OSN, simplified tax system, unified agricultural tax, PSN and UTII for Russian entrepreneurs are not mysterious abbreviations, but a direct indication of what their tax burden will be. TASS explains what they mean

The share of small and medium-sized enterprises (SMEs) in the Russian economy at the end of 2020 amounted to 21.9%. Such data was published by Rosstat. In terms of money, this amounts to more than 20 trillion rubles, media have calculated.

In total, as of April 10, 2020, more than 6.1 million SMEs operated in Russia - 3.6 million individual entrepreneurs (IP) and 2.5 million legal entities. Moreover, over the past year this number has grown by more than 100 thousand projects.

But when starting their own business, aspiring entrepreneurs first of all face two questions: what form of organization should they choose and what tax system should they use? And this is very important, because taxes directly affect the company’s profit. Typically, the answer depends on the type of activity and size of the organization.

TASS, together with the Department of Economic Policy and Development of the City of Moscow, explains how to make the right choice.

Type of ownership

The two most common forms of business are individual entrepreneurs and limited liability companies (LLC). To understand which one is right for you, just answer two simple questions:

- will you be the sole owner of the business?

- Will you be selling alcohol?

If there is more than one founder or you plan to engage in alcohol, then the choice is simple - LLC. In an individual entrepreneur, the owner can only be one private person, who, moreover, cannot sell alcoholic products.

Differences between individual entrepreneurs and LLCs

Simultaneously with registering the form, the entrepreneur must choose a taxation system. Thus, in Moscow there are several tax regimes available to small businesses:

- general tax system (GTS);

- simplified taxation system (STS);

- taxation system for agricultural producers (UTS);

- patent taxation system (patent, or PSN).

The first three can be used by both legal entities and individual entrepreneurs; the patent system is available only to individual entrepreneurs. But the single tax on imputed income (UTI) has not been applied in the capital since 2014.

LLCs and individual entrepreneurs differ in other respects as well. For example, registration is more difficult for legal entities, and in case of bankruptcy they are liable for obligations only within the authorized capital and can sell the business. The individual entrepreneur is responsible for all the property and for another five years after that he cannot conduct business, and he will not be able to sell the business.

Accounting and taxes are calculated differently in these two forms. LLCs must keep accounting records, individual entrepreneurs do not. For individual entrepreneurs, insurance premiums are fixed, although they change if income exceeds 300 thousand rubles. Fines for administrative violations for legal entities are significantly higher than for individual entrepreneurs. The latter, however, face restrictions when obtaining loans, etc.

General tax system

Companies on OSN pay:

- income tax - 20%;

- value added tax (VAT) - 0%, 10% or 20% (depending on the types of goods);

- property tax - up to 2.2%.

Individual entrepreneurs on OSN are paid by:

- personal income tax (NDFL) - 13%;

- VAT - 0%,10% or 20%;

- property tax - up to 2%.

OSN is a system with the highest complexity of accounting - it is almost impossible to maintain it without specialists, with a large number of taxation items, special requirements for storing reports, and most importantly - with the highest tax burden.

Experts explain that a business may end up on the special tax regime if it does not meet the requirements and conditions of preferential tax regimes, must pay VAT, is an income tax exemption, or its owners simply do not know about other taxation systems.

One of the advantages of OSN is everything that becomes an obstacle under preferential regimes - there are no restrictions on the amount of profit or the number of employees, you can rent any number of premises, including for trade.

It is also possible to confirm business losses and not pay income tax or reduce its rate by transferring the loss to the future.

Calculation formula, application in Russia

The proportional system implies that people with different incomes pay an equal percentage of them, so the calculations come down to a simple formula. The tax rate is divided by 100 and multiplied by income. You can learn more about this from the following video:

For example, if a cleaner earns 15,000 rubles, then at a rate of 13% the tax amount will be 1,950 rubles (15,000 x 0.13 = 1,950). As income increases, the amount will increase proportionally.

In Russia, a significant part of total tax revenues consists of the following types of taxes:

- 1.For profit.

- 2.Added value.

- 3. Payments to non-state funds.

- 4. Excise duties.

How NPO reports are submitted to the Ministry of Justice.

The federal budget of the Russian Federation is filled largely through the value added tax. Receipts from other sources have fluctuated greatly over the past decade.

For example, profits from the sale of energy resources have always depended on their prices on the world market and the political situation. Profit from taxation is significantly more stable and has an increased share.

Simplified taxation system

It is this taxation system that experts recommend for start-up projects with a small turnover, since it is aimed at reducing the tax burden and simplifying accounting - three taxes (VAT, income tax/personal income tax and property tax) are replaced by one. Also, only one declaration needs to be submitted at the end of the year.

A distinctive feature of the system is that those working under the simplified tax system can choose the object of taxation themselves, and their decision will determine the rate:

- 6% if the object of taxation is income (STS “Income”);

- 15% if income minus expenses is taxed (STS “Income minus expenses”).

Moreover, in the first case, regional authorities can reduce it to 1%, and in the second to 5%. You can find out exactly what rate is in force in your region at the tax office at your place of registration.

A simple formula will help you understand which type of simplified tax system is more profitable in a particular case: Income*6% = (Income – Expenses)*15%

It follows from it that if expenses exceed 60% of income, then it will be more profitable to use the simplified tax system “Income minus expenses” option. Otherwise, experts recommend the simplified tax system “Income”.

Both companies and individual entrepreneurs can work with the simplified tax system, but with restrictions.

By type of activity: banks, pawnshops, insurers, non-state pension funds (NPFs), investment funds, microfinance organizations (MFOs), professional participants in the securities market, companies selling alcohol, cigarettes and other excisable goods, notaries, etc. cannot apply the simplified tax system. d.

By the number of employees: there should be no more than 100 people.

Regarding the presence of branches: to apply the simplified tax system, the company should not have them.

Regarding the participation of other organizations: a company cannot operate under the simplified tax system if the share of other organizations in its authorized capital is more than 25%.

By economic weight: the residual value of fixed assets should not exceed 150 million rubles. But here only property is taken into account that, when purchased, cost 100 thousand rubles or more.

At the same time, even if the company initially met all these conditions, but later stopped doing this - for example, it increased its staff, then it will have to switch to OSN.

In the “Income” simplified tax system, the tax can be reduced by the amount of insurance premiums paid, and in the “Income minus expenses” simplified tax system, they can be taken into account when calculating the tax base.

But at the same time, unlike the OSN, the presence of losses does not exempt you from paying the minimum amount of tax - 1% of the income received.

Efficiency of proportional system

It is necessary to highlight the fact that with this system the opportunities for evading taxes or reducing them are minimized as much as possible, the system is most effective in case of high corruption and is easy to implement.

Countries with high progressive tax rates have seen a sharp increase in crime

related to the transfer of business to the shadow economy. Sometimes even law-abiding citizens take advantage of this opportunity. With the same approach to all taxpayers, this loses its meaning.

Legislators came up with a progressive taxation scale from poor to rich citizens, which was used in Russia until 2000. But along with the positive aspects, progressive taxation, as it turns out, has its disadvantages, which make it not very popular.

Unified agricultural tax

Just like the simplified tax system, it replaces several taxes with one, the rate of which is 6% and is calculated on the tax base “income minus expenses.” The law allows regions to reduce the rate to 0%.

Obviously, agricultural producers and fishing industries have the right to apply preferential treatment. Since 2020, this list also includes companies and individual entrepreneurs that help agricultural producers grow plants and animals.

At the same time, they have a strict requirement for revenue - at least 70% of it must come from income from agricultural activities. In addition, the staff of fishing enterprises and individual entrepreneurs using the Unified Agricultural Tax should not exceed 300 people.

The Unified Agricultural Tax allows you to apply a simplified accounting procedure, combine it with other regimes and does not imply a minimum tax.

Proportional system

The proportional tax system involves the use of a fixed percentage rate for each individual taxpayer. In this case, the rate does not depend in any way on changes in the tax base. The famous economist and philosopher Adam Smith once spoke about such a system, who believed that citizens should, in accordance with their abilities, actively participate in the provision of government.

Most Russian taxes are based on a proportional taxation system, as in most European countries. For example, income tax, where the percentage is clearly fixed and does not depend on the amount - 2%.

Patent

The essence of this preferential tax regime is to obtain a special document - a patent, which allows you to carry out certain types of activities, but only in one region. For the most part, this is the provision of services - from haircuts, interpretation and translation to furniture and shoe repair, etc. — and retail trade. In addition, only individual entrepreneurs who have no more than 15 employees and whose annual income does not exceed 60 million rubles can use the patent.

The entrepreneur independently chooses the period for which he takes out the patent - from one to 12 months, but within one calendar year. Typically, short periods are useful to try out a small business and see if it will be in demand.

The main advantages of the system are a simple and clear calculation of the tax amount, no need to use cash register equipment when paying in cash, no need to file a declaration, but you need to keep a special income book to make sure that they will not exceed 60 million rubles.

The peculiarity of the PNS is that it is not calculated from actual income received, but is 6% of the potential annual income (PVGY) for the selected type of activity. That is, you have to pay the tax in advance. The size of the PVGD is determined by regional laws, and therefore a patent for the same service in different regions may cost differently. You can calculate how much a patent will cost in the online calculator of the Federal Tax Service (FTS).

In addition, the tax cannot be reduced due to insurance premiums paid, but reduced rates can be applied to them.

Features and advantages - what the state gains

The proportional system has a number of important advantages. For example, a fixed rate that does not depend on changes in the tax base. It is considered relatively fair , and the origins of the system were born during the French Revolution, which the people rose up out of a desire for justice.

The diagram shows the general essence of proportional taxation

According to political scientist Alvin Rabushka, the choice of Eastern European countries had a positive impact on the development of their economies, and he cites Russia and Slovakia, as well as Georgia, Ukraine, Latvia, Estonia, etc. as winners. The expert suggests that over time, other countries, in particular the Czech Republic and Poland, will appreciate the benefits of proportional taxation.

Compared to other taxation systems

In practice, the system is considered very effective , even in comparison with the progressive one, in which the state receives significant income through increased taxes for wealthy citizens.

The fact is that in this case, social tension is growing, and most large entrepreneurs prefer to register a company abroad, in offshore countries, trying to avoid taxation or reduce costs to a minimum. The same applies to a regressive system. Given the high level of corruption in Russia, their use might not be so effective.

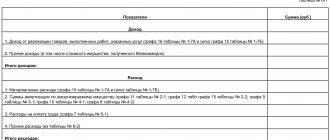

Calculation of profit and loss: familiarize yourself with the formulas.

Read about how to open a seasonal business in the summer.How to start a business in rural areas? Read here.

A single tax on imputed income

For legal entities, UTII replaces:

- income tax;

- property tax;

- VAT.

For individual entrepreneurs, this list is largely the same, only personal income tax is taken into account instead of income tax.

Just as with a patent, for calculating UTII, the amount of income actually received does not matter - the state expects that by engaging in a permitted type of activity, you earn (imputed) income. Moreover, it depends on certain physical indicators - the number of employees, area of premises, units of transport, etc. - to which the basic profitability is tied (conditional income per month per unit of physical indicator).

For example, if you have a store, then it is assumed that you should receive an income of 1,800 rubles per square meter of sales floor. That is, with an area of 40 sq. m imputed income will be 72,000 rubles per month.

UTII itself is equal to 15% of imputed income, while the amount of tax can be reduced by the amount of insurance premiums.

The list of activities that can be carried out under UTII is relatively small:

- retail;

- catering;

- household and veterinary services;

- repair, maintenance, washing and parking of cars;

- distribution and/or placement of advertising;

- rental of retail spaces, land plots;

- temporary accommodation and accommodation;

- transportation of passengers and cargo.

There are also a number of other conditions:

- the taxpayer must have no more than 100 employees;

- the share of other organizations in the authorized capital of the company cannot be more than 25%;

- activities are not carried out under simple partnership or trust management agreements, etc.

And what is important is that UTII must operate on the territory of your municipality.

Combination of modes

Entrepreneurs often work in several areas - for example, they sell in a store and provide trucking services. Then the regimes can be combined in different combinations: patent and simplified tax system, unified agricultural tax and patent; in regions where UTII operates, it can be combined with all preferential regimes.

But there are exceptions - obviously, OSN cannot be combined with either the simplified tax system or the unified agricultural tax. The last two cannot be combined with each other either.

You can also use the online service, take a short test and find out which tax regime is right for you.