Economic concepts

The TIN system was created in order to facilitate the activities of the Federal Tax Service by automating certain sections of accounting processes. Thanks to this system, the tax structure becomes simpler and clearer. And if previously the TIN was used only in the tax system, now it accompanies a person in many areas of activity involving social, economic and labor relations.

How does the abbreviation stand for?

The concept of TIN appears so often in various documents that many of our citizens have a rough idea of what is meant by this abbreviation.

TIN

It is customary to decipher it as “tax identification number,” but it is more correct to say “individual taxpayer number.”

It is this transcript that appears in all official papers. The TIN looks like a sequence of numbers and is assigned to all entities - both individuals and legal entities. The Tax Service needs the TIN to create and maintain a unified taxpayer registration database. All able-bodied citizens of the Russian Federation, as well as institutions and organizations engaged in commercial activities in the country, are required to have a TIN.

How to get a TIN

The procedures for obtaining an identification number for citizens and organizations differ significantly, so we will consider them separately.

How to get a TIN for an individual

There are four options for obtaining an identification number:

1 In person at the tax office . Previously, it was necessary to contact the Federal Tax Service strictly at the place of registration, but from 2020 it is possible to obtain a TIN certificate from any inspectorate, since taxpayer databases are now combined. If you are receiving a TIN for the first time, you must fill out a three-page application according to form No. 2-2-Accounting (a sample of the form is below on 3 sheets, click on the picture, also download the form and filling procedure):

If you don’t understand the filling procedure, watch the video instructions:

Video: Rules for filling out an application for a TIN for an individual

Then print it out and bring it to the Federal Tax Service (don't forget your passport!). A paper certificate must be issued no later than 5 days later. Another option is to come to the Federal Tax Service with your passport and ask the inspector to fill out an application, then sign it. The certificate will also be issued within 5 days.

2 By mail . If it is not possible to contact the tax authority in person, the application can be sent by Russian Post or any postal service by registered mail with notification. True, you will have to attach a notarized copy of your passport to your application (a double-page spread with a photo and a page with permanent registration at your place of residence). After processing the application, the TIN certificate is sent to the address indicated by the applicant, also by registered mail. It is recommended to use this method when there are no other options, and also if you are sure that the postman or courier service will find your address without problems.

3 On the website of the Federal Tax Service . This option is best if you do not need a paper certificate. By filling out an application in the specialized service of the Federal Tax Service and attaching a scan of your passport to it, you will be able to track the status of the application and receive an identification number. If necessary, you can also order a paper TIN certificate from any tax office of your choice. However, you will have to go get him in person.

4 In the multifunctional center (MFC) . The algorithm for obtaining a TIN here is approximately the same as in the Federal Tax Service, with the difference that MFC branches are now located in most administrative centers of municipalities, and tax inspectorates are only in cities and regional centers. To obtain a TIN, you need to submit an application using the same form as with the Federal Tax Service (it can be printed and filled out in advance, or you can do it on the spot, with the help of an MFC specialist). You will also need a passport with registration in the Russian Federation (the specific place of residence does not matter - the document will be issued to you at any multifunctional center in the country). The service execution period is 5 working days, plus 2 days are spent on sending papers from the MFC to the Federal Tax Service and back. In some cases (in small localities) you can only submit documents to the MFC, and you will have to receive a paper certificate from the tax office.

TIN of an individual: decoding and procedure for obtaining

In relation to individuals, the TIN performs the function of identifying people who have similar personal data. Any person receives an individual number shortly after birth, and throughout his life this number does not undergo any changes. No matter what happens to a person (gets married, changes his last name or even his gender), the TIN remains unchanged. When a person dies, his TIN loses its relevance and becomes part of the archive.

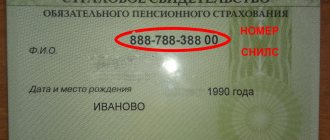

The individual number assigned to an individual has 12 digits.

- The first pair

indicates the region code. - The second pair

is the number of the Federal Tax Service division that assigned this TIN to the individual. - Numbers 5 to 10

are the serial number in the registration list containing important information about the payer. - The number ends with two digits

, which form a check number confirming the authenticity of the number. This number is calculated using a special formula.

Most citizens receive a TIN at the same time as their passport. But some institutions may require tax documents for a child under 14 years of age. Therefore, parents are advised to take care in advance of obtaining a certificate of registration and obtaining a TIN for their child. Having registered the child at their place of residence, parents can contact the tax service and receive the above documents.

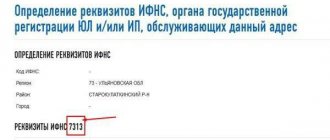

The body that issues TIN to individuals is the tax office at the place of residence. The certificate is issued within 5 days after the applicant submits the documents. The TIN is indicated on page 18 of the passport. It may also contain information about the responsible tax authority that issued the certificate and the date of its issue.

When a citizen registers an individual entrepreneur, his individual number becomes the number of the business entity he founded. From now on, it is considered as the individual taxpayer number of this individual entrepreneur.

TIN for individual entrepreneurs - how many characters

TIN is an individual digital code intended for tax accounting of legal entities and individuals. To obtain the code, you must contact the tax authorities, who, after assigning the value, issue a state certificate with the corresponding registration entry. When opening a business, among other mandatory steps, the company is required to issue a Taxpayer Identification Number (TIN).

The indicator includes 12 consecutive numbers, each of which serves to designate certain groups. In particular, the first two digits indicate the code of the Russian Federation, digits 3 and 4 indicate the inspection number of the Federal Tax Service, from 5 to 10 the number of the taxpayer’s record in the Russian tax accounting system. The last two digits, that is, 11 and 12, are intended to control the correctness of the entry.

TIN of a legal entity: decoding and application

The individual number assigned to legal entities consists of only ten characters.

- The first two characters

in the number are used to determine the region code. - The next two

indicate the number of the Federal Tax Service division that issued the TIN to the legal entity. - Numbers 5 to 9

are the serial number in the registration journal containing information about the legal entity. - The tenth digit

is the control digit. It is used to verify the data provided.

Again, using the TIN, a specific organization is identified among similar entities. Having a number helps simplify the tax accounting process and contributes to the correct conduct of business. The issuing of certificates of registration of legal entities is carried out by the controlling tax authority - in other words, the inspection at the place of registration of the enterprise. These certificates, like those held by individuals, are issued once. Throughout the entire operation of the organization, no changes are made to the TIN.

Do the TIN of an individual and individual entrepreneur match?

What does the IP INN look like? And who is this code issued to? First of all, it should be noted that conducting business without a TIN is impossible. Only with the code will a businessman be able to report taxes on time, pay fiscal amounts to the budget, conclude agreements with suppliers and customers, and obtain a bank loan. Any interaction with tax, statistical, and social government agencies is carried out with the identification of the entrepreneur using an individual code.

Do the TINs of an individual and an individual entrepreneur match or not? If an individual has already received a TIN before opening the individual entrepreneur status, the assigned code will be used. If not, you must obtain a TIN at the same time as submitting an application for business registration. In this case, the certificate will be issued to the individual along with a package of documentation for opening a business. How many digits does the individual entrepreneur have? More on this below.

Why do you need a TIN and how to check it

Some citizens (civil servants and individual entrepreneurs) are required to provide an original or a copy of a tax registration certificate when applying for a job. All others, theoretically, may not have a TIN at all. In other words, it is provided by the tax authority at the request of the applicant. There is a version that the reluctance of individual citizens to receive an individual number is due to their religious beliefs. But it’s not easy to live without identifiers in modern life. A person who does not have a TIN will not be able to purchase housing, receive a loan or any benefits. Thus, its existence in the economic and social sense can hardly be called complete.

If a person has a need to find out his TIN or a business partner, any organization, employer or seller, he can use one of the many specialized Internet services that provide information about the TIN in the shortest possible time.

Let's summarize. So, the TIN is issued once and is not subject to change throughout the life of a person or enterprise. It is used as a means of identification and helps simplify (and partially automate) tax accounting. A TIN is required for legal entities; it is assigned to individuals upon request. But, one way or another, without a Taxpayer Identification Number (TIN), normal human existence is impossible in the modern economy.

Our groups:

What is TIN

Taxpayer identification number (TIN of a legal entity or individual) is a digital code that streamlines the accounting of taxpayers in the Russian Federation. Assigned by the tax office to both legal entities and individuals.

The TIN of the organization is indicated in the tax registration certificate, which the Federal Tax Service issues simultaneously with the Unified State Register of Legal Entities entry sheet. The TIN consists of 10 digits and never changes (clauses 6, 16 of the Procedure for assigning a TIN).

You can check the counterparty’s TIN on the Federal Tax Service website - https://egrul.nalog.ru.

History of Taxpayer Identification Number

Organizations began to be assigned this number in 1993, i.e. from the moment the active development of market relations and business activities began,

individual entrepreneurs - since 1997,

other individuals – since 1999 (since the beginning of the first part of the Tax Code of the Russian Federation).

For reference:

1. What is the Unified State Register of Legal Entities2. What is OGRN

Is it possible to change the TIN

Article 23 of the Tax Code does not mention the obligation to change the TIN when changing personal data. This means that the taxpayer identification number does not change if a person changes his last name, place of residence or other personal data. The TIN certificate does not need to be changed; data on the change of your last name is transmitted to the tax office by the civil registry office automatically. The same thing happens when you change your registered address at your place of residence.

If you decide to update your certificate, for example, after getting married and changing your last name, you can do this voluntarily. The following documents are required:

- application on form No. 2-2-Accounting (see form and filling procedure);

- passport with a note indicating a change of surname;

- old TIN form.

You can submit these documents at your Federal Tax Service inspectorate, as well as through the website nalog.ru. In the second case, you need to enter your personal account for individuals, select the “Life Situations” section, and in it the item “Application for clarification of personal data.” Your new data is indicated here, scans of documents are attached to the application. You still need to obtain a certificate from a tax inspector at your place of registration.

How many digits does the identification number contain?

How long does it take to open an individual entrepreneur, what determines the duration of registration

Each time they are not chosen at random. The system automatically generates a unique combination. There is a difference for legal entities and individuals; they are awarded different numbers.

The IP INN has this number of numbers, which are deciphered as follows:

Decoding the 12-digit TIN

There are 12 in total, which contain:

- the first two are the region of registration;

- the next two are the branch number of the local tax service that generated the document;

- the next six are the personal data of the taxpayer, using which it is easy to find him in the State Register;

- the last two are a verification code, assigned according to a certain formula, and helps eliminate errors made when entering new data.

For legal entities, the combination is different; the number of digits is smaller. Total 10. The length of the combination matters, each number stores information:

- 1-2 - show the region code;

- 3-4 - the number of the tax office that issued this code;

- 5-9 - registration number of the specified taxpayer (one number less than that of individuals);

- the last number is a verification number.

Tax Service departments are responsible for issuing TINs. It is enough to contact the nearest one at your place of registration. It's easy to find out the combination there.

The procedure for re-obtaining a TIN

If the TIN certificate is lost for any reason, it can be restored. To do this, an individual applies (in person or through a representative) to the tax authority at the place of residence with a list of documents.

This list includes:

- application for the issuance of a duplicate TIN certificate drawn up in any form;

- an identity document confirming registration at the place of residence - Russian passport;

- a receipt for payment of the state duty in the amount of 200 rubles (for issuing a certificate the next day, the amount of the state duty increases to 400 rubles);

- a notarized power of attorney from a representative of an individual, if it is he who submits documents to the tax authority.

If you change your place of residence, there is no need to obtain a new TIN certificate.

Please note that any citizen of the Russian Federation has the right to apply to the Federal Tax Service (at their place of residence) to obtain a TIN stamp in their passport.

This mark greatly facilitates the execution of transactions and documents; At the same time, we repeat, the presence of a TIN mark in the Russian passport is a right, and not an obligation, of a citizen.