Should an individual entrepreneur submit 2-NDFL?

Each individual entrepreneur making payments to individuals is responsible for withholding and transferring personal income tax. This is precisely the essence of the status of a tax agent. In addition, after a year, such an individual entrepreneur is required to fill out a declaration in the 2-NDFL format for each citizen to whom he made a payment. It includes the amounts paid, the amount of taxes withheld and the deductions provided. The declaration is submitted to the Federal Tax Service.

Important! All of the above applies to persons working for a businessman under employment agreements and receiving services from him under civil contracts.

In general, a 2-NDFL format certificate is necessary to confirm the real level of earnings and transfer the established amount of taxes from it. Such a document is needed to:

- take a loan from a bank;

- apply for social benefits or other type of government assistance;

- confirm your right to receive a tax deduction;

- apply for a visa;

- adopt a child;

- present to bailiffs;

- get a new job and confirm the income received with deductions applied from them according to the law.

The certificate is prepared for submission to the Federal Tax Service or at the request of an individual.

On the simplified tax system

Businessmen working on a simplified basis issue a certificate to their employees in the 2-NDFL format. Such individual entrepreneurs submit reports to the tax authorities in the manner prescribed by this taxation scheme. 2 Personal income tax for the businessman himself in order to confirm his income is not registered on the simplified tax system; there is other documentation for this.

On UTII

Businessmen on UTII do not keep journals to record profits and expenses. To draw up a document in 2-NDFL format, they have to present primary documents or a cash book certified by a seal. But an individual entrepreneur can draw up the paper independently according to the current sample.

Patent system

For individual entrepreneurs, the patent provides for the submission of 2-NDFL forms for employees annually. Such entrepreneurs withhold personal income tax for employees on the day of salary payment and transfer the tax within one day.

BASIC

In the general taxation scheme, entrepreneurs submit reporting documentation in the prescribed manner for each employee. The list of papers also includes form 2-NDFL. An individual entrepreneur can confirm his own solvency with an account statement in a banking structure or from a journal of financial receipts, contracts and other documents.

What documents can confirm the income of an individual entrepreneur?

As a rule, credit institutions offer their clients to confirm the level of income received using one of two documents - a certificate in form 2-NDFL or a certificate in the bank’s form.

If an individual entrepreneur does not have a part-time job, he cannot issue the first type of certificate, because he is a tax agent only in relation to his own employees.

Citizens working on the simplified tax system have the right to contact a financial organization or government agency and clarify whether it is possible to provide a certificate in free form or in the form of a bank instead of 2-NDFL. As a rule, institutions accommodate entrepreneurs halfway.

In addition, an individual entrepreneur using the simplified tax system has the right to use other documents to confirm his solvency, namely:

- KUDiR;

- copies of declarations submitted to the Federal Tax Service in form 3-NDFL;

- primary documentation (for example, contracts, bank statements);

- cash book.

Formally, the legislation does not contain instructions on the form of a document capable of certifying the solvency of a private entrepreneur.

At the same time, not every organization or authority will agree to replace the generally accepted 2-NDFL, so it is recommended to discuss in advance with representatives of these institutions the possibility of issuing another document confirming the level of solvency of the individual entrepreneur. Otherwise, replacement will not be accepted.

Where to receive and where to give

Individual entrepreneurs who combine entrepreneurship with employment can obtain paperwork from their employer. However, it will contain data exclusively on “salary” income, without taking into account the merchant’s own business.

When considering the question of whether an individual entrepreneur can issue a 2-NDFL certificate for himself, it should be taken into account that tax agents have the right to issue such a document. A businessman is such only in relation to his employees. Accordingly, he is not allowed to write out the paper on himself. If there is a need for such documentation, entrepreneurs confirm earnings in other ways.

The completed form 2-NDFL is submitted along with a package of reporting documentation to the Federal Tax Service within the time limits established by law. Tax agents who report for less than 25 employees have the right to submit documents on paper, others - exclusively in electronic form.

Declaration for certain categories of individuals 3-NDFL

Since 2010, according to Order of the Ministry of Finance No. ММВ-7-3/654, the submission of a special type of tax return has been provided. Responsibility for filing it rests directly with the citizens who fall under the scope of the order.

April 30 is the deadline for filing 3-NDFL for the following categories of citizens:

- Individuals engaged in conducting business on an entrepreneurial basis (PBOYUL), who are subject to the general taxation procedure;

- Notaries and other persons engaged in private practice;

- Employees of an employer who is not a tax agent;

- Income received by citizens who are not related to the employer and from which personal income tax has not been withheld (from the sale or rental of property, dividends, etc.);

According to the letter of the Law, entrepreneurs are required to submit a 3 personal income tax report for individual entrepreneurs even in the absence of accrued income. Among accounting workers, such a report is called “zero”. The deadline for it is the same as for 2-NDFL (April 30).

One of the main difficulties of switching to an electronic document management system is that the electronic document management system requires certain operating algorithms and user skills that are not always available to the average employee of a typical organization.

In order to use electronic document exchange, it is necessary to indicate in the enterprise’s accounting policy for the next year that primary documents can be drawn up not only on paper, but also in electronic form and certified with an electronic signature. Find out more here.

Cases in which individuals submit a 3-NDFL declaration of their own free will:

- The desire to receive standard tax deductions described in Article 218 of the Code. The declaration is submitted if they were not provided during the calendar year (tax period) or their size was reduced for reasons beyond their control;

- Application for a social tax deduction from personal income tax if there are documents confirming payment for such services, transfers to charitable foundations or replenishment of a voluntary pension fund;

- Receiving deductions when selling property or purchasing real estate (this point most often concerns entrepreneurs as individuals);

- Professional deductions (do not apply to individual entrepreneurs).

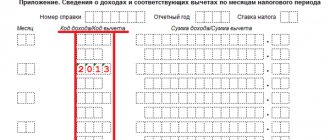

How to fill out a certificate

Filling out the document involves entering information about:

- employee personal data;

- employer details;

- the amount of an individual’s earnings by month;

- applicable tax deductions indicating codes;

- signature of the manager and chief accountant (if there is one).

When the certificate contains data on a person’s income and personal income tax, the number 1 is entered in the “Attribute” section. When tax collection is not withheld, 2 is also noted here. In the “Adjustment number” section, you usually need to enter 00.

The header of the document must contain the date of formation, number and year for which the document is issued. Information to be entered into the IFTS and OKTMO code fields should be clarified with the tax authorities or on the Federal Tax Service website.

When an organization acts as a tax agent, its details are entered in the first section: checkpoint, tax identification number, name, contact information. Entrepreneurs write my full name instead of the checkpoint.

In the section about the recipient the following is written:

- FULL NAME.

- Date of Birth.

- Status (1 - for residents of the country, 2 - for non-residents).

- TIN.

- Citizenship (for Russians - 643).

- Place of residence.

- Passport details (enter 21 in the required field).

Important! It is allowed to use a permanent address, but not a temporary one.

The third section is intended to display the rate and payment amount by month and code. All tax rates must comply with the accrual parameters. Amounts are entered in rubles and kopecks, but the rounding rule applies to the tax amount. Values below 50 kopecks are discarded, values above are rounded to the nearest ruble.

The following are indicated:

- Month of payment accrual (01, 02, etc.).

- Payment code (2000 for wages, 2012 for vacation pay, 2300 for sick leave benefits, 2760 for financial assistance).

- Payment amounts.

- Code and amount of deduction (if any).

Most often, 503 is indicated - the code for non-taxable financial assistance, which amounts to 4,000 rubles per year.

The fourth section describes all types of deductions: investment, standard or social type. For each, a code is indicated, the amount of the annual reduction. For these purposes, codes 114 are used for the first child, 115 for the second, 311 for property return. All codes are specified in the corresponding order of the Federal Tax Service. For property and social compensation, notification from the tax authorities will be required.

The fifth section contains information about the total amount of payment, the tax base, as well as taxes - calculated, withheld, and transferred. If payments are provided at different rates, sections 3-5 are filled out separately for each such rate.

The validity period of the document is not limited by law. However, a number of institutions and organizations set their own deadlines. For example, a bank certificate will be valid for 10-30 days.

Sample

In order not to make mistakes when filling out the certificate and not to waste time making adjustments, it is worth using a sample of such a document. It is worth making sure that the sample is up to date, since various changes occur in legislation from time to time.

PDF file

Where can I get a personal income tax certificate 2 if I work?

To answer the question of where to get personal income tax certificate 2, let’s get acquainted with the scope of application of this document. Citizens usually need a certificate of this form for:

- confirmation of work experience during a certain period, as well as the amount of income received during this period;

- filing with the tax authority in order to obtain a deduction for taxes and property;

- a report on the payment of income tax to government authorities in case of belonging (location) in different countries;

- submitting documents for a loan to the bank, which will allow you to get a more convenient interest rate on the loan by minimizing the bank’s risks and confirming the client’s solvency;

- travel abroad - to a visa center to confirm solvency;

- change of place of work - the employer can request this certificate in the package of documents, which is necessary for timely and accurate reflection of data in accounting;

- other cases.

The contents of the certificate reflect information about the employer, employee, controlling tax authority, amounts of employee income received and tax and other deductions from income.

Help for yourself and for employees

All types of certificates in 2-NDFL format are divided into two groups. The first is documents that an individual entrepreneur or his employees need to take for their own needs. Such paper is necessary, for example, to obtain a mortgage from VTB or another banking structure. The second group includes reporting that an entrepreneur submits for employees with whom he has employment agreements.

A certificate for employees is issued according to the above rules. An individual entrepreneur cannot make a similar document for himself. However, often a businessman needs to explain to certain authorities where he gets his income and in what amount.

Individual entrepreneurs working on the simplified tax system or OSNO can replace 2-NDFL with copies of simplified tax returns or 3-NDFL submitted to the Federal Tax Service. A printed receipt of acceptance by a tax officer or a tax return with an inspection mark completely replaces the income certificate.

For businessmen, such confirmation is a book in which financial receipts and expenses are recorded. You can make copies of the necessary pages, but they will have to be certified. An alternative is bank statements, contracts, and receipt orders.

The most difficult thing is to confirm earnings for merchants working on UTII. Their reporting does not contain specific indications of the amount of profit received, and they do not keep books of income and expenses. Such people confirm their own income exclusively in free form, for example, by providing a cash book and primary documentation. As an option, it is possible to maintain a register with recording and systematization of all received documents.

XLS file

Tax deduction when purchasing an individual entrepreneur apartment

One of the documents that is provided when applying for a tax deduction when purchasing an apartment is a 2-NDFL income certificate. An entrepreneur has the right to purchase an apartment as an individual entrepreneur or as an individual. The last option will be the most optimal, since in this case the person receives the following rights:

- receive a deduction from the costs of purchasing an apartment;

- in the case of selling an apartment, deduct the expenses spent on its purchase, regardless of the tax period, in full.

An entrepreneur will be able to receive a property deduction when purchasing an apartment in the following cases:

- The apartment was purchased at our own expense. To purchase an apartment, a person must use his own income, including income from business activities. In this case, it will not matter what taxation system the individual entrepreneur is on.

- An individual must have income from which personal income tax is withheld (13%). Due to this, he will be given a tax deduction. Income can be presented as revenue from business activities if the entrepreneur applies the OSN. If he pays tax according to the simplified tax system and UTII, then he will already need to have other income subject to personal income tax. For example, it could be:

- wages other than business activities;

- GPA payments;

- income from winnings, renting out property as an individual.

Important! If there is no income subject to personal income tax at a rate of 13%, then the entrepreneur’s wife has the right to use the deduction for acquired property.