What does the legislation say about zero 4-FSS?

Reporting to social security in Form 4-FSS is a calculation presented in tabular form, containing information:

- on insurance premiums for compulsory insurance against accidents at work and occupational diseases (ASP and OPD), accrued and paid in the reporting period (for injuries);

- expenses for payment of insurance coverage under NSP and PZ.

Zero calculation 4-FSS is a type of insurance reporting in the absence of reporting data. This situation arises if the company has suspended, ceased or is just planning to start operations.

The condition for the mandatory submission of such a calculation is contained in Art. 24 of the Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ. This article speaks of the need for quarterly reporting on insurance premiums by all policyholders.

Find out who is taking the 4-FSS from this article.

Note! An individual entrepreneur without employees does not submit a zero to the Social Insurance Fund, since he is not an insurer.

There is no mention of zero form 4-FSS in the law. Nothing is said about this type of reporting in the FSS order No. 381 dated September 26, 2016, which describes the technology for filling out this reporting form.

However, this does not mean that the lack of reporting data relieves policyholders from submitting 4-FSS - everyone needs to report every reporting quarter. We will tell you how to do this in the following sections.

What is the F-4 form, when and who needs it

A certificate of reservation in form F-4 is a document confirming a deferment from conscription, which is issued to an employee who is in the reserve and subject to reservation. Typically, the decision about who is subject to reservation is made taking into account territorial lists of professions and positions. However, organizations may request personal deferments for individual employees if their activities are necessary for the smooth operation of the enterprise in wartime. But the final decision on this matter is made at the level of interdepartmental commissions on reservation issues.

Mandatory zero sheets

Social insurance expects 4-FSS from policyholders in any case - whether they made payments in the reporting period in favor of individuals or not. If there is nothing to write down in the report, the employer will be required to submit a 4-FSS zero calculation completed according to special rules.

Its main difference from a regular (data-filled) calculation is the reduced volume of tables presented.

If in one of the quarters, for example, in the first, you had accruals for hired employees, but not in subsequent quarters, the report until the end of the year will not be zero, because some lines are filled with a cumulative total. ConsultantPlus experts explained the nuances of filling out each line of form 4-FSS. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Calculation 4-FSS - 2020 is filled out on the form approved by. by order of the FSS dated September 26, 2016 No. 381, as amended. from 06/07/2017. You can download it below.

The minimum set of sheets and tables of the report is defined in clause 2 of Appendix No. 2 to Order No. 381 - it includes:

- title page;

- 3 tables (1 - calculation of the base for calculating insurance premiums, 2 - calculation of injury premiums and 5 - results of assessing working conditions).

These are mandatory sheets for 4-FSS. The remaining calculation tables (1.1, 3 and 4) may not be filled out - this is indicated in clause 2 of the Procedure for registration of 4-FSS, approved. by order No. 381 (Appendix No. 2). Therefore, you can create a zero calculation without them.

We will talk about the specifics of filling out the cells of the zero calculation tables in the next section.

Which report is considered zero?

Before considering the question of whether you need to submit a zero 4-FSS, it will be useful to determine the criteria by which this report will be considered zero.

The following interpretations are possible here:

- A zero report is a document reflecting the absence of accruals and payments of contributions for 3 months of the reporting period (quarter).

- A zero report is a document reflecting the absence of accruals and payments since the beginning of the year.

It is the second type of report that can be rightfully considered as a zero 4-FSS. The fact is that this form is filled out with a cumulative total of contributions. And if they were accrued at least once and reflected in any of the previously submitted forms during the year, then the figures for these contributions also appear in subsequent reports.

There are exceptions to the cumulative total rule for a zero 4-FSS report in 2018 - we will get to know them a little later. For now, let’s look at who is obligated to submit the report in question.

How to prepare a report if there is no data - zeros, dashes or empty cells?

To correctly fill out the zero calculation in Form 4-FSS, use the algorithm set out in Appendix No. 2 to Order No. 381:

| Clause of Appendix No. 2 to Order No. 381 | Decoding |

| 2 | Dashes are added to table cells if there is no reporting indicator. |

| 5.8 | When filling out the “TIN” field in the 2 initial cells (zone of 12 cells), enter zeros (00) if the TIN consists of 10 characters. How to find out the FSS registration number by TIN in a couple of minutes, see the material |

| 5.10 | In the 1st and 2nd cells of the field “OGRN (OGRNIP) of the legal entity, enter zeros (their OGRN consists of 13 characters with a 15-digit zone to be filled in) |

In addition, individual calculation cells are not filled in at all - neither with zeros nor dashes. For example:

- the field “Cessation of activity” located on the title page - according to clause 5.6 of Appendix No. 2 to Order No. 381, code “L” is entered in this field (if the company or individual entrepreneur is liquidated in the reporting period) or it is not filled in at all;

- field “Budgetary organization” - only state employees work with it (clause 5.12 of Appendix No. 2 to Order No. 381), and in the reporting of other companies and individual entrepreneurs it remains blank.

From these features of the calculation filling technique, the following conclusion can be drawn:

- zeros are entered only in the 1st and 2nd cells of the “TIN” and “OGRN” fields if the value indicated in them consists of 10 or 13 characters, respectively;

- In the cells of the form tables, if there is no data, dashes are inserted;

- individual cells for a specific purpose are left unfilled.

If you generate several different reports in parallel at once, read the next section to protect yourself from errors.

Zero reporting to the Social Insurance Fund - when there is no activity, but there is a report

Even when preparing zero reporting, an accountant may encounter a lot of difficulties and make some mistakes, because submitting zero reporting does not mean providing blank forms. Let's figure out how to properly report to the Social Insurance Fund if the company does not actually operate.

All companies are required to submit reports to the Social Insurance Fund 4 times a year. Since 2015, new reporting deadlines have been introduced. On paper, the calculation is submitted to the Social Insurance Fund by the 20th of the month following the reporting period (i.e., by April 20, July 20, October 20, January 20), and in electronic form by the 25th.

What to submit and how to fill it out

The report is prepared according to Form 4-FSS, approved by Order of the Ministry of Labor dated March 19, 2013 No. 107n.

The procedure for filling out form 4-FSS is approved in Appendix No. 2 to Order No. 107n.

Let's look at an example of how to fill out a zero report. If you do not have time to deal with this issue yourself and spend time traveling to the FSS, then contact us for help here:

An example of filling out a zero report in the Social Insurance Fund

According to the filling procedure, zero reporting to the Social Insurance Fund should consist of a title page, as well as tables 1, 3, 6, 7, 10. Since tables 6 and 7 are on one page, our report will consist of 5 pages.

Let's fill out a zero report for 2014 for Pyshka LLC.

Please note that if the company does not have any data, then a dash is placed in the corresponding field of the report; this is provided for by the filling procedure.

Title page

The policyholder's registration number and subordination code can be found in the certificate of registration with the Social Insurance Fund.

The title page is always the first page, so we write -1 in the corresponding field.

We are filling out the original report, so we put 000 in the “Adjustment number” field.

Our reporting period is one year, Pyshka LLC does not apply to the Social Insurance Fund for money to pay benefits, so we write 12/—.

We indicate the year for which we are reporting, i.e. 2014, although we will submit the report in 2020.

Next, we indicate the name of our company, INN, KPP, OGRN (they can be viewed in the certificate of registration at the tax office).

We write the contact phone number. Using it, the FSS will be able to contact us and promptly resolve all issues if they arise. The phone number must include the city code or mobile operator. Parentheses and other delimiting marks are not written.

After this, the company address with postal code is indicated. It can be clarified, for example, in an extract from the Unified State Register of Legal Entities.

Next, fill in the policyholder code.

The first 3 digits are usually 071. This code is written if the company does not have benefits on contributions to the Social Insurance Fund.

The next two numbers are for companies using special regimes. “Simplified” must put 01, UTII payers – 02, Unified Agricultural Tax payers – 03. If the company uses OSNO, 00 is put in the field.

The last 2 digits refer to budgetary organizations, and commercial ones are put in the 00 field.

Pyshka LLC does not have benefits on contributions and applies the simplified tax system, so the company’s policyholder code will look like this: 071/01/00.

Let's move on to the number of employees. The field indicates the average number of employees (here you can read how it is calculated). Zero reporting to the Social Insurance Fund means that no one worked. Whether the payroll average can be zero is a controversial issue.

Some experts believe that if the sole founder is the general director, there is no need to conclude an employment contract. And, if no activity is carried out, the average is zero. You can read more about whether it is possible not to enter into an employment contract with the general director and not pay him a salary in this article.

Pyshka LLC entered into an employment contract with the general director. In 2014, the general director was on leave at his own expense. Therefore, the number of employees is 1.

If the CEO is a woman, then 1 should also be put in the “of which women” field. This is our case, because The general director of Pyshka LLC is O.R. Pirozhkova.

We do not have disabled people or workers in hazardous industries, so we put dashes in the appropriate fields.

As we calculated earlier, our report will consist of 5 pages, so in the “Calculation submitted on” field we put 005. We don’t have any attachments to the report, so we put dashes.

Pyshka LLC submits the report independently, without resorting to the help of, for example, a third-party organization, so we put “1” in the field confirming the accuracy of the report.

Next we write the full name of the general director. Pirozhkova O.R., in turn, signs the report after it is printed.

We put the date of compilation of the report and the company seal.

Tables

In the “header” of each page you must indicate the registration number of the policyholder and the number of subordination, as we indicated on the title page.

We also set the serial number of the page: 002, 003, etc.

At the bottom of the page you need to put the date the report was compiled.

Each page must be signed by the same person as the title page.

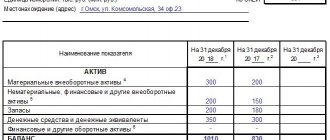

Table 1

At the top you need to indicate the company's OKVED (if you need to choose a new OKVED, then read this article). The main activity of Pyshka LLC in accordance with the constituent documents is retail trade in non-specialized stores of non-frozen products, including drinks, and tobacco products, which corresponds to OKVED 52.11.2.

Further, dashes are added in all fields of Table 1.

Table 3

We put dashes.

Page 4 (tables 6, 7)

At the top of the page we indicate OKVED, as on the second page. In column 6 of Table 6 we indicate the amount of the insurance tariff, which can be viewed in the notice of the amount of insurance premiums received from the Social Insurance Fund. Since Pyshka LLC does not have a discount on the tariff, we write the same figure in column 10. In the remaining fields of tables 6 and 7 we put dashes.

Table 10

All jobs are subject to special assessment, so in column 3 you need to indicate the total number of jobs the employer has. In our case, this is the place of the general director, and we put 1. If the title page indicates a zero average salary or the employees do not have jobs (for example, when employees work from home), then a dash is placed in column 3.

Since a special assessment of working conditions at Pyshka LLC was not carried out, we put dashes in the remaining fields.

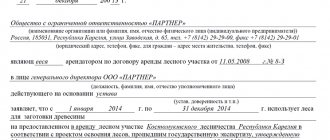

Covering letter

As a rule, along with zero reporting, companies submit a covering letter to the Social Insurance Fund explaining why the report is zero. This letter is not required by law, but many authorities ask for it. The letter is written in free form.

Sample

Good luck with your reporting! Follow the instructions and deadlines and you will be happy. Although it’s better, of course, to submit non-zero reports, because that’s why a business is created, to work! If your business goes well, read this article about filling out the 4-FSS report in numbers.

If you have questions about filling out a zero report in the Social Insurance Fund, then ask them in the comments!

Technology of filling out calculations - how not to make a mistake?

The above method of filling out the fields is typical only for 4-FSS. When preparing, for example, the calculation of contributions, a different scheme is used (clause 2.20 of Appendix No. 2 to the Federal Tax Service order No. ММВ-7-11/ [email protected] dated ):

- 12 acquaintances of the “TIN” field of a single calculation for insurance premiums must be filled out from the first cells, and with a 10-digit TIN, dashes are entered in the last 2 cells (for example, 8970652349—);

- missing indicators (quantitative and total) are filled with zeros; in other cases, empty cells are crossed out.

For a sample zero-sum calculation for insurance premiums, please follow the link.

Do not confuse these technical features of the design of different reporting forms, otherwise problems may arise with the timely acceptance of the 4-FSS calculation by social insurance specialists. They may not accept the calculation on formal grounds - due to non-compliance with the procedure established by law for filling it out.

How much the policyholder will have to pay if, due to a technical or other error, the calculation is not submitted on time, find out here.

Where can I get the information for Table 5?

Always fill out this table, regardless of whether the indicators are in the other calculation tables or not. It is devoted to the results of a special assessment of working conditions (SOUT) and mandatory medical examinations performed at the beginning of the year.

Please put dashes in all cells if you have registered as an insured this year. Other companies and individual entrepreneurs need to collect information:

- from the personnel service - about the number of jobs (this information is needed for column 3), the number of employees required to undergo medical examinations (column 7) and those who have already passed them (column 8);

- from the SOUT report - on the number of certified workplaces, including those classified as harmful and dangerous working conditions (columns 4–6).

What the law on SOUTH refers to as hazardous working conditions is described here.

For all the details on filling out this table, see our material “4-FSS - Table 5: how to fill out in 2020.”

Sample 4-FSS with an example for a novice policyholder

Let's consider the scheme for filling out the 4-FSS 2020 for a company created in the 3rd quarter.

Example

Initial data:

- Stroika Plus LLC was registered in August 2020.

- At the end of the 4th quarter, activities had not yet begun, staff had not been recruited, payments had not been made, insurance premiums had not been paid.

- Only the director is on staff.

- The injury contribution rate is 2.3% (without discounts or surcharges).

- The SOUT is scheduled for September 2020.

Despite the lack of activity, in October 2020 the company will be required to submit its first calculation to social insurance in Form 4-FSS. It will be null because there is no data to fill:

- table 1—no injury payments were accrued;

- table 2 - Stroika Plus LLC did not conduct mutual settlements with the Social Insurance Fund;

- table 5—there is no information about the results of special assessment tests and mandatory medical examinations.

How to complete a zero calculation, see the sample of filling out 4-FSS, latest edition 2020.