How to fire an employee due to death and what to do if there is no certificate?

If an employee of the organization has died, then the procedure for terminating the contract with him is as follows:

- Relatives or dependents of the deceased provide the employer with a corresponding death certificate. If the employee was single, the head of the company (enterprise) can obtain the document himself when contacting the registry office, if he himself handled the funeral. If there is no information about the employee, the employer may apply to the court to declare him dead.

- The dismissal order, prepared by the HR department, is submitted for signature to the employer in the person of the head of the company (enterprise).

- Information about the order is entered into the appropriate accounting journal.

- A certificate of invoice is issued.

- The employee’s personal card is filled out.

- A new entry about dismissal is made in the employee’s work book.

- After completing all the necessary personnel documentation, the deceased’s employment record is provided to the dependents or relatives of the deceased. In the absence of such persons, this document is sent to the archives of the company (enterprise).

Relatives of the deceased do not always submit a death certificate in a timely manner . However, the employer cannot order a duplicate of this document from the registry office. This is only possible if such a certificate is lost or damaged.

As a result, the head of the organization needs to establish contacts with the dependent or close relatives of the deceased. After all, he cannot dismiss a deceased employee from work until he receives the appropriate death certificate.

In the absence of a death certificate and information about the employee’s last whereabouts, the employer must file a lawsuit to declare such a person dead or missing (clause 6 of Article 83 of the Labor Code of the Russian Federation). If the stated claims are satisfied, the court makes an appropriate decision.

A person is considered missing if for 12 months at his place of registration there is no information about his current place of residence (Article 42 of the Civil Code of the Russian Federation).

An employee is recognized by the court as deceased if there is no reliable information about the location for 5 years or more, and if he went missing under emergency circumstances or in the event of death due to an accident - within 6 months (Article 45 of the Civil Code of the Russian Federation).

What number should I use for payment?

According to Art. 84.1 of the Labor Code of the Russian Federation, the day of dismissal of an employee is considered his last day of work. However, the day of termination of the contract with a deceased employee is the day of his death, established by the death certificate, or the day a court decision to recognize such a person as missing or deceased enters into legal force.

It is incorrect to talk about the dismissal of a deceased employee. Therefore, the order only talks about the date of termination of the employment contract.

In practice, relatives of the deceased do not always notify the administration of the enterprise (company) about the death of an employee. If such a situation arises, the employer gives the employee absenteeism.

After two absences have been recorded, the employer can legally dismiss the employee. However, if the employee died, such actions of the official are considered a violation of labor rights. Therefore, the employer should find out the reasons for the employee’s temporary absence from his workplace, and then make the necessary personnel decisions. Information about the death of a citizen can be obtained from the police .

If an employer decides to fire an employee for absenteeism because he cannot contact relatives and obtain information about the death, the documents must be completed correctly - send a letter to the employee inviting him to provide an explanation for his absence from work and record the fact that the letter was sent.

What documents are needed?

If you receive a death certificate for an employee or a court decision declaring him dead, the company must make a copy of this certificate and prepare the following documentation regarding the deceased employee:

- order to terminate the employment contract;

- certificate-calculation;

- work book;

- personal card.

An order to terminate an employment contract due to the death of an employee is issued on the same day when the head of the organization receives the relevant court decision or death certificate.

Moreover, in this case, the employer does not need to carry out the procedure of familiarizing himself with such an order, because the employee to whom it concerns is no longer alive. The date of termination of the contract will be the date of death.

How is an order issued?

An order to terminate an employment contract for a deceased employee is drawn up in form T-8 , established by Resolution of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004. The company can develop its own form, because the T-8 form is only a guideline.

As a reason for canceling an employment contract (agreement), the following should be indicated here: “death of an employee, clause 6, part 1, art. 83 Labor Code of the Russian Federation." In the line indicating the grounds for dismissal, you must leave a link to the death certificate and the number of such document (or court decision).

Not all sections of the order are filled in (for example, the line about the employee familiarizing himself with the order remains empty). In addition, dependents or relatives of the deceased also do not sign such a document.

The order is drawn up by a responsible official , who is usually an employee of the personnel department. Then this document is submitted for signature to the head of the organization’s company, and then registered in the appropriate accounting book.

The order to dismiss a deceased employee is dated on the day the employer receives the relevant death certificate or court decision. The date of termination will be the date of death as reflected on the death certificate. Moreover, this date does not change if the deceased employee:

- was on sick leave;

- business trip;

- on holiday;

- died on a holiday or Saturday (Sunday).

An order to terminate an employment contract with a deceased employee of an organization is drawn up on the day the employer receives a court decision or death certificate, and not on the day of the employee’s actual death. Moreover, the official date of termination of labor relations in such a situation is precisely the day of death, established by one of the documents.

Example. Ivanov D.R. died on November 7, 2020. His wife gave the death certificate to his employer on November 15, 2020. Then the dismissal order will be drawn up on November 15, 2020. The date of termination of the employment contract with the employee in this situation will be November 7, 2020.

Step-by-step instructions for dismissal due to the death of an employee

If an employee of an organization passes away, the dismissal process is carried out in accordance with the standard scheme. It looks like this:

- Relatives report the incident and provide supporting documentation. Representatives of the company must copy it and draw up an appropriate order.

- The HR specialist prepares the order. It records the employee’s personal data. You can specify the specialist’s personnel number. Additionally, you must indicate the reason for dismissal. A copy of the document confirming the death of the specialist must be attached to the order.

- A notice of dismissal is filled out. It must clearly contain the number when cooperation with the specialist is terminated. The number must match the date of death. This rule applies even if the death certificate was provided on a different day. This is true when a person is listed as absent from the organization. Additionally, you need to indicate the name of the paper that serves as the basis for dismissal. The line that is supposed to confirm familiarization with the order remains blank.

- The order is transmitted to the head of the enterprise. A wet stamp is placed on it. The paper is then recorded in a journal.

- A settlement certificate is being issued. It must be completed by two specialists. One of them is an employee of the HR department, who must indicate the details of the organization, information about vacations used, the personal data of the specialist and the actual period of time worked. The information is necessary to perform accounting calculations. The second part of the certificate is filled out by an accountant. The specialist calculates the required payments based on the data provided by the personnel service.

- A citizen’s personal card is being issued. To close it, you must make a record of dismissal. No additional data required.

- An entry is made in the work book. The law obliges the head of the organization to state the fact of termination of the employment contract and the basis for the decision. All entries made are certified by the employer or other responsible person. Additionally, the organization's seal is affixed. The column intended for the employee’s signature is not filled in.

Additionally, you need to make an entry in the accounting book. When filling out the documentation is completed, the work book is provided to the relatives of the deceased.

What entry should be made in the work book of the deceased?

In the “Work Information” section of the deceased’s work book, the personnel officer must enter the following information about the employee:

- In column No. 1 - the number of the new entry.

- In column No. 2 - the date of termination of the contract. In particular, if the date of cancellation of the employment contract is November 7, 2020, then column No. 2 indicates the following date: “11/07/2019”.

- In column No. 3 - “The employment contract was terminated due to the death of the employee, paragraph 6 of part 1 of Article 83 of the Labor Code of the Russian Federation.”

- In column No. 4 - a link to the dismissal order (for example, “Order dated November 15, 2019 No. _”).

All of the above entries in the deceased’s employment record are certified by the official seal of the company and the signature of the personnel officer. An individual entrepreneur also puts his stamp and personally signs the work document. Then the record of the deceased’s work record is entered into the work record book.

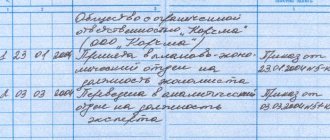

Sample entry in the work book about dismissal due to the death of an employee:

Relatives or dependents should not leave the work book of the deceased with the employer - such a document officially confirms that the administration of the company (enterprise) has no claims against the former employee.

If none of the relatives or dependents applied for the deceased employee’s work record, the employer is obliged to store it in the organization’s archives for 50/75 years (clause 449 of the List approved by order of the Federal Archive No. 236 of December 20, 2020). The specified List is valid from February 18, 2020.

Drawing up an order for dismissal upon death of an employee

The corresponding document is drawn up according to the standard T-8 form. In such an order, they try not to use the word “dismiss”. As a rule, they write “terminate the employment relationship” and indicate the reason: “due to death.” There is no signature in the line “I have read the order”; relatives should not sign there either.

Sample letter of dismissal due to death

Calculation rules

Relatives of a deceased employee are entitled to various payments and compensations. These payments are indicated in the corresponding calculation certificate.

The calculation certificate is filled out by two specialists - a personnel department employee and an accountant . The last of them calculates wages and other payments due to the deceased employee, based on the data provided by the personnel officer.

What payments and compensations are due and to whom should they be paid?

Wages, compensation for unused vacation and other payments due to the deceased employee must be paid to the relatives of the deceased (mother/father, spouse, children) or his dependents (Article 141 of the Labor Code of the Russian Federation).

Moreover, according to Art. 1183 of the Civil Code of the Russian Federation, one of the close relatives or dependents of the deceased must have time to contact the relevant employer within 4 months from the date of opening of the inheritance. From the moment of such an application, wages and other payments for the deceased are issued within 7 days.

To receive such payments, the applicant submits the following documents to the deceased’s employer:

- statement;

- personal passport;

- a document certifying the relationship with the deceased (birth, adoption or marriage certificate).

In addition, in some situations, relatives of a deceased employee are entitled to appropriate financial assistance. However, the clause on its provision must be specified in the employment contract (agreement) of the employer with the deceased employee or in the corresponding internal act of the head of the organization.

A relative of the deceased or another person who was involved in his funeral has the right to receive a separate social benefit for burial from the deceased’s employer. Since the beginning of February 2020, the amount of such payment is 6124.86 rubles. Taking into account regional coefficients, this payment may be higher.

In accordance with paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, wages and other payments earned by a deceased employee are not subject to personal income tax . Therefore, the entire amount is given to the applicant.

As a result, in the event of dismissal of an employee of an organization due to his death, the employer and relatives (dependents) of the deceased must keep in mind some of the nuances of this procedure. Relatives and dependents have the right to receive appropriate compensation and payments due to the deceased, but for this they must provide a death certificate of the employee.

The employer is obliged to hand over the work book of the deceased to the relatives. If the deceased had no relatives (he was single) or they did not take the work book, such a document is sent to the archives of the organization.

Calculation of payments

After issuing the dismissal order, the accounting department must accrue the appropriate payments. The company can pay the accrued amount within 4 months from the date of death of the employee. If during this period the relatives do not apply, then the entire amount is added to the inheritance. If there is no inheritance, then the money remains with the employer.

This is also important to know:

Dismissal by agreement of the parties with payment of compensation: how to formalize and calculate the amount of payment

Relatives, spouses and persons who were dependent on the deceased can receive payments. If there are several applicants, the entire amount is given to the first applicant. If a controversial situation arises, you can invite relatives to come to an agreement or go to court.

The company must pay the entire amount within 1 week after the relatives apply.

A deceased employee is entitled to payments as for a normal dismissal:

- salary;

- sick leave;

- all necessary allowances;

- bonuses;

- compensation for unused vacation.

In addition to them, financial assistance to relatives or compensation for burial may be awarded for consideration by the management. We will consider the procedure for calculating all payments in the table.

| No. | Name of payments | Accrual procedure | Peculiarities |

| 1. | Wage | Payroll continues until the day of death. According to the timesheet, days worked are calculated and wages are calculated. In this case, all allowances, bonuses, etc. are taken into account. | The day of death is not paid. |

| 2. | Vacation compensation | The company is obliged to pay compensation for unused vacation. Accruals are made in accordance with current legislation. If at the time of death the employee was already on leave, which was provided to him in advance, then no one returns the money back. | |

| 3. | Sick leave | If a person died during his illness, then the ballot closes on the day of death. | The day of death is not paid |

| 4. | Compensation for burial | It is calculated based on receipts and invoices provided by relatives. This payment can be received by any person who spent his personal savings on funerals. | Amounts to 5740.24 rubles. |