Subsidies from the employment center

If you are just planning to open your own business, then the first thing you need to know about is the existence of a special program of the Ministry of Economic Development to provide subsidies to small and medium-sized businesses at the regional level. As part of this program, the employment center provides one-time financial assistance in starting your own business.

The amount is provided in the amount of 12 times the maximum amount of unemployment benefit. Previously it was 58,800 rubles. (based on the assumption that the unemployment benefit amount was 4,900 rubles). However, from January 1, 2020, the maximum benefit amount will increase from 4,900 rubles. up to 8,000 rubles, so the size of the subsidy may increase. One-time financial assistance is also provided for the preparation of documents: payment of state fees, performance of notarial acts during state registration, purchase of blank documentation, production of seals, stamps, legal services, consultations. For example, in the Moscow region, financial assistance for the preparation of documents amounts to 7,500 rubles.

A subsidy from the employment center is available to citizens over 18 years of age. But in order to receive it, they need to register with the employment center, that is, have unemployed status and receive benefits. It is also worth considering that subsidies are not given to everyone, since there are a limited number of them, and they are issued at the beginning of the financial year (you need to try to get into the right period). Vasily Puchkov, deputy director of the regional center for supporting the Olympic movement, talks about these and other subtleties.

Assistance in developing existing small businesses

Support for existing small businesses and those with positive development indicators is also provided within the framework of these programs. In addition, in recent years, the trend has been for government officials to develop mechanisms to stimulate the development of the manufacturing sector. Such programs are supported through the provision of subsidies and special loans.

When applying for financial support, it is important to correctly draw up a package of documents that will justify the request for government subsidies. It includes:

- an application drawn up in the prescribed form;

- a copy of the complete package of all constituent documents;

- copy of the founder's passport;

- certificate confirming inclusion in the register of small businesses;

- certificate confirming state registration.

You can increase the chance of a positive result of reviewing your request by including in your business plan:

- data on employee salaries and staffing levels;

- indicators of wage growth, maintaining the number of employees and increasing their number;

- data on the expected level of financial costs and payback periods.

Grant support

This measure of state support is usually provided by regional authorities. The grant is provided to a start-up entrepreneur in the form of a one-time subsidy, on a non-refundable and free basis. The maximum amount, as a rule, is 600,000 rubles. But depending on the region, the conditions for receiving grants may differ. Therefore, it is better to find out all the details locally. Money is allocated to those whose applications have passed the competitive selection process. The selection criteria include the field of business activity, the amount of revenue, the number of jobs, etc.

In 2020, beginning farmers can still count on special government support. The size of the grant under the “Support for Beginning Farmers” program can reach 3 million rubles. This amount, for example, is received by beginning livestock farmers in the Moscow region if they specialize in cattle breeding, and 1.5 million rubles each. provided to farms operating in other areas. The farm that received such a grant must create at least one job for every 1 million rubles. grant.

In Tatarstan for 2020, the amount of grant support under the Beginning Farmer program will be higher - it will amount to up to 5 million rubles. instead of the previous 3 million. So the conditions and amounts should be clarified in each specific case.

In addition, there are grants in the amount of up to 30 million rubles. for the development of family livestock farms.

In St. Petersburg, since 2020, the “Support for Social Entrepreneurship” program has been implemented, within the framework of which costs associated with the payment of rental payments and the acquisition of equipment are subject to reimbursement: rental of buildings, non-residential premises, rental of equipment and purchase of equipment.

In addition, a program to support entrepreneurs creating children's centers has been developed in St. Petersburg; support program for entrepreneurs involved in handicrafts, and other programs.

To find out more about receiving grants and subsidies, go to official government websites that provide information about business support measures. For example, on the website of the Ministry of Economy of the Republic of Tatarstan, all areas of state support are described in detail. For the Moscow region, such information is provided by the website of the Center for Entrepreneurship Development of the Moscow Region. The website “Small Business of Kuban” provides a detailed list of subsidies for entrepreneurs operating in the south of Russia.

It will be easier if you use the search in the “Support for SMEs in the regions” section on the Federal Portal of Small and Medium Enterprises. Just enter your region in the search and you will be automatically transferred to the “local” SME portal.

On the website of the Ministry of Economic Development of the Russian Federation, you can use the list of authorized bodies for supporting small and medium-sized businesses in the constituent entities of the Russian Federation.

Grant conditions

The main document required to receive a grant is a business plan.

The decision of the commission for issuing grants depends on its quality and relevance. Article navigation

- Small Business Development Grant 2020

- Conditions for receiving a grant to support small businesses

- List of documents for receiving a grant for starting a business from the state

- Small business grant amounts

- Refusal to issue a grant for starting a business in 2020

- How is a grant different from a subsidy?

- How to get a grant for small business development

- Grants from business incubators

Many business projects in Russia have come to life thanks to support from the state. After all, it is quite difficult to achieve success only with your own efforts and savings. The topic of our review is government grants for business development for individual entrepreneurs in 2020.

Federal business support programs

This type of business support can be divided into programs from:

- Ministry of Economic Development of Russia

His area of interest extends to the implementation of a program to provide subsidies from the federal budget to provide state support to SMEs in the regions (in accordance with Decree of the Government of the Russian Federation of December 30, 2014 No. 1605 and annually issued orders of the Ministry of Economic Development).

Funds are distributed on a competitive basis between regions and allocated for activities provided for by regional programs, but on the condition that the costs are co-financed by the regions.

The program of the Ministry of Economic Development involves direct and indirect support measures that can be counted on by those who produce goods, develop and implement innovative products, specialize in folk arts and crafts, carry out handicraft activities, promote rural and ecotourism, and develop social entrepreneurship.

- SME Corporations

This organization is engaged in solving a different range of problems, including providing financial, property, legal, infrastructural, and methodological support; organizes various types of support for investment projects, etc.

- JSC "SME Bank"

He is engaged in the state program of financial support for entrepreneurship, providing SMEs with direct guarantees for obtaining bank loans and helping to take advantage of credit resources when collateral is insufficient.

The organization acts as a guarantor for SMEs to fulfill their loan obligations, sharing with banks the risks that may arise as a result of a deterioration in the financial condition of the borrower. Guarantee products are available to SMEs wishing to obtain loans from SME Bank partner banks.

- Fund for Assistance to the Development of Small Enterprises in the Scientific and Technical Sphere

This organization is responsible for the development and support of small enterprises in the scientific and technical field and directly provides financial assistance to targeted projects. The “Umnik” program is especially well known, aimed at supporting talented young innovators. But there is also a program for startups “Start”, various offers to support enterprises “Development”, “Internationalization”, “Commercialization”.

- Ministry of Agriculture of Russia

Various government support measures are provided for the agro-industrial complex in 2020. Thus, from January 1, 2020, commodity producers, organizations and individual entrepreneurs engaged in the production, processing and sale of relevant products can apply to a bank authorized by the Ministry of Agriculture of Russia for a short-term or investment loan at a rate of no more than 5%.

There are also subsidies for manufacturers of agricultural machinery, a subsidy for increasing productivity in dairy farming, etc.

Regional support programs

To find out about support programs for constituent entities of the Russian Federation, use a special search filter.

More information about support programs and conditions on the basis of which you can apply for state assistance in business development can be found on regional portals for small and medium-sized businesses. For example, the Ryazan portal provides detailed information on types, forms, and support infrastructure.

Online accounting for self-employed entrepreneurs who do not understand accounting. Beginning entrepreneurs get a year as a gift!

Try for free

Subsidies for loan interest reimbursement

A business can count on compensation for the cost of paying interest on loans received from credit institutions for the support and development of activities, including the renewal of fixed assets (with the exception of loans received for the purchase of passenger vehicles).

The conditions for receiving a subsidy need to be clarified in the regions. For example, in Moscow they are as follows:

- the organization meets the criteria for an SME;

- the organization or individual entrepreneur is registered and operates in Moscow, and the duration of registration is at least 6 months before the date of filing an application for a subsidy;

- the period of overdue debt on taxes, fees and other obligatory payments on the day of filing the application does not exceed one month;

- there are no pending contracts for the provision of subsidies from the budget of the city of Moscow on the day of submission of the application;

- there are no violations of contractual obligations secured from the budget of the city of Moscow;

- there is a loan agreement with a credit organization included in the list of credit organizations selected in the prescribed manner by the joint-stock company "Federal Corporation for the Development of Small and Medium Enterprises", and which has concluded a cooperation agreement with the Department of Science, Industrial Policy and Entrepreneurship of the city of Moscow, or has received approval of the loan organizations for issuing a loan.

In 2020, the state will allocate 7.2 billion rubles to banks. for preferential loans for entrepreneurs, thus increasing budget subsidies for the soft loan program for small businesses in priority sectors by 11 times. This is provided for in the draft federal budget for 2020 and subsequent years 2020–2021. The total amount of expenses for the next 6 years will be 190.9 billion rubles.

The proposal is to issue loans to small and medium-sized businesses for projects in priority sectors at a rate of 6.5%. It will apply to such industries as agriculture, construction, transport, communications, tourism, manufacturing, electricity, gas and water production, healthcare, collection, processing and disposal of waste, industries in which priority areas for the development of science and technology are being implemented and technology.

According to the rules, the difference with market rates (3.1% under a loan agreement for medium-sized businesses and 3.5% for small businesses) is reimbursed to banks by the budget. In 2020, thanks to innovations, preferential lending will be provided in more than 200 billion rubles.

Can the state support any business?

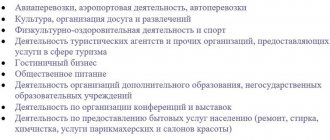

State support programs for small and medium-sized businesses are aimed primarily at industries that are a priority for the state

. They will help you with financing a business that will be useful for your region, region or even a specific city: for example, opening a pharmacy, developing crop production or tourism. But they will not support the gambling, alcohol or cigarette businesses.

The programs also have requirements for the entrepreneurs themselves: you can receive support only if you have not violated the terms of the programs

before. For example, if you have already been given subsidies, but you spent them on other purposes, you may end up on the “black list” and will no longer be able to count on government support.

Another obvious requirement is to meet the definition of a small and medium-sized business

.

The Law on the Development of Small and Medium Enterprises distinguishes three categories of enterprises:

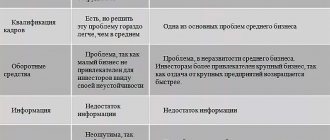

- microbusiness (no more than 15 employees in the company and annual turnover up to 120 million rubles);

- small business (no more than 100 people in the company and turnover up to 800 million rubles);

- medium business (no more than 250 people in the company and annual turnover up to 2 billion rubles).

At the same time, some measures of state support for entrepreneurs can be designed both for all three categories simultaneously, and for only one of them, for example, for medium-sized businesses.

Some programs have additional requirements. To participate you must be, for example:

- aspiring entrepreneur

, that is, open your first business.

- young entrepreneur

. This criterion is suitable for individual entrepreneurs under the age of 30 inclusive and companies in which at least half of the authorized capital belongs to entrepreneurs under the age of 30 inclusive.

There are several levels of government support. According to the federal program of the Ministry of Economic Development of the Russian Federation, money is issued to regions on a competitive basis or taking into account certain criteria. Local authorities distribute this money and funds from their own budgets in areas of priority specifically for their region. There are also special programs of state support for small and medium-sized businesses, for example from the SME Corporation or from the Ministry of Agriculture.