How to make the transition from the simplified tax system to the OSNO in 2020-2021

The simplified tax system and the OSNO are such different taxation systems that it is very difficult to compare them.

OSN provides for the maintenance of full accounting with the accrual and payment of all types of taxes. The simplified tax system allows for the payment of a minimum amount of taxes. How to switch from simplified tax system to OSN? A transition from one tax regime (STS) to another (OSN) is possible in the following cases:

- Termination of the use of the simplified tax system on a voluntary basis when submitting a notification to the tax office (clause 6 of article 346.13 of the Tax Code of the Russian Federation). It must be sent to the Federal Tax Service no later than January 15 of the year from the beginning of which the regime change takes place. The notification is submitted in form No. 26-2-3 (approved by order of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3/829).

Important! It is mandatory to submit a notice of voluntary departure from the simplified tax system, according to the Ministry of Finance. Without doing this, you cannot begin to apply the general taxation regime. You can find out how the latest judicial practice on this issue is shaping up from the analytical collection from K+, having received free access to the system.

- Forced termination of the use of the simplified tax system as a result of exceeding the maximum permissible level of annual income or violation of other conditions for the use of the simplified tax system (clause 4 of article 346.13 of the Tax Code of the Russian Federation). A notice of termination of the use of the simplified tax system is submitted within the first 15 days of the quarter following the one in which the conditions for the use of the simplified tax system were violated. The notification is submitted in form No. 26-2-2 (approved by order of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3/829).

Important! If you are late or do not submit this notice at all, you may be fined 200 rubles. (Clause 1 of Article 126 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated December 6, 2017 No. 03-11-11/81211). For the director of an organization (chief accountant or other official), an administrative fine of 300 rubles is also possible. up to 500 rub. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

How to switch to the simplified tax system in 2020

The simplified taxation system (STS) is the simplest accounting option for individual entrepreneurs and LLCs, which requires minimal time expenditure (compared to other systems) and allows you to save on tax payments. It is not surprising that many owners are wondering how to make the transition to the simplified tax system for their business.

In this article we will talk about the criteria that a business must meet to work under the simplified tax system, and consider the features and timing of the transition to the simplified tax system.

simplified taxation system 6% or simplified taxation system 15%

Using a simplified taxation system allows entrepreneurs to pay a single tax - additionally there is no VAT, property and profit tax. There are two variants of the simplified tax system, differing in the object of taxation:

- STS “Income” (or “STS 6%”). Companies operating under this system pay a tax of 6% on the income received during the year. This tax regime does not take into account expenses, and therefore will be especially beneficial for businesses with minimal expenses (when expenses do not exceed 60% of annual income).

- STS “Income minus expenses” (or “STS 15%)”. Companies operating under this system pay a tax of 15% on the difference between income received and expenses incurred. If a business’s expenses for the reporting period exceed 60% of its income for the year, choosing the simplified tax system of 15% will be more profitable. One important point should be taken into account here - in order for the tax office to take into account your expenses when calculating the tax base, they must be within the scope of the list specified in Art. 346.16 Tax Code of the Russian Federation. Expenses outside the list will be considered unproven, which means they cannot be taken into account to reduce the tax burden.

In accordance with the law of the Russian Federation, in the regions, rates under the simplified tax system can be preferential, that is, reduced - up to 1% for the simplified tax system “Income” and up to 5% for the simplified tax system “Income minus expenses”. For maximum tax savings, we recommend checking your type of activity with the table of rates for the simplified tax system in the regions.

Criteria for switching to the simplified tax system in 2020

You can change the tax regime voluntarily or forcefully if you do not meet the criteria of the chosen taxation system. In the case of the simplified tax system, the transition to this system is carried out “out of love”, voluntarily - this is already the most simplified system, so no one can “force” a company to switch to it. Moreover, it is not profitable for the tax authorities for your company to reduce its tax payments to the budget, so it will only be happy if, for example, your transition from OSNO to simplified tax system does not happen.

To work on any type of simplified tax system, an entrepreneur’s desire is not enough - his business must meet certain criteria. Over time, the list of conditions undergoes changes, so we recommend monitoring the information posted on the website of the Federal Tax Service of the Russian Federation - there you can always find up-to-date data on the current working conditions for any taxation system.

To work on the simplified tax system, an entrepreneur must fulfill the following conditions for the transition to the simplified tax system, indicated in Article 346.12 and Art. 346.13 Tax Code of the Russian Federation:

- The number of employees should not exceed 100 people (both full-time employees and those working on the basis of a contract are considered).

- The organization's income for the tax period (year) cannot be more than 150 million rubles. This limit will apply until 2021 without indexation.

- The residual value of the property cannot exceed 100 million rubles.

- The maximum possible share of funds from third-party companies in the authorized capital is 25%.

- Lack of branches. At the same time, the presence of representative offices and separate divisions is permitted.

- The type of activity carried out by the organization should not be on the list of prohibited for use of the simplified tax system (clause 3 of article 346.12 of the Tax Code of the Russian Federation).

We draw your attention to the fact that a business on the simplified tax system must meet the entire list of conditions at once. That is, if at least one of the above points ceases to be met, the taxation system in the company will have to be changed (which must be notified to the tax authority within 15 days from the beginning of the new reporting period).

In accordance with the law, the company itself is obliged to monitor compliance with the above criteria. If subsequently, during a tax audit, it turns out that the tax regime was chosen incorrectly, the company faces fines due to non-payment of taxes (Article 122 of the Tax Code of the Russian Federation).

Step-by-step transition to a new tax system

If we are talking about opening an LLC or individual entrepreneur, everything is extremely simple: an application for transition to the simplified tax system (notification) is submitted during registration along with the main package of documents to the tax authority. The main thing is to make sure in advance that the business being created meets the criteria for switching to the simplified tax system. At the same time, we advise you to immediately take into account your development plans for the near future - if after a couple of months of existence the company ceases to comply with the conditions under the simplified tax system, the business owner will be forced to change the tax regime as soon as possible as required by the Tax Code of the Russian Federation, which will become an extra headache for startups .

In other cases, to change the taxation system it will be necessary to go through the following steps:

- Make sure that, based on current indicators, the company falls under the criteria of the new taxation system.

- Write a notice of transition to another tax regime. To avoid confusion in concepts, it should be noted that there are two terms that are similar in meaning - “application” and “notification”. In the case of the “simplified” tax system, it will be necessary to fill out a notification about the transition to the simplified tax system.

- The completed notification must be submitted to the tax authority. The owner can do this in several ways:

- during a personal visit to the tax office;

- by entrusting a visit to the inspection to intermediary representatives - for example, an in-house accountant, an outsourcing accounting company;

- by mail, sending a valuable letter with an inventory of the contents;

- online - for example, through a personal account on the website of the federal tax service or using electronic document management systems (EDMS).

- Provide copies of documents confirming that this business fits the conditions of the simplified tax system. Such documents include:

- profit declaration;

- certificate of residual value;

- average number of employees;

- information about the share of participation of other companies.

- Wait for the tax system to change. This point is more applicable to other taxation regimes, since when switching to “simplified” taxation, you will not have to wait for feedback from the tax office.

However, in our experience, it is better to keep confirmation of submission of the notification - in the case of a personal visit, such confirmation will be a copy of the notification with the tax office’s mark on its acceptance; for mailing, a list of the attachments will be sufficient. When submitting remotely, the confirmation will already appear in your personal account/in the EDMS you are using.

Additionally, you can protect yourself by making a special request to the tax office to officially confirm that your organization operates on the simplified tax system. Such confirmation will arrive within 30 days from the date of sending the request, which can be done online through the tax office website.

Time frame for transition to simplified tax system

As we mentioned earlier, the easiest and fastest way to switch to the simplified tax system is at the time of registration of a legal entity. If you want to switch to the simplified tax system in the middle of the year, you will have to wait until the end of the year, submit a corresponding notification to the tax office and wait for the new year - the company will be able to start working under the new tax regime only from January 1.

In order not to be late with the deadline for submitting an application to the tax office, we recommend that owners do not try to take the entire process into their own hands, but trust professional accountants so that, due to an incorrect and late notification, you do not have to wait another year and pay extra taxes throughout this time .

1+

What does it mean to “go wild”?

“Flying off the simplified system” is what people call the loss of the right to use the simplified tax system. To do this, you need to exceed at least one of the taxpayer’s performance indicators:

- OS cost - 150 million rubles. in 2020-2021;

- average number of employees - 100 people;

- established income limit: in 2020 - 150 million rubles, for 2021 this amount will be indexed;

Important! From 2021, exceeding the income and number limits will not lead to immediate dismissal from the special regime. There will be transitional provisions that will allow in such a situation to retain the right to simplification, albeit on slightly less favorable terms. See our article for more details.

- start engaging in activities incompatible with the simplified tax system, for example, producing excisable goods, organizing a pawnshop (clause 3 of article 346.12 of the Tax Code of the Russian Federation);

- acquire a branch (in this case, the presence of a representative office or other separate division does not interfere with the use of the simplified tax system);

- exceed the 25 percent share of participation of legal entities in the management company of a simplified company;

- become a participant in a simple partnership agreement or trust management of property (clause 3 of Article 346.14 of the Tax Code of the Russian Federation).

If you lose the right to use the simplified tax system, you need to calculate and pay the taxes used under the OSNO. This is done according to the rules that are prescribed in the Tax Code of the Russian Federation for newly created organizations or newly registered individual entrepreneurs. You will not have to pay fines and penalties for late payment of monthly payments during the quarter in which you switched to OSNO.

During the transition period from the simplified tax system to the OSN, it will be necessary to determine:

- The amount of accounts receivable, since under the cash method and under the accrual method, income will differ.

- Accounts payable for taxes, employee salaries, and to suppliers.

- Outstanding accounts payable.

- Residual value of the property.

All these indicators will help in calculating tax bases and taxes themselves.

How to calculate and pay taxes, as well as submit reports in case of loss of the right to the simplified tax system, is explained in detail in the Ready-made solution from ConsultantPlus. If you do not yet have access to the system, get it absolutely free and go to the material.

What to do if the tax office has reported non-compliance with the conditions of the simplified tax system, read here.

Rule 4 – for buyers (customers)

Amounts paid after the transition from the OSN to the simplified tax system are not taken into account as expenses, if such expenses were already taken into account before the transition - when working on the general taxation system (subclause 5, clause 1, article 346.25 of the Tax Code of the Russian Federation).

Example with goods – purchase and shipment to the buyer in 2020, and payment to the supplier in 2020.

In this case, there will be no problems with VAT, and there will be no need to restore the tax. EXAMPLE.

COSTS ON GOODS WHEN TRANSITIONING FROM OSN TO STS The organization in December 2020 purchased goods worth 177,000 rubles (including VAT 27,000 rubles) and sold them to the buyer for 236,000 rubles (including VAT 36,000 rubles .).

The goods were paid to the supplier in January 2020 - after the transition to the use of the simplified tax system with the object of taxation “income reduced by the amount of expenses”. In accordance with the accounting policy of the organization, when selling goods, they are assessed at the cost of each unit. The accountant will make entries: in December 2020 : DEBIT 41 CREDIT 60

- 150,000 rub.

(RUB 177,000 – RUB 27,000) – purchased goods are accepted for accounting; DEBIT 19 CREDIT 60

- 27,000 rub.

– reflected “input” VAT on goods; DEBIT 68 subaccount “Calculations for VAT” CREDIT 19

- 27,000 rub.

– “input” VAT on goods has been accepted for deduction; DEBIT 62 CREDIT 90-1

- 236,000 rubles.

– revenue from the sale of goods is reflected; DEBIT 90-2 CREDIT 41

- 150,000 rub.

– expenses for the purchase of goods are written off; DEBIT 90-3 CREDIT 68 subaccount “VAT calculations”

- 36,000 rubles.

– VAT is charged on proceeds from the sale of goods; DEBIT 51 CREDIT 62

- 236,000 rub.

– payment for goods has been received from the buyer. in January 2020: DEBIT 60 CREDIT 51

- 177,000 rubles. – goods have been paid to the supplier. For tax purposes, expenses for the fourth quarter of 2020 must include the actual cost of goods – 150,000 rubles. But the organization does not have any “simplified” expenses.

Read also: “The book of accounting for income and expenses under the simplified tax system will be adjusted”

Transition from simplification to imputation

The transition from the simplified tax system can be not only to the special tax system, but also to other tax regimes, for example, UTII, if this corresponds to the type of activity being carried out (clause 2 of article 346.26 of the Tax Code of the Russian Federation). However, such a transition can only be made from the beginning of the next year, since voluntary refusal of the simplified tax system during the tax period is not allowed (clause 3 of article 346.13 of the Tax Code of the Russian Federation). At the same time, you will have to notify the Federal Tax Service of your intention to apply UTII within the first 5 working days of the year (clause 3 of Article 346.28 of the Tax Code of the Russian Federation).

Important! In 2021, UTII should be abolished. However, there is a possibility that this regime will be extended until 2024.

The list of activities to which UTII can be applied is established by local city or district authorities. She also makes a decision regarding the size of the single tax rate, which depends not on the results of economic activity, but on its types.

Organizations that have switched to imputation, just as under the simplified tax system, are required to submit financial statements to the tax office. The set of mandatory taxes for companies and individual entrepreneurs remains the same as under the simplified tax system (payments to extra-budgetary funds, personal income tax), but the simplified tax system tax is replaced by the UTII tax.

Just as with the simplified tax system, income tax, property tax (in the absence of property valued at cadastral value), VAT are not payable on UTII, but if there is a base, land, transport and water taxes are paid.

The tax base for UTII is deciphered in Art. 346.29 Tax Code of the Russian Federation. Adjustment factors are applied to it. The monthly tax amount is determined by multiplying the tax base by 15%. The single tax is reduced by the amount of insurance premiums paid - by 100% (individual entrepreneurs working alone) or 50% (firms and individual entrepreneurs hiring workers).

Notification of transition to simplified tax system

Changing the tax regime from OSNO to USN begins with sending a notification to the Federal Tax Service (clause 1 of Article 346.1 of the Tax Code of the Russian Federation). The following must be taken into account:

- This is done on any day during the year, until December 31, before the year when the organization switches to simplified legislation.

- The notification is filled out according to form 26.2-1, which indicates ONE, income for 9 months, and the residual value of fixed assets as of October 1.

- Notice may be sent electronically.

New organizations and individual entrepreneurs can become simplifiers if they submit a notification within 30 days after making the relevant entries in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs. For more information on the procedure for notifying tax authorities about a change in the taxation system, see the article Application for the use of the simplified tax system when registering an LLC (nuances).

Features of the transition from a simplified taxation system to a general one: we recognize income and expenses

Revenue unpaid under the simplified tax system must be included in income in the 1st month of application of the simplified tax system (subclause 1, clause 2, article 346.25 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated 01/09/2018 No. SD-4-3/6).

All advances that the “simplified” person received before the transition from the simplified tax system to the OSNO are included in the taxable base for a single tax. This is done even if the goods are shipped in advance after the transition from the simplified tax system to the general taxation system (subclause 1, clause 1, article 251 of the Tax Code of the Russian Federation). The costs of such shipment will reduce the income tax base (letter of the Ministry of Finance dated January 28, 2009 No. 03-11-06/2/8).

Expenses during the transition from the simplified tax system to OSNO (in the first month of application of the new regime) include unpaid debt for services rendered (subclause 2 of clause 2 of article 346.25 of the Tax Code of the Russian Federation), unpaid wages and unpaid insurance premiums (letters from the Ministry of Finance of the Russian Federation dated 05/03/2017 No. 03-11-06/2/26921, dated December 22, 2014 No. 03-11-06/2/66188).

The Tax Code of the Russian Federation does not link the possibility of classifying unpaid goods, works, and services as expenses under the simplified tax system with the use of one or another object of taxation under the simplified tax system (“income” or “income minus expenses”). That is, expenses that were incurred when applying the simplified tax system, including with the object “income,” but were paid after the transition to OSNO, are taken into account when calculating income tax. The procedure for accounting for expenses on goods causes controversy. In order to take into account the costs of them for the simplified tax system, the goods must not only be paid for, but also sold. Therefore, goods that were purchased and paid for under the simplified tax system, and sold after the transition to OSNO, are allowed by senior judges to be taken into account during the period of their sale, that is, when calculating income tax (letter of the Federal Tax Service of the Russian Federation dated 01/09/2018 No. SD-4-3/6 , ruling of the Supreme Court of the Russian Federation dated March 6, 2015 No. 306-KG15-289). Previously, the Ministry of Finance expressed a different position - expenses should be taken into account on the date of transition (letter dated July 31, 2014 No. 03-11-06/2/37697). Now the position of the department coincides with the opinion of the Supreme Court (letters of the Ministry of Finance of the Russian Federation dated November 14, 2016 No. 03-03-06/1/66457, dated January 22, 2016 No. 03-03-06/1/2227). This is especially beneficial for those who used the simplified tax system with the object “income”, because before switching to OSNO they cannot use expenses to reduce tax.

If a taxpayer has accounts receivable using the simplified tax system, the return of which is impossible, then losses from their write-off are not taken into account. It cannot reduce the tax base for the simplified tax system (Article 346.16 of the Tax Code of the Russian Federation) and attribute it to expenses for the special tax system (subclause 2 of clause 2 of Article 346.25 of the Tax Code of the Russian Federation) will also not work (letter from the Ministry of Finance dated February 20, 2016 No. 03-11-06 /2/9909, dated June 23, 2014 No. 03-03-06/1/29799).

Read about the procedure for accounting for expenses during a voluntary transition from the simplified tax system to the OSN in the material “From the simplified tax system to the OSN: adding up last year’s expenses.”

Conclusions (+ video)

The simplified taxation system has many advantages. Despite this, many businessmen prefer the standard method of calculating taxes. It is important to note that, unlike voluntary regime change, forced transfer can be carried out at any time during the reporting period. At the time of changing the tax payment system, it is very important to comply with all the requirements of regulatory authorities regarding tax and accounting reports. The use of the classical form of taxation provides an opportunity for an entrepreneur to use additional methods of business development that are not available to other tax payers.

Determination of the residual value of fixed assets and intangible assets during the transition from the simplified tax system to the OSNO

If the simplifier makes the transition to OSNO voluntarily from the beginning of next year, then problems with fixed assets do not arise. Property purchased under the simplified tax system is written off in equal shares during the tax period - a year.

If the transition from the simplified tax system occurs before the end of the year, the balance of the cost of the acquired fixed asset will be recorded. With the object “income minus expenses”, this balance of the property value not written off as “simplified” expenses must be transferred to tax accounting on OSNO as the residual value of fixed assets (letter of the Ministry of Finance of the Russian Federation dated March 15, 2011 No. 03-11-06/2/34). When switching to OSNO from the simplified version with the object “income”, you also have the right to determine the residual value of the OS (clause 3 of Article 346.25 of the Tax Code of the Russian Federation, clause 15 of the Review approved by the Presidium of the Supreme Court of the Russian Federation on July 4, 2018, letter of the Ministry of Finance dated June 14, 2019 No. 03 -04-05/43643, Federal Tax Service dated July 30, 2018 No. KCH-4-7/14643). To do this, from the original cost of the object, you need to subtract the expenses that could have been incurred if you had used the object “income minus expenses”.

Examples of calculating the residual value of fixed assets for each of these cases can be viewed by obtaining free access to ConsultantPlus.

The Tax Code of the Russian Federation has a rule on calculating the residual value of fixed assets and intangible assets when switching from the simplified tax system to the OSNO. It concerns objects that were acquired before the application of the simplified tax system during the period of work at OSNO. That is, they bought property on OSNO, then switched to the simplified tax system, and then returned to OSNO. On the date of return to income tax, the tax residual value of fixed assets and intangible assets is calculated as the difference between the residual value of these objects upon transition to the simplified tax system and the expenses written off during the period of application of the simplified tax system (clause 3 of Article 346.25 of the Tax Code of the Russian Federation).

For more information about fixed assets, see this article.

Limits and restrictions on the simplified tax system

Now let’s look at what conditions you can lose for violating the right to a simplified license. Most often this happens due to exceeding the income limit. Paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation states that this is 150 million rubles based on the results of the reporting or tax period. That is, the transition from the simplified tax system to the OSNO in 2020 will occur if, at the end of any quarter or the entire year, the amount of income taken into account on an accrual basis exceeds this figure.

In addition, you can lose your right to preferential treatment for the following reasons:

- the average number of employees per year exceeded 100 people;

- the organization opened a branch;

- the share in the company owned by another legal entity exceeded 25%;

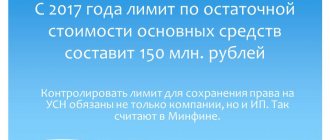

- the residual value of fixed assets exceeded 150 million rubles;

- the organization began to engage in business that is prohibited for the simplified tax system (for example, producing excisable goods);

- a company using the simplified tax system with the object “Income” has entered into a simple partnership or entered into a property trust management agreement.

The restrictions for the use of the simplified tax system are described in detail in paragraph 3 of Article 346.12 of the Tax Code of the Russian Federation.

The Ministry of Finance proposes to increase the limits on income and the number of employees from 2020, as well as introduce additional increased tax rates. If this is ultimately approved, the following procedure will apply:

- If the number of employees is no more than 100 people and / or income is no more than 150 million rubles, the previous rates will be applied - 6% for the simplified tax system for income and 15% for the object “Income minus expenses”.

- If the number of employees is 101-130 people and / or income is from 150 to 200 million rubles, rates of 8% and 20% will be applied.

- If you go beyond the upper values from point 2, the simplification cannot be used.

The increased rates will remain in effect until the end of the year in which the limit was exceeded, as well as the entire next year. If at the end of it the number of employees / income fits into the amounts specified in paragraph 1, then the rate is reduced to the standard one.

VAT upon transition from simplified tax system to OSNO

When the application of the simplified tax system is terminated (regardless of the reason for this termination), the company or individual entrepreneur becomes a VAT payer and acquires the obligation to accrue it. During the transition period, you need to take into account when the money arrived. If an advance payment for a product was received before the transition to OSNO, and its purchase occurred later, then VAT must be charged only on sales. If an advance is received after the transition from the simplified tax system to OSNO, VAT is calculated from the amount of the advance and accrued for sale. Moreover, after shipment, VAT on the advance payment can be included in deductions.

Read more about the rules for VAT refund on a simplified basis in this article .

See also the article “What to do with “input” VAT on fixed assets when transitioning from the simplified tax system to the general taxation regime?”.

When switching from the simplified tax system, VAT must be charged from the beginning of the quarter in which the transition to OSNO took place, even if this happened in the last month of the quarter. The company must calculate and pay tax to the budget for the entire quarter.

Rule 2 – for sellers (performers)

Money received after the transition to the use of the simplified tax system (for example, in 2020) is not included in income if these amounts are reflected in income before the transition to the use of the simplified tax system (subclause 2, clause 1, article 346.25 of the Tax Code of the Russian Federation).

Read also “What income cannot be taken into account under the simplified tax system”

A common situation is receiving payment in 2020 for last year’s or earlier sales of goods, works, and services. The following is important here. If before 2020 the organization worked on a common system, then by the time it switched to using the simplified tax system it had already recognized income from sales. Therefore, when receiving payment, there is no need to recognize the same income within the simplified tax system again - upon receipt of money.

Fortunately, there are no VAT difficulties in this situation.

The tax must be accrued and paid to the budget in the usual manner - upon shipment, during the period of work on the general taxation system. EXAMPLE.

LACK OF INCOME WHEN TRANSITIONING FROM OSN TO STS Let's assume that an organization (performer) sold goods in November 2016 in the amount of 236,000 rubles, including VAT - 36,000 rubles.

Payment was received in January 2020 - after the transition to the use of the simplified tax system. The accountant will make entries (we do not consider writing off the cost of goods): in November 2020: DEBIT 62 CREDIT 90-1

- 236,000 rubles.

– revenue from the sale of goods is reflected; DEBIT 90-3 CREDIT 68 subaccount “VAT calculations”

- 36,000 rubles.

– VAT is charged on the cost of goods. in January 2020: DEBIT 51 CREDIT 62

- 236,000 rubles. – payment for goods has been received. And for tax purposes, income in the amount of 200,000 rubles. the organization recognized in November 2020. There is no need to reflect income in January 2020 (upon receipt of money).

Invoices during the transition from the simplified tax system to the OSNO

It is necessary to pay attention to the fact that re-issuance of invoices with the inclusion of VAT is possible only for those shipments whose issuance period (5 days) expires in the month when the transition to OSNO became necessary. This is regulated by the fact that invoices from the date of shipment are issued exactly within this period (clause 3 of Article 168 of the Tax Code of the Russian Federation). Similar explanations are given by the letter of the Federal Tax Service dated 02/08/2007 No. MM-6-03/ [email protected] If the seller loses the right to the simplified tax system, then he will have to pay VAT at his own expense. It will not be possible to take this amount into account in expenses for income tax (Article 170, paragraph 19 of Article 270 of the Tax Code of the Russian Federation).

Some arbitration courts come to the conclusion that it is correct to re-issue invoices with the allocation of VAT from the beginning of the entire tax period for VAT, which includes the loss of the right to the simplified tax system (Resolution of the Federal Antimonopoly Service of the Volga District dated May 30, 2007 No. A12-14123/06-C29 was supported by the YOU RF in definition dated 06.08.2007 No. 9478/07).

Results

You can switch from the simplified tax system to the general taxation system on a voluntary basis from the beginning of the new year or if you lose the right to a simplified tax system. As a result of this, the volume of both accounting and tax accounting will increase, as well as the number of taxes paid.

Sources:

- Tax Code of the Russian Federation

- Review of judicial practice of the Supreme Court of the Russian Federation No. 2 (2018)

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Transition to UTII

You can change the taxation regime from the simplified tax system to the imputed income system only at the beginning of the calendar year by submitting an application to the Federal Tax Service in the form of UTII-1 (for legal entities) and UTII-2 (for individual entrepreneurs). You can switch from OSN to UTII at any time by submitting an application within five working days from the day from which you plan to apply UTII. The transition is carried out exclusively for types of activities that are covered by UTII, so the system can be combined with OSNO and simplified tax system. In this case, it is necessary to maintain separate tax records. Do not forget that UTII will be canceled from January 1, 2021. With the abolition of UTII, organizations and individual entrepreneurs have the right to switch to a simplified taxation system, and individual entrepreneurs to a patent taxation system or to pay tax on professional income.