In Russia, along with the main tax system, there are several preferential ones. This or that regime is applied in certain conditions, and for many there are restrictions on the types of activities. By skillfully combining these systems, businessmen have a legitimate opportunity to save on mandatory payments. Let's figure out whether it is possible for an individual entrepreneur to combine a patent and the simplified tax system.

Simplified system

The simplified taxation system can be applied throughout the country; almost any activity falls under it. Therefore, the simplified tax system is the most universal tax system. But there are also limitations to its use. In 2020, the main ones for individual entrepreneurs are:

- annual income, as well as the residual value of the property, should not exceed 150 million rubles;

- number of employees - no more than 100 people on average per year.

A complete list of criteria for switching to the simplified tax system is given in Article 346.12 of the Tax Code of the Russian Federation.

Average number of employees

Another criterion, the compliance with which determines the legality of combining the simplified tax system and the PSN, is the average number of employees. For a “simplified” person, it cannot exceed 100 people per year or reporting period (clause 15, clause 3, article 346.12 of the Tax Code of the Russian Federation). The average number of employees of an individual entrepreneur on a “patent” should not be more than 15 people (Clause 5 of Article 346.43 of the Tax Code of the Russian Federation).

But for part-time workers in these special regimes, the criterion for the number of personnel is not established by law.

According to the Ministry of Finance, in order to comply with restrictions on the number of employees employed in both areas of activity, individual entrepreneurs must keep separate records of their number. In this case, the number of people employed in patent activities should not be more than 15 people, and in “simplified” - 100 people. Therefore, an individual entrepreneur who simultaneously uses the PSN and the simplified tax system can have up to 115 employees (letter dated September 20, 2018 No. 03-11-12/67188).

Previously, a similar statement was made by the Supreme Court in its ruling dated June 1, 2020 No. 306-KG16-4814.

Patent

The patent tax system in 2020 for individual entrepreneurs has more stringent restrictions:

- PSN must be introduced on the territory in relation to the business that this individual entrepreneur is engaged in. The main list of areas of activity for which a patent can be purchased is given in paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation. However, regions have the right to expand this list;

- maximum number of employees - 15 people;

- annual income - no more than 60 million rubles for all types of patent activity;

- PSN is not applied within the framework of a simple partnership agreement or trust management of property;

- A patent cannot be used when selling goods that are subject to mandatory labeling - medicines, shoes and fur clothing.

Free tax consultation

What is better for an individual entrepreneur - a patent or the simplified tax system?

It is impossible to unequivocally answer the question of what is better for an individual entrepreneur—a patent or a simplified version.

Each tax system has advantages and disadvantages. For some types of activities it is preferable to use the PSN, and for some the simplified tax system - much depends on the volume of incoming income and spent funds. In addition, for both the PSN and the simplified tax system, the Tax Code defines strict restrictions, beyond which it is impossible to further apply the selected regime. Let us briefly describe these two tax systems.

The application of this tax regime, presented in Chap. 26.2 of the Tax Code of the Russian Federation, is provided in two versions:

In general, the simplified tax system is applicable to most types of activities. Exceptions are listed in paragraph 3 of Art. 346.12 of the Tax Code of the Russian Federation (banks, pawnshops, insurers, etc.).

Restrictions for the simplified tax system are presented as:

- average number of employees - no more than 100 people per year;

- income amount: 150 million rubles. per year - for an entity already using the simplified procedure, and 112.5 million rubles. in 9 months - for those planning to switch to it next year.

Organizations are subject to restrictions on the share of participation in their authorized capital of other companies.

The declaration with the single tax calculated for the tax period is submitted by the simplifier once a year, advances are paid quarterly.

You can combine the simplified tax system with UTII and a patent. It is impossible to apply the simplification at the same time either with the general regime or with the Unified Agricultural Tax.

This mode, described in Chap. 26.5 of the Tax Code, loved by individual entrepreneurs - and it is provided exclusively for them; organizations do not use the PSN - because it does not contain reporting on the main tax. Payment for the period of validity of the patent is calculated by tax inspectors, which eliminates errors on the part of taxpayers. The latter are obliged to promptly transfer the amount of the patent to the state treasury; delay threatens the accrual of fines and penalties.

The tax liability is calculated based on the potential income established at the level of the constituent entities of the Russian Federation. The tax rate is 6%, but regions have the right to reduce it.

Regime restrictions apply to:

- volume of income - for the year, revenue should not exceed the limit of 60 million rubles, adjusted for the deflationary coefficient;

- types of activities - their full list is given in paragraph 2 of Art. 346.43 of the Tax Code of the Russian Federation, however, regional authorities have the right to supplement it;

- the area of the premises used in carrying out certain types of activities;

- number of employees - no more than 15 people.

A patent can be used together with the OSN, simplified tax system, and UTII if the entrepreneur conducts business in several directions at once.

From the description of tax regimes it is clear that activities on the simplified tax system can be carried out on a much larger scale than activities on the special tax system. This applies to both employees and the amount of annual income. And not every type of activity can be applied to PSN. That is, the scope of application of the patent is significantly narrower compared to the simplified one. However, an entrepreneur on a PSN does not have the obligation to submit a declaration and calculate tax. The tax is calculated by the tax service, and payment is made according to receipts issued by it. Thus, an entrepreneur with a patent is initially exempt from fines for late submission of a declaration and non-payment (incomplete payment of tax) as a result of understating the tax base.

Combination conditions

When using PSN and simplified tax system together, the limitations of each system are taken into account. It turns out that they can be combined if the following conditions are met:

- The amount of income of an individual entrepreneur does not exceed 60 million rubles. According to paragraph 6 of Article 346.45 of the Tax Code of the Russian Federation, income under both special regimes is taken into account.

- The entrepreneur employs no more than 100 people, while no more than 15 employees are employed in all patent activities. This rule was introduced by Law No. 325-FZ of September 29, 2019. Before it came into force, a different procedure was applied - an individual entrepreneur could hire no more than 15 people in all areas of business. As soon as he had another employee, he lost the right to the patent system, even if he was engaged in “simplified” activities.

Thus, it is possible to combine the simplified tax system and the patent system if:

- activities within each regime meet the requirements of the Tax Code of the Russian Federation;

- the above conditions for their joint use are met.

And one more important rule: it is unacceptable to combine simplified taxation and PSN for one type of activity within one subject of the Russian Federation. This is due to the fact that the patent is valid in the region and all activities are transferred to it. Therefore, for example, it is impossible to open a retail store on a patent in one area of the city and on the simplified tax system in another.

But the Federal Tax Service still makes an exception for one type of activity - renting out your own real estate. Such objects are indicated in the patent. According to letter No. SD-4-3/ [email protected] , an individual entrepreneur has the right to acquire a patent for leasing certain real estate properties. Moreover, if he has other objects, including in the same region, he has the right to rent them out and apply the simplified tax system.

In addition, in 2020, another situation has arisen when it is possible to combine simplified legislation and a patent for one type of activity. We are talking about the sale by a businessman of labeled and other goods. For example, you can simultaneously sell shoes in a store using the simplified tax system, and other goods using a patent. This follows from the letter of the Ministry of Finance dated January 15, 2020 No. 03-11-11/1277. This permission is due to the fact that the sale of goods subject to mandatory labeling for the purposes of applying PSN is no longer considered retail trade. Therefore, formally, the sale of shoes and, for example, bags are different types of activities.

Transition to patent

We have already said that the transition to a patent is carried out only for the type of activity in respect of which it was issued, and if you continue to conduct other types of activity, they may be taxed under the simplified tax system.

The transition to PSN is possible at any time during the year. To do this, you only need to submit an application for a patent to the tax authority at your place of residence, no later than 10 days before the start of your activity (clause 2 of Article 346.45 of the Tax Code of the Russian Federation).

The tax authority considers the application for a patent within 5 days from the date of receipt of the application from the individual entrepreneur. Based on the results of consideration of the application, a decision will be made to issue a patent or a decision to refuse (clause 3 of Article 346.45 of the Tax Code of the Russian Federation). Grounds for refusal may be:

- discrepancy between the declared type of activity and the list of types of activities falling under the application of the PSN;

- indicating an incorrect patent validity period;

- tax arrears;

- violation of the conditions for the transition to PSN.

Combination practice

Before using the systems together, you need to make sure that for the chosen type of activity a patent will be more profitable than the simplified tax system. The tax service website has a special service for calculating the cost of a patent. It depends on the region, field of activity and scale of business.

If an individual entrepreneur already uses the simplified tax system, he can simply purchase a patent for the desired area. If a different tax regime is applied, then a transition to a simplified tax regime is made. However, this can only be done starting from the next calendar year.

The simplified tax system applies to all activities, and the patent applies to the one for which it was acquired. For clarity, here are a couple of examples demonstrating the combination of the simplified tax system and a patent in 2020.

Example 1

An individual entrepreneur from the Moscow region provided services under the simplified tax system with the Income object (tax rate 6%) and additionally decided to rent out an apartment that belonged to him. That is, in this example, there is a combination of the simplified tax system for services and the PSN for leasing residential real estate. Its area is 50 square meters. meters, rental cost - 25 thousand rubles per month. The income of an individual entrepreneur for the year will be 25 x 12 = 300 thousand rubles.

When applying the simplified tax system at a rate of 6%, the annual tax will be 300 * 6% = 18 thousand rubles. But the cost of a patent for this entrepreneur for the entire 2020 will be 13.6 thousand rubles. There is a small benefit, so combining the modes is justified.

Example 2

A Moscow resident registered as an individual entrepreneur and immediately switched to a simplified system. He then acquired a retail patent and opened a small store selling souvenirs. The cost of the patent for 2020 for him was 162 thousand rubles.

Additionally, the entrepreneur decided to sell products via the Internet. The activities of an online store are not covered by a patent, but they can be conducted using the simplified tax system. Since the individual entrepreneur switched to this system in advance, he can open an online store without additional registration. If he had not previously taken care of applying the simplified regime, he would have had to pay taxes on the activities of the online store in accordance with the main system. And wait until next year to switch to the simplified tax system.

Disadvantages of a patent

Ch. 26.5 of Federal Law No. 94-FZ of June 25, 2012 does not provide for a reduction in the tax paid in connection with the application of the PNS by the amount of insurance premiums.

In this regard, a question arises for entrepreneurs whose all employees are only on a patent, and the individual entrepreneurs themselves are on the simplified tax system. Can an individual entrepreneur reduce insurance premiums for himself? The Letter of the Ministry of Finance dated October 3, 2014 No. 03-11-11/49926 clarifies that in this case the fixed payment for yourself can be reduced by the simplified tax system. Moreover, if there are also hired workers on the “simplified” payroll, then the tax can be reduced only by 50%. And if there are no employees, then the reduction is made without restrictions.

If an individual entrepreneur combines a patent with the simplified tax system “income minus expenses,” then he, just like an individual entrepreneur on UTII, must keep separate records of expenses. That is, he will have to divide proportionally insurance premiums, accrued wages, transport tax, etc. At the same time, he will be required to register all this in the accounting policy, in particular, how he will determine income for a particular type of activity.

Features of combining the simplified tax system and a patent

The patent does not require the submission of any reports, however, in the simplified system it is necessary to submit a declaration. Therefore, applying simultaneously the PSN and the simplified tax system, the individual entrepreneur is obliged to submit this report to the Federal Tax Service. Moreover, this must be done even for those periods when “simplified” activities are not carried out. In this case, a report will be submitted without indicators (zero declaration).

Generate a simplified taxation system declaration online

If you neglect to submit a declaration under the simplified tax system, the Federal Tax Service may impose a fine under Article 119 of the Tax Code of the Russian Federation. It will be 1 thousand rubles - this is the minimum amount that is assigned if there is no tax to pay. And this is, perhaps, the only disadvantage of combining these modes compared to the independent use of PSN.

The advantages of combining these tax regimes are that individual entrepreneurs can optimize their payments. He saves by purchasing a patent in those areas of business for which its cost is lower than the tax under the simplified tax system. At the same time, with such a combination, the entrepreneur has the right to deduct his own insurance premiums. The tax may be reduced on them for “simplified” activities. If you use only PSN, you cannot deduct contributions.

Another advantage of the combination is that if the right to a patent is lost (for example, due to exceeding the limits), the entrepreneur will find himself on the simplified tax system. If he does not first switch to this system, that is, he uses the PSN in its pure form, if he loses the right to it, he will be considered to be applying the main tax regime.

Rules for the transition from simplified tax system to PSN

To start doing business using the patent system, an individual entrepreneur operating under a simplified taxation regime must submit an application to the Federal Tax Service at the place of registration no later than 10 days before the start of a new reporting period (beginning of the year).

We recommend you study! Follow the link:

Documents and conditions for obtaining a patent for individual entrepreneurs

It is recommended to submit an application to switch from the simplified tax system as early as possible, since an error will result in a refusal and you will have to wait for a new tax period.

The most common reasons for refusal:

- The individual entrepreneur indicated in the application a line of business for which a patent is not issued.

- An impossible period of validity for which the patent must be issued is indicated;

- Partial underpayment for a previous patent.

- Submitting an application during the reporting period in which the individual entrepreneur lost the right to use the PSN until the end of its validity period.

- All important fields in the application have not been completed.

The NI is obliged to provide a patent or notification with the reason for refusal to the individual entrepreneur within 5 calendar days after acceptance of the application. Once the reasons for the violation have been eliminated, you can resubmit the application.

The application must be filled out on the basis of strict form 26.5-1, established by order of the Federal Tax Service of Russia dated July 11, 2017 No. ММВ-7-3/589. Submission of an application is carried out in the following ways: delivery in person, by registered mail or through your personal account, if there is an electronic signature.

Submitting an application requires mandatory reference to the territorial location of the individual entrepreneur’s work, even if registration is issued in another region.

Separate accounting

An individual entrepreneur on a patent and the simplified tax system must separately keep records of property, transactions and obligations. In this case, we are talking only about tax accounting, since an individual entrepreneur is not required to maintain accounting records. It is also necessary to maintain separate personnel records for personnel engaged in activities under different tax regimes.

Free accounting services from 1C

The entrepreneur keeps his records in the book of income and expenses (KUDiR). An individual entrepreneur on the simplified tax system keeps this book for the simplified system, and an individual entrepreneur on a patent keeps this book for the patent system. When combined, both books are filled out.

The essence of separate income accounting is to record in the appropriate accounting book the revenue that is received from activities within the framework of a particular tax regime. Revenue control is needed in order not to miss the moment of possible loss of the right to use a patent and to correctly calculate the tax under the simplified tax system.

Similarly, when combining PSN and simplified tax system, expenses are also taken into account. But some of them cannot be attributed to one or another regime. This usually concerns the costs of paying management and support workers, rent and utility bills.

Therefore, individual entrepreneurs on a patent and the simplified tax system often have a question at the same time: how to keep track of such expenses? It's actually simple. They need to be distributed in proportion to the income received from the patent and from “simplified” activities.

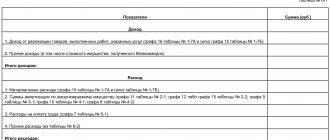

For example, an individual entrepreneur received the following income:

- according to the simplified tax system - 200 thousand rubles;

- for a patent - 100 thousand rubles.

At the same time, the total costs for both systems amounted to 30 thousand rubles. They will be distributed in this way: 20 thousand will be allocated to the simplified tax system, and 10 thousand to patent activity.

What are the advantages of simultaneous use

How to switch from individual entrepreneur to self-employment or combine them at the same time

The simplified tax system based on a patent implies the need to maintain an income ledger. Its form, rules, and procedure for filling out are regulated by the norms of Order of the Ministry of Finance of the Russian Federation No. 135n of October 2012. It is for this reason that income is determined using the Book.

If individual entrepreneurs have expenses, it becomes necessary to determine the share. It is necessary to determine exactly how much income was received on a cumulative basis using the simplified approach and the amount on the patent, after which the portion of the costs when working with the simplified approach is determined.

Disadvantages of using a patent

Important : using a patent does not incur costs, which is why they are not taken into account.

The combination of a patent and the simplified tax system has the main advantage - a low level of control on the part of government bodies. Basic minutes indicates the need to keep separate records.

The simplified tax system and the patent taxation system require mandatory payment of contributions. Many entrepreneurs are trying their best to reduce their size in the Pension Fund and other funds, but this will bring nothing but disappointment.

The only possible way out is considered to be the right to a deduction under the cash register, which in 2020 is 18 thousand rubles. for each individual cash register. The right is reserved for individual entrepreneurs on the simplified tax system and on the PSN, including on UTII.

conclusions

So, we looked at whether it is possible to combine a patent and the simplified tax system. This can be done by entrepreneurs whose annual income does not exceed 60 million rubles. The number of their employees should not exceed 100 people, of which no more than 15 are involved in patent activities. At the same time, it is important to comply with other conditions for the application of these regimes, including local specifics.

The combination of simplified taxation system and PSN in one region for one type of activity is unacceptable, with some exceptions. In order to correctly calculate indicators and calculate taxes, when combining the simplified tax system and the personal tax system, it is necessary to keep records of income, expenses and personnel separately.

Application of limits when combining a patent and simplified tax system

An entrepreneur can combine a patent and the simplified tax system, but he must remember the limits and restrictions that apply to each of the regimes.

Thus, the income limit on a patent, exceeding which will entail the loss of the right to use a special regime, is 60 million rubles, and on a “simplified” patent – 150 million rubles. (from 2021 – 200 million rubles). How to determine the amount of income if an individual entrepreneur combines the simplified tax system and a patent? The answer to this question is contained in paragraph 6 of Art. 346.45 of the Tax Code of the Russian Federation: with the simultaneous use of the “simplified tax” and PSN, income from sales must be taken into account collectively for both special regimes. If the income received by an individual entrepreneur since the beginning of the year from activities on the simplified tax system and the PSN exceeds 60 million rubles, he “flies” from the PSN and switches to the simplified tax system for the “patent” types of his business from the beginning of the tax period, i.e. from the beginning of the period for which he was issued a patent (letter of the Ministry of Finance dated March 12, 2018 No. 03-11-12/15087). In this case, within 10 days (calendar) from the date of exceeding the limit, the entrepreneur must declare the loss of the right to a patent to the Federal Tax Service.

Another important point for those who apply a patent and the simplified tax system at the same time are different limits on the average number of employees. According to paragraph 5 of Art. 346.43 of the Tax Code of the Russian Federation, the limit of 15 people is valid only for activities on a patent, and according to the simplified tax system, the maximum limit that allows you to remain in a special regime is 100 people (130 people - from 2021). An individual entrepreneur must keep records of the average number of employees for employees engaged in “simplified” and “patent” activities separately. When there are more than 15 employees on the PSN, the right to the patent is lost and the individual entrepreneur completely switches to “simplified”.