When should I fill it out?

An application in form P14001 (sample of completion below) is chosen when the Charter is not involved in the changes and you only need to adjust the entry in the Unified State Register of Legal Entities.

An application in form P14001 (download the form for free here) will help correct the name or address erroneously recorded in the Unified State Register of Legal Entities, change the director or enter his new surname , change the composition of participants and their shares in the LLC, and supplement information about the types of economic activities.

It is important to remember the rules for filling out form P14001. It is possible to declare multiple changes on one form, but corrections of errors must always be completed separately from the changes .

What sheets and sections are there?

Let's consider how to fill out form P14001 correctly? In total, the application contains 51 pages, included in 17 sheets:

Procedure for filling out form P14001:

- 1 sheet of form P14001 indicates about which organization and in connection with which the application is being submitted ;

- And it is needed to correct the name of the organization erroneously recorded in the Register ;

- B is filled in when the organization changes its address without changing the Charter. The same sheet is also intended for correcting an erroneous address in the Register;

- In (4 pages, 5 sections) is dedicated to a participant who is a legal entity of the Russian Federation ;

- G (5 pages, 5 sections) describes a foreign legal entity among the participants;

- D (9 pages, 7 sections) indicates information about the applicant in form P14001 - an individual;

- sample of filling out sheet E of form P14001 (7 pages) indicates the participant, which is the Russian Federation, a subject of the Russian Federation or a municipal entity ;

- G (5 pages, 5 sections) includes information about the participant - the mutual investment fund ;

- sheet 3 of form P14001 informs about the share owned by the organization;

- And indicates who keeps the register of shareholders ;

- form P14001 sheet K (2 pages, 3 sections) is dedicated to the head of the organization .

If necessary, it is possible to fill out sheet K of form P14001 in several copies. A sample of filling out form P14001 sheet K can be found in the publication below; - L (3 pages, 9 sections) describes the management organization ;

- M (2 pages) is intended for information about the manager ;

- form P14001 sheet N (2 pages, 2 sections) allows you to indicate the OKVED codes ;

- O (2 pages) is designed to accommodate changes relating to branches or representative offices;

- P discloses information about the authorized capital ;

- form P14001 sheet P - sample filling (4 pages) contains 5 sections dedicated to the applicant , and the sixth section for the person certifying the applicant’s signature. Now you know how to fill out sheet P of form P14001.

If necessary, prepare several copies of the same sheet. Unnecessary sheets are skipped and are not included in the P14001 application (form below in the article).

Required sheets

Any application must contain a title page , and it is also necessary to fill out sheet P of form P14001 with information about the applicant.

- The title page consists of two sections. Section 1 indicates the company's OGRN, INN and name without abbreviations.

Section 2 indicates the reason for filing the application. This can be either a change in data or correction of errors made in the Register. - Page

1 sheet P informs about the applicant. Section 1 indicates the number corresponding to the desired option from the list on the page. Sections 2 and 3 are usually not completed . - Page 2 sheets P are devoted to the applicant’s personal data : full name, TIN (if any), where and when of birth, code and details of the document that is the applicant’s identity card, by whom and when the document was issued.

- Page 3 sheets of P are intended for detailed information about the applicant's address. The index, code of the subject of the Russian Federation, city are indicated.

Addressable objects are designated as stated in KLADR (stanitsa – “st-tsa”, microdistrict – “mkr”, street – “ul”). Words identifying the building and premises (“house”, “building”, etc.) are written in full.When filling out contact information, a mobile phone starts with +7, a landline – with 8, telephone codes must be highlighted in brackets (each bracket must occupy a separate cell), and there are no dashes in the number.

These requirements for completing Form P14001 apply to all sections with address information found on other sheets.

- Page 4 sheets R with the applicant's full name and signature are filled out manually in the presence of a notary . It also indicates the method for obtaining documents confirming that the declared changes have come into force.

What sheets need to be filled out?

Before you start filling out form P14001, you should know which sheets are required and under what circumstances.

When there is a change of founders

Application form P14001 (you can download the form for free here) is used if the withdrawal of the participant is not accompanied by amendments to the Charter .

Sheets are selected that describe the participants (for example, B - Russian legal entity; D - foreign legal entity; D - individual), and sheet Z, informing about the organization’s share.

The sequence of events is as follows: a participant leaves the LLC, his share goes to the Company, and then is distributed among those remaining. All this is reflected in the new form P14001 (download a sample form below).

Sample P14001 when a participant leaves an LLC and distributes his share.

Let's consider an example of filling out form P14001 : Bystropack LLC with an authorized capital of 15,000 rubles, 10% of which belongs to two individuals, 50% to a Russian and 30% to a foreign company, which decided to leave the Company.

For the outgoing foreign participant, sheet G is filled out , where a two is placed in section 1 , and section 2 is filled out according to the extract from the Register. Sections 3 and 4 are skipped .

For each individual, a copy of sheet D (of two pages) is filled out, and for “Labor Cedar” - sheet B (page 1), where the following data is indicated in four sections:

- section 1 : a three is given;

- section 2 : information about the participant is entered from the Unified State Register of Legal Entities extract;

- section 3 : not completed;

- section 4 : the new share is indicated in rubles, as well as in percentage or fractional terms. Since the share is distributed in proportion to participation, in our example, in section 4, individuals should enter the amount of 2142.85 rubles. and a percentage of 4.28, and “Labor Cedar” - the amount of 10,714.30 rubles. and percentage 21.43. The numbers are not written from the first cell, but are “collected” around a dot or slash.

If the withdrawing participant (founder) is replaced by another , a sheet B, D, D, E or F is also filled out for the newcomer, where a unit is put in section 1, data about the participant is entered in section 3, and the share he receives is entered in section 4.

Sheet 3 shows the movement of the share of the withdrawing participant:

- In section 1 - the amount in rubles transferred to Bystropack LLC, and subsequent distribution to the remaining members of the LLC.

- In section 2 - the balance after distribution in rubles and percentages (or fractions). In paragraphs 2.1 and 2.2.1, a 0 is placed to the left of the point, indicating that there is a zero amount and zero percentage remaining.

The applicant in this case is the director of Bystropack. He encloses with the application :

- application of a foreign participant on withdrawal and transfer of shares;

- minutes of the meeting with the decision on the distribution of its share.

Bought or donated a share

If there has been a purchase or sale of a share (by a participant or a third party), then the same sheets as when a participant leaves and changes of participants:

- For the selling participant - sheet B, D, E, F, selected according to his status, where a two is placed in the first section (termination of participation), and in the second the data about the participant is filled in according to the extract from the Register. Sections 3 and 4 are left blank.

- For the purchasing participant - the corresponding sheet, where in section 1 a three is put (change of information), section 2 is filled out according to the extract, section 3 is skipped, and in the fourth the new share size is indicated.

- For the third party who bought the share - a participant’s sheet of choice, where section 1 should be marked with one (new participant), section 2 should be left blank, in the third section write down all the data about the newcomer, including passport data, and in the fourth - his share.

- Sheet 3 shows that a share in a certain amount was transferred to the Company (clause 1.1.), and then sold for the same amount (clause 1.2.). In section 2 you need to indicate that the sale was completed without a balance ( put 0 in paragraphs 2.1. and 2.2.1. to the left of the point).

The director announces the sale. The application will need to be accompanied by a decision/protocol on the sale, a purchase and sale agreement and confirmation of payment.

Sample of filling out P14001 when purchasing a share of an LLC by a third party.

Sample of filling out P14001 when purchasing a share of an LLC by a company participant.

If the share is donated, then application P14001 (download the new form below) is drawn up according to the same scheme, but in this case the applicant will be the donor of the share, and the notary will provide the application to the Federal Tax Service .

Notaries often do this via electronic communication channels, and this method makes it necessary to indicate the applicant’s P e-mail address on page 3 of the sheet .

The donor shall attach to the application a written notice of intention to donate the share and minutes of the subsequent meeting of participants approving the donation.

Sample of filling out P14001 when donating a share to an LLC.

Address changed

If only the city is recorded in the constituent documents, and the organization changes its address within the city, then you can declare a change of address by writing an application on form P14001 (download the document below).

To adjust the address of an organization, you will need sheet B , which contains 9 sections, including the code of the subject of the Russian Federation, type of settlement and type of street, numbers of buildings and premises, etc. For Moscow and St. Petersburg, indicate the code of the subject (77 and 78), and the name of the city not recorded. Abbreviations when filling out form P14001 of settlements and streets (city - “g”, lane - “lane”) are entered, checking with KLADR .

The application is submitted by the manager. Other papers may also : a letter of guarantee from the owner, a copy of the certificate of ownership.

You can download the new form P14001 for free below. For filling out P14001 when changing your legal address, see here in *.docx format.

OKVED code has changed

How to fill out an application when adding OKVED (on adjustments to types of economic activities)? Fill out sheet N.

An application in form P14001 sheet N, page 1 is provided for foreign economic activities that are added or replace the previous ones.

- if necessary, change the main type of economic activity in paragraph 1.1. is entered ;

- when adding additional OKVED codes, they are listed in paragraph 1.2 , arranged one after the other horizontally. also enter the previous main foreign economic activity here if you want to keep it among the additional ones. At least four digits must be specified for each code.

Page 2 sheets H contain excluded foreign economic activities. They are entered similarly to the first page: in paragraph 2.1. the main one is indicated, and in paragraph 2.2. – additional foreign trade activities.

If all foreign economic activity does not fit on one page, you can use several pages of the same type .

The tax application form P14001 is submitted by the director. It is recommended to add the minutes of the meeting with the decision to change the foreign economic activity, since notaries often require it.

Sample application R14001 when changing OKVED codes.

The director has changed

How to fill out form P14001 when changing the director, what sheets must be completed? To change managers , fill out sheet K.

- Page 1 sheet K is filled out in two copies - for both managers. For the former director, in Section 1, termination of powers is chosen as the reason for the application, for which a two is entered . Section 2 includes the TIN and full name of the outgoing manager. The third section is not touched.

- Page 1 sheet K for the new manager in section 1 should contain the unit (assignment of powers). Section 3 indicates not only the full name and TIN of the appointed director, but also his passport details. Information is entered in strict accordance with the spelling in the passport, including abbreviations, dashes, periods and spaces.

- Page 2 sheets K contains information about the address of the appointed director and his contact details.

Application in form n P14001 when changing the director.

Last name changed

If a change in the surname of a participant or director does not affect the Charter, then submitting an application using form P14001 (an example of filling is below) in this regard is not required : the new surname must be provided to the Federal Tax Service by the Migration Service of the Russian Federation within 5 days from the date of changes .

However, in practice, sometimes delays occur, and it also happens that the manager’s last name changed right before submitting an application for any changes to the Unified State Register of Legal Entities. If deadlines are running out, a new application form P14001 (download for free) is submitted with the new name of the manager , attaching all the necessary documents.

It occasionally happens that a change in the name of a manager that occurred before July 1, 2011 has not yet been reported to the tax office. You can’t count on the FMS here; you’ll have to announce this change yourself.

To do this, you need to fill out page 1 of sheet K : in the first section, select changes in information about the person as the reason by placing a three in an empty cell, and in the following sections enter information about the manager, but not all, but only the updated ones.

P14001 sample filling when changing the passport details of an LLC participant.

Submitting Form 14001 to the tax office when changing the passport details of the LLC director.

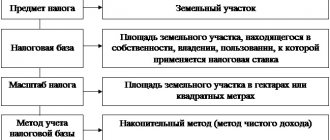

What is KND certificate 1160077 and why is it needed?

The full name of the mentioned certificate is: “Certificate confirming that the taxpayer has not received a social tax deduction or confirming that the taxpayer has received the amount of the provided social tax deduction provided for by subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation for ____ year.”

The abbreviation KND stands for “classifier of tax documentation.”

The need to obtain a certificate in the KND form 1160077 may arise when terminating certain types of certain contracts and returning a sum of money to the citizen. Such agreements include the following agreements:

- voluntary life insurance;

- voluntary pension insurance;

- non-state pension provision.

However, in cases of termination of these contracts for reasons beyond the control of the parties, no refund is made.

A citizen can conclude such agreements both in his own favor and in favor of his spouse (widow, widower), parents (adoptive parents) and disabled children (including adopted children and wards).

When returning the contract amount to a citizen, the insurance organization or non-state pension fund must withhold personal income tax. At the same time, for the purpose of calculating income tax, these organizations reduce the amount of the agreement due to the citizen by the amount of contributions made by him under these agreements, but only on the condition that the citizen has not previously taken advantage of a social tax deduction in relation to these contributions. But the fact that a citizen took advantage (or did not take advantage) of a tax deduction must be confirmed by a certificate issued by the tax office at the citizen’s place of residence. This certificate is a certificate in the form of KND 1160077.

Based on this certificate, a citizen will be able to pay income tax in a smaller amount.

Let us consider in more detail the conditions under which it is possible to reduce the amounts paid as personal income tax for various types of contracts.

The reduction in tax payment is a consequence of a reduction in the monetary (redemption) amount by the amount of contributions under the agreements listed below, based on KND certificate 1160077, subject to the following conditions:

- for a voluntary life insurance contract:

this contract must be concluded by a citizen for a period of at least five years in his own favor and (or) in favor of his spouse, parents, children (including adopted children, those under guardianship or trusteeship). At the same time, insurance premiums paid starting from January 1, 2020 are accepted for deduction to reduce personal income tax; - for a voluntary pension insurance agreement:

this agreement must be concluded by a citizen in his own favor and (or) in favor of his spouse, parents, disabled children (including adopted children or those under guardianship or trusteeship). Please note that insurance premiums paid under such contracts starting from January 1, 2008 are accepted for deduction; - for a non-state pension agreement:

such an agreement must be concluded by a citizen with a licensed Russian non-state pension fund (NPF) in his own favor and (or) in favor of his spouse, parents, children (including adopted children), grandparents, grandchildren, brothers and sisters, as well as disabled children under guardianship (trusteeship). Under such an agreement, insurance premiums paid starting from January 1, 2008 can be deducted.

The stated rules also apply when changing the validity period of a non-state pension agreement.

Basic filling rules

Form P14001 is read (the form can be downloaded for free below) automatically , and this requires clear writing of the data .

Form P14001: instructions for filling out.

is preferable to fill out the application on a computer : either using excel files or using a special program.

The font should be CourierNew 18 .

If you don’t have a computer at hand, you can fill out form P14001 (download the new one for free below) with a black ballpoint pen in block letters . For any filling method, only capital letters .

For each character , be it a letter, a dot or a bracket, a separate cell is used . In a multi-word entry, each word must end with a space separating it from the other word.

If a word in such an entry ends exactly at the end of a line, the space is moved to the beginning of the next line. A word that does not fit on one line is moved to the next without a space and without a hyphen .

Paper sheets are not filled out on both sides: one page of the form - one sheet of paper.

Existing problems

An incorrectly completed application is almost a 100% refusal . The biggest problem is with spaces: if they end up at the beginning of a line, they are forgotten about.

The same applies to the passport series : they forget to separate the first two digits from the second pair of digits with a space. Approximate type of document: passport code in form P14001 – Series-Space-Document Number.

Disputes arise about the need to enter zeros in the second section of sheet Z when operations with shares .

If the share is sold or distributed in full, in paragraphs 2.1. and 2.2.1, many registration authorities require that a 0 be entered to the left of the period - in order to clearly indicate a zero balance, and not about a possible omission of a section due to forgetfulness.

The requirements do not explain the procedure for filling out P14001.

Many refusals are caused by the fact that to indicate at least four digits of OKVED codes is not met An attentive applicant will take the time to indicate several lower-level four-digit codes, instead of choosing one upper three-digit code and being denied.

You cannot abbreviate words in any order , especially when writing address objects. Abbreviations must comply with KLADR , and the designations of buildings and premises must be entered in full.

Failure to comply with the format for writing telephone numbers also risks refusal.

Problems cannot be avoided for those who filled out everything correctly but missed the three-day deadline for submitting an application - they may receive a fine.

Sample form P14001

The shape is quite large. You do not need to fill out all the sheets, but only those related to the information that you are changing. Page numbering is continuous. Page No. 1 is filled out by all organizations, and then only completed sheets are numbered in format 002, 003, and so on.

The P14001 form has several blocks.

1. Page 1. Here you indicate the details of the company for which you are making changes. Please refer to section 2. Select the reason you are applying. If it is to correct typos, please indicate the number of the entry that was made on the application with an error.

2. Sheet A. Filled out by companies that have found errors in the Unified State Register of Legal Entities regarding the name of the LLC.

Important! The name appears in the company's charter; if you want to change it, use form P13001. Application P14001 is submitted to correct an error in the name, that is, when the name in the Charter differs from the name in the Unified State Register of Legal Entities.

3. Sheet B. To replace or correct the company address. When filling out subject codes, Appendix 1 to the Order will be useful to you. To correctly indicate the address details, read Appendix 2.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

4. Sheets B, D, D and E. These are sheets of information about the participants of the company: Russian legal entities, foreign companies, individuals and government officials, respectively. Here is a list of cases when these sheets will have to be filled out:

- withdrawal of a participant from the company;

- purchase and sale, inheritance or gift of a share;

- distribution of shares;

- changing the passport details of an individual participant;

- error change.

Important! You can find out the code of your identification document in Appendix 3.

5. Sheet J. Information about mutual investment funds is changed here.

6. Sheet Z. Filled out for transactions with company shares in the authorized capital.

7. Sheet I. To be filled out by joint stock companies. Changes related to a change of registrar are made through it.

8. Sheet K, L and M. To be filled in when the general director, management company or manager changes, respectively.

Important! Please note that when a manager changes, one person terminates his authority and another person assumes it. For example, when changing the general director, you fill out two sheets K. The first - in section 1, put the number 2 “Termination of powers” and fill out section 2. The second - in section 1, enter the number 1 “Assignment of powers” and fill out section 3. Similarly with sheets L and M. If you just need to change the information, put the number 3 in section 1.

9. Sheet N. Needed to change OKVED codes or enter new ones. On page 1 indicate the codes you want to add, on page 2 - exclude.

10. Sheet O. For changes in information about branches and representative offices.

11. Sheet P. When changing the size of the authorized capital.

12. Sheet R. To be filled in by everyone. The details of the person submitting the application are indicated here. Please note that there are a total of 16 categories of applicants.

Important! If the applicant applies to the Federal Tax Service independently with a passport and a document confirming his authority, there is no need to notarize P14001. Which sheets to fill out in specific situations We have listed in the table the situations that require changes, and the sheets of form P14001 that need to be filled out.

Submitting an application

P14001 new form (filling sample) download in PDF format.

Form P14001 code according to KND 1111516, form in XLS format.

Who can apply?

- the applicant in person;

- representative with a power of attorney (confirmed by a notary);

- notary.

Where can I apply?

- Inspectorate of the Federal Tax Service.

- MFC.

- Mail (by a valuable letter with an inventory).

- State Services website.

- Form P14001 tax ru is also submitted (Federal Tax Service website).

In any form?

- in the form of a package of paper documents (by direct delivery or by post);

- in the form of electronic scanned documents (on websites; an electronic qualified signature of the applicant or notary is required).

An attempt to reduce the chaos in documentation is always an opportunity to make the life of society more civilized.

In this light, the strict and voluminous new tax form P14001 (above), designed for all occasions, is perceived by everyone as a step forward.

However, if they try to simplify some activity, it is obvious that in order to ensure this simplicity, work and complexity will be added somewhere. Automation of reading the form f P14001 (see the sections of the article for a sample of filling) is a huge progress, but the requirements developed “for the machine” inevitably cause problems : the slightest deviation results in refusal of registration.

Anyone who needs form n P14001 (filling example above) must be attentive, accurate and punctual, otherwise you may receive a refusal or a fine of 5 thousand rubles . But those who use the tips and instructions wisely will be able to pass the application without much difficulty.

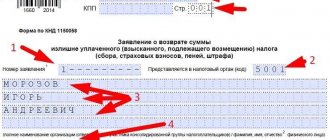

How to obtain a tax certificate using the KND form 1160077

To obtain KND certificate 1160077, which gives the right to use the social tax deduction, you must follow a clear sequence of actions. Let's look at the process step by step.

Stage No. 1. Preparation of documentation and application

To obtain a certificate, the first step is to fill out a corresponding application. In addition, the following list of documentation must be attached to the application :

Copies of contractual acts for non-state pension funds or policies for insurance contracts.- Copies of documentary evidence of family ties with persons in whose favor contributions were paid. These include birth, adoption or marriage certificates.

- Copies of confirmations of payment of fees. These can be receipts, checks, payment orders and other documents.

Detailed regulations can be found in letter No. ШС-6-3/ [email protected] of the Federal Tax Service and Article No. 219 of the Tax Code.

Stage No. 2. Transfer of the documentary package and application to the tax service

There are several methods to provide a documentary package and an application to the tax service.:

- during a personal visit to the tax office;

- through a person representing your interests;

- online from your personal account on the Federal Tax Service resource (you must scan the attached documents and attach scanned copies to the completed form);

- by postal delivery - by registered mail (in this case, you need to order a receipt of delivery in order to have evidence that the documentation has been received by the tax service).

This procedure is regulated by the same legislative acts as at the previous stage.