KBK codes according to the simplified tax system “income” 6% in 2020–2021

Incorrect indication of the income code should not lead to major troubles.

After all, even if the BCC is incorrect, the money will go to the budget, and this payment details can always be clarified. A sample application for this can be found here.

However, the fact that a mistake will not entail sanctions should not discourage you. In any case, this is a waste of time and nerves. Therefore, changes in the BCC need to be monitored. Moreover, it is not at all difficult for payers using the simplified tax system to do this with the object “income”: the codes for them have not changed since 2014.

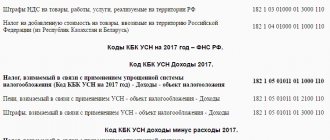

The BCC for the simplified tax system for 2014–2017 for various taxation objects (including the BCC for the simplified tax system of 15% for 2014–2017) can be clarified in reference books. We are now only interested in the BCC under the simplified tax system of 6% for 2020–2021. They are shown in the table.

IMPORTANT! The list of BCCs from 2021 is determined by order of the Ministry of Finance dated 06/08/2020 No. 99n, for 2020 - dated November 29, 2019 No. 207n, and for 2020 it was established by order of the Ministry of Finance dated 06/08/2018 No. 132n. See which BCCs have changed from 2021 to 2020.

Codes according to the simplified tax system “income” 6% for 2020–2021

| Year | Tax | Penalty | Fines |

| 2020 | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| 2021 | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

As you can see, the KBK according to the simplified tax system “income” of 6% for 2021 for each type of payment is no different from the KBK according to the simplified tax system “income” for 2020 for the same types of payments. The difference in the codes for the main tax, penalties and fines is only in one digit - in the 14th digit, which characterizes the subtype of budget revenues.

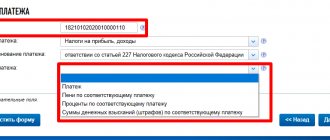

Instructions for filling out payment slips for the payment of advance payments under the simplified tax system, as well as tax for the year, including samples of payment slips, were prepared by K+ experts. If you have access to K+, go to the Ready Solution. If you don't have access, get it for free.

Values

KBK USN “6” in 2020 is used the same as in previous years. Although the Order on approval of budget classification codes is issued by the Ministry of Finance annually, the values themselves may not change with such frequency. For 2020, the list of indicators was approved by Order of the Ministry of Finance dated 06/08/2018 No. 132n.

| Payment | Tax | Penalty | Fine |

| Fulfillment of the financial obligation to pay a single fee under the simplified taxation system, object “income” | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| simplified tax system, object “income minus expenses” (incl. minimum tax) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

BCC for the simplified tax system “income” and “income minus expenses” in 2020–2021

There are no differences in the BCC applied by organizations and individual entrepreneurs, but their meanings for different objects of taxation are different. The 2020-2021 codes are listed in the table below.

| Payment type | Code for simplified tax system “income” 6% | Code for simplified tax system “income minus expenses” 15% |

| Basic tax | 182 1 0500 110 | 182 1 0500 110 |

| Tax penalties | 182 1 0500 110 | 182 1 0500 110 |

| Tax fines | 182 1 0500 110 | 182 1 0500 110 |

As you can see, the difference is only in the tenth digit of the code (9–11 digits are the income sub-item).

Let us remind you that the indicated rates (6 and 15%) are generally established, but regions can decide to reduce their value.

Instructions for filling out payment slips for the payment of advance payments under the simplified tax system, as well as tax for the year, including samples of payment slips, were prepared by K+ experts. If you have access to K+, go to the Ready Solution. If you don't have access, get it for free.

Read about existing simplified tax rates here.

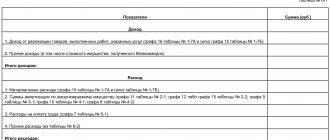

KBK table according to the simplified tax system

If an organization applies the simplified tax system in the amount of 6% (“Revenue”), then use the following budget classification codes (BCC):

| Purpose of payment | Basic payment | Penalty | Fines |

| KBK single tax under a simplified taxation system 2020 “Income” | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

IMPORTANT!

State and budgetary institutions do not have the right to apply a simplified taxation system. Such norms are enshrined in paragraphs. 17 clause 3 art. 346.12 Tax Code of the Russian Federation.

KBK for minimum tax on a simplified taxation system

The minimum tax is paid only by taxpayers who apply the simplified tax system “income minus expenses” in cases where the estimated tax amount from the actual base is less than the minimum established by law - 1% of income.

Thus, at the end of the year, the accountant calculates two amounts, then compares them with each other and chooses the maximum for payment. Currently, the BCC for the minimum and ordinary tax under the simplified tax system “income minus expenses” is one: 182 1 05 01021 01 1000 110. The codes differed until 2020.

Under the simplified tax system with the object “income”, this tax is not calculated.

Read about the form on which the simplified taxation system declaration is generated in this material.

Deadlines for payment of taxes and advance payments

The deadlines for depositing tax funds when applying the simplification are regulated by Ch. 26.2 Tax Code of the Russian Federation Federal Law No. 117 dated 05.08.2000 ed. 12/25/2018 (an unpublished version of the law has been prepared for the current period). The tax period for collection under the simplified SNA is a calendar year, and the reporting period for paying an advance is a quarter. Funds are calculated and deposited on an accrual basis.

If an entrepreneur switches from a simplified tax regime to another scheme for imposing state duties, then the individual entrepreneur must pay the total amount before the 25th of the reporting period. For entrepreneurs on the simplified SSS, there is one date for payment of the fee and advance payments for the latter. Moreover, in 2020, the BCC for the simplified tax system was changed: Income minus expenses 15%.

Payment deadlines 2020

In 2020, the advance payment for the simplified tax payment is made to the tax budget before the end of the month that follows the reporting quarter:

- I - until April 25, 2018;

- II - until July 25, 2018;

- III - until October 25, 2018;

- IV - until April 25, 2019.

The annual fee, calculated on an accrual basis, is paid before April 30 of the year following the reporting year./p>

Payment deadlines 2020

In 2020, the day for making advance funds has not changed - until the 25th day of the month following the reporting quarter:

- I - until April 25, 2019;

- II - until July 25, 2019;

- III - until October 25, 2019;

- IV - until 04/25/2020.

For late payment of advance funds, the payer faces penalties and a fine in accordance with clause 3 of Art. 58, art. 75 of the Tax Code of the Russian Federation.

Penalties according to the simplified tax system

Penalties under the simplified tax system are accrued in case of late payment of taxes and advance payments.

You can calculate the amount of penalties using our service “Fine Calculator” .

BCC under the simplified tax system “income” (penalties) in 2020-2021 - 18210 50101 10121 00110.

Also, an error when specifying the BCC in the payment may result in the accrual of penalties. A payment order with an incorrect code is either subject to return or falls into the “Unclear” category. Penalties are accrued as long as the payment is included in this category. You can correct the situation by submitting an application for clarification of payment. After clarification, the penalty should be reversed.

Payment period

So, we have determined where in the payment order to enter the BCC for individual entrepreneurs using the simplified tax system “6”; In 2020, tax payment is made in four payments per year. Advances must be transferred based on the results of the quarter, half a year, nine months and make the final payment for the year. Advance payments, according to Art. 346.21 of the Tax Code of the Russian Federation, are transferred until the 25th day of the month following the reporting one, the final fee according to the simplified tax system - until March 31 of the year following the reporting one (that is, for 2020 - until 03/31/2019). In 2020, the payment deadline has been postponed to April 1 due to the fact that March 31 falls on a Sunday.

Table of payment deadlines

| Reporting period | Deadline for payment |

| 2018 | 01.04.2019 |

| I quarter | 25.04.2019 |

| I half of the year | 25.07.2019 |

| 6 months | 25.10.2019 |

| 2020 | 31.03.2019 |

Results

The BCCs used for the simplified tax system have remained unchanged since 2014. However, they differ depending on the objects of taxation and the type of payment (tax, penalty, fine). Incorrect indication of the BCC in the payment document may result in money not being credited as intended and will require the taxpayer to take additional actions to clarify the payment.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated November 29, 2019 No. 207n

- Order of the Ministry of Finance of Russia dated 06/08/2018 No. 132n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Calculation of penalties under the simplified tax system “income minus expenses”

The penalty is calculated based on the refinancing rate (key rate) established by the Bank of Russia. If the value of the refinancing rate was adjusted during the period of delay, the calculation of the penalty must be made taking into account this change.

For arrears made by individual entrepreneurs under the simplified tax system, a penalty is accrued according to the formula:

penalty = 1/300 of the refinancing rate x Amount of arrears in rubles x Number of days of delay in payment.

If the delay is caused by a legal entity, the calculation scheme depends on the duration of the delay period:

- the arrears are repaid within 30 calendar days from the date of their occurrence - the formula is applied, as in the case of individual entrepreneurs (1/300 of the rebate);

- if there is a delay of more than 30 days, the penalty is calculated in stages - in the first 30 days the calculation algorithm is applied, as indicated above, and from the 31st day, instead of 1/300 of the refinancing rate, 1/150 of the rate is applied.

The maximum amount of the penalty is limited to the amount of arrears.

When transferring penalties to the budget according to the simplified tax system “income minus expenses” of the KBK, the payment documents indicate the following (including for penalties on the minimum tax): 18210501021012100110.

To pay penalties on the minimum tax (1%) for periods earlier than 01/01/2016, you must indicate the code: 18210501050012100110.

Let us show with examples how penalties are calculated under the simplified tax system “income minus expenses” 2020.

Read also: Budget classification codes (BCC) for 2019

Example 1

The individual entrepreneur had to pay the tax according to the simplified tax system for 2018 in the amount of 19,700 rubles no later than 04/30/2019. In fact, the payment was made on June 27, 2019. The key rate in the period was 7.75%. The delay period starts from 05/01/2019:

- in May overdue – 31 days;

- in June – 27 days, taking into account the day of debt repayment;

- the total length of the period of delay is 58 days (31 + 27).

The penalty is equal to: (19,700 x 1/300 x 7.75% x 58) = 295.17 rubles.

KBK income from payment of fines and penalties

Penalties and fines are listed indicating individual BCCs.

BCC for penalties on the simplified tax system 6% - 182 1 0500 110.

Penalties are paid for each day of tax delay. Quarterly payments are due by the 25th day of the month following the end of the quarter. And at the end of the year - until March 31 of the next year (organization) or until April 30 of the next year (individual entrepreneur). In 2020, April 30 falls on a day off, so the deadline has been moved to May 4. If the taxpayer does not meet these deadlines, penalties will be assessed.

BCC for fines on the simplified tax system 6% - 182 1 0500 110.

Fines are assessed for gross violation of payment deadlines. A fine, unlike a penalty, is assessed and paid once, and not for each overdue day.

KBK table for simplified taxation system income 2016

| Purpose of the KBK | KBK number |

| EH transfer - “income” scheme | 182 1 0500 110 |

| transfer of penalties for a single tax - “income” scheme | 182 1 0500 110 |

| transfer of fines according to EN - “income” scheme | 182 1 0500 110 |

| transfer of the minimum tax (1%) - any simplified tax system | 182 1 0500 110 |

| transfer of penalties for the minimum tax | 182 1 0500 110 |

| transfer of minimum tax penalties | 182 1 0500 110 |

Penalty

Article 72 of the Tax Code establishes that penalties are one of the means of ensuring the fulfillment of taxpayers’ obligations. The legislation states that citizens are required to contribute this amount to the budget if they are late in paying advance payments, taxes and fees.

The penalty is received daily during the delay and begins to be calculated from the moment following the last day of payment of the tax. The calculation ends after the tax and debt are paid off. The amount is calculated by the Central Bank taking into account 1/300 of the current refinancing rate.

Companies can calculate the penalties themselves by plugging the numbers into the formula:

P = N × Dn × 1/300 Sref

Variables mean:

| N | unpaid tax |

| Day | overdue time in days |

| Sref | rate set by the Central Bank |

There are several BCCs that differ in the purpose of payment:

| penalties | 182 1 0500 110 |

| fines | 182 1 0500 110 |

Deadlines for making advance payments to the simplified tax system in 2020

Article 346.21 of the Tax Code of the Russian Federation defines the deadlines no later than which it is necessary to transfer the amount of the advance payment:

for the first three months of the current year - April 25,

for six months - no later than July 25;

9 months in advance - no later than October 25.

When determining the deadline for paying an advance under the simplified tax system, the rule applies to postponing the payment deadline if it coincides with a weekend or holiday.

For example, April 25, 2020 will be a day off - Saturday. According to Article 6.1 of the Tax Code of the Russian Federation, the advance payment can be paid on the first working day after April 25, 2020. Those. You can pay the advance payment of the simplified tax system until April 27, 2020 inclusive.

In 2020, there are no coincidences between the deadlines for paying the advance under the simplified tax system and weekends and holidays, so the advance payment should be made no later than the dates indicated above.