Where are contributions accrued to extra-budgetary funds paid in 2020?

Since 2020, control over the calculation and payment of insurance premiums intended for the Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund (except for contributions for injuries) has been transferred to the tax authorities. The calculation rules and description of the procedure for paying contributions to those who replaced the administrator were included as an integral part in the text of the Tax Code of the Russian Federation. These changes have led to the fact that insurance premiums have become subject to most of those provisions of tax legislation that are common to all tax payments. It is precisely because of this that the term “taxes to extra-budgetary funds” has become fair in relation to insurance premiums.

Where are taxes paid to extra-budgetary funds in 2020? There are no changes in this compared to 2020:

- contributions controlled by the tax service are paid to the budget, registering this payment in the same way as payment of any other tax, with the corresponding “budgetary” BCC;

- contributions for injuries remaining under the jurisdiction of the Social Insurance Fund are transferred to this fund itself.

Accordingly, reporting on contributions is submitted to 2 different places and 2 different authorities control the correctness of accrual and timely payment.

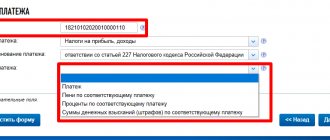

Features of filling out an income tax return

The mandatory pages of the income tax return for all taxpayers are the title page, subsection 1.1. section 1, sheet 02 and appendices No. 1 and 2 thereto. The remaining sheets are filled out only in cases where, according to the terms of the activity, this is mandatory for taxpayers.

When filling out your income tax return, you need to pay attention to the following important points:

- the report does not need to include those sheets that do not contain any data;

- the quarterly declaration may contain monthly advance payments if the company pays them;

- payments on profits must be divided at rates - 3% to the federal budget and 17% to the regional budget;

- if there is a separate division in the territory of a region different from the region where the head office is located, the declaration is submitted at the location of this division;

- if the company did not conduct business during the reporting period and did not have a profit, then it can fill out the declaration in a simplified form - only the title page and subsection 1.1 with dashes indicating the amounts of tax payable.

In some cases, taxpayers are required to file an adjusted income tax return. The updated calculation should be completed on the form that was used to submit the initial report.

An adjustment declaration must be generated if errors are found in the calculations due to which the income tax is calculated incorrectly. In the case where the amount of income tax in an incorrectly formed declaration was underestimated due to an error, when submitting adjustment reports, you must also pay the difference in tax to the budget.

Important! In case of additional payment of income tax, you will also have to pay a penalty.

for late payment.

Types of contribution payers and differences in their assessments

Payers of contributions are divided into 2 groups (Article 419 of the Tax Code of the Russian Federation):

- employers, which include legal entities, individual entrepreneurs and individuals providing work to hired employees;

- self-employed persons (individual entrepreneurs, notaries, lawyers, appraisers and others like them) who must pay contributions for themselves, regardless of whether they have employees (i.e., having employees does not exempt them from paying contributions for themselves, but paying contributions for itself does not serve as an exemption from payments for hired employees).

The rules for calculating and paying contributions for these 2 groups differ significantly. There are differences in almost all key points:

- the number of extra-budgetary funds to which contributions are paid;

- rules for calculating the base for calculating payments;

- opportunities to apply benefits and use insurance funds;

- reporting obligations;

- the procedure for accrual and timing of payments.

Employers pay all 4 types of contributions (pension, medical and social insurance (sick leave and maternity), injury) intended for all 3 extra-budgetary funds (PFR, MHIF, Social Insurance Fund). The basis for their calculation is income paid to employees. Part of this income is preferential, and social payments can be made through contributions to the Social Insurance Fund. Employers generate quarterly reports on accrued/paid/used contributions.

Self-employed persons are required to pay contributions only to the Pension Fund and the Compulsory Medical Insurance Fund (clause 6 of Article 430 of the Tax Code of the Russian Federation). The volume of their payments to each of the funds depends on the federal minimum wage established at the beginning of the year and is fixed in nature, but for accruals to the Pension Fund it can acquire a variable part. The benefits here are expressed in the fact that contributions to the Pension Fund of the Russian Federation are always accrued by the heads (members) of peasant farms (peasant farms) only in a fixed amount. Reporting on contributions is not provided and, as an exception, is submitted only by heads of peasant farms that ceased operations before the end of the accounting year.

However, 2 such different types of payers also have common points regarding contributions:

- accruals are made by them independently;

- the billing period, defined as a year, is the same;

- payment to each fund is calculated and paid separately;

- When calculating contributions, the same basic tariffs are applied;

- the established deadlines are subject to the rule of transfer to a later date if they fall on a weekend (clause 7 of article 6.1 of the Tax Code of the Russian Federation, clause 4 of article 22 of the law “On compulsory social insurance...” dated July 24, 1998 No. 125-FZ);

- The same rules for processing payment documents are used.

For more information on filling out payment slips for insurance premiums, read the article “How to fill out payment slips for insurance premiums in 2017?”

The procedure for calculating and paying contributions from the salaries of employees

Contributions from the income of employees are calculated by employers monthly when calculating salaries for the next month and are also paid monthly (but in the month following the billing month). The last day of payment for all types of contributions is the same - the 15th day (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 of Law No. 125-FZ of July 24, 1998).

The accrual base is formed on an accrual basis from the beginning of the year, and the amount that is actually accrued for the last month of the period is actually subject to monthly payment. The base is reduced due to payments that are not subject to taxation (Article 422 of the Tax Code of the Russian Federation, Article 20.2 of Law No. 125-FZ of July 24, 1998).

In 2020, for contributions accrued to the Pension Fund, employers continue to use basic tariffs that are lower than the basic ones (Article 426 of the Tax Code of the Russian Federation). At the same time, some payers have the right to apply even lower rates on payments both to the Pension Fund and to other funds (Articles 427–429 of the Tax Code of the Russian Federation). The values of a number of these rates have been increasing since 2020, and some of them have reached generally established values.

For the bases calculated for the Pension Fund of Russia and the Social Insurance Fund, there is a concept of their limit values, upon reaching which contributions to the Social Insurance Fund for sick leave and maternity leave cease to be accrued, and contributions to the Pension Fund of the Russian Federation begin to be calculated at a different rate. The value of these limits is growing every year, and 2020 was no exception in this sense.

To learn about the amounts to which the income limits for employees are expected to increase in 2020, read the material “The government has decided on the size of the maximum contribution bases for 2018.”

How do self-employed persons calculate and pay contributions?

For self-employed persons, a different procedure for paying insurance premiums applies. They need to pay for the billing period, but how this will be done (in parts or one-time) does not matter. It is important to meet payment deadlines. And they will differ depending on what the payment turned out to be (fixed or containing a variable part).

A payment is considered to be fixed when the basis for its calculation is determined only by the federal minimum wage established at the beginning of the accounting year and the number of months of activity in a year (including the number of days falling on an incomplete month). This calculation algorithm is used for payments (clauses 1, 2 of Article 430 of the Tax Code of the Russian Federation):

- in the Compulsory Medical Insurance Fund;

- Pension Fund, if they are accrued when the annual income of a self-employed person does not exceed 300,000 rubles, or is carried out by the heads (members) of peasant farms.

If the annual income of a payer who is obliged to pay contributions for himself turns out to be more than 300,000 rubles, then a variable is added to the fixed part of the payments accrued to the Pension Fund. This variable part is calculated as 1% of the amount of income exceeding RUB 300,000. However, the amount of contributions calculated in this way cannot exceed 8 times the value of the fixed part calculated for the full year.

Compared to the previous year, a larger federal minimum wage (RUB 7,800) is used to calculate fixed payments in 2020. The rates remain the same and are the highest possible from the base rates.

For information about the size of the federal minimum wage at the beginning of 2018, read the article “The size of the minimum wage in 2020.”

Deadlines for paying taxes to funds in 2020 for yourself

For payment of fixed payments there is only 1 legally established period. It corresponds to December 31 of the accounting year (clause 2 of Article 432 of the Tax Code of the Russian Federation), i.e. the fixed payment (as well as the fixed part of the payment to the Pension Fund, which also contains a variable component) must be paid in the year of its accrual. However, the number and volume of payments that can be made against this payment during the year are not limited in any way.

For the variable component of the calculation of contributions for the Pension Fund, a different deadline applies, the last date of which is set as April 1 of the year occurring after the end of the calculation year.

These deadlines will not be observed only if the payer ceased activity in the accounting year. In such a situation, he will have to pay contributions within 15 calendar days from the date (clauses 4, 5 of Article 432 of the Tax Code of the Russian Federation):

- deregistration of a self-employed person who is not the head of a peasant farm;

- submission by the head of the peasant farm of a report on contributions to the Federal Tax Service, for the submission of which he is also given no more than 15 calendar days.

Taking into account the transfers allowed by law, the deadlines for payment of contributions by self-employed persons in 2020 will be as follows:

The variable part of the payment to the Pension Fund, accrued for 2020, will need to be paid already in 2020 - no later than 04/01/2019.

Tax calendar for 2020: reporting deadlines

We present to your attention the reporting calendar for 2018. For the convenience of visitors, the information is collected in a table. The calendar is very extensive, so for more convenient use, we advise you to select those reports that relate to your activities. The third column indicates which organizations or individual entrepreneurs submit a specific report.

| Deadline for submission | Title of the report and receiving authority | Who rents |

| January 9 | Declaration on mineral extraction tax for December 2020 to the Federal Tax Service | Legal entities - subsoil users |

| January 15 | Report on the generation, use, neutralization and disposal of waste (except for statistical reporting) for 2020 in the Technical Specifications for Natural Resources and Ecology | Legal entities and individual entrepreneurs whose work generates waste |

| January 15 | SZV-M for December 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| January 22 | Unified simplified tax return for the 4th quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs that did not operate during the reporting period |

| January 22 | Information on the average headcount for 2020 at the Federal Tax Service | Legal entities and individual entrepreneurs who hired workers during this period |

| January 22 | Declaration of water tax for 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs using water bodies |

| January 22 | Declaration on UTII for 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs |

| January 22 | DSV-3 for the 4th quarter of 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs who pay additional contributions to the funded part of the pension |

| January 22 | Journal of accounting of received and issued invoices for the 4th quarter of 2020 in electronic form in the Federal Tax Service | The following legal entities and individual entrepreneurs:

|

| January 22 | Declaration of indirect taxes for December 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs paying VAT and excise taxes in the process of importing goods into Russia from their EAEU member states |

| January 22 | 4-FSS (paper) for 2020 in the FSS | Legal entities and individual entrepreneurs with hired employees, numbering less than 25 people |

| The 25th of January | 4-FSS (electronic) for 2020 in the FSS | Legal entities and individual entrepreneurs with employees of 25 or more people |

| The 25th of January | VAT return for the 4th quarter of 2020 to the Federal Tax Service | The following legal entities and individual entrepreneurs:

|

| January 30 | Unified calculation of insurance premiums to the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| January 31 | Declaration on mineral extraction tax for December 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs - subsoil users |

| 1st of February | 2 TP-waste in Rosprirodnadzor technical specifications | Legal entities and individual entrepreneurs involved in waste management |

| 1st of February | Transport tax return for 2020 to the Federal Tax Service | Legal entities to which vehicles are registered |

| 1st of February | Tax return for land tax for 2020 to the Federal Tax Service | Legal entities - owners of land plots |

| February, 15 | SZV-M for January 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| February 20th | Declaration of indirect taxes for January 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs paying VAT in connection with the import of products to Russia from EAEU member countries |

| 28th of February | Income tax return for January 2020 to the Federal Tax Service | Legal entities with income of more than 15 million rubles for the last quarter during the last year submit a declaration and pay tax monthly |

| 28th of February | Tax calculation for income tax for January 2020 at the Federal Tax Service | Legal entities-tax agents, calculating monthly advance payments based on actual profit received |

| 28th of February | Declaration on mineral extraction tax for January 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs - subsoil users |

| March 1 | SVZ-STAZH for 2020 in the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| March 1 | Information about the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of tax not withheld for 2017 in the Federal Tax Service | Legal entities and individual entrepreneurs - tax agents for personal income tax |

| 10th of March | Declaration of payment for negative environmental impact for 2020 to Rosprirodnadzor | Legal entities and individual entrepreneurs obligated to pay fees for negative impact on the environment |

| March 15th | SZV-M for February 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| 20th of March | Declaration of indirect taxes for February 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs paying VAT in connection with the import of products to Russia from EAEU member countries |

| March 28 | Income tax return for 2020 to the Federal Tax Service | Legal entities, regardless of the procedure for paying advance payments |

| March 28 | Income tax return for February 2020 to the Federal Tax Service | Legal entities paying advance payments based on actual profit received |

| March 28 | Annual report on corporate income tax activities in the Russian Federation for 2020 to the Federal Tax Service | Foreign organizations operating in Russia through a permanent representative office |

| 30th of March | Property tax return for 2020 to the Federal Tax Service | Legal entities - property owners |

| April 2 | Annual financial statements for 2020 to the Federal Tax Service | Legal entities required to maintain accounting records |

| April 2 | Auditor's report along with the annual financial statements for 2020 to the Federal Tax Service | Legal entities subject to mandatory audit |

| April 2 | Declaration under the simplified tax system for 2020 to the Federal Tax Service | Legal entities on the simplified tax system |

| April 2 | Declaration on Unified Agricultural Tax for 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs – agricultural producers |

| April 2 | 6-NDFL for 2020 in the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| April 2 | 2-NDFL for 2020 at the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| April 16 | SZV-M for March 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| April 16 | Documents confirming the type of activity in the Social Insurance Fund | Legal entities registered in 2020 or earlier |

| 20 April | Declaration of water tax for the 1st quarter of 2020 to the Federal Tax Service | Legal entities that have water bodies |

| 20 April | Declaration on UTII for the 1st quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs using UTII |

| 20 April | Journal of accounting of received and issued invoices for the 1st quarter of 2020 in electronic form in the Federal Tax Service | Legal entities and individual entrepreneurs of the following categories:

|

| 20 April | Unified simplified tax return for the 1st quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs that do not have taxable objects |

| 20 April | 4-FSS for the 1st quarter of 2020 on paper in the FSS | Legal entities and individual entrepreneurs employing employees of less than 25 people |

| 25th of April | VAT return for the 1st quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs, tax agents who are exempt from taxpayer duties or are not payers and organizations selling goods and services exempt from taxation |

| 25th of April | 4-FSS for the 1st quarter of 2020 in electronic form in the FSS | Legal entities and individual entrepreneurs with employees of more than 25 people |

| April 28 | Income tax return for the 1st quarter of 2020 to the Federal Tax Service | Legal entities that report quarterly |

| April 28 | Income tax return for March 2020 to the Federal Tax Service | Legal entities that report monthly |

| April 28 | Tax calculation for income tax for March or 1st quarter of 2018 at the Federal Tax Service | Legal entities that are tax agents for income tax |

| April 30 | Declaration of the simplified tax system for 2020 | Individual entrepreneurs using the simplified tax system |

| May 3 | 6-NDFL for the 1st quarter of 2020 in the Federal Tax Service | Legal entities and individual entrepreneurs - tax agents for personal income tax |

| May 3 | Unified calculation of insurance premiums for the 1st quarter of 2020 at the Federal Tax Service | Legal entities and individual entrepreneurs, with employees |

| May 3 | Calculation of property tax on advance payments for the 1st quarter of 2018 to the Federal Tax Service | Legal entities that are tax payers |

| May 15 | SZV-M for April 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| May 21st | Notification of controlled transactions for 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs, if controlled transactions took place |

| May 28 | Income tax return for April 2020 to the Federal Tax Service | Legal entities that report monthly |

| May 28 | Tax calculation for income tax for April 2020 at the Federal Tax Service | Legal entities that are tax agents, calculating monthly advance payments based on actual profit received |

| June 15 | SZV-M for May 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| July 15 | SZV-M for June 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| July 20 | 4-FSS for the first half of 2020 on paper in the FSS | Legal entities and individual entrepreneurs with employees of less than 25 people |

| July 20 | Declaration of water tax for the 2nd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs with water bodies |

| July 20 | Unified simplified tax return for the 2nd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs in the absence of taxable objects |

| July 20 | Declaration on UTII for the 2nd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs using UTII |

| July 20 | Journal of accounting of received and issued invoices for the 2nd quarter of 2020 in electronic form in the Federal Tax Service | Legal entities and individual entrepreneurs of the following categories:

|

| July 25 | 4-FSS for the first half of 2020 in electronic form in the FSS | Legal entities and individual entrepreneurs with employees of more than 25 people |

| July 25 | VAT return for the 2nd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents, companies that are exempt from taxpayer obligations or are not payers and organizations that sell goods and services exempt from taxation |

| July 30 | Income tax return for the 2nd quarter of 2020 to the Federal Tax Service | Legal entities that report quarterly |

| July 30 | Income tax return for June 2020 to the Federal Tax Service | Legal entities that report monthly |

| July 30 | Tax calculation for income tax for June or the 2nd quarter of 2018 at the Federal Tax Service | Legal entities - tax agents for income tax |

| July 30 | Unified calculation of insurance premiums for the first half of 2020 at the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| July 30 | Calculation of property tax on advance payments for the 2nd quarter of 2018 to the Federal Tax Service | Legal entities that are tax payers |

| July 31 | 6-NDFL for the first half of 2020 at the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| August 15 | SZV-M for July 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| August 28 | Income tax return for July 2020 to the Federal Tax Service | Legal entities that report monthly |

| August 28 | Tax calculation for income tax for July 2020 at the Federal Tax Service | Legal entities that are tax agents for income tax |

| September 15th | SZV-M for August 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs using hired labor |

| September 28 | Income tax return for August 2020 to the Federal Tax Service | Legal entities that report monthly |

| September 28 | Tax calculation for income tax for August 2020 at the Federal Tax Service | Legal entities classified as tax agents for income tax |

| October 15 | SZV-M for September 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| 22 of October | Unified simplified tax return for the 3rd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs that do not have taxable objects |

| 22 of October | Declaration of water tax for the 3rd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs who have water bodies |

| 22 of October | Declaration on UTII for the 3rd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs using UTII |

| 22 of October | Journal of accounting of received and issued invoices for the 3rd quarter of 2020 in electronic form in the Federal Tax Service | Legal entities and individual entrepreneurs of the following categories:

|

| 22 of October | 4-FSS for 9 months of 2020 on paper in the FSS | Legal entities and individual entrepreneurs with employees of less than 25 people |

| the 25th of October | VAT return for the 3rd quarter of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs, tax agents, companies that are exempt from taxpayer obligations or are not payers and organizations selling goods and services |

| the 25th of October | 4-FSS for the first half of 2020 in electronic form in the FSS | Legal entities and individual entrepreneurs with employees of more than 25 people |

| 29th of October | Income tax return for September or the 3rd quarter of 2018 to the Federal Tax Service | Legal entities that report monthly |

| 29th of October | Tax calculation for income tax for September or the 3rd quarter of 2018 at the Federal Tax Service | Legal entities - tax agents for income tax |

| October 30 | Unified calculation of insurance premiums for 9 months of 2020 to the Federal Tax Service | Legal entities and individual entrepreneurs with employees |

| October 30 | Calculation of property tax on advance payments for the 3rd quarter of 2018 | Legal entities - tax payers |

| October 31 | 6-NDFL for 9 months of 2020 at the Federal Tax Service | Legal entities and individual entrepreneurs who are tax agents for personal income tax |

| 15th of November | SZV-M for October 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| November 28 | Income tax return for October 2020 to the Federal Tax Service | Legal entities that report monthly |

| November 28 | Tax calculation for income tax for October 2020 at the Federal Tax Service | Legal entities - tax agents for income tax |

| December 17 | SZV-M for November 2020 in the Pension Fund of Russia | Legal entities and individual entrepreneurs with employees |

| December 28th | Income tax return for November 2020 to the Federal Tax Service | Legal entities that report monthly |

| December 28th | Tax calculation for income tax for November 2020 at the Federal Tax Service | Legal entities - tax agents for income tax |

Results

For contributions accrued to extra-budgetary funds, the same calculation and payment rules apply in 2020 as in 2020.

However, the magnitude of a number of components of the calculations changes. Moreover, these changes apply both to payments accrued by employers (the maximum value of the taxable bases is changing, the value of some rates, regarded as lower, is increasing), and to amounts calculated by self-employed persons (the minimum wage used in calculations has increased). You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Tax payment schedule for special regimes

| Payment | Characteristics | Period | Payment deadline |

| Unified agricultural tax | All payers | 2017 | Until April 2 |

| 6 months 2020 | Until July 25 | ||

| simplified tax system | When transferring tax by companies | 2017 | April 2 |

| When transferring tax to individual entrepreneurs | 2017 | April 30 | |

| Regardless of the payer category - when making advance payments | 1st reporting quarter, 6 months, 9 months 2020 | The 25th day of the month that follows the period for which the payment is calculated | |

| UTII | Regardless of payer category | 4th quarter of 2020, first 3 reporting quarters of 2018 | 25th day of the month following the period for which the payment is calculated |

| PSA | All payers | Periods are similar to those established by law for mineral extraction tax, income tax, VAT | The same as those defined for mineral extraction tax, income tax, VAT |

| PSN | Payers (only individual entrepreneurs) who have issued a patent for a period of less than 6 months | The validity period of a patent, which can begin in 2020 and end in 2018, or begin and end in 2018 | Patent expiration date |

| Payers with a patent issued for a period of 6 months or more, upon payment of 1/3 of the amount of the patent | 90 days after receiving a registered patent (if registered in 2020) | ||

| Payers with a “long” patent, upon payment of 2/3 of its amount | Patent expiration date |

Now - about the deadlines for paying insurance premiums in 2020.