Decoding code 2013 in 2-NDFL

Among the new codes, the 2013 income code was introduced in 2-personal income tax, what does this mean? This code indicates compensation for unused vacation of an employee upon his dismissal. Such a codifier must be indicated not only in relation to the next labor leave, which was not used by the employee before dismissal. Code 2013 is also indicated in relation to compensation accrued for additional days of vacation.

What amounts are included under the 2013 income code in personal income tax certificate 2, what it means and when to use it. Indicate this code in the 2-NDFL certificate if the employment contract with the employee was terminated, and in the reporting period he was accrued:

- Compensation for unused days of main labor leave for the current period.

- Compensation payment for unused days of additional leave.

- Calculation upon dismissal for unpaid vacations of previous periods.

Filling example

Let's look at a sample of filling out a certificate using the following example. Stepanova L.V. got a job on February 1, 2020. Her salary is 38,900 rubles. She was granted annual leave from July 31 to August 13.

Payment of funds was made on July 26. At the request of the employee, Stepanova was granted unpaid leave for the entire month of October. And on December 1, the employee quit. On the day of dismissal, compensation was paid for 9 days of vacation not taken.

Since vacation pay is paid in advance, it will appear on the invoice in July, because most vacation days fall in August. Earnings in July and August will be calculated in proportion to the time worked.

There will be no payments for October, since Stepanova did not work this month. Compensation for vacation and payment will be reflected in December, because the money was transferred on the day of dismissal - December 1.

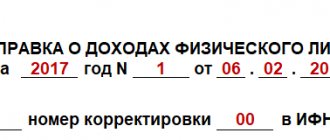

Certificate 2 of personal income tax for 2020 is as follows:

For each type of income in 2 personal income tax there is a code. The tax agent is obliged to correctly reflect payments made to individuals. Vacation pay is recorded under the code 2012, since it is not wages. A separate code is also provided for compensation for unused vacation - 2013.

An example of when to indicate code 2013 in 2-NDFL

Pomidorkin A.B. resigned in November of the reporting year. For the period worked, he had unused basic leave for 2020 - 28 days, for 2016-2017 - 34 days. In addition, according to the collective agreement, the employee is entitled to 3 additional vacation days.

Pomidorkin did not use additional vacations, therefore, he accumulated 9 days (for 2020, 2020, 2020). As a result, the company is obliged to pay compensation to the employee for 71 days in the amount of 122,000 rubles. It is this amount that needs to be included in the 2-NDFL certificate for income code 2013.

Main types of “income” codes

To make it easier to navigate, we will divide the most used codes into several types.

Payments for labor relations:

- The income code “2000” in the 2-NDFL certificate is used for data on employee salaries and maintenance, allowances for military personnel, excluding those listed in clause 29 of Article 217 of the Tax Code (remunerations under GPC agreements are not included here).

- Bonus in 2-NDFL - more than one income code is provided, since bonuses can be based on different sources of formation. Amounts are included in employer expenses in different ways, so you will have to choose based on the following conditions:

income code “2002” in 2-NDFL is indicated if accrual depends on production results, and remuneration is provided for by local acts and labor legislation;

- the income code “2003” in the 2-NDFL certificate is applied to bonuses paid from profits, target sources, and special-purpose funds.

- code “2014” – payment of severance pay, average earnings during the period of employment, as well as compensation to management exceeding 3 times (6 times in the Far North) the average salary;

Other payments

For other income, it is also necessary to indicate for what and on what basis the funds were paid. There are a lot of codes, so it is more correct to check the entire list given in order No. ММВ-7-11/387. For some types it is easy to select the required value, for example:

- For dividends - income code “1010” in the 2-NDFL certificate is needed if dividends were transferred to the company’s participants in the reporting year.

- The income code “2010” in the 2-NDFL certificate is used for remuneration to individual contractors under GPC agreements (except for royalties).

- The income code “2720” in the 2-NDFL certificate indicates the value of the gifts given to the recipient.

Other codes are longer and more difficult to understand. For example:

- Income code "2510» In the 2-NDFL certificate, an entrepreneur or company indicates if they:

paid for the employee the cost of any goods (work, services), including expenses for utility bills, study, food, and recreation;

- paid for the acquisition of personal property rights.

- if this is only a rental of the car itself, then the meaning of the applied code is “2400»;

For payments that cannot be classified into other categories, use the income code in 2-NDFL “ 4800 ”. Such income, for example, includes payment for downtime, daily allowances in excess of the taxable limit, as well as all others for which it is not possible to find a different value.

Read also: Citizenship (country code) in 2-NDFL

The table below shows income codes for 2-NDFL (2019) - a complete list of them in accordance with Order No. MMV-7-11/387.

Check your reporting

Check whether the codes in the 2-NDFL certificates are indicated correctly. If there are errors in the reports already submitted, corrections must be submitted. For example, for compensation upon dismissal, the income code 2013 is not indicated in the personal income tax certificate 2, what is this in 2020? This is mistake.

For incorrectly submitted information, a fine of 500 rubles is provided (Clause 1, Article 126 of the Tax Code of the Russian Federation). If the company files its own adjustments, there will be no penalty. Fill out the correction according to the general rules. Consider the provisions of the Federal Tax Service Letters on deduction and income codes.

Why should vacation time be taken into account separately from basic earnings?

Vacation payments to an employee are one of the forms of social guarantees provided for in Art. 114 Labor Code of the Russian Federation. But they cannot be considered as wages, since during vacation the employee de facto does not work.

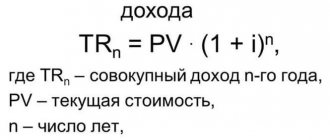

The difference between payments for time worked and for annual rest is significant, since they provide for different points for calculating the taxable base for personal income tax:

- earnings for days worked - the last day of the month of its accrual or the day of termination of the working relationship (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- vacation pay - the day of the expense transaction for their payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

That is, the tax agent is obliged to calculate and withhold personal income tax at the time of payment of vacation pay, and he has the right to transfer the withheld amount to the budget until the last day of the month in which the payment was made.

This judgment was officially confirmed by the Russian Ministry of Finance in its letter dated January 17, 2017 No. 03-04-06/1618.

Thus, a separate reflection of the vacation pay code in the 2-NDFL certificate is required so that tax authorities can monitor compliance with the deadlines and amounts of tax transfers.

We work according to new rules

Representatives of the Federal Tax Service approved a new format for reporting 2-NDFL. Now you have to fill out two reports. One form is provided for submitting information to the Federal Tax Service. And the second is issued directly to employees, upon their written request. For example, to obtain a bank loan or apply for a subsidy.

Use in your work the report form and rules for filling out, approved by Order of the Federal Tax Service of Russia dated October 2, 2018 N ММВ-7-11 / [email protected] But the income codes and deduction codes that must be indicated in the 2-NDFL certificate remain the same. The latest updates to the codifier were adopted back in 2020.

Officials supplemented the main classifier (Order of the Federal Tax Service of Russia dated September 10, 2015 N ММВ-7-11/ [email protected] ) with new codes. The latest changes were enshrined in Order No. ММВ-7-11/ [email protected] , and came into effect from the beginning of 2020.

The Bukhsoft program has updated the electronic version of the certificate taking into account the new order. See how to prepare and print your new form. Please note that there are now two forms.

One to give to the employee:

If you filled out an old form and want to quickly convert it into a new one, use the free service in the Bukhsoft program.

Articles on the topic

Starting from 2020, the 2-NDFL certificate must include a new income code 2013. What it means, when and how to apply it, we will tell you in this article.

To correctly reflect the vacation compensation payment to a dismissed employee, use the income code 2013 in the report. Let's see what it is.

Code 2-NDFL 2000 and income code 4800

One of the most common types of employee income is compensation; [email protected] dated November 22, 2016 came into force, questions arose about the application of this code in the case of payment of bonuses. This issue was resolved in the following way: it was necessary to look at what exactly the bonus was awarded for, and, depending on this, choose a code. If an employee received bonuses for labor achievements, then this income was marked with code 2000, but if the bonus was given to him in honor of any event (wedding, anniversary, birth of a child, etc.), then this income should be classified as other and designated code 4800.

From December 26, 2020, 2 new codes were introduced to indicate premiums in 2-NDFL (Federal Tax Service order dated November 22, 2016 No. ММВ-7-11/ [email protected] , Federal Tax Service letter dated April 24, 2017 No. BS-4-11/ [ email protected] ):

- 2002 - for bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, labor and (or) collective agreements (paid not at the expense of the organization’s profit, not at the expense of special-purpose funds or targeted revenues);

- 2003 - for remunerations paid from the organization’s profits, special purpose funds or earmarked proceeds.

What does the 4800 income code refer to? Income code 4800 - decoding of other types of income will be presented below; it applies to any other income that does not have a code designation, for example:

- daily allowances received in excess of the standard established by the local regulatory act of the organization;

- compensation accrued to an employee for the use of his personal property for the purposes of the organization, etc.

Income code 4800, which means other income in the 2-NDFL certificate, is also used to indicate a scholarship or remuneration to a student for work performed by him. Payments under a student agreement often raise questions, because Art. 217 of the Tax Code of the Russian Federation, which lists income that is not subject to personal income tax, also mentions scholarships. We emphasize that this article deals exclusively with those scholarships that are paid from the budget in state educational institutions. If the stipend is paid by an enterprise, it is taxed.

For information on how to return income tax paid on amounts spent on education, read the article “Procedure for the return of income tax (NDFL) for education .

New income code 2013

The Federal Tax Service of the Russian Federation, by order of October 24, 2017 No. ММВ-7-11/ [email protected], introduced a number of new income codes. These include 2013 and 2014, which accountants are required to take into account when filling out the 2-NDFL certificate from January 1, 2020.

Let's take a look at these new ciphers.

Code

What's hidden underneath?

Compensation for unused vacation to a dismissed employee

A dismissal benefit exceeding the usual three times the average monthly salary (six times for Northerners).

The company was fined for violating consumer rights

I had to write off a bad debt from my balance sheet

Interest on bonds of Russian enterprises

The table shows that the new income code 2013 in the 2-NDFL certificate will mean a compensation payment for unpaid vacation. Previously, this numerical combination was part of the general income code 4800. Now, certain payments have been separated out from it, which have acquired independent meaning.

Why do you need income and deduction codes?

Tax legislation requires employers (tax agents) to keep records of income paid to individuals, deductions provided and taxes paid. All amounts are reported to the Federal Tax Service in Form 2-NDFL and included in the income certificate, which is given to employees upon request or upon dismissal.

Read more: Reporting rules and sample of filling out the 2-NDFL certificate

For incorrect completion of reporting, including an incorrect personal income tax code when compensating for unused vacation, the employer faces a fine. Errors in paperwork are also undesirable for employees: sometimes they even lead to lawsuits.

How to apply the new income code 2013 in the 2-NDFL certificate

The procedure for using 2013 is the same as for conventional ciphers. If compensation was issued for unused vacation, then an entry is made in 2-NDFL in the corresponding month.

This is done on the second sheet of form 2-NDFL.

- Enter the month number. For example, May – 05;

- In the next cell put the code 2013;

- In the third column, indicate the amount of compensation.

Let us remind you that if an employee has worked for a whole year, then he is entitled to 28 calendar days of vacation. If before dismissal, he decided to take time off, then he will not receive any compensation.

If he decided not to walk these days, but to get money. Calculate the amount due to him and give it to him (ATM). Don’t forget to reflect this operation in the 2-NDFL report.

Important! In case of partial leave of absence, or when working for an incomplete year, compensation is calculated proportionally.

At the same time, in the report, even partial benefits for vacation will be reported under the income code 2013.

Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home! The service will remind you of all reports.

Certificate 2-NDFL tells about the employee’s sources of income, salary and taxes withheld. Each income source or tax deduction has its own code. These codes were approved by Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] At the end of 2020, the tax service changed the list of codes (Order dated November 22, 2016 No. ММВ-7-11/ [email protected] ). Since 2018, the tax office has made several more changes to personal income tax codes: four income codes and one deduction code. We will tell you in the article which codes need to be used in the 2-NDFL certificate in 2020.

General concept of 2-NDFL certificate for the Federal Tax Service

Organizations and individual entrepreneurs that employ individuals must report to the tax service for each employee to whom income is accrued.

Certificate 2-NDFL is necessary to inform the tax service and the taxpayer about payments transferred by tax agents that are subject to tax, such as personal income tax, in favor of individuals:

- Workers;

- Contractors;

- Individuals who receive dividends.

A separate 2-NDFL certificate is drawn up for each individual to whom income is accrued. If a certificate in Form 2-NDFL is not provided for each employee, then the tax inspectorate may impose a fine, the amount of which is regulated in paragraph 1 of Article 126 of the Tax Code of the Russian Federation. There is also a fine for incorrectly compiled reporting, the amount of which is also regulated by clause 1 of Article 126 of the Tax Code of the Russian Federation. If the company has registered a large number of employees, and certificates for them are not provided or are provided only with errors, then the imposition of a fine will hit the business very hard and the resulting sanctions from the Federal Tax Service will be very noticeable.

The new form of the 2-NDFL certificate was approved by order of the Federal Tax Service dated October 2, 2020 No. ММВ-7-11/ [email protected] From January 1, 2020, a new 2-NDFL reporting form will be introduced. Now there are two forms: one is submitted to the tax office, and the second is issued to an individual.

Now the 2-NDFL certificate is submitted to the tax office in two types. Let's take a closer look in table form:

| Type of certificate | Reflection of the help attribute | Deadline for submission to the tax service |

| The certificate contains all income, regardless of whether tax is withheld from it or not. | Attribute 1 is indicated | 2-NDFL reporting for the year must be submitted before April 1 of the year following the reporting year. |

| The certificate contains income from which tax has not been withheld | Attribute 2 is added | 2-NDFL reporting for the year must be submitted before March 1 of the year following the reporting year. |

Income codes that are always subject to personal income tax

Income code 2000 is wages, including bonuses (for harmful and dangerous work, for night work or combined work).

Income code 2002 is a bonus for production and similar results that are provided for in employment contracts and legal norms.

Income code 2003 – a bonus from the company’s net profit, targeted income or special purpose funds.

Income code 2010 – income from civil contracts, excluding copyright contracts.

Income subject to personal income tax in full

The most popular code is 2000 . This is the employee's salary. This also includes allowances for hazardous conditions and night work.

The remuneration of members of the Board of Directors is included in a special code. The role of the council may be performed by another management body. Indicate the remuneration of its participants using code 2001 in the 2-NDFL certificate.

A separate code was allocated for bonuses for results achieved in work. It is designated by number 2002 .

Employees can receive money from the company's net profit. Usually these are owners and top managers. Such income is marked with the code 2003 . This also includes targeted revenues and special-purpose equipment.

The company may employ persons engaged under a GPC agreement. Their income is accompanied by the code 2010 . Copyright agreements do not fall into this category.

Indicate income in the form of vacation pay with the code 2012 . But compensation for missed vacation is carried out according to code 2013 . Severance pay - 2014 .

Sick leave is also subject to income tax. Therefore, in the certificate there is a code for them 2300 . But maternity and child benefits are not subject to personal income tax, which means they are not included in the certificate.

An employee can give an interest-bearing loan. The amount earned from receiving interest is his income. Accompanied by number 2610 in 2-NDFL.

An individual who owns property can rent it out. For example, renting out a garage or an apartment. For such income the code is 1400 . This does not include revenue from the rental of vehicles, communications equipment and computer networks. code 2400 is allocated for them in 2-NDFL.

An employee can have their debt forgiven. Then personal income tax is withheld from him, since in essence this is already his income. The code in the help is 2611 .

For interest income on bonds of domestic firms there is code 3021 .

Indicate dividend income with number 1010 .

Rarely, but there are situations when income does not have an established number. These are accrued additional payments in excess of taxable daily allowances or additional payments for sick leave. This income is subject to personal income tax, and the certificate contains a universal code - 4800 .

There are other codes, but they are less common. For example, cash prizes are number 2750 . If you have earnings from foreign currency transactions, indicate it together with the code 2900 . There is an income code even for betting winnings - 3010 . Check out the full list of income and deductions on the 2-NDFL certificate.