When to file a tax deduction when buying an apartment? Many problems traditionally arise with this issue, which causes a number of difficulties for taxpayers. You should consider when the deadline for filing the 3rd personal income tax return expires in 2019, what changes have occurred, and what citizens who want to receive a deduction for purchasing property need to do.

When to take it?

The report must be sent to the INFS at the place of residence or place of stay of the individual. The document can be submitted during a personal visit, or sent by registered mail, while making an inventory of the attachment. It is also possible to transmit information through the online service on the website of the Federal Tax Service of Russia.

The deadline for filing the 3rd personal income tax return for 2020 for tax deduction will be in 2019. In 2019, it is necessary to report for income arising in 2018, and the last day on which this can be done is April 30, 2020. This date is prescribed by law, but if the date falls on a weekend, it is moved to the next weekday. In 2019, April 30 falls on a Monday, which is why it is the last one.

There is an exception only for individual entrepreneurs and privately practicing lawyers - if their activities are terminated before the end of the year, then they must report within 5 days after closure.

By establishing this restriction, the tax authorities created an unclear situation - to the question of when it is necessary to submit a declaration for the return of compensation, the answer seems clear, on April 30. But this applies to people who need to declare income. If we are talking about an income tax refund from the purchase of an apartment, then you can submit the document on any day of the year. When purchasing residential space in January 2017, you are allowed to claim the right to property benefits throughout the entire 2019 year.

Due dates in 2020

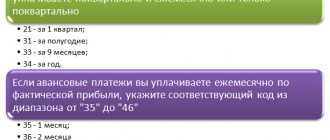

Income tax payers are divided into two categories:

- those who pay advances quarterly;

- those who pay advances monthly.

Companies whose income for the previous 4 quarters did not exceed 15 million rubles (the limit was increased in 2020 from 10 million rubles) are entitled to submit declarations quarterly. Other companies pay advances once a month from actual profits, so they also fill out reports every month.

Let's present the deadline for filing income tax returns in the form of tables.

Quarterly reporting

| Period | Term |

| 2020 | Until March 28, 2021 |

| 1st quarter 2020 | Until 04/28/2020 |

| Half year | Until July 28, 2020 |

| 9 months | Until October 28 |

Monthly reporting

| 1 month 2020 | Until February 28 |

| 2 months 2020 | Until March 30 |

| 3 months 2020 | Until April 28 |

| 4 months 2020 | Until May 28 |

| 5 months 2020 | Until June 29 |

| 6 months 2020 | Until July 28 |

| 7 months 2020 | Until August 28 |

| 8 months 2020 | Until September 28 |

| 9 months 2020 | Until October 28 |

| 10 months 2020 | Until November 30 |

| 11 months 2020 | Until December 28 |

| 2020 | Until 01/28/2021 |

Restrictions

Regardless of the time of filing, the property tax deduction has no statute of limitations. They can be used at any time throughout life. For example, if a person purchased residential space in 2013, but did not know about his right, he can use it in 2019. Moreover, it is allowed to receive the benefit immediately for three years preceding the year of application.

In cases of pregnant women or women on maternity leave, the right is also not canceled. However, they will be able to receive a refund only after they are reinstated in their jobs and begin to receive taxable income - wages.

If you have difficulties filling out and submitting the 3-NDFL declaration, you can use the services of organizations that carry out activities such as transferring information to the Federal Tax Service. Employees will answer any questions that arise, draw up documents themselves, and hand them over in the presence of a power of attorney.

Deadlines for registering separate divisions with the tax authority

Article 83 of the Tax Code of the Russian Federation contains an indication that legal entities that have separate subdivisions (SBs) in the constituent entities of the Russian Federation must register for taxation with the Federal Tax Service at the territorial location of each of the SBs. A legal entity is obliged to inform the tax authorities at its place of residence about the creation of an OP. In this case, it does not matter which Federal Tax Service has jurisdiction over the territory in which the OP was created.

A legal entity must send a notification to the Federal Tax Service about the creation of an OP. After this, the legal entity will be registered with the tax authorities in the subject of its location, provided that they are not its representative offices or branches. (clause 4 of article 83, subclause 3 of clause 2 of article 23 of the Tax Code of the Russian Federation). The form of such a document was approved by order of the Federal Tax Service of Russia dated June 9, 2011 No. ММВ-7-6/ [email protected]

The legislation allows a period of one month to provide the Federal Tax Service with a notification about the creation of an OP. According to paragraph 6 of Art. 6.1, clause 2 of Article 84 of the Tax Code of the Russian Federation, representatives of tax authorities register the organization at the location of its OP within a period not exceeding five working days after receiving the message. The document confirming the fact of registration is the notification of registration.

Starting from February 1, 2008, legal entities are exempt from the obligation to submit an application for tax registration in the territory of the OP location. Registration is carried out automatically by the Federal Tax Service on the basis of information provided by a legal entity (clause 3, clause 2, article 23 of the Tax Code of the Russian Federation) within a period of 5 days from the date of receipt of this information (clause 4, article 83, clause 2 Article 84 of the Tax Code of the Russian Federation). So, the organization must, within a month from the moment of creation of the OP, send a message about this to the Federal Tax Service of the subject in which it is located.

It should be noted that a legal entity must also, within a period of one month, notify in writing about the creation of an OP to the authorities monitoring the payment of insurance premiums. This is done at the location of the company (clause 2, part 3, article 28 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”, further – Law No. 212-FZ).

Letter of the Ministry of Health and Social Development of Russia dated September 9, 2010 No. 2891-19 contains an indication of the fact that an organization is obliged to report the creation of an OP, regardless of whether it has a separate balance sheet, current account and mutual settlements with individuals.

The following government bodies control the timely payment of insurance payments:

- The Pension Fund of the Russian Federation and its territorial divisions in relation to insurance contributions for compulsory pension insurance paid to the Pension Fund and insurance contributions for compulsory medical insurance paid to the FFOMS;

- The Social Insurance Fund and its territorial divisions in relation to insurance payments for compulsory social insurance in case of temporary disability and in connection with maternity paid to the Social Insurance Fund of Russia.

Notification of the creation of an OP can be provided to the body monitoring the payment of insurance premiums at the location of the legal entity in free form, since the law does not approve a single form.

Is it difficult to understand everything and not make mistakes when communicating with the tax office? Seek help from professionals.

How we are working? Services. Primary audit. Agreement.

Explanation of changes

When taxing in 2020, it should be taken into account that the maximum allowable deduction is based on an amount of 2,000,000 rubles. However, now this restriction applies not to the property, but to the subject. This means that a person can claim not 13% of the cost of housing, but 13% of the amount of 2,000,000 rubles. Of course, with a real estate price of 700,000 rubles, this is significantly more.

Until 2014, it was possible to apply only for an object, but now you can submit documents unlimitedly until the amount of 260 thousand rubles (13%) is repaid.

A declaration is submitted to return interest on mortgage lending - the amount is limited to 3 million rubles. However, all adjustments made are significant if:

- the person did not receive a deduction for real estate, the right to which appeared before 01/01/2014;

- the citizen purchased the property after 01/01/2014.

Thus, if the period for receiving a tax deduction has arrived, a person has used it within the limits of previously existing restrictions (130 thousand rubles), then after a couple of years he cannot receive an additional amount, because he has already used his right.

Deadlines for filing income tax returns for non-profit organizations and tax agents

There are exceptions to the general rule for submitting interim reporting. They concern non-profit organizations, cultural budgetary institutions and tax agents for NP.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Non-profit organizations do not have to pay IR; they only submit an annual IR report. The same rule applies to cultural budgetary institutions (libraries, concert organizations, museums, theaters) (Clause 2 of Article 289 of the Tax Code of the Russian Federation).

The deadline for all listed organizations is once a year - March 28 of the next (after the end of the reporting) year (clause 1 of Article 285, clause 4 of Article 289 of the Tax Code of the Russian Federation).

IR agents have different regulations.

A tax agent for an IR is an enterprise in the Russian Federation that pays any income (dividends, interest on securities, etc.) to third-party Russian and/or foreign companies.

The tax agent must report on the income paid and the organizations that received them in a timely manner.

The IR agent needs to submit reports by the 28th day after the end of the reporting period when the income was transferred (clauses 1, 3, 4 of Article 289, Article 285 of the Tax Code of the Russian Federation). The accrued tax by the agent is paid within the same time frame. At the end of the tax period, the agent also submits the payment for the IR, even if the payment was only once.

For which years can I submit information in 2019?

It is already known when the right arises, therefore, if you have never used it before the new year, then you can apply even with a deduction for the purchase of property even in 2003. You just need to understand that the amount will be limited taking into account the limits at that time.

You can return the deduction from the moment the right arose, as well as for the last three years. Pensioners have the opportunity to reimburse for the previous four years, that is, for the years 2014-2017.

If the owner bought the property in 2007, but applied for the deduction only in 2019, he can claim the amount of taxes transferred in 2015-2018. The right to income from 2007-2014 has already been lost, but the right to the deduction itself has not.

INFS actions

Anyone who wishes to receive a deduction must submit a personal income tax return. In order to submit a tax deduction when purchasing an apartment or real estate, the Federal Tax Service clearly indicates what information to provide.

The processing time for a tax refund return is three months. During this period, the procedure for contributions, payment of insurance premiums, and benefits are considered. The ownership of an apartment that was purchased before applying for a tax deduction is also assessed.

To receive property personal income tax, citizens will have to submit all the required documents. And after making a positive decision, wait for the payment itself within a month. After insurance premiums and other indicators are verified, accrual will occur. The property deduction will return after this. Although in practice, when you can get a deduction for an apartment, it takes much longer to transfer it.

The remaining changes related to 3-NDFL declarations concern individual entrepreneurs and the self-employed population. The procedure for calculating insurance premiums, tariffs, liability and fines has been changed. For individuals applying for a property return, there are no other changes yet and are not expected. In any case, if difficulties arise, you can always contact specialized companies for advice.

What are the deadlines for registration with the tax authority?

Each legal entity must be registered with the Federal Tax Service within the period established by Russian legislation. According to Article 83 of the Tax Code of the Russian Federation, a company must initiate tax registration (TR):

- Upon initial registration as a legal entity in the subject of its residence (clause 2 of Article 8 of Law No. 129-FZ dated 08.08.2001).

- In the subject of the Russian Federation where its separate divisions are located (clause 4 of Article 83 of the Tax Code of the Russian Federation).

- In the subject of the Russian Federation in which the real estate and vehicles owned by it are located (clause 5 of Article 83 of the Tax Code of the Russian Federation).

- In other situations described in the Tax Code of the Russian Federation.

Let's take a closer look at the situation in which a company is just being created. Based on clause 8 of Art. 51 of the Civil Code of the Russian Federation, an organization is considered created from the day when an entry about it was made in the unified register of legal entities. Based on the entry in the Unified State Register of Legal Entities, the company is registered. This point is regulated by clause 3 of Art. 83 of the Tax Code of the Russian Federation.

The organization is registered with the Federal Tax Service (clause 1 of Article 51 of the Civil Code of the Russian Federation, clause 1 of the Regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation of September 30, 2004 No. 506). Divisions of the fiscal service are also involved in registering legal entities for tax purposes during their initial registration (clause 2 of article 84 of the Tax Code of the Russian Federation).

By default, after registration, a legal entity is required to use the general taxation system. If an economic agent wishes to apply a different regime, then he is obliged to promptly inform the tax office about this. The procedure begins with submitting an application for registration as, for example, a UTII payer (the procedure for this regime is slightly different).

According to the provisions of the Tax Code of the Russian Federation, a legal entity is required to submit an application to the Federal Tax Service within a period of 5 days. Counting starting from the day of the actual transition to UTII (clause 6, article 6.1, paragraph 1, clause 3, article 346.28 of the Tax Code of the Russian Federation). The date of transition to UTII may not coincide with the start date of the company’s activities, since the application of this tax regime is voluntary. If such a situation arises, the application for registration with NU shall indicate the date from which the payer began to apply UTII. In this way, possible discrepancies in timing will be eliminated.

Example . Avangard LLC has been engaged in retail trade since January 12, 2020. From that moment on, the company was under the general taxation regime. From March 1, 2020, the company switched to UTII.

According to paragraph 2 of Article 6.1 of the Tax Code of the Russian Federation, the establishment of the deadline for filing an application begins from the date following the day of the event. However, it should be noted that the period is calculated in working days only unless otherwise specified. This point is regulated by paragraph 6 of Article 6.1 of the Tax Code of the Russian Federation.

In our example, the five-day period provided for registration begins on March 2, 2020 and ends on March 6.

In other words, Avangard LLC must notify the Federal Tax Service of its desire to switch to UTII by March 6 inclusive. The start date for the application of UTII will be March 1, 2020. This date will appear in the documents as the organization’s registration as a UTII payer.