambiguous, so almost any situation related to requesting information from a bank ultimately leads to litigation. The main instrument of the tax authority is Art. 86 of the Tax Code of the Russian Federation, which stipulates the responsibilities of banks for registering taxpayers. In particular, a credit institution is obliged to report to the tax service within five days information about the closure or opening of accounts by both individuals and various organizations. Banks are also required, upon request, to inform the relevant tax authorities about transactions carried out by entrepreneurs.

As follows from the concept of tax secrecy, the content of information received by the tax authority at the bank where the taxpayer’s account is opened is also kept confidential.

Access to information constituting tax secrets

In accordance with the Tax Code of the Russian Federation, access to tax secrets means that a person has the legal right to possess certain information regarding the taxpayer’s data, the specifics of taxation of a certain enterprise, organization, etc.

Certain officials have legal access to information that has been recognized as a tax secret. The exact list of these persons can be established by the federal executive body with the appropriate powers, the federal body related to criminal proceedings, the federal customs institution, etc.

Access to this information is usually provided in writing.

The document specifies a list of powers and precise information about the information to which the official has access.

In addition, the official must sign an agreement that if tax secrets are disclosed to other persons or they are provided with unlawful access, this violation will necessarily entail the application of certain penalties established by the Tax Code of the Russian Federation and other regulatory legal acts .

To apply certain penalties, access and the fact of violation of the interests of the taxpayer must be proven, otherwise the establishment of punishment will become impossible.

1) Accounting and tax documents, financial statements.

Accounting statements are public in nature, in contrast to accounting registers and internal accounting reports. A trade secret regime cannot be established in relation to accounting (financial) statements (Clause 11, Article 13 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”). In accordance with clause 89 of the Regulations on maintaining accounting and financial statements in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n, the annual financial statements of the organization are open to interested users: banks, investors, creditors, buyers, suppliers and others who can familiarize themselves with the annual financial statements and receive copies of them with reimbursement for the costs of copying.

ACCOUNTING SERVICES

Otherwise, the issue of providing the counterparty with tax accounting documents is resolved. In accordance with paragraph 9 of Art. 84 of the Tax Code of the Russian Federation, information about the taxpayer from the moment he is registered with the tax authority is a tax secret. This information also includes tax accounting data. At the same time, information disclosed by the taxpayer independently or with his consent is not recognized as a tax secret (clause 1, clause 1, article 102 of the Tax Code of the Russian Federation). Thus, the Tax Code of the Russian Federation limits the possibility of dissemination of relevant information by regulatory authorities. The organization itself has the right to independently determine whether (and to what extent) to provide information about itself as a taxpayer to other persons. In addition, an organization can determine that tax accounting data is its trade secret (Article 3, Article 10 of the Federal Law of July 29, 2004 No. 98-FZ “On Trade Secrets”). A trade secret regime can be established in relation to any economic information that has actual or potential commercial value due to its unknownness to third parties. To do this, it is necessary to include the relevant information in the list of information containing a trade secret, determine the procedure for handling this information, establish control over such handling and determine the circle of persons who can have access to the information (receive it), mark the documents as “Trade Secret” and regulate relations regarding the use of trade secrets with employees and contractors.

Features of tax secrecy

Content, access and the very disclosure of tax secrets, as legal concepts, have their own characteristics and nuances. For example, the disclosure itself constitutes personal use or transfer of this information to others.

Taxpayer data can be transferred to other persons, both free of charge and for a certain monetary reward. Of course, both of these methods are gross violations of the existing norms and rules of the Tax Code of the Russian Federation and are classified as legal tax crimes.

However, it will not be a violation to transfer taxpayer information to a responsible member of a consolidated group of taxpayers. Provided that the transfer was carried out by an authorized tax authority.

The provisions of tax secrecy provide for the establishment of liability even if documents containing secret information were lost by the responsible person.

Such documents may include tax returns and other papers that may contain information constituting a state secret. Most often, the loss of these documents entails the imposition of a fine, dismissal of an official from his position and other legal measures.

Tax secrecy in Russian legislation

The category of tax secrecy is relatively new to Russian legislation and was first introduced in 1999 with the entry into force of the first part of the Tax Code of the Russian Federation. The provisions of tax secrecy are disclosed in Article 102 of the document. ()

The Code defines tax secrets as any data obtained by the relevant government agencies about taxpayers and insurance premium payers. This data cannot be disclosed and has limited access. Tax secrecy applies to all taxpayers - individuals and legal entities, individual entrepreneurs.

The purpose of keeping taxpayer data confidential is the need to maintain the confidentiality of information constituting a trade secret, personal data of the entrepreneur and employees.

The Tax Code does not disclose the list of data classified as tax secrets, but based on other norms of the code, an approximate list can be compiled.

Data related to tax secrecy include:

- primary documentation data (cash orders, invoices, receipts);

- documents on the movement of funds , cash and other assets;

- financial documents that are not subject to disclosure and publication;

- personal information of employees;

- objects of intellectual property (developments, know-how, patents);

- data on taxes and fees paid for goods imported into the territory of the Eurasian Union (EAEU);

- other information included in the trade secret.

Thus, tax secrets include a fairly wide range of information that is transmitted to tax and other government authorities, but should not be publicly available.

Article 102 of the Tax Code of the Russian Federation () separately stipulates the principles of tax secrecy for special declarations. A special declaration is submitted by individuals who wish, as part of the next stage of the “capital amnesty,” to declare property in other countries - real estate, funds in accounts, securities, corporate rights.

For special declarations, more stringent requirements apply - a significant part of the information from such declarations is closed, including data on the declared property, identification codes, tax registration, etc.

Conditions for recognizing the information of a special declaration as a tax secret

Certain information contained in the submitted special declaration may be considered a tax secret, but only taking into account the established conditions and nuances. These include:

- this information is a tax secret, without any exceptions or additions, in accordance with the current tax legislation;

- the fact of loss of this information, or its unlawful disclosure, will necessarily entail the need to establish criminal liability for the crime committed;

- this information contained in a special declaration can be obtained exclusively from the tax authority by submitting a written request from the person himself - the author of this declaration;

- an authorized official who has gained access to this information cannot be held accountable for any type of established liability for refusing to give testimony that relates directly to the information included in the tax secret.

Only if the above conditions are met, information and information contained in a document such as a special declaration can be officially recognized as a tax secret.

Only after this recognition can legal liability be assigned for the disclosure of this information, depending on the gravity and seriousness of the offense committed.

Content

Tax services of any country have virtually unlimited access to information about the financial status of any citizen. Since the disclosure of such information is quite capable of causing serious harm to both individuals and legal entities, it was necessary to introduce special articles into tax legislation.

Specifically speaking, information constituting a tax secret includes:

- any information contained in the taxpayer’s documents;

- data on income and expenses;

- information about property and financial status;

- information about taxes and fees paid;

- personal data of the taxpayer.

This list of classified information does not end there. Every person has the right to keep personal or family secrets, which are also protected from disclosure.

In the legal literature you can often find a classification of various secrets into “ours” and “others”. The first relate to a specific person, and the second arises if someone disclosed their personal data to a trusted person (doctor or lawyer) due to professional necessity. Art. 102 of the Tax Code of the Russian Federation states that only “one’s own” secrets are protected by law. To maintain the secrecy of information received from another person, an appeal to other legislative codes is required, where such cases are considered.

Article 102. Tax secrecy. Tax Code of the Russian Federation

1. Tax secret consists of any information about the taxpayer received by the tax authority, internal affairs bodies, investigative bodies, the body of the state extra-budgetary fund and the customs body, with the exception of information:

1) that are publicly available, including those that became so with the consent of their owner - the taxpayer;

2) about the taxpayer identification number;

3) excluded;

3) on violations of the legislation on taxes and fees and penalties for these violations;

4) provided to tax (customs) or law enforcement authorities of other states in accordance with international treaties (agreements), one of the parties to which is the Russian Federation, on mutual cooperation between tax (customs) or law enforcement authorities (in terms of information provided to these authorities);

5) information provided to election commissions in accordance with the election legislation based on the results of checks by the tax authority about the amount and sources of income of the candidate and his spouse, as well as about the property owned by the candidate and his spouse;

6) provided to the State Information System on state and municipal payments, provided for by Federal Law of July 27, 2010 N 210-FZ “On the organization of the provision of state and municipal services”;

7) on special tax regimes applied by taxpayers, as well as on the taxpayer’s participation in a consolidated group of taxpayers;

provided to local government bodies in order to monitor the completeness and accuracy of information provided by payers of local fees for the calculation of fees, as well as the amounts of arrears on such fees.

provided to local government bodies in order to monitor the completeness and accuracy of information provided by payers of local fees for the calculation of fees, as well as the amounts of arrears on such fees.

2. Tax secrets are not subject to disclosure by tax authorities, internal affairs bodies, investigative bodies, bodies of state extra-budgetary funds and customs bodies, their officials and attracted specialists and experts, except for cases provided for by federal law.

Disclosure of tax secrets includes, in particular, the use or transfer to another person of information that constitutes a trade secret (trade secret) of the taxpayer and has become known to an official of the tax authority, internal affairs body, investigative body, body of a state extra-budgetary fund or customs body, an engaged specialist or expert in the performance of their duties.

2.1. The provision by the tax authority to the responsible participant of a consolidated group of taxpayers of information about the participants of this group that constitute a tax secret does not constitute a disclosure of tax secrets.

3. Information constituting a tax secret received by tax authorities, internal affairs bodies, investigative bodies, bodies of state extra-budgetary funds or customs bodies has a special storage and access regime.

Access to information constituting a tax secret is available to officials determined respectively by the federal executive body authorized for control and supervision in the field of taxes and fees, the federal executive body authorized in the field of internal affairs, the federal government body exercising powers in the field of criminal legal proceedings, the federal executive body authorized in the field of customs affairs.

4. The loss of documents containing information constituting a tax secret, or the disclosure of such information entails liability provided for by federal laws.

5. The provisions of this article regarding the determination of the composition of information about taxpayers that constitute a tax secret, the ban on disclosure of the specified information, requirements for a special regime of storage and access to the specified information, as well as liability for the loss of documents containing the specified information, or disclosure of such information shall apply on information about taxpayers received by organizations subordinate to the federal executive body authorized for control and supervision in the field of taxes and fees, which enter and process data on taxpayers, as well as on employees of these organizations.

6. The provisions of this article regarding the ban on disclosure of information constituting a tax secret, requirements for a special regime for storing said information and access to it, liability for the loss of documents containing the specified information or for the disclosure of such information apply to information about taxpayers received by state bodies, local government bodies or organizations in accordance with the legislation of the Russian Federation on combating corruption.

Access to information constituting a tax secret in state bodies, local government bodies or organizations that received such information in accordance with the anti-corruption legislation of the Russian Federation is available to officials determined by the heads of these state bodies, local government bodies or organizations.

7. The provisions of this article regarding the ban on disclosure of information constituting a tax secret, requirements for a special regime for storing said information and access to it, liability for the loss of documents containing the specified information, or for the disclosure of such information, apply to information about the amount and sources income of employees (their spouses and minor children) of organizations with state participation, received by state bodies in accordance with regulatory legal acts of the President of the Russian Federation and the Government of the Russian Federation.

Access to the information specified in this paragraph that constitutes a tax secret in state bodies to which such information was received in accordance with the regulatory legal acts of the President of the Russian Federation and the Government of the Russian Federation is available to officials determined by the heads of these state bodies.

8. Information contained in a special declaration submitted in accordance with the Federal Law “On the voluntary declaration by individuals of assets and accounts (deposits) in banks and on amendments to certain legislative acts of the Russian Federation”, and (or) the documents attached to it and (or) information is recognized as a tax secret, taking into account the following features:

1) such information is recognized as a tax secret without the exceptions established by subparagraphs 1 - 3 and 5 - 8 of paragraph 1 of this article;

2) disclosure of such information and loss of submitted special declarations and (or) documents and (or) information attached to them are grounds for criminal prosecution for illegal disclosure of information constituting tax secrets in accordance with the Criminal Code of the Russian Federation;

3) an official of the tax authority to whom such information became known cannot be held liable for refusing to testify on circumstances that became known to him from the information specified in paragraph one of this paragraph;

4) such information can be requested from the tax authority only at the request of the declarant himself, recognized as such in accordance with the Federal Law specified in paragraph one of this paragraph;

5) if it is necessary to confirm the fact of submission to the tax authority of a special declaration and documents and (or) information attached to the declaration, and the reliability of the information contained therein, an official of a government body or a bank, to which, as a basis for providing the guarantees provided for in this paragraph, paragraph one of this paragraph by the Federal Law, a copy of the special declaration was submitted with a mark from the tax authority on its acceptance, has the right to send it to the federal executive body authorized for control and supervision in the field of taxes and fees, for verification with the original of the special declaration located on the centralized storage. The federal executive body authorized for control and supervision in the field of taxes and fees, within five days after receiving such a copy of the special declaration, sends a response notification about whether the received copy of the special declaration corresponds or does not correspond to the original.

Results

Information classified as a tax secret is confidential information, access to which is legally limited. Classified tax information, with the consent of the taxpayer, can become publicly available after a special consent is issued, the form of which is regulated by a joint order of the Ministry of Finance and the Federal Tax Service of Russia.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance and the Federal Tax Service of Russia dated November 15, 2016 No. ММВ-7-17/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

What does this expression mean?

Tax secrecy is all information regarding the taxpayer’s person that is received by tax, law enforcement, investigative and customs authorities, as well as non-budgetary organizations. Such information is considered confidential and has limited access.

This feature is the same for all taxpayers, regardless of their status - private individual, enterprise or individual entrepreneur.

So, the tax authorities have access to information about the financial and property status of the taxpayer, the dissemination of which could harm both the personal life of a private individual, which according to the law is inviolable, and the financial position of an enterprise.

You can find out what tax secrecy is and what information does not apply to it in this video:

What is included in tax secrecy and who is responsible?

According to Article 102 of the Tax Code of the Russian Federation on tax secrecy, there is no specific list of what exactly this concept refers to, however, such a list is provided by another legislative act - a letter from 2011 from the Ministry of Finance, according to which tax secrecy is:

- Contents of primary documentation in the taxpayer's accounting department;

- Data on the movement of funds from the declaration;

- Information about property status;

- Personal information;

- Information about tax payments and dividends. Here you can find out how dividends are paid to the founders of the LLC;

- Production secrets;

- Trade secret.

Employees who, in the course of their professional activities, have access to study it, are responsible for the safety of confidential data.

Dear readers! We constantly write relevant and interesting materials to our FBM online magazine, subscribe to our Yandex-Zen channel!

The list of such people includes employees of the following departments:

- Tax structures;

- Customs;

- Law enforcement agencies, including the investigative committee and internal security agencies;

- Extra-budgetary institutions;

- Including third-party specialists brought in for professional activities in these structures.

trade secret

This is a regime of confidentiality of information, thanks to which the subject has the opportunity, in the current state of affairs, to receive a profitable income, while avoiding unjustified expenses, to maintain its status in the commercial market for the provision of services, or to receive some other benefit.

The list of data not subject to disclosure should be:

- Real;

- Available only to a certain circle of people;

- Legitimate.

This information may have a relationship that, according to the law, does not have public status:

- Organizational;

- Technical;

- Commercial;

- Production.

For example, in the banking sector, according to Federal Law No. 98, the data of clients and their transactions must be kept safe, while compliance with such requirements is controlled at the state level.

This is interesting: How to obtain a license for insurance activities: 6 requirements

Banks may also classify as trade secrets the advantageous technological developments that make their product competitive.

What is tax secrecy?

Tax secret of the taxpayer

The information contained in the tax return is considered confidential, since any company or individual entrepreneur is interested in hiding data regarding suppliers and clients.

From April 1, 2020, legislative acts on the tax taiga received new additions according to which the taxpayer has the right to independently make his confidential information, in full or in part, publicly available.

Important: the taxpayer can complete such a statement about his own data using a special form approved by the Order of the Federal Tax Service of November 2020.

The information listed in the form became available for viewing by interested parties from July 25 in accordance with the Order of the Federal Tax Service dated December 29, 20126 on the official portal of the tax service.

Banking secrecy

It is an important legal aspect in the laws of many states, according to which financial institutions protect data about their clients, their transactions, accounts, deposits, as well as their personal information.

Each country has its own list of information falling under this concept, but the main points are almost the same.

In Russia, since 2014, banking secrecy is practically absent, since this year legislative annexes to acts came into force, according to which banks are required to submit a report on transactions performed by citizens and enterprises to the Federal Tax Service.

Important: financial institutions are required to report account balances and cash flows at any time upon the first request of the tax authorities within 3 days.

Such amendments made the income of persons who work illegally via the Internet and in an enterprise, or the income of entrepreneurs using gray schemes, as transparent as possible.

Important: there is no statute of limitations in this case, that is, the Federal Tax Service has the right to demand payment of tax for any of the past years. How in practice the writing off of accounts payable with an expired statute of limitations is carried out - read the link.

What information is not a tax secret?

Procedure for obtaining access

Disclosure of tax secrets at the request of a body entitled to do so or a representative authorized by it is carried out subject to several conditions. First, the necessary request must be submitted on the letterhead of the organization that makes it. Such a statement must be registered as an official document. The text of the request is certified by the seal and signature of the head of the organization applying for secret information. The request will not be considered valid if its text does not contain a reference to a normative act that makes it possible to request secret information.

To gain access to tax secrets, it is very important to substantiate in detail the goals pursued by the organization requesting information about the taxpayer. The possibility of obtaining the necessary information will increase significantly if you provide details of official documents (court decisions, sentences in criminal cases), on the basis of which the requirement to provide access is carried out.

Responsibility for keeping secrets

The preservation of secrecy regarding taxpayers is provided for by law; all data that falls under acts of tax secrecy must have access to a particularly secret regime, and there is responsibility for their disclosure.

There are 2 types of violation of confidentiality, these are:

- Receipt of information to persons performing their duties;

- Loss of documents with secret data.

In this case, the definition of a violation of confidentiality occurs according to several legal criteria:

- Causing direct damage to the person in relation to whom the secret was disclosed;

- Illegal behavior of an official responsible for data security;

- Cause-and-effect relationship between the actions of an official and the taxpayer receiving damage.

Liability in this case depends on the type of violation of secrecy:

- Material – damage caused to a person by government agencies is compensated from the state treasury;

- Administrative – a fine of 4,000 to 5,000 rubles is imposed;

- Criminal - imprisonment for up to 3 years, and in case of causing particularly large amounts of damage up to 5 years.

Procedure for obtaining information

Obtaining the necessary information can occur through an official request on the basis of legislative acts; such a request can be carried out for the purpose of administering justice, fighting corruption, monitoring the fulfillment of tax obligations, and generating state information resources:

- Courts;

- Prosecutor's office;

- Investigation departments;

- Statistics;

- Pension Fund;

- Health insurance;

- Tax and Archive Service of Russia;

- Audit check.

When making such a request, the authority must comply with all legal requirements and makes it in a special form with the permission of the head of the authority, indicating the date of the request and the name of the requesting employee.

The request can be fulfilled only in case of verification of the taxpayer regarding the fact of concealment of income or to obtain the necessary documentation regarding it.

In this case, the employee of the institution at the place of application must accept the request against a receipt if it is made on paper.

Important: the authorities are not required to notify the taxpayer about these activities.