Accounting statements of individual entrepreneurs on OSNO

In accordance with paragraph 2 of Art. 6 of the Law of December 6, 2011 No. 402-FZ Individual entrepreneurs may not keep accounting records . Therefore, unlike legal entities, individual entrepreneurs are not required to send financial statements to the Federal Tax Service and Rosstat

Individual entrepreneurs must fill out books of purchases and sales, as well as a book of income and expenses. These registers, in the absence of “full-fledged” accounting, form the basis of their accounting.

However, many entrepreneurs still balance debit and credit on a voluntary basis. This allows individual entrepreneurs to assess their financial situation “in a comprehensive manner”, and it is easier to fill out tax returns when the accounting system as a whole is in place.

Sometimes an individual entrepreneur does accounting because he needs to provide financial statements to external users. These could be banks when processing loans, or counterparties if a large contract is expected to be concluded.

But even in this case, the entrepreneur is not obliged to submit a report to government agencies.

What kind of reporting does an individual entrepreneur submit?

In order to find out what kind of reporting an individual entrepreneur submits, you must first determine the categories of this reporting. Conventionally, all reporting of individual entrepreneurs can be divided into 4 categories, namely:

- reporting depending on the taxation system (tax regime) chosen by the individual entrepreneur;

- reporting for employees (if any);

- reporting on cash transactions (if there is a cash register);

- reporting on additional taxes.

Mandatory tax reporting for individual entrepreneurs on OSNO

The main taxes for individual entrepreneurs on OSNO are personal income tax and VAT.

VAT reporting must be done quarterly; 25 calendar days are allotted for generating the declaration. The new form was approved by order of the Federal Tax Service dated December 28, 2018 No. SA-7-3/ [email protected]

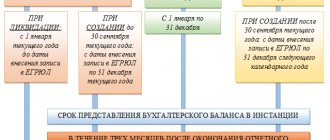

If legal entities pay income tax, then for individual entrepreneurs on OSNO its “analogue” is personal income tax. You need to submit a declaration in form 3-NDFL once a year before April 30 (Federal Tax Service order No. ММВ dated 10/03/2018 [email protected] ).

Also, individual entrepreneurs on OSNO are required in certain cases to fill out form 4-NDFL on estimated income (order of the Federal Tax Service of the Russian Federation dated December 27, 2010 No. ММВ-7-3 / [email protected] ).

The deadline for submission depends on the reason for filling out the form:

- Within 5 days after the month in which the individual entrepreneur received his first income.

- If income decreases or increases by more than 50% compared to the previous declaration;

- If the individual entrepreneur is deprived of the right to use the special regime and switches to OSNO.

It is interesting that in the last two cases there is no deadline for submitting 4-NDFL. However, it is better to do this as quickly as possible to avoid problems with the tax authorities in the future.

Book of accounting of income and expenses (KUDIR)

All individual entrepreneurs who use the simplified tax system, PSN, unified agricultural tax and OSN must maintain an Income and Expense Accounting Book (KUDIR). Individual entrepreneurs do not keep such a book on UTII and PND. Entrepreneurs on UTII keep records of physical indicators. There is no need to enter information about the income and expenses of individual entrepreneurs on UTII in KUDIR.

Let us remind you that starting from 2013, KUDIR does not need to be certified. The book must be printed, bound and numbered. It is kept by the individual entrepreneur.

The exception is for individual entrepreneurs using unified agricultural tax.

According to the Procedure for filling out the Book of Income and Expenses of Individual Entrepreneurs using Unified Agricultural Tax, approved by Order of the Ministry of Finance of the Russian Federation No. 169 n dated December 11, 2006 KUDiR:

- if the maintenance is carried out on paper, it is certified by the signature of an official of the tax authority and sealed with the seal of the tax authority before the start of its maintenance;

- if the maintenance is carried out electronically, it is certified by the signature of an official of the tax authority and sealed with the seal of the tax authority no later than 31.03 of the year following the reporting year.

Do not forget that the absence of KUDIR may result in a fine.

Individual entrepreneur reporting on OSNO with hired employees

If an individual entrepreneur has employees , then the entrepreneur is required to submit the entire “package” of personnel reports, similar to an employer who is a legal entity

In addition to the 3-NDFL declaration, which is filled out “for oneself”, individual entrepreneurs at OSNO also report on personal income tax withheld from staff.

The entrepreneur submits Form 6-NDFL with general information quarterly, for which he is given a month after the reporting period (Federal Tax Service order No. ММВ-7-11 dated October 14, 2015/ [email protected] ). The annual 6-NDFL must be submitted by April 1.

Also, once a year, before April 1, the individual entrepreneur submits “personal” information on income tax for each individual in the form of 2-NDFL certificates (order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11 / [email protected] ). If it was not possible to withhold tax from any income, then data on such employees must be sent before March 1.

Individual entrepreneur on OSNO also reports on all accruals made on wages. Calculation of insurance premiums (DAM) must be submitted to the Federal Tax Service every quarter, no later than 30 days after its end (Federal Tax Service order No. ММВ-7-11 dated October 10, 2016/ [email protected] ).

The DAM form does not include only one type of mandatory charges - contributions “for injuries”. The report on them (form 4-FSS) must be sent not to the tax authorities, but to the fund itself. 4-FSS must also be submitted quarterly: within 20 days after the reporting period on paper (allowed only if the number of employees is less than 25 people), and within 25 days - in electronic form (Order of the FSS of the Russian Federation dated 06/07/2016 No. 381 ).

The rate of contributions “for injuries” depends on the type of activity of the employer. Legal entities must annually confirm the right to use a particular rate by submitting a special form to the Federal Social Insurance Fund of the Russian Federation. Individual entrepreneurs on OSNO are exempt from such obligations. For them, the main type of activity “by default” is the one indicated in the state register (clause 10 of the rules approved by Decree of the Government of the Russian Federation of December 1, 2005 No. 713).

Individual entrepreneurs will have to send reports to the Pension Fund monthly, 15 days are allotted for this. The short form SZV-M was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p.

The annual form of SZV-experience must be submitted to the Pension Fund of the Russian Federation before March 1 (Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

Another report related to personnel - information on the average number of employees - must be sent annually to the tax office. The form, which reflects only one indicator, is submitted before January 20 (order of the Federal Tax Service of the Russian Federation dated March 29, 2007 No. MM-3-25 / [email protected] ).

If an individual entrepreneur works at OSNO “alone”, without employees, then he only needs to submit mandatory tax reporting. Such an entrepreneur should not fill out any of the reports listed in this section.

Reporting methods

3-NDFL for individual entrepreneurs - what is it, sample form and when to submit

An individual entrepreneur has the right to choose the method of submitting documentation to the tax office. There are three options:

- personally to the tax inspector;

- sending by registered mail with a list of contents in the envelope;

- sending tax returns via electronic exchange service.

For your information! When choosing a reporting method, you should consider its pros and cons. For some it will be more convenient to go to the tax office in person, while for others it will be easier to send it via mail, for example, if the entrepreneur is located in another city.

Personal submission of declarations

The most reliable method, but at the same time the most outdated. It is not always convenient to arrive at the inspection office on time and submit documents. But you can definitely be sure that the papers have arrived, as evidenced by the mark that is immediately placed in the tax authority’s journal.

A less reliable method and also takes a lot of time. The plan of action is almost the same as when submitting documents in person. But instead of the inspection, you need to go to the post office and send the declaration by registered mail to the address of the tax office where the entrepreneur is registered.

Note! Letters don't always arrive on time, but that doesn't matter. The main thing is to send the declarations within the deadline established by law. Since the envelope is sent by registered mail, there is written confirmation of dispatch on a specific date.

This method of submitting declarations is convenient for those who live or are at the time of the reporting period in another city and are not able to come to the tax office in person.

Sending a declaration electronically

Electronic method

More recently, a new way of exchanging documentation between an entrepreneur and the tax office has emerged. Probably the most convenient and time-consuming option.

For electronic exchange of documentation, it is necessary to conclude a cooperation agreement with a telecom operator. After which an electronic digital signature and a special program for drawing up documents are provided. Using this software, a declaration is drawn up in a few clicks, then signed with an electronic signature and sent to the tax office.

Note! Electronic document management has the same validity as in paper form. In addition, there are no delivery delays, and it takes a minimum of time from the accountant or the company owner himself.

List of individual entrepreneurs reporting on OSNO

Below are all the reporting forms that the individual entrepreneur provides to the regulatory authorities.

| Accounting statements of individual entrepreneurs on OSNO | |

| Balance sheet, form No. 2, attachments | There is no obligation to submit, but can be completed voluntarily |

| Mandatory tax reporting for individual entrepreneurs on OSNO | |

| VAT declaration | quarterly, until the 25th |

| Declaration 3-NDFL | annually, until April 30 |

| Declaration 4-NDFL | depending on the situation |

| Additional tax reporting for individual entrepreneurs on OSNO | |

| Property tax declaration | no need to submit, tax is paid based on notification from the Federal Tax Service |

| Transport tax declaration | |

| Land tax declaration | |

| Individual entrepreneur reporting on OSNO with hired employees | |

| 6-NDFL | quarterly until the end of the next month, annually - until March 1 |

| 2-NDFL | annually until March 1 |

| Calculation of insurance premiums | quarterly until the 30th |

| 4-FSS | quarterly until the 20th (25th)* date |

| SZV-M | monthly until the 15th |

| SZV-experience | annually until March 1 |

| Average headcount | annually until January 20 |

*the first date is for paper format, the second is for electronic format.

Important!

According to paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation, if the deadline for submitting any report falls on weekends or holidays, then it can be submitted on the first working day.

Mandatory payments to the simplified tax system

But knowing what kind of reporting an individual entrepreneur submits to the simplified tax system without employees is not enough. The simplified tax calendar also includes deadlines for paying taxes and contributions. Let’s take a closer look at what amounts an individual entrepreneur pays under the simplified taxation system.

1. Insurance premiums for yourself. These payments are divided into fixed, the same for all entrepreneurs, and additional. In 2020, an individual entrepreneur must pay 40,874 rubles for himself plus an additional contribution (1% of the excess annual income of 300,000 rubles).

2. Advance payments at a rate of 6% of income. This is part of the single tax that is paid at the end of each reporting period:

- first quarter;

- half year;

- nine month.

Advances are paid only when income is received in the reporting period; if there is no income, then nothing needs to be paid.

3. Tax at the end of the year at a rate of 6%. The final calculation of the single tax occurs at the end of the year, taking into account all advance payments and insurance premiums paid. Often, with low income of an entrepreneur without employees, tax payments are completely reduced by contributions, so the tax at the end of the year is zero.

Important: if an entrepreneur works within the tax holiday, he can take advantage of the benefit for up to two years and not pay tax. As for insurance premiums for themselves, all simplifiers pay them, including during the holidays.

How to create a zero report

The tax return should be filled out on the same forms as a regular report. You can from the tax website. The number of open sheets in the document may be less.

The zero reporting form does not require putting zeros instead of numbers. The declaration must contain dashes.

As an example, let’s look at which sheets need to be filled out in VAT and simplified taxation tax returns.

In the VAT report for individual entrepreneurs, you should open 2 sheets: the title page and the mandatory section 1. The first sheet indicates the full name, TIN of the entrepreneur, tax period code, activity code, etc. In the first section we enter OKTMO, KBK, and dashes are added in the remaining lines.

According to the simplified tax system, the sample forms will differ depending on the object of taxation. For the object “income”, you should open the title page, sections 1.1 and 2.1.1, for the object “income minus expenses” - the title page, sections 1.2 and 2.2.

Additional simplification reports for certain categories of individual entrepreneurs

In some cases, the current legislation provides for simplified individual entrepreneurs the need to prepare and submit additional reports. For each of them, requirements for content and deadlines are established.

1-IP

The document represents one of the forms of statistical reporting. The obligation to report to the statistical authorities at the place of registration arises if the individual entrepreneur is included in the Rosstat sample. Information about this is posted on the official website of the department. It is necessarily duplicated by sending the corresponding notification directly to the business entity.

The report in Form 1-IP contains basic information about the financial and economic activities of an individual entrepreneur. The requirements for filling it out are regulated by Order No. 419, signed by the head of Rosstat on July 22, 2018.

The document is drawn up and submitted to the statistical authorities at the end of the year. The due date is March 2 of the year following the reporting year.

Indirect tax returns

The need to prepare and submit a report on indirect taxes to the Federal Tax Service arises if an individual entrepreneur is engaged in importing goods into Russia from the territory of states that are members of the EAEU. These include the following countries: Kazakhstan, Belarus, Kyrgyzstan and Armenia.

The report must be submitted monthly. The deadline for submitting the document is the 20th day of the month that follows the month of importation of imported goods.

VAT declaration

The obligation to prepare and submit a declaration for this tax arises if the individual entrepreneur erroneously allocated VAT in the invoice or acted as a tax agent. Examples of such cases include the purchase of waste paper or scrap metal from a VAT payer, as well as the purchase or lease of land directly from state, regional or municipal authorities.

The frequency of submitting the declaration, if necessary, is quarterly. The deadline is no later than the 25th day of the month following the reporting quarter.

Water tax declaration

The basis for preparing and submitting a water tax return is the legal requirements in this area. Most often, in such a situation, we are talking about the use of water resources of a lake or river to conduct commercial activities of an individual entrepreneur, for example, to irrigate agricultural land.

If warranted, the report must be submitted every quarter. The deadline for submitting the document is until the 20th day of the month following the reporting quarter.

Comments

View all...Next »

Natalya 09/05/2015 at 20:29 # Reply

Good evening. I opened an IP (usn income) in July, the first income will be in October. Did I understand correctly that I don’t need to pay anything for the 3rd quarter (including it’s better to pay to the Pension Fund in the 4th quarter and not in the 3rd quarter for deductions), and in the 4th quarter I need to pay the entire amount in the Pension Fund up to 31 December, and I will need to pay the simplified tax system only in 2020 - until April 30, 2020 - pay the tax according to the simplified tax system funds (for the fourth quarter of last year);

Natalia 09/05/2015 at 21:16 # Reply

Natalya, good evening. You understood correctly, if you have no income until October, i.e. in the third quarter, then you will not have the simplified tax system, but you can pay to the funds until December 31 in order to deduct these amounts from the simplified tax system in the fourth quarter.

Tatyana 09/07/2015 at 14:42 # Reply

kurid

Is this book checked by the Federal Tax Service?

Natalia 09/07/2015 at 14:49 # Reply

Tatyana, the Federal Tax Service can check any document related to business activities. The book of income and expenses is the main document for individual entrepreneurs.

Diana 09/17/2015 at 08:35 # Reply

Hello! Please tell me, I want to open an individual entrepreneur even tomorrow. all documents are ready. but I want to carry out my activities from October 1 using the UTII regime. Is it worth applying for the simplified tax system along with documents for an individual entrepreneur? After all, they don’t immediately accept UTII. If so, what reports will I need to submit before applying for UTII? Thanks in advance!

Natalia 09.17.2015 at 14:38 # Reply

Diana, hello. Payers of UTII who do not intend to carry out activities that are not subject to taxation on imputed income should submit an application to switch to the simplified tax system. The list of activities subject to UTII taxation is very small, and it may well happen that, while conducting activities subject to UTII taxation, tomorrow you will want to start another type of business that is no longer subject to the single tax on imputed income. This is not to mention the possibility, during business development, of exceeding the limits established by law for the application of UTII. During the year you will not be able to switch to the simplified tax system if necessary. If activities are not carried out under the simplified tax system, you do not need to pay any additional taxes; submit a “zero” simplified tax return once a year. Therefore, submit an application for application of the simplified tax system along with the documents for registration of individual entrepreneurs. Then apply for UTII. Submit the zero report of the simplified tax system for 2020 by April 30, 2020.

Olga 09.17.2015 at 16:09 # Reply

Good afternoon I opened an individual entrepreneur with 6% income on 08/18/15. Revenues amount to 322,000.00. When and what payments should I pay?

Natalia 09.17.2015 at 20:29 # Reply

Olga, hello. As I understand, your income since August 18, 2015 amounted to 322,000 rubles. By the end of September (the last month of the third quarter), your income will increase even more, so I advise you to pay contributions to the Pension Fund and the Social Insurance Fund for the time of the third quarter that you work until the end of the year, this amount will be: In the Pension Fund 5965x26%x4+ (5965:31x14)x26 %=6203-60 rubles In FFOMS 5965x5.1%x4+(5965:31)x5.1%)=700-40 rubles You can pay these amounts before the end of the year, but then you will not be able to reduce the advance payment of the simplified tax system (which you must pay until October 25 (19320-00 Rubles) for the amount of paid contributions. In other words, if you pay fixed contributions before the end of September, then the advance payment for the 3rd quarter, which must be made before October 25, 2015, will be 12416-00 instead of 19320-00 You will also have to pay to the Pension Fund 1% of the amount exceeding 300,000 rubles of annual income by April 1, 2016. Otherwise, if you receive an income of 600,000 rubles by December 31, 2015, you must additionally pay to the Pension Fund 300,000x1% = 3000- 00 rubles.

Olga 09.22.2015 at 12:05 # Reply

Hello, thank you, don’t you need to pay another 1% on income exceeding 300,000 to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund? And by what date in the 3rd quarter must I pay the contribution to the Pension Fund and the Federal Compulsory Medical Insurance Fund in order to apply the deduction under the simplified tax system?

Natalia 09.23.2015 at 18:20 # Reply

Olga, I wrote to you that “You will also have to pay to the Pension Fund by 04/01/2016 1% of the amount exceeding 300,000 rubles of annual income. Otherwise, if you receive an income of 600,000 rubles before December 31, 2015, you must additionally pay 300,000 x 1% = 3,000-00 rubles to the Pension Fund.” To apply the deduction under the simplified tax system, you must until the end of the 3rd quarter, i.e. pay the fixed amount of contributions by September 30th. Moreover, it is not necessary to divide the annual amount evenly; whatever amount of fixed payments you pay before September 30, you will deduct the amount from the simplified tax system.

Natalia 09.23.2015 at 18:22 # Reply

Olga does not need to pay to the FFOMS; the amount of 1% of the amount exceeding 300,000 rubles of annual income is paid only to the Pension Fund.

Dmitry 10/15/2015 at 01:37 pm # Reply

Natalia. You've found something incomprehensible here. Check the formulas and numbers. In the Pension Fund 5965x26%x4+ (5965:31x14)x26%=6203-60 rubles In the Federal Compulsory Medical Insurance Fund 5965x5.1%x4+(5965:31)x5.1%)=700-40 rubles

Dmitry 10/15/2015 at 01:53 pm # Reply

The Pension Fund of Russia receives 6904.01 rubles. FFOMS correct formula 5965x5.1%x4+(5965:31x14)x5.1%) = 1354.25 rubles.

Angela 09.17.2015 at 17:30 # Reply

Good afternoon On June 27, 2015, I opened an individual entrepreneur under the simplified tax system 6% without employees, the activity began on July 15. I have several questions... 1. I have not registered with the Trade Tax (I am now going to do this) Is it possible to avoid a fine? 2. When and what payments should I pay??? 3. Do I need to conduct KUDiR??? Thank you in advance!

Natalia 09.17.2015 at 20:41 # Reply

Angela, good evening. I answer point by point: 1. The trade tax has been introduced so far only in Moscow from 07/01/2015. Article 3 of Law No. 62 lists the types of trade that can be carried out in Moscow without paying a trade tax. These are: • retail trade carried out using vending machines; • trading at weekend fairs, specialized fairs and regional fairs; • trade through retail chain facilities located on the territory of retail markets; • retail retail trade carried out at facilities under the operational management of autonomous, budgetary and government institutions. The deadline for submitting a notice of registration as a trade tax payer is five working days from the date of occurrence of the object of taxation (clause 2 of Article 416 of the Tax Code of the Russian Federation). According to specialists from the Federal Tax Service of Russia, if, as of July 1, 2020, an organization or individual entrepreneur is already trading through a trade facility that is subject to trade tax in Moscow, then the tax service must be notified about this no later than July 7, 2020. Carrying out trade subject to trade tax without sending this notification is equivalent to conducting business without registration (Clause 2 of Article 416 of the Tax Code of the Russian Federation). And for this violation, tax liability is provided in the form of a fine in the amount of 10 percent of the income received as a result of such activity, but not less than 40,000 rubles (clause 2 of Article 116 of the Tax Code of the Russian Federation). Please note that at present, a notification of registration as a fee payer can be submitted in any form, indicating the necessary information (they are listed in paragraph 1 of Article 416 of the Tax Code of the Russian Federation). 2.The first time trade fee must be paid by October 25, 2020. Using the simplified tax system, you pay advance payments by the 25th day of the month following the reporting quarter, i.e. next payment until October 25, 2015. You must also transfer fixed contributions to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund, there are two options: - pay the entire amount one time before the end of the year; — pay in installments in order to be able to reduce the amount of the advance payment of the simplified tax system by the amount of fixed contributions transferred in the quarter for which you pay the advance payment of the simplified tax system. Until April 1, 2016, they must additionally transfer to the Pension Fund 1% of the amount exceeding 300,000 rubles of annual income.

Natalia 09.17.2015 at 20:43 # Reply

Angela, I’m sorry, I didn’t answer your third question. You must keep a book of income and expenses based on primary documents. There is no need to certify it to the tax office.

Angela 09.21.2015 at 12:20 # Reply

Thanks a lot!

Veniamin 09/22/2015 at 07:17 # Reply

The bank transferred 8.96 rubles. credited to my account as monthly income for storing money in an individual entrepreneur’s account. They refuse to recall, citing this. that in the application when opening the account I agreed to this transfer of income for storing money on an account. I am on an Internal Income Tax Act, and have filed a zero declaration under the simplified tax system every year. The simplified tax system has 6% income. How to behave now, bother with taxes from 8.96 rubles. and I don’t want a declaration under the simplified tax system (no longer zero), please advise.

Natalia 09.22.2015 at 12:30 # Reply

Benjamin, good afternoon. Since such a situation has already occurred and you signed an Agreement with the bank, the bank fulfilled its obligations and transferred the amount of your income to you, then: - re-enter the Agreement with the bank for the next period, in which the bank will not be obliged to transfer you income for storing money - for the amount already received report to the tax office and pay 6% of income (pay 6%, draw up a corrective declaration, send this declaration to the tax office, attaching a copy of the payment slip confirming payment of the tax)

Veniamin 09.22.2015 at 14:35 # Reply

Sorry, but why draw up a corrective declaration if this is the simplified tax system and it was August 31, 2015. In my opinion, the declaration must be submitted in 2016.

Natalia 09.23.2015 at 18:17 # Reply

Veniamin, you wrote that you filed zero declarations, not taking into account income in the amount of 8.96 rubles (in the first question you did not say that it was 08/31/2015), so I answered that it is necessary to file a corrective declaration taking into account that that income was received. And if you meant that you received income only in 2020, then naturally submit a declaration based on the results of 2020, and from 2016 renew the Agreement with the bank. I apologize for the misunderstanding.

Angelika 09.24.2015 at 12:09 # Reply

To which bodies should I pay fees? I'm new to this. If possible, list them. Usn 6% without employees. I’m starting to sell things myself.

Natalia 09/25/2015 at 10:56 am # Reply

Angelica, good afternoon. You need to pay fixed contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund. You determine the deadlines for paying contributions yourself. Can be done once until the end of the year. You can quarterly, in this case, by the amount of contributions paid in the reporting quarter, you can reduce the advance simplified tax system payment to the tax office. The amount of advance payments depends on the minimum wage established by the government of the Russian Federation for each year: in the Pension Fund of the Russian Federation the minimum wage is 26%; in FFOMS minimum wage x 5.1%. Advance payments must be transferred to the tax office quarterly by the 25th day of the month following the reporting quarter. Also, until April 1, pay to the Pension Fund 1% of the amount exceeding the annual income over 300,000 rubles. Those. if your annual income is 600 thousand rubles, then you pay (600 thousand - 300 thousand) x 1% = 3000-00 rubles to the Pension Fund.

Angelika 09.24.2015 at 12:49 # Reply

Hello

And tell me who I can contact for full advice on organizing an individual entrepreneur?

Natalia 09/25/2015 at 10:59 am # Reply

Angelica, it’s not clear what you mean by the phrase “individual entrepreneur organization.” If you mean registering an individual entrepreneur, paying taxes and contributions, then you can contact the tax authority, the Pension Fund of the Russian Federation, accordingly. And the organization of the business process itself is already your area of responsibility; you can contact individual entrepreneurs conducting a similar type of activity.

Sofia 09.25.2015 at 12:46 # Reply

Hello, thank you for the informative article and answers to questions, which are very useful. Remaining questions: 1. When calculating mandatory contributions, should the day of registration be taken into account? 2. Individual entrepreneur on the simplified tax system income 6%, did not pay for goods and services with VAT, did not accept invoices. Do I need to submit a VAT return? 3. Do I need to submit a settlement to the Federal Tax Service for the advance payment for the 3rd quarter, and if so, within what time frame?

Natalia 09/25/2015 at 01:16 pm # Reply

Sofia, good afternoon. I answer your questions: 1. When calculating fixed contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund. you need to take into account the date of registration as an individual entrepreneur. If you overpay into these funds, then it’s okay, but if you underpay, you will have to pay a fine. 2. In your case, the VAT return is not submitted. 3.Calculations are not accepted for advance payments. You submit a declaration to the simplified tax system once a year - before April 30, 2020, for 2020.

Sofia 09/28/2015 at 09:18 # Reply

Hello, today I started looking at documents for the quarter and discovered that the bank has issued me an invoice for 300 rubles per hour for the services of certifying signatures on subscription cards. VAT 45.76 rub. What to do in this case. Do I need to submit a VAT return? And please tell me how does an individual entrepreneur determine his income for taxation using the cash method?

Natalia 09/28/2015 at 01:03 pm # Reply

Sofia, good afternoon. If you are not a VAT payer and have not issued invoices to anyone, then you do not need to submit a VAT return. You reduce the VAT on your sale at the expense of the purchase VAT, therefore you simply write down the VAT in your KUDIR as expenses on a separate line. Individual entrepreneurs have the right to determine their income using the cash method. The date of receipt of income is the day of receipt of funds into bank accounts and (or) the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt to the taxpayer in another way (cash method).

View all...Next »