How to close an individual entrepreneur in Elba

Elba will help you submit a declaration under the simplified tax system or UTII and will calculate insurance premiums after the closure of the individual entrepreneur.

In the "Details" section, scroll down to the bottom of the page. Check the box “I closed the individual entrepreneur and know the closing date.” Indicate the date when you closed the individual entrepreneur - according to the state register entry sheet that was given to you by the tax office.

Then, in the “Current tasks” section, complete tasks on insurance premiums and reporting. They will be generated taking into account the date when you closed the individual entrepreneur.

What is needed to close a sole proprietorship

Using the simplest example of an individual entrepreneur without employees, let’s look at what documents need to be submitted during the year and what to pay. Entrepreneurs in the Russian Federation are encouraged to use a general or special tax regime.

Entrepreneurs working under OSN:

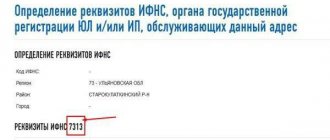

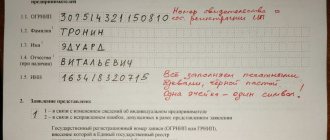

- They declare income using Form 3-NDFL. (The sample for filling out the 3-NDFL declaration changed last year).

- Quarterly VAT declaration.

- Makes payments for pension and health insurance.

IP on the simplified tax system in 2020:

- Advance payments are made every three months.

- At the beginning of the new year, they submit a declaration to the simplified tax system.

- Make payments for compulsory medical insurance and compulsory health insurance.

Individual entrepreneurs using UTII in 2020:

- Makes payments to the Federal Compulsory Medical Insurance Fund and the Pension Fund.

- Provides UTII declarations quarterly.

IP on PSN:

- Makes payments to the Federal Compulsory Medical Insurance Fund and the Pension Fund.

- Reporting is submitted only if there are workers.

When using different taxation regimes, the deadlines for submission and the procedure for submitting reports differ.

The procedure for collecting pension contributions after the closure of an individual entrepreneur

After deregistration of an individual entrepreneur, 15 calendar days are given to voluntarily repay outstanding contributions. If during this time the debts are not settled, the process of forced collection of insurance premiums is launched. Tax officials are filing a lawsuit. After a court decision is made, the bailiffs seize the individual’s property in the amount of the existing debt.

We recommend reading: Taxes and contributions of individual entrepreneurs: types, terms and amounts of payments to the tax office.

Individual entrepreneur's debt for insurance payments

The individual entrepreneur must pay funds for payments for two insurance payments to the Pension Fund of the Russian Federation to a current account (personal under certain conditions, the movement on which can be tracked by visiting the account, where you can also find out the current percentage), as savings capital. Mandatory payments include established financial. contributions (payment of current payments, interest and fines/penalties) to the Pension Fund and contributions to the state Compulsory Medical Insurance Fund, i.e. compulsory medical insurance. insurance of citizens. In this case, compulsory medical insurance is divided (not always, it is important to clarify the purpose of the payment at the Pension Fund branch) into two contributions, namely into transfers to the savings capital of the Russian Federation and territorial bodies. Before making payments, it is necessary to find out the presence or absence of debt in the Pension Fund for a businessman conducting individual activities, and also visit the methodologist’s office at the Pension Fund branch.

It is important to understand that payments and capital are interrelated concepts, since insurance premiums and the resulting interest are accumulated.

In anticipation of mandatory payments and insurance contributions to the Pension Fund, an entrepreneur conducting individual activities must make sure that there are no overdue payments on his account for the previous period. If there is currently a large debt, it is necessary to urgently repay the outstanding financial claims.

How does closing an individual entrepreneur differ from liquidating an LLC?

When answering the question of whether it is possible to close an individual entrepreneur with debts, it is worth remembering the legal status of an individual entrepreneur. An individual entrepreneur is an individual who has received the right to engage in business. In this case, the entrepreneur bears full property liability for all his obligations. And even the cessation of entrepreneurial activity does not change anything in this sense.

Here is what the Ministry of Finance says about this in letter No. 03-03-06/1/25384 dated April 27, 2017: “Thus, after a citizen ceases to operate as an individual entrepreneur, he continues to bear property liability to creditors for his obligations.”

Indeed, after deregistration as an individual entrepreneur, the person himself does not go anywhere. But if a company closes, it is excluded from the Unified State Register of Legal Entities, after which the legal entity ceases to exist.

That is why the LLC liquidation procedure begins with notifying creditors so that they can make claims against the still operating organization. And if it turns out that the company’s financial insolvency was caused by the actions of the founders, they will be held vicariously liable.

Conditions for early termination

Individual entrepreneurs who officially cease their activities pay contributions only for the period while the entrepreneur’s status was valid. Accordingly, if insurance premiums were paid ahead of schedule and in full, then the individual entrepreneur has the right to terminate the contract and return the funds.

In this case, it is necessary that the fact of overpayment be reflected in the Pension Fund of Russia, as well as in the tax office. Therefore, it is necessary to submit all the latest reporting documents on deductions to the Pension Fund and the tax service. If you paid contributions before the liquidation of the individual entrepreneur, then you do not know the end date of the “action” of the individual entrepreneur. This means that an overpayment could well have occurred, so after the liquidation itself you can request a refund.

What awaits an entrepreneur who closed a business, but did not “close” the individual entrepreneur?

First, payment of dues. If you are not conducting business, but the individual entrepreneur has the status of “active”, then you are required to continue paying contributions. It is impossible to avoid such payments.

Secondly, fines. If you do not submit reports on time, the government agency will certainly issue fines for each report not submitted on time.

Thirdly, penalties and fees. The tax authority charges penalties on the amount of unpaid contributions. The fees will be assessed by the enforcement authorities of debt collection.

It should be noted that if you have a debt, the next government agency you will have to get acquainted with is the bailiffs. According to the law, it is these representatives who are responsible for collecting debts; this procedure is called enforcement proceedings.

The Tax Service (previously this issue was handled by the Pension Fund) sends the demand for collection of debt collection directly to the bailiff service, bypassing the court. Having received such a demand, the bailiff initiates enforcement proceedings.

Next, the bailiff notifies the debtor of the need to repay the debt within five days voluntarily. If this does not happen, the debt is collected forcibly.

Many entrepreneurs, ignoring the payment of collection debts, forget that to pay off the debt of an individual entrepreneur, the bailiff has the right to use both accounts and property for business activities, as well as personal accounts and property of the debtor.

For example, debtor “A” has a personal car, purchased long before the registration of an individual entrepreneur, and “A” himself is engaged in the manufacture of wood products. If “A” has debts on fees and taxes for conducting activities (as an individual entrepreneur), then the government body can take away and sell his personal car to return the money to the budget.

How to calculate fixed individual entrepreneur contributions for yourself for less than a full year?

Individual entrepreneurs are required to pay insurance payments for themselves from the date of registration as an individual entrepreneur to the closing day, including the last days. If an individual entrepreneur closes or opens during the year, then this year is incomplete, and for it the amount of contributions must be calculated separately, taking into account the status of an entrepreneur.

For a full year, the amount of insurance payments for compulsory pension and health insurance includes:

- fixed payment for OPS = 32,448 rubles. (for 2020, there is a benefit for victims of coronavirus, the amount is reduced to 20,318 rubles);

- additional pension contribution in the form of interest for incomes over 300 thousand rubles. = 1% × (Annual income - 300,000) ;

- fixed payment for compulsory medical insurance = 8,426 rubles.

For a full year, fixed contributions are transferred until the end of the accounting year, interest - until July 1 of the following year.

If during the year a person closes an individual business or opens one, then the year is incomplete; accordingly, the insurance amount to be paid for oneself must be reduced in proportion to the period worked in the status of an individual entrepreneur.

When closing , you need to calculate what part of the fixed contributions falls on the period from January 1 of the accounting year to the day of termination of business specified in the certificate, inclusive.

When opening , you need to calculate what part falls on the period from the date of registration indicated in the certificate, inclusive of December 31 of the accounting year.

To calculate the insurance amount payable for compulsory health insurance and compulsory medical insurance (fixed part), you must first determine the part of the contributions falling on full months, then calculate the part falling on days in an incomplete month (in which the individual entrepreneur was opened or closed), add up the received meanings. The result will be the amount of the fixed insurance payment for compulsory health insurance and compulsory medical insurance that the citizen must pay on time for himself.

Formulas for calculation:

Contribution for full months of work as an individual entrepreneur = Annual fixed payment ÷ 12 months. × Number of complete months.

Contribution for days of work as an individual entrepreneur in an incomplete month = Annual fixed payment ÷ 12 months. × Number of days as an individual entrepreneur in an incomplete month ÷ Number of calendar days in an incomplete month.

Total fixed payment = Contribution for full months + Contribution for days in an incomplete month

For example, if an individual entrepreneur ceased its activities on September 29, 2020, then contributions must be calculated for the period from January 1 to September 29, 2020, with 8 full months (from January to August) and one incomplete month - September, in which the person was an entrepreneur within 29 days.

Below is an example of a calculation in the case where an individual entrepreneur closes in mid-2020.

Percentage on the amount exceeding 300 thousand rubles.

The actual time spent in the status of an individual entrepreneur does not in any way affect the payment of an additional 1% on the amount of excess income over 300 thousand rubles.

If an individual entrepreneur’s income during work in the accounting year is more than 300 thousand rubles, then you need to additionally calculate 1% of the difference between the actual income and 300,000. It does not matter when he stopped his activities and when he started them.

For example, if an individual entrepreneur closed on July 20, 2020 and managed to earn 500,000 rubles in the period before closing from January 1 to July 20, 2020, then you need to separately calculate the part of fixed insurance payments for compulsory health insurance and compulsory medical insurance using the formulas given above (in proportion to work as IP) and further calculate the percentage of excess using the formula = 1% × (500,000 - 300,000).

Example of calculating insurance payments at closing in 2020

Initial data:

The individual entrepreneur is engaged in the retail sale of food products and closes on October 5, 2020 - this date is indicated in the certificate of termination of activity as an individual entrepreneur.

The amount of income received for the period from January 1 to October 5, 2020 = 480,000 rubles.

How to calculate contributions payable for yourself:

Retail sales of products are not included in the List of industries affected by coronavirus, and therefore the size of the fixed insurance payment for this individual entrepreneur is standard, established for 2020 (not reduced).

In 2020, the individual entrepreneur worked for 9 full months (from January to September) and 5 days in October before closing.

Fixed on OPS = (32,448 ÷ 12 × 9) + (32,448 ÷ 12 × 5 ÷ 31) = 24,336 + 436 = 24,772 rubles.

Fixed on compulsory medical insurance = (8,426 ÷ 12 × 9) + (8,426 ÷ 12 × 5 ÷ 31) = 6,319.5 + 113.3 = 6,432.8 rubles.

Additional on OPS = 1% × (480,000 - 300,000) = 1,800 rubles.

Transfer of insurance payments must be made before October 20, 2020 inclusive.