What is the contract for?

Employees of a company may be held financially liable if they, through their actions or inactions, caused material damage to the organization.

These provisions are enshrined in law, and the employee can be exempted from it if the company’s material losses arose due to reasons beyond the employee’s control.

Such force majeure reasons include:

- fires;

- natural disasters;

- floods and other disasters.

An employee is also exempt from financial liability if damage to property was caused as a result of his taking measures for self-defense.

Important! If an employee causes damage to the company, full financial liability arises only when a financial liability agreement is drawn up with this person.

Therefore, when hiring financially responsible persons, it is necessary to draw up an agreement on full financial responsibility. For example, with a storekeeper, driver, watchman, etc.

If this is not done, then the employee can only be recovered for damages within the limits of his salary for one month. In this case, financial liability is limited.

An agreement on full financial liability can only be concluded with a company employee. Therefore, it is often considered an annex to the employment contract.

Attention! Financial responsibility is often established as a condition of an employment contract. Important for drawing up an agreement on full financial liability is the employee’s work with the company’s material assets.

In some cases, drawing up an agreement on full liability is mandatory.

Such professions include, for example:

- cashier;

- accountant;

- storekeeper;

- warehouse manager;

- driver for the car;

- watchman;

- etc.

Types of contracts and what is their difference

There are several types of liability agreements. Let's take a closer look at them.

You might be interested in:

Is it possible to extend or shorten an employee’s probationary period?

| Characteristics | Individual agreement on full financial responsibility | Collective agreement on full financial responsibility |

| When is | Sharing of responsibilities is possible | Separation of responsibilities is not possible |

| Parties to the agreement | Employer and employee | The employer and the team of workers, which must be represented by its manager. He is appointed or elected by the members of the team. |

| Contents of the liability agreement | Standard content of a liability agreement. A list of situations when financial liability may arise must be included. | Standard content of a liability agreement. A list of situations when financial liability may arise must be included. |

| Who signs | Employer and Employee. | The employer and all employees included in the team. |

How to recover damages

Damage may be recovered by the administration (no more than 20% will be deducted from the employee’s salary each month). It is important here that such an order was given no later than a month from the moment the amount of damage was established. Such a penalty is possible if the employee does not object to it.

You can also recover damages through court. This is usually resorted to if the administration did not manage to issue an order within a month (however, no more than a year has passed since the offense), the amount of payments is greater than the average monthly earnings of the employee, he himself expressed his disagreement with such actions (the very fact of the penalty or its size) or resigned From the job.

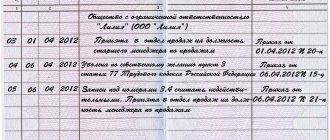

Samples of a liability agreement:

limited

full individual

Who will the contract be mostly concluded with?

The Labor Code of the Russian Federation allows the employer to enter into a full liability agreement only with certain categories of employees who have reached 18 years of age. The list of positions and jobs with which this can be done is listed in Resolution of the Ministry of Labor of Russia dated December 31, 2002 N 85.

This document includes two sections:

- The first section contains a list of positions with which it is envisaged to conclude individual contracts for financial responsibility. In particular, this is provided for the cashier, cashier-controller, and other employees who have the duties of cashiers.

- The second section contains a list of jobs, and full responsibility agreements can be concluded with the workers involved. This includes, for example, the acceptance and payment of various payments, the sale of any goods, work or services (including through the cash register, seller, waiter, etc.), servicing vending machines, producing coupons and subscriptions, etc.

With whom can you enter into a liability agreement?

The Labor Code of the Russian Federation stipulates that the conclusion of a DMO is allowed with an employee who is over 18 years old, and whose job description involves the use of financial or commodity assets of the enterprise.

Resolution of the Ministry of Labor of the Russian Federation No. 85 dated December 31, 2002 established a List of positions and works performed by employees for whom it is allowed to issue a DME. Among the positions and works noted in the resolution are:

- Controllers and cashiers.

- Bosses and specialists involved in buying and selling, working with securities, jewelry and other types of financial handling.

- Chiefs and their deputies of retail outlets, catering, hotels, household services.

- Traders and merchandisers.

- Heads of construction and installation enterprises, construction and installation work foremen.

- Warehouse managers, supply managers, suppliers and other working persons involved in the accounting and preservation of valuables.

- Activities related to the maintenance and breeding of livestock.

- Acceptance and processing of goods and other valuables for further postal delivery.

Note. A subordinate's performance of the work noted in the List does not automatically mean financial responsibility. When employing such an employee, the employer, in addition to drawing up an employment agreement, is also required to draw up a DMO.

The List does not include the director of the enterprise (except for some institutions), but he is also subject to liability for losses caused to the company (Article 277 of the Labor Code of the Russian Federation). The employer has the right to demand full compensation for losses from the head of the enterprise, regardless of the content of such a clause in the employment agreement.

Also not noted in the List of Ch. accountant, that is, you cannot issue a DMO with him. However, the condition on his responsibility can be reflected in the employment agreement, according to Art. 233 and 243 of the Labor Code of the Russian Federation. In the absence of such a clause, from Ch. an accountant can only be charged an average monthly salary.

What is the financial responsibility of an employee?

Today there are the following types of financial punishment:

- Limited (Articles 231, 238, 241 of the Labor Code of the Russian Federation). The essence of such punishment is that the employee does not sign the DMO and the employer has the right to withhold losses from the employee in a limited amount, and if the amount established by law is exceeded, only in court (Article 248 of the Labor Code of the Russian Federation).

- Full individual (Articles 242, 243 of the Labor Code of the Russian Federation). In this option, a DMO is drawn up with the employee and the amount of valuables for which the employee is responsible is easily determined.

- Full collective (Article 245 of the Labor Code of the Russian Federation). This form of responsibility differs from individual responsibility in that the volume of material assets is controlled by a group of people who are responsible for the company’s property.

Both forms of full liability require the presence of a formalized written DMO (Articles 244, 245 of the Labor Code of the Russian Federation):

- individually - with each employee;

- collectively – with all employees of the group.

Valuables are transferred to responsible persons according to the acceptance certificate, with periodic inventory.

What should the contract contain?

The law does not define any requirements for a liability agreement. Typically, each company draws up a standard template in which it indicates all the essential conditions of its day, and which, however, should not contradict the Labor Code.

The contract must begin with an indication of its name, as well as the place and date of its execution.

The next step is to identify each party to the contract. The company must indicate its name, information about the director, as well as the document on the basis of which he conducts his activities. For an employee, here you must indicate the position title and his full name.

Next, it is necessary to indicate in detail the responsibilities of the person to ensure the safety of the property. For example, here we can mention the obligation to document each movement of material assets, periodic inventory, etc.

Then it is necessary to describe the measures that the employer himself is taking to protect his property. For example, this may include installing a safe, equipping the premises with a security alarm, engaging a third-party security company (PSC), etc.

The contract must mention the provision of the employee with a job description and other documents establishing the need for full financial responsibility.

Next, it is necessary to indicate the cases in which the employee will be held financially liable. Situations in which such liability does not arise should be separately identified - for example, in the event of natural disasters, forced defense, etc.

Attention! The contract must indicate the number of copies in which the contract was drawn up, the procedure for its termination or extension for a new term.

The agreement must be completed with the details of each party, signatures and seals.

Is it possible to hold an employee financially liable without a contract?

The Labor Code establishes that an employee can be held financially liable only within the limits of his average monthly earnings, with the exception of other cases provided for.

Such other cases include:

- If the Labor Code or federal laws impose full financial liability on the employee for damage caused during work;

- If there is a shortage of valuables that were transferred to him on the basis of a written agreement or a one-time document;

- If he caused the damage intentionally;

- If he caused damage while under the influence of alcohol or drugs;

- If the damage was caused as a result of criminal acts determined by the court;

- If the damage occurred due to the disclosure of state, commercial or other secrets, when this is provided for by law;

- The damage was caused due to the employee's failure to fulfill his duties.

Attention! Thus, the absence of an agreement on liability is actually the employer’s refusal to recover the full amount of damage from the employee. In this situation, it will be possible to bring him to justice only within the limits of his average monthly earnings.

What is a full individual liability agreement?

The contract is a guarantee for the employer that in the event of loss or damage to property, the person who is responsible for it will reimburse the cost of the damage. In the absence of a written agreement, the employer does not have the right to hold the employee accountable for damage or shortage of property. In this case, attraction is possible only if the conditions are met (Article 244 of the Labor Code):

- the employee's age is over 18 years;

- compliance of the position or job responsibilities with the List;

- existence of an agreement on full financial liability;

- proof that the employee committed actions that resulted in damage or loss of material assets entrusted to him.