Finding out the form of taxation of an individual entrepreneur is a task that arises in a number of cases: for example, you need to check the taxation system of a counterparty - an individual entrepreneur, or the individual entrepreneur himself wants to clarify information about himself.

An individual entrepreneur can apply various taxation systems: OSN, simplified tax system and others. He must clearly understand what system he is working under, because the payment of taxes depends on this, and violation of obligations to the state threatens with serious fines. However, the question “what taxation system is the individual entrepreneur on” often arises in practice. Situations are different; often intermediaries help entrepreneurs fill out documents to open a business; Some individual entrepreneurs, who have not carried out activities for a long time, may simply forget about the applied regime. Or you need to get information about the counterparty - individual entrepreneur. What actions should you take to obtain the necessary information? More on this later in the article.

How to get the information you need from documents

First of all, you should check the documents on obtaining special status. The following points must also be taken into account.

When registering an individual entrepreneur, the general taxation regime is applied automatically if the entrepreneur has not submitted the appropriate document about his intentions regarding the choice of taxation regime to the Federal Tax Service of the Russian Federation:

- STS - notification of the transition to a simplified tax system (Article 346.13 of the Tax Code of the Russian Federation) in form No. 26.2-1, approved by order of the Federal Tax Service of the Russian Federation dated November 2, 2012 N MMV-7-3 / [email protected] ;

- UTII - application for registration as a UTII taxpayer (Article 346.28 of the Tax Code of the Russian Federation) according to form No. UTII-2, approved by order of the Federal Tax Service of the Russian Federation dated December 11, 2012 N ММВ-7-6/ [email protected] ;

- PSN - application for a patent (Article 346.45 of the Tax Code of the Russian Federation) in form No. 25.5-1, approved by order of the Federal Tax Service of Russia dated July 11, 2017 N ММВ-7-3/ [email protected]

If the entrepreneur has not filled out such applications, he is guaranteed to be on the ORN.

In addition, if an application is submitted for registration as a UTII taxpayer or for the acquisition of a patent, a response must be received (notification of registration, patent or refusal to issue it).

In addition, UTII and PSN apply only to the types of activities specified in the Tax Code. Regional authorities also have the right to narrow this list. Therefore, it is worth familiarizing yourself with the lists of types of activities in the Tax Code of the Russian Federation and local laws and comparing them with those listed in the extract from the Unified State Register of Individual Entrepreneurs. For example, in the capital, in accordance with the decision of local authorities, UTII is not applied at all.

For what purposes is information about the tax system required?

There are cases when an organization or business entity did not work for a certain period of time. If previously it used a taxation system different from the general one, you should check with the territorial tax service about the procedure for calculating taxes in force on the date of resumption of operations. For example, in previous working periods, one of the conditions for the application of the simplified tax system was violated by the enterprise (the maximum number of employees or income for the year, the share of third-party organizations in the authorized capital was exceeded as a result of a change of founders).

Firms engaged in registration and documentary support of activities, obtaining licenses and permits on orders from enterprise clients will additionally learn information about the procedure for their taxation for the correct execution of permits.

The norms of the Tax Code of the Russian Federation exempt a number of organizations from paying value added tax according to the type of their activity, for example:

Tax offset

- In the field of education, preschool education, culture, art

- Basic services of banks and insurance organizations

- Funeral services

- In the field of healthcare, care for disabled people

- Archive services

- Sanatoriums, resorts in Russia

- Pharmacies

- Associations of lawyers

For correct tax accounting and calculation of value added tax amounts, it is necessary to know exactly the taxation system used by each counterparty. According to the Tax Code of the Russian Federation, “simplified” companies are exempt from paying VAT and do not issue invoices to their counterparties with the allocation of tax for the possibility of its deduction by recipients of goods or services. But if an organization using the simplified system performs the function of an intermediary (under a commission agreement), the value added tax in the invoice must be allocated and accepted for tax deduction. It turns out that according to the commission agreement, in order to correctly account for VAT, the recipient of the goods needs to check the tax status of the supplier and intermediary.

VAT payers also do not receive a tax deduction when dealing with payers of the single agricultural tax. The recipient’s inability to receive a tax deduction leads to an increase in his costs and loss of competitiveness, so customers who pay value added tax try to limit or completely eliminate business contracts with VAT evaders.

Important! Legislative norms of the Russian Federation place the responsibility for verifying the accuracy of information about the tax system used by the counterparty and the corresponding VAT accounting on the recipient.

False information provided by mistake by the counterparty does not exempt the recipient from penalties for incorrect inclusion of amounts in the tax deduction.

Example. Luch LLC, due to the lack of information about the tax status of several counterparties in 2020, overestimated the total amount of tax deductions by 300 thousand rubles. After identifying a violation by the Federal Tax Service during a control on-site inspection in the first quarter of 2020, the company was presented with financial sanctions in the amount of underestimated VAT of 300 thousand rubles, a 20% fine of 60 thousand rubles and a penalty for late payment of tax.

The current system of calculating and collecting value added tax and other payments to the budget is fraught with a significant number of pitfalls that can lead to an increase in taxes and penalties. To avoid receiving an unexpected fine out of the blue that leads to financial difficulties, carefully check the taxation system used by your business partners.

Top

Write your question in the form below

What you can find out on the Federal Tax Service website

The surest way to check the tax regime of your individual entrepreneur is to log into your personal account on the website of the Federal Tax Service and find the answer to your question there. The answer looks like this:

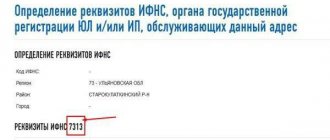

Let's now see how to find out the taxation system for individual entrepreneurs by TIN using the Federal Tax Service website.

If the entrance to the taxpayer’s personal account is not available for some reason, you can use another option. On the information page from the Unified State Register of Legal Entities, you need to enter the TIN of the individual entrepreneur (or other information identifying him: for example, OGRNIP or full name) and click the “Find” button. A report will be generated based on the search results. A “Get statement” button will appear next to the required individual entrepreneur. The extract will be generated as a pdf file. It contains all important information about the taxpayer, including a list of documents. If an individual entrepreneur applied for a transition, for example, to a simplified system, the statement will show information about this.

How to find out the tax system of a counterparty by TIN

When working with legal entities for the long term, it is worth carefully studying your business partners.

It is important to find out the taxation option of the counterparty:

- Obtain information about the integrity and responsibility of the partner. If a counterparty who evades paying taxes, including VAT, is chosen for cooperation, then sanctions will be imposed on the business partners of the culprit.

- To maintain accounting records, you will need information about counterparties, forms for filing declarations and the tax rate.

There are several ways to find out which tax mechanism your partner is on. Let's look at each in more detail, focusing on online tools. Please note that obtaining information on the TIN online provides access to a limited set of knowledge; confidential information is provided only to the business owner regarding himself. Using the Internet, an entrepreneur has the right to access the official website of the Federal Tax Service, the government services portal and the platforms of outsourcing companies.

To clarify information both online and during a personal visit, you will need the counterparty’s TIN.

Contacting the Federal Tax Service is a direct and elementary way to obtain information. First, it is permissible to visit the agency in person and request information. It is permissible to contact either the department at the place of registration of the individual entrepreneur or another department. Since information is requested from a common system, belonging to a specific locality is not required.

Secondly, if an entrepreneur is connected to the online reporting mechanism, then he has the right to use the official website of the tax service to obtain information.

There is no unified form of contact, but the response comes in the form of an email that contains:

- information of interest about the counterparty

- seal;

- inspector's signature.

When controversial situations arise, the paper acts as evidence and argument. Clarifying how to check the information in person, we note that at the territorial branch of the Federal Tax Service you need to request information about the counterparty, indicating the personal data of the partner.

At the moment, providing information from the Unified State Register of Legal Entities through the public services portal is not profitable. A fee of fifty thousand rubles is charged for the option, and the processing time for the application is five working days.

The procedure looks like this:

It is preferable to use the resources of the official website of the Federal Tax Service for free or other services at a lower cost. Most of the options related to the tax service on the government services portal and in the MFC are provided for a significant fee. It is recommended that you contact the department directly.

The option allowing access to information from the Unified State Register of Legal Entities is available to users who have verified their identity. The procedure is carried out through a personal visit to a government agency: MFC, tax office, Pension Fund and others.

In addition to official government services, there are outsourcing companies. The services also include obtaining information about the counterparty.

Companies can order the following options:

- request information about counterparties;

- accounting;

- submission of reports and more.

Some are interested in how to determine information about a counterparty according to OKVED; we note that the codes do not reflect the taxation mechanism, but will indicate it if we are talking about agriculture or activities related to patent law.

How to request information from the Tax Inspectorate

Contacting the Tax Inspectorate is perhaps the most effective, fastest and reliable way to obtain the necessary information about the taxation system. You can contact the inspector personally with your passport and Taxpayer Identification Number (TIN) and explain the situation.

You can also generate a request for confirmation of the fact that the simplified tax system is applied, as if the notification of the transition was not submitted. If it was indeed sent and the system is applied, the Federal Tax Service of the Russian Federation must respond to this request with a confirmation letter in form No. 26.2.-7. There is also the opportunity to request Form 39, a certificate of debt; this form will reflect the tax line for which the entrepreneur is obliged to report and pay tax. If the individual entrepreneur sent a notification about the transition to the simplified tax system, then he will find the corresponding line in the certificate.

What types of taxation can an individual entrepreneur use?

By registering the right to conduct business, an individual entrepreneur independently chooses the future taxation system.

The choice of the entrepreneur determines how much taxes he will pay, what reports he will have to submit, and what activities he will be able to engage in. Currently in the Russian Federation there are 5 systems for collecting mandatory contributions and payments to the budget:

- general - OSNO;

- simplified - simplified tax system;

- single tax on imputed income - UTII;

- unified tax on agricultural activities - UNA;

- patent - PNS.

You will learn about the differences in tax regimes from the article “Which taxation system is better for individual entrepreneurs?”

Tax legislation does not prohibit mixed taxation, that is, the use by a taxpayer of more than one tax regime at the same time. For example, hotel business owners use the simplified tax system for income from renting out residential rooms in hotels and UTII when organizing meals for guests.

Note! Combining the simplified tax system and OSNO with the norms of the Tax Code of the Russian Federation is not allowed (letter of the Ministry of Finance of the Russian Federation dated September 8, 2015 No. 03-11-06/2/51596, determination of the Constitutional Court of the Russian Federation dated October 16, 2007 No. 667-О-О).

How can you find out what tax regime an individual entrepreneur has?

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Who may be interested in what tax regime the individual entrepreneur is in?

Before we tell you how to find out the type of taxation of an individual entrepreneur, let’s consider who may need such information and why.

Naturally, the tax regime of an entrepreneur may be of interest to his counterparty. It is known that taxpayers applying special tax regimes do not calculate or pay VAT, with the exception of some cases specifically specified in the Tax Code of the Russian Federation (import of goods into the Russian Federation, etc.). Therefore, a company planning to work with an entrepreneur must understand how beneficial this will be for it.

Also, in practice, sometimes the entrepreneur himself needs information about his taxation system. For example, if:

- he is just starting his business, has registered with the help of third-party specialists and wants to check the tax regime assigned to him;

- there is a change in the employee responsible for tax and accounting reporting;

- An individual entrepreneur is switching to a different tax regime and wants to make sure that the tax authority has received his notification.

Note! The main tax regime in the Russian Federation is the general taxation system (OSNO), which is applied by default. Therefore, if an entrepreneur did not submit an application to the tax authority to switch to one of the special tax regimes or the application for some reason did not reach the tax office, he will have to use the general tax regime - OSNO. Otherwise, he may be subject to tax liability.

What types of tax regimes are there?

According to the tax code, there are several types of tax regimes.

General taxation system

Note! This system is used by default, in the absence of requests to switch to other systems. This system will be suitable for all business entities.

Under OSNO, the following are paid: VAT, income tax, property tax, personal income tax.

Among the advantages of this system it is worth highlighting:

- there are no restrictions on business (volume of production and income, number of employees, etc.);

- can be used for any type of activity;

- there are no restrictions on the choice of counterparties (whether the counterparty is a VAT payer or not);

- in case of losses there is no need to pay all taxes.

- numerous reports;

- it is required to pay all major types of taxes;

- there are VAT payments;

- problems from tax inspections.

If an individual entrepreneur works on OSNO, then it is necessary to take into account some subtleties:

- the absence of any restrictions on its use;

- in order to refuse this system, you must write an application to switch to another regime;

- the taxpayer can count on a tax reduction in the presence of certain circumstances that are defined at the legislative level;

- those who use OSNO can count on VAT deductions.

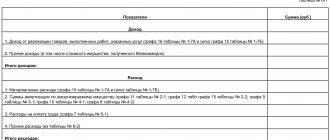

The following types of reports must be submitted at OSNO:

- profit report: submitted once a quarter;

- VAT report: once a quarter;

- property declaration: once a year;

- 2-NDFL based on the results of the year;

- 6-NDFL is calculated based on period reports

- insurance reports.

Simplified system

Simplified system is the most popular mode. The system was introduced in 1996. It simplifies the process of calculating and filing taxes, as several taxes are replaced by one. Also, simplified reporting makes it much easier to maintain reports.

Important! A simplified system allows you to reduce the tax burden, as well as reduce costs for the accountant. Even a novice entrepreneur can conduct reporting under the simplified tax system on his own.

There are two regimes under which taxation can be carried out under the simplified tax system. They differ in the way they determine the tax base.

The first mode has the following characteristics:

- the tax base is the total amount of income received;

- the tax rate is 6%. However, in some regions it may be lower.

This type is suitable for those who have low expenses and high markups.

The second mode has the following features:

- The tax base is defined as the difference between income and expenses. The list of expenses is regulated by Article 346.16 of the Tax Code of the Russian Federation;

- the tax rate is 15%. The rate may be lowered in the regions.

This type is suitable for those who have large expenses, more than 60% of the profit.

Important! The simplified tax system is more suitable for those who are just starting their own business. The simplified tax system for some types of activities provides for tax holidays in the first two years of operation.

A single tax on imputed income

The meaning of this tax is that the amount of tax payments is calculated on the basis of physical quantities that are indicated in the tax code. The choice of these values depends on the type of activity and the likely volume of commercial activity.

To switch to UTII, you must meet certain conditions:

- activities must comply with Article 346.26 of the Tax Code;

- the total number of employees is no more than 100 people;

- cash and non-cash transactions must be carried out in compliance with all regulations;

- If several taxation systems are maintained simultaneously, then it is necessary to maintain separate records of property, as well as separate calculation of taxes.

UTII reporting is submitted every quarter. The report is due by the 20th day of the first month of the quarter. Reporting includes:

- UTII declaration if the entrepreneur works without part-time work;

- if the individual entrepreneur works under other systems before the declaration of OSNO or simplified tax system.

Unified agricultural tax

This system can be used for agricultural producers. This regime will reduce the tax burden, as well as reduce taxes for future periods in the event of a loss from current activities. The Unified Agricultural Tax replaces several types of taxes with one. Under this system, the following are not paid: income tax, property tax and VAT.

This is important to know: Writing off personal tax debts

The Unified Agricultural Tax scheme is available only if certain requirements are met (Article 346.2 of the Tax Code of the Russian Federation):

- the entrepreneur must carry out the production of agricultural products: livestock, crop production;

- the amount of income from agricultural production is equal to at least 70% of total revenue;

- The transition to this scheme is possible only upon the application of the entrepreneur to the Federal Tax Service.

Important! The Unified Agricultural Tax system can be used by individual entrepreneurs who provide services to agricultural production entities. However, work on processing agricultural products cannot apply the Unified Agricultural Tax regime.

The tax base under the Unified Agricultural Tax system uses income for the reporting period, which is reduced by the amount of expenses. Tax rate 6%. To switch to the Unified Agricultural Tax, you need an application from the agricultural producer sent to the Federal Tax Service.

At the end of the year, it is necessary to fill out the Unified Agricultural Tax declaration. It is submitted to the tax office no later than March 31.

Patent

The essence of the PSN system is that it is necessary to purchase a permitting document - a patent. Features of the patent system:

- it provides the right to carry out only one type of activity;

- it is possible to acquire several patents;

- a patent can be valid from a month to one year. Patent duration affects cost;

- purchasing a patent means paying income tax, which is paid in advance.

Under the PSN system, an entrepreneur is exempt from paying: VAT, personal income tax and property tax.

To switch to the patent system, an application from the entrepreneur is required. It must be presented to the tax office. A patent costs 6% of potential income. Probable income is determined by the subjects of the federation for each type of activity. The patent system can be combined with others.

Is it possible to get such data

The Taxpayer Identification Number is usually publicly available . Therefore, based on this combination, it will not be difficult to find out not only your own regime, but also the regime applied by other individual entrepreneurs and legal entities. Today, you can obtain the information you are interested in in several ways - visit a branch of the Federal Tax Service in person, use the official website of the Federal Tax Service, call the tax office phone number, or send a message to the support service.

How to confirm OSNO

This question arises because of VAT. Companies using OSNO prefer to work with organizations on the same system in order to avoid problems when submitting taxes for deduction. Firms operating under simplified regimes are exempt from VAT. Therefore, if after the transaction the company received documents indicating “excluding VAT”, then it has the right to request a certificate or letter confirming the right not to allocate tax.

A sample certificate of application of the general taxation system, as well as a form, is not only difficult, but simply impossible to find. With a simplified system, for example, you can present a copy of the notice issued upon transition to this mode. Nothing like this is provided for OSNO. The Tax Code does not contain either a letter form or a certificate form that could notify the counterparty of the tax system used.

There are cases when taxpayers offer to confirm their system with a notification from the Federal Tax Service that the entrepreneur has lost the opportunity to use one of the special modes and has been transferred to the general one. This is possible, for example, if the organization exceeds the maximum permissible limit on income or when changing the type of activity that is not provided for by special regimes. It is in these cases that the tax inspectorate sends a paper demanding that you abandon the current tax regime and switch to OSNO. This message is drawn up in form 26.2-4.