The article describes which BCC UTII is used for individual entrepreneurs in 2019, the deadlines for paying the tax, where to pay it and which BCCs are used for fines.

Imputed income tax is a taxation system in which the tax base is not earned income, but the amount of income fixed by legislators according to the activities carried out by a legal entity. The tax does not depend on the income received. The calculation is made based on physical indicators according to:

- type of activity;

- number of hired personnel;

- area of retail premises.

For tax payment by firms and businessmen, the KBK for UTII is provided.

Where to pay UTII

UTII is paid to the Federal Tax Service, whose department is the place where they work under “imputation”. The company is registered with the Federal Tax Service as the payer of the imputation.

Types of business for which exceptions are made from the general norms (registration at the place of provision of services is not required):

- sale of goods by carry-out and distribution methods;

- pasting of transport advertising materials;

- transportation of goods, passenger transportation.

The tax is sent to the inspectorate at the address of the company's head office. The BCC for paying UTII in 2020 has not changed compared to 2020.

BCC for other taxes, fees and obligatory payments for 2018

Below we present the BCC for all other taxes, fees, and obligatory payments. Check the codes on your payment slips with the tables to avoid errors.

KBK on UTII (single tax on imputed income) 2018

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for 2020 for individual entrepreneurs (patent)

| Purpose of payment | Mandatory payment | Penalty | Fine |

| tax to the budgets of city districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

BCC for Unified Agricultural Tax for 2020

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for water tax for 2020

| Tax | 182 1 0700 110 |

| Penalty | 182 1 0700 110 |

| Fines | 182 1 0700 110 |

BCC for land tax (table)

| Payment Description | KBK tax | KBK penalties | KBC fines |

| For plots within the boundaries of intra-city municipalities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts with intra-city division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

KBC for mineral extraction tax 2018

| Payment Description | KBK tax | KBK penalties | KBC fines |

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Combustible natural gas from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Extraction tax for common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, when extracting minerals from the subsoil outside the territory of the Russian Federation | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of natural diamonds | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of coal | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

Payments for the use of subsoil (KBK 2018)

| Payment Description | KBK |

| Regular payments for the use of subsoil for the use of subsoil (rentals) on the territory of the Russian Federation | 182 1 1200 120 |

| Regular payments for the use of subsoil (rentals) for the use of subsoil on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

Payments for the use of natural resources - KBK for 2018

| Payment Description | KBK for payment |

| Payment for negative impact on the environment Payment for emissions of pollutants into the air by stationary facilities | 048 1 1200 120 |

| Payment for emissions of pollutants into the atmospheric air by mobile objects | 048 1 1200 120 |

| Payment for discharges of pollutants into water bodies | 048 1 1200 120 |

| Payment for disposal of production and consumption waste | 048 1 1200 120 |

| Payment for other types of negative impact on the environment | 048 1 1200 120 |

| Payment for the use of aquatic biological resources under intergovernmental agreements | 076 1 1200 120 |

| Payment for the use of federally owned water bodies | 052 1 1200 120 |

| Income in the form of payment for the provision of a fishing area, received from the winner of the competition for the right to conclude an agreement on the provision of a fishing area | 076 1 1200 120 |

| Income received from the sale at auction of the right to conclude an agreement on fixing shares of quotas for the production (catch) of aquatic biological resources or an agreement for the use of aquatic biological resources that are in federal ownership | 076 1 1200 120 |

KBK for fees for the use of wildlife objects (2018)

| KBK for fees | BCC for penalties | KBC for fines |

| 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

BCC 2020 for fees for the use of aquatic biological resources

| Payment Description | Codes | ||

| Tax | Penalty | Fines | |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

KBK 2020 for trading fee

| Payment Description | KBK for payment |

| Trade tax in federal cities | 182 1 0500 110 |

| Penalty trading fee | 182 1 0500 110 |

| Interest trading fee | 182 1 0500 110 |

| Fines trade fee | 182 1 0500 110 |

KBK 2020: tax on gambling business

| BCC for tax | BCC for penalties | KBC for fines |

| 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

State duty: BCC for 2020 (table)

| Payment Description | KBK |

| State duty on cases considered in arbitration courts | 182 1 0800 110 |

| State duty on cases considered by the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by the Supreme Court of the Russian Federation | 182 1 0800 110 |

| State duty for state registration: – organizations; – individuals as entrepreneurs; – changes made to the constituent documents of the organization; – liquidation of the organization and other legally significant actions | 182 1 0800 110 |

| State duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget | 182 1 0800 110 |

| Other state fees for state registration, as well as performance of other legally significant actions | 182 1 0839 110 |

| State duty for re-issuance of a certificate of registration with the tax authority | 182 1 0800 110 |

Income from the provision of paid services and compensation of state costs: KBK 2018

| Payment Description | KBK for payment |

| Fee for providing information contained in the Unified State Register of Taxpayers | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs | 182 1 1300 130 |

| Fee for providing information from the register of disqualified persons | 182 1 1300 130 |

KBC 2020: fines, sanctions, damages

| Payment Description | KBK for payment |

| Monetary penalties (fines) for violation of legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, paragraphs 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art. 129.4, 132, 133, 134, 135, 135.1 | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

Source

Source

Terms of payment of UTII

Calculation of UTII is submitted and tax is paid quarterly. Conditions for using UTII:

- The average number of employees in the company does not exceed one hundred;

- the share of other companies in the company is not higher than 25%, excluding companies where 50% of employees have disabilities, consumer cooperation companies;

- companies and businessmen are not recognized as payers of the Unified Agricultural Tax;

- the company is not one of the largest taxpayers;

- the activity is not carried out under a simple partnership agreement;

- The area of the premises for trade or customer service hall for catering is no more than 150 square meters. m.

UTII is prohibited from using:

- when leasing gas stations;

- gas filling stations;

- educational, health and social welfare institutions providing public catering services.

UTII has the right to use companies providing services:

- household;

- public catering;

- road transport;

- ONE HUNDRED;

- retail;

- rental of places for trade.

ENVD can be combined with various taxation regimes: OSNO, patent, Unified Agricultural Tax, simplified taxation. The simultaneous use of taxation regimes for one type of activity is not permissible.

UTII payment dates in 2020

Tax is paid according to quarterly calculations. UTII payment dates:

- 04/25/18 - for the first quarter;

- 07/25/18 - for the 2nd quarter;

- 10.25.18 - for the third quarter;

- 01/25/19 - for the fourth quarter.

Tax is paid regardless of whether income was received and the company was operating or not. As long as the company is registered as an “imputed” taxpayer, payment is required and the filing of a zero declaration is not approved. The KBK UTII 2020 for legal entities is described further in the section KBK for transfers of UTII, penalties and sanctions for individual entrepreneurs 2018–2019.

UTII payment dates in 2020

The deadlines for payment of imputation in 2020 have not changed compared to 2018.

- I quarter — April 25, 2019;

- II quarter — July 25, 2019;

- III quarter — October 25, 2019;

- IV quarter — January 27, 2020.

If the day for payment coincides with a weekend, then the tax amount is paid to the budget on the next working day.

Payment due in 2020

The rules haven't changed. There have been no changes to the timing. There are 4 quarters provided. At the end of each quarter, the merchant is obliged to pay UTII.

The following dates were in effect:

| Fourth quarter 2020 | Until January 25, 2020 |

| First quarter of 2020 | Until April 25, 2020 |

| Second quarter 2020 | Until July 25, 2020 |

| Third quarter 2020 | Until October 25, 2020 |

The last day of payment did not fall on a working day. Entrepreneurs paid according to the standard scheme, without transfer to working days. Pay attention to the time of filing the declaration. The deadline differs from the direct payment of the tax - until the 20th of the corresponding month. In other words, the act is submitted earlier than the payment of the obligation.

BCC for transfers of UTII, penalties and sanctions for individual entrepreneurs 2018–2019

For non-payment of UTII, the following measures are provided:

- collection of tax debts;

- imposition of penalties of 20% of the lost tax in case of non-payment committed by the payer unintentionally;

- 40% of the amount not received if the amount is not paid intentionally.

BC codes for paying tax, including BC for UTII penalties:

- UTII tax - 18210502010021000110;

- penalties - 18210502010022100110;

- fine - 18210502010023000110.

For UTII paid late, penalties are charged for each day of delay.

BCC for payment of UTII for companies (LLC and JSC)

The BCC “imputation” for companies and entrepreneurs is the same. The tax base for tax calculation is the basic yield (BR). This is the monthly profitability taken as a basis per unit of physical indicator, calculated in rubles. When calculating tax, 2 coefficients are taken into account:

- K 1 - deflator coefficient, updated annually;

- K 2 is a reduction factor, numbers range from 0.005 to one.

Companies and entrepreneurs have the right to reduce the amount payable by 50% by the amount of insurance premiums paid for themselves and their employees.

KBK on income tax 2020 for legal entities

If you indicate the wrong KBK or completely forgot to write down the code, inspectors will receive a notification of refusal to accept the declaration. It will say: there was an error in filling out the data for the “Budget Classification Code” indicator. The error code is 300300027.

If you do not solve the problem and are late in submitting the report, then a fine cannot be avoided. Delay the report for more than 10 days and tax inspectors will suspend transactions on bank accounts. To avoid such troubles, check

KBK of income tax to the federal and regional budgets - 2018

| Purpose of payment | Mandatory payment | Penalty | Fine |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the profits of controlled foreign companies | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

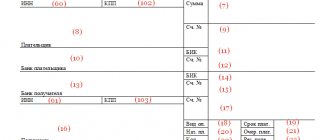

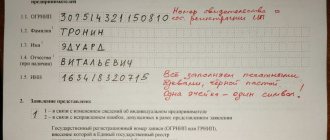

Sample of filling out a payment order for payment of UTII

BCC is reflected in the payment order in field No. 104. The following fields of the payment invoice are entered as follows:

- No. 105 - OKTMO of the municipality in which the company or individual entrepreneur is registered as a payer of “imputation”;

- No. 106 – “TP”;

- No. 107 - numbering of the quarter for which UTII is paid (“KV.01.2019”;

- № 108 – «0»;

- No. 109 - the date when the declaration of imputation was signed;

- No. 22 - “zero”. “UIN” – enter if the company (IP) pays tax at the request of the inspectorate.

- No. 110 - “Payment type” - do not enter.

Become an author

Become an expert

What are they needed for

Budget classification codes are something like part of an address.

It ensures your payments are sent in the right direction and end up in the budget they were intended for. KBK is part of the payment order, indicated in field No. 104. Twenty digits of the code become a real treasure trove of information for the recipient. The first three numbers are information about where the money should go, the department code. The next three explain the income group and subgroup. The next five digits are needed to make the income item and subitem clear. Two more numbers are the income element. The next four digits indicate the type of payment, and the last three indicate the type of income. The main document that regulated the BCC was Order No. 65n of the Ministry of Finance. He approved the Instructions on the procedure for applying the budget classification of the Russian Federation. But on June 20, 2020, a fresh order No. 90n changed the BCC. In 2020, three major changes to budget classification codes and 12 new BCCs were introduced. Firstly, if your profit is somehow received with the help of foreign organizations that you control, then tax on such income is now charged according to the new BCC - 18210101080011000110. For fines you may need code 18210101080013000110, and for penalties - 18210101080012100110. Secondly, simplified entrepreneurs paying the minimum tax were deprived of their code. And thirdly, important innovations were related to social contributions.

Calculation and calculation of transport tax

According to Art. 362 ch. 28 Tax Code of the Russian Federation Federal Law No. 117 of 08/05/2000 (as amended on 12/25/2018), the amount of the fee is calculated based on the cost of the car, since the Legislation contains a register of expensive cars for which a luxury duty is paid.

For ordinary citizens and organizations, the amount of duty is calculated using various methods. But for both the former and the latter, the calculation uses an increasing coefficient, which is set by local authorities individually for each region.

Individuals and individual entrepreneurs use this formula to calculate the amount:

Stn * NB * (Mvl / 12) * Kp, where

- Stn - tax tariff;

- NB - tax base;

- Mvl - number of months of vehicle ownership;

- Kp - increasing coefficient.

The latter indicator applies to cars whose price is above 3 million rubles. The duty for other cars is calculated using this formula without taking into account the coefficient. Individuals and entrepreneurs pay the result received annually no later than December 1 of the reporting year, but no more than for three quarters. Citizens and private businessmen contribute tax funds based on a notice from the tax office.

Companies use the same formula, but pay tax differently than individuals. Organizations pay quarterly advances on the vehicle tax during the year, so the tax amount is equal to:

Sf - AvPl, where

- Sf - the amount obtained by the formula;

- AvPl - the amount of advance payments for the reporting year.

According to para. 2 p. 1 art. 363 ch. 28 of the Tax Code of the Russian Federation, the deadline for paying advances and the main payment for organizations is established by local authorities. Organizations, unlike individuals and individual entrepreneurs, pay money for the vehicle tax by filling out a declaration without notification, filling out the form themselves.

Late or intentional failure to pay tax is punishable by a fine, the same in both cases:

- unintentionally - 20% of the amount of the duty calculated for payment;

- intentionally - 40% of the amount of the fee calculated for payment.

Sanctions are regulated by Art. 122 Tax Code of the Russian Federation Federal Law No. 146 of July 31, 1998 (as amended on December 27, 2018).

Error in KBK

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes.

According to paragraph 4 of Art. 45 of the Tax Code of the Russian Federation, the tax does not go to the budget, and is considered unpaid if the following errors are made in the payroll:

- The name of the transfer recipient bank is incorrectly indicated;

- The Russian Treasury account number is incorrectly indicated.

If an error was made in the KBK number when filling out the payroll, then you do not need to pay UTII, fines, interest or penalties again. In such a situation, the tax is still considered paid. However, you will have to provide the tax office, where the entrepreneur or organization is listed as a UTII payer, with a letter confirming the clarification of the payment made. The letter must indicate the corrected BCC, as well as provide a copy of the payment order in which the error was made.

Author of the article: Arina Gyulmetova

Generate payments for KBK in the cloud service for small businesses Kontur.Accounting. Keep records, easily calculate salaries, pay taxes, generate reports and send them via the Internet. The service will tell you about the dates of payments and reports, and will relieve you from rush jobs and routine. The first 14 days of work are free.