The essence of the agency agreement

The difference between mediation and standard transactions is that the intermediary receives remuneration specifically for the service provided, which consists in attracting third parties. Despite the receipt of funds for goods or services directly by the agent, the ownership of the objects being sold does not pass to him at all stages of the transaction, but belongs to the principal.

A bilateral transaction, under the terms of which one participant, called an agent, undertakes to perform a number of legal actions on behalf of a second participant, called the principal, for a fee - this is what an agency agreement is in essence (Clause 1 of Article 1005 of the Civil Code of the Russian Federation). The peculiarities of an agency agreement are that the transaction is always completed at the expense of the principal, but the agent can act both on behalf of the principal and on his own behalf.

Rules apply to legal relations based on an agency agreement depending on on whose behalf the intermediary agent acts (Article 1011 of the Civil Code of the Russian Federation):

- The agent acts on behalf of the principal - rules for the agency agreement (Chapter 49 of the Civil Code of the Russian Federation). If an agency agreement is concluded between legal entities or when one of the parties is a business entity, then the principal (principal) is obliged to pay remuneration to the agent (attorney) in the amount determined by the text of the agreement (Article 972 of the Civil Code of the Russian Federation), and if not, be guided by similar established market conditions prices under comparable conditions (clause 3 of Article 424 of the Civil Code of the Russian Federation).

- Agency services are provided on one's own behalf - rules for a commission agreement (Chapter 51 of the Civil Code of the Russian Federation). The commission fee is calculated in the same way as an order transaction.

There are legal restrictions regarding the conclusion of agreements. For example, an agency agreement with an individual entrepreneur selling the principal’s goods in a retail network can only be a commission agreement, since when making sales through a stationary outlet, a business entity, by definition, acts on its own behalf.

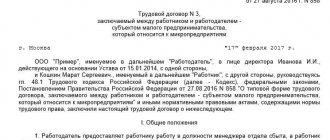

Agency agreement - sample

: Agency agreement - sample (49.0 KiB, 9 hits)

Remuneration of the agency agreement

As a general rule, an agency agreement is a compensation agreement, since it is most often used in business relations. The compensation nature of this agreement is indicated by Article 1005 of the Civil Code of the Russian Federation - the principal’s obligation to pay the agent a fee.

Regardless of the fact that the legislator has established the remuneration of this contract, information about the price is not an essential condition of the contract. That is, in the absence of this condition in the contract, the amount of remuneration is determined in accordance with the cost of the agent’s services usually charged under comparable circumstances. This rule exists by virtue of Art. 1006, 424 Civil Code of the Russian Federation.

Some lawyers propose to include a condition on the amount of remuneration in the agency agreement as an essential condition of the relationship.*

Samples of agency agreement:

- Sample agency agreement (the agent acts on his own behalf and at the expense of the principal)

- Sample agency agreement on commission terms

- Sample agency agreement on terms of assignment

- Agent's report on the acquisition of real estate (annex to the agency agreement)

- Specification for the sale of real estate (annex to the agency agreement)

Due to the wide range of issues considered, our company has developed an “internal request analyst” system. After receiving a request for consultation, the system automatically distributes applications among lawyers for further processing.

On our website you can find sample documents, as well as consult with a specialist using the “call a lawyer” form on the main page, or “request for consultation” in the “CONTACTS” section.

To speed up communication with a specialist, call: 8 (495) 151-29-09, 8 (929) 985 98 65 or write: [email protected]

We will be happy to help you!

Subject of the agreement

The only essential condition, without which a transaction is considered not concluded, for an agency agreement is an object that does not have a material expression, but represents a number of significant legal actions performed by one party on behalf of the other. If a standard purchase and sale transaction involves settlement with the buyer and settlement with the seller, as with two independent contractors, then an agency agreement with an individual or business entity provides for the conclusion of another agreement linking the principal and the final buyer.

The subject of the agency agreement is exclusively intermediary services paid by the principal. The specifics are determined by contractual terms, and in the absence of specifics, by the norms of civil law. However, it is important for the agent to detail the actions in order to avoid recharacterization of the agreement into a standard transaction with additional tax liabilities during audits.

The order given to the agent may include the following actions:

- searching for wholesale and retail buyers for the owner’s products with subsequent sales on behalf of the principal or one’s own;

- finding performers to perform a specific type of work or provide services ordered by the principal;

- concluding agreements with prospective buyers or sellers in the interests and at the expense of the principal.

Unlike standard bilateral transactions, a mediation agreement involves the involvement of a third party. For example, an agency agreement for the provision of legal services provides for the conclusion of another transaction between the customer and the law firm. As a result, the customer will pay for information, consulting or other legal services, and the agent will receive a fee for intermediary services in attracting a client.

Essential terms and important points

The agency agreement has two essential conditions:

- The subject of the agreement is a list of legal and actual actions;

- Determining on whose behalf the agent will act. Within the framework of one agreement, an agent may act on his own behalf and on behalf of the principal when performing transactions specified in the agreement.

Without specifying these essential conditions, the contract in question is considered invalid (Article 168 of the Civil Code of the Russian Federation).

When concluding a contract, you need to pay attention to:

- term of the contract - fixed-term and unlimited-term possible;

- agency fee confirming the paid nature of the contract;

- agent reporting procedure;

- restriction of the rights of the parties;

- provision on the admissibility of a subagency agreement;

- reasons for termination of the contract.

The absence of the above clauses in the contract does not entail its invalidation.

Ownership under agency agreements

Features of the agency agreement - funds and property assets received at all stages of the transaction are the property of the principal until the moment of actual sale to the buyer. The absence of a transfer of ownership leads to the absence of tax obligations with proper registration and maximum specificity. The agent is not exempt from liability for damage or loss of assets belonging to the owner located on the territory of the intermediary (Articles 996, 998 of the Civil Code of the Russian Federation).

The participation of a transit agent in settlements makes the situation ambiguous in the tax field. If goods received under agency agreements are subject to capitalization on off-balance sheet accounts, then a number of questions arise in relation to the funds received from the buyer and not transferred to the principal at the end of the tax period. In accordance with Article 128 of the Civil Code of the Russian Federation, the objects of civil rights are:

- property assets, including funds in cash and non-cash form;

- the results of work performed and services provided, accepted on the basis of signed acts;

- intangible assets;

- intellectual property results.

Failure to fulfill obligations, including failure to meet a deadline for either party, leaves the transaction open at the end of the reporting period. For example, receiving an advance payment from a buyer for a product without subsequent shipment is not considered the performance of an intermediary service. However, during audits, tax authorities try to equate the advance to the income received with automatic inclusion in the base for calculating tax liabilities for VAT and income tax.

In favor of the arguments of the fiscal service, the explanations of the Supreme Arbitration Court of the Russian Federation, set out in information letter No. 85 dated November 17, 2004, regarding commission agreements: in the absence of an additional agreement, the funds received are subject to immediate transfer to the principal.

Definition of intermediary transactions by civil law

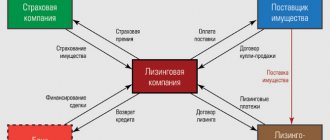

The current civil legislation distinguishes three types of intermediary transactions - commission agreements, assignments and agency agreements.

The listed transactions formalize the representation by one person of the interests of another through the conclusion of agreements with third parties and other legal actions.

Article 990 of the Civil Code of the Russian Federation defines the commission agreement

as an agreement under which “one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions on its own behalf, but at the expense of the principal.”

As follows from this definition, when executing a contract, transactions are made on behalf of the commission agent. This is the main distinguishing feature of a commission agreement. When performing an assigned transaction, the commission agent acts as a completely independent person.

According to Article 990 of the Civil Code of the Russian Federation, in transactions made by a commission agent with third parties, it is the commission agent who acquires rights and becomes obligated, although the principal was named in the transaction or entered into direct relations with the third party for its execution. On the other hand, third parties have obligations towards the commission agent and acquire rights in relation to him.

Article 971 of the Civil Code of the Russian Federation defines the contract of agency

as an agreement under which one party (the attorney) undertakes to perform certain legal actions on behalf and at the expense of the other party (the principal).

Here, as in the commission agreement, the attorney is entrusted with performing certain legal actions of interest to the principal. However, in contrast to the commission agent, the attorney, fulfilling the obligations under the agency agreement, performs legal actions on behalf of the principal. According to Article 971 of the Civil Code of the Russian Federation, “the rights and obligations under a transaction completed by an attorney arise directly from the principal.” On the other hand, third parties in transactions carried out by the attorney at the expense of the principal are obligated in relation to the latter and acquire rights in relation to him.

According to Article 1005 of the Civil Code of the Russian Federation, under an agency agreement

one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal.

The design of an agency agreement in Russian civil law pursues the goal of legal formalization of relations in which the intermediary (representative) carries out both transactions and other legal actions, as well as actual actions that do not entail legal consequences. For example, an organization acting as an agent may take on the task of selling other people's goods, which will imply not only concluding sales and purchase agreements, but also conducting an advertising campaign and other activities to study and develop the market. In such situations, it is impossible for the parties to the contract to make do with one of the traditional structures of an order, commission or contract. It is necessary to conclude either several different but closely interrelated agreements between the same entities, or a complex mixed (complex) agreement. Concluding an agency agreement can significantly simplify this situation.

According to paragraph 1 of Article 1005 of the Civil Code of the Russian Federation, in a transaction concluded by an agent with a third party on his own behalf and at the expense of the principal, the agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction. In a transaction concluded by an agent with a third party on behalf and at the expense of the principal, the rights and obligations arise directly from the principal.

Although an agency agreement is an independent business agreement that synthesizes commission and mandate agreements, specific transactions, specific business transactions performed by the agent for the principal fit within the framework of commission and mandate agreements. According to Article 1011 of the Civil Code of the Russian Federation, the rules provided for in Chapter 49 “Assignment” or Chapter 51 “Commission” of the Civil Code of the Russian Federation are applied to relations arising from an agency agreement, depending on whether the agent acts under the terms of this agreement on behalf of the principal or on his own behalf , if these rules do not contradict the essence of the agency agreement or special regulations of the Civil Code of the Russian Federation on agency.

Thus, we can highlight the following feature of commission agreements, commissions and agency agreements, which determines both the taxation scheme for transactions under them and the accounting procedure for business transactions carried out within the framework of these agreements: the property with which transactions are carried out (in relation to which purchase transactions are concluded - sale, contract, etc.) does not belong to the intermediary (commission agent, attorney, agent) by right of ownership.

Agent report and remuneration

The fact of fulfillment of contractual terms must be recorded by drawing up a report by the agent, accepted by the principal within the agreed time frame (clause 1 of Article 1008 of the Civil Code of the Russian Federation). If a bilateral agreement does not establish a period for submitting a report on the execution of an order, then in the absence of claims from the principal within 30 days from the date of transfer, the report is considered accepted (clause 3 of Article 1008 of the Civil Code of the Russian Federation). To avoid additional tax payments, it is recommended to stipulate in an agency agreement with a legal entity:

- execution acceptance mechanism;

- form and content of the report;

- procedure and deadlines for providing documentation;

- factual evidence of expenses incurred, reimbursed by the principal.

The agency report must contain detailed information about the execution of the principal's instructions. If a commission agreement has been concluded, an example of a report on the execution of an order, in addition to the details of the parties, contains:

- a list of sold inventory items broken down by date for the reporting period;

- the transferred amount of funds indicating the details of payment documents;

- expenses incurred related to the execution of the order;

- the amount of commission with reference to the clause of the contractual conditions.

If the agency agreement does not establish the form of the report, then the contractor may submit a document of arbitrary content to the guarantor. But the document must contain information about actions taken in the course of fulfilling obligations, costs incurred, funds received and transferred. Otherwise, the obligations will be considered unfulfilled by the agent.

Payment of remuneration is provided for by the terms of the agreement and can be made:

- by transferring funds by the principal within a specified period;

- carrying out mutual settlement and transferring payment minus remuneration.

The absence of payment terms in the document in question obliges the principal to make payment within a week from the moment the agent submits a report on the fulfillment of obligations (Article 1006 of the Civil Code of the Russian Federation).

Mediation services under contract

Each type of service follows a specific pattern.

Scheme No. 1. Simple mediation - searching for buyers of goods or services when the agent is an individual. face:

| Parties | Actions | |||

| Principal | Gives assignments, booklets, price list | Waiting for results | Sells goods and receives payment for them | Transfers a percentage or agreed remuneration to the agent's account. May gain a regular customer |

| Agent | Receives brochures, price list | Actively searches for buyers, advertises and convinces them of the need to purchase services/products | Brings the consumer to the manufacturer | Receives remuneration and incentive for further activities. If the client becomes a regular customer, he can receive a percentage of each purchase (if the agreement provides) |

| Consumer/Buyer | Does not yet know about the manufacturer and product | Interested in the product and wants to purchase | Buys goods and pays | May become a regular customer |

This is the simplest scheme, which is used by many organizations that need cheap but massive advertising.

The simplest example is a call center. For a tiny percentage, operators call mobile phone owners and offer their company’s services or products. According to this principle, the relationship between an actor and his agent, for example, develops.

More serious and complex scheme No. 2 – Agency services with sales.

It is carried out in two ways.

- The agent sells a product/service by indicating the principal's bank account. He, from each transaction or at the end of the month, based on the results of interest calculation, transfers the agent’s remuneration, minus taxes, to a bank card or account. You will learn how an individual entrepreneur can withdraw money from a current account in this article.

- It is beneficial for an agent to become an individual entrepreneur and have a personal or individual entrepreneur current account. He sells the product/service himself on his own behalf. Depending on the initial capital, an advance payment or payment is made after the buyer receives the goods. Interest on sales is calculated by the agent himself and remains on his account. The remaining amount is transferred to the principal. The agent pays taxes as an individual entrepreneur.

There is a third option, which is used by agents with extensive experience, developing a wide network of services as a legal entity.

Sample of filling out an agency agreement for the sale of goods.

Agency agreement to carry out actions to find buyers.

This scheme is used most often. The basis of network Internet sales, such as the Oriflame company, with the subsequent registration of an individual entrepreneur, is an agency agreement. Somewhat simplified to understand, mixed with a pyramid scheme.

Characteristic differences of an agency agreement

An agency agreement falls into the category of intermediary transactions with nuances of taxation and the specifics of determining the revenue indicator when choosing tax schemes. Details of the differences with a standard purchase and sale transaction are presented in the table:

| Analyzed indicators | Standard delivery | Agency |

| Parties - participants | Supplier and buyer | Principal and agent |

| Subject of the agreement | Inventory | Intermediary services |

| Ownership of sold goods and materials | Transferred from the supplier at the time of receipt of goods and materials according to the invoice | Belongs to the principal until sale to the final consumer |

| Primary document for mutual settlements | Packing list | Agent's report |

| Received payment or advance payment for goods | Considered the property of the recipient of funds, regardless of the fact of settlement with the supplier | Only the remuneration is considered the property of the agent, and becomes the property of the principal at the moment of transfer of funds by the agent |

| Date of occurrence of tax obligations | Each delivery or receipt of advance payment | Date of drawing up the report for the agent, receipt of funds for the principal |

When choosing a taxation system, the key parameters include the turnover or revenue indicator. Brave taxpayers can only include commission when calculating the indicator.

Agency agreement as a type of intermediary transaction

An agency agreement is one of the possible types of intermediary transactions provided for by the legislation of the Russian Federation, along with a commission and assignment agreement. All three types of contracts have a common criterion: one person represents the interests of another, concluding contracts with a third party or performing other legally significant actions. Let us consider the specifics of each of the types of agreements we have noted and highlight the features of agency agreements.

Why are agency agreements useful?

For what specific purposes can an agency agreement be useful if, it would seem, other types of contracts provided for by the Civil Code of the Russian Federation can be used? The main advantage of this type of transaction is that within the framework of the latter it is possible to fix the mode of actions of the representative, which can both imply legal significance and prohibit the agent from carrying out activities that have legal consequences.

As a rule, such communications are typical for transactions with a complex structure of the subject. For example, it often happens that a particular store that sells goods as a dealer provides additional services for the counterparty - advertising support, marketing research, etc. In this case, within the framework of an agency or commission agreement, it is quite difficult to draw up the correct range of provisions that would reflect the specifics of communications between the two organizations. Thus, a trade agency agreement can be concluded, the subject of which is various activities of the representative, which may predetermine the emergence of his rights and obligations.

Reward Aspect

Under agency agreements, the principal, in accordance with the provisions of the Civil Code of the Russian Federation, must pay his counterparty a remuneration for taking actions to conclude contracts necessary for the business. But, if for some reason the corresponding condition is not specified in the contract, then the amount of remuneration must be determined in accordance with the provisions of Article 424 of the Civil Code of the Russian Federation. That is, the reference point here is the average market prices for certain intermediary services. The payment period must also be specified in the contract, and if this clause is missing, the principal must pay the agent within a week.