Entrepreneurs become entrepreneurs to create their own business, earn big money and finally become independent from their bosses. Entrepreneurs really don’t have bosses, but control over their activities is still carried out, and at a multi-level level. And instead of a call to the carpet and a reprimand with a record of labor, another effective tool is used - individual entrepreneur fines.

Fine is different from fine

If you have already faced a choice between an individual entrepreneur and an LLC, then you have probably found information that fines for individuals are several times lower than for legal entities. This is indeed true when it comes to a fine for individual entrepreneurs under the Code of Administrative Offenses of the Russian Federation.

This code regulates the imposition of administrative sanctions, and for organizations they are much greater than for entrepreneurs. One striking example is a fine for placing outdoor advertising without approval from the local administration. If such an advertisement is found on him, then he will get off with an amount of three to five thousand rubles. Well, if a legal entity violates advertising legislation, then the range of fines here is completely different - from 500 thousand to 1 million rubles.

But the Tax Code makes no distinction between an entrepreneur and an organization. All taxpayers are liable equally for violation of tax laws, with a few exceptions.

Please note that so-called supervisory holidays or periods of exemption from scheduled inspections apply only to non-tax authorities. These are Rospotrebnadzor, Rostransnadzor, State Labor Inspectorate, Rosprirodnadzor, Gospozhnadzor, Roszdravnadzor, etc. A consolidated plan for such inspections is published annually on the website of the Prosecutor General's Office.

But in addition to scheduled ones, it is possible to conduct unscheduled inspections - at the request of a person whose rights have been violated, or in cases of harm to the life and health of citizens, cultural heritage and the environment. And although there are many sanctions prescribed in the laws, believe me, it is quite possible to work calmly if you know the main and most frequent violations.

Here are the TOP 7 situations for individual entrepreneurs for which you can be fined. Just keep them under control, it's not that difficult.

Tax inspector fines for individual entrepreneurs and liability

In paragraph 1 of Art. 3 of the Tax Code of the Russian Federation states that individuals and organizations must pay taxes and fees in the prescribed manner and within fixed periods. Failure to comply with this requirement is a significant offense, entailing tax, administrative and even criminal liability.

These types of obligations for non-compliance with legislation apply to various business entities. Officials of the organization are subject to administrative and criminal liability; tax obligations in this case are assigned to the taxpayer as a whole. In view of this, the principle of the impossibility of repeatedly collecting a fine for the same violation of fiscal norms does not apply, because different entities are subject to sanctions. In addition, each type of liability for non-payment of taxes and fees has its own purpose: these punishments are designed to compensate for the damage caused to the budgetary system of the Russian Federation, and administrative and criminal ones are intended to compensate for the losses that the taxpayer caused to public relations.

The only factor that unites these types of punishments is the presence of a common event - an offense. This is the organization’s evasion of paying fiscal fees, tax fines for individual entrepreneurs, as well as failure to fulfill the duties of a tax agent.

It follows that if the director of an enterprise or the chief accountant, manager and other officials were brought to justice on the basis of criminal legislation, in the future the enterprise may also be subject to tax sanctions. This is directly stated in paragraph 4 of Art. 108 of the Tax Code of the Russian Federation: collecting a fine from a company for a tax offense does not relieve its managers from administrative, criminal and other liability, if there are legal grounds for this. That is why, when sending materials collected on a taxpayer to the police and other law enforcement agencies, the fiscal service will not suspend the collection of all payments due from him for non-compliance with regulatory requirements.

But individual entrepreneurs are not simultaneously subject to various types of liability, since Article 9 of the Tax Code states that in tax legal relations an individual entrepreneur is a payer - an individual, and double sanctions cannot be applied to the same entity. In this situation, only one type of tax penalty is provided for individual entrepreneurs.

In accordance with fiscal legislation, an offense in this area is a committed action or criminal inaction, which leads to the emergence of certain obligations (under Article 106 of the Tax Code of the Russian Federation). And paragraph 5 of Article 108 states that holding a person accountable for violating tax laws does not give him the right not to pay the required amount of fees.

This provision provides for an exception for withholding agents. They must transfer obligatory payments to the budget only from those amounts that they withheld from taxpayers. If this does not happen, nothing can be recovered from the agent, since there is no provision in fiscal legislation that he is obliged to pay taxes from his own funds that were not deducted from the organization.

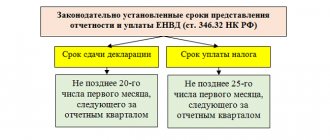

Failure to comply with the reporting schedule

If an individual entrepreneur works on his own, then he has little mandatory reporting. For example, on the simplified system there is only one annual declaration, but on the PSN there are no declarations at all.

But everything changes when an entrepreneur hires workers. There are several types of reports, some are submitted once a quarter, but there are also monthly ones. You can find out what and where to submit in accordance with the chosen regime in our tax calendar.

The minimum fine for failure to submit tax reports, including zero ones, is 1,000 rubles. For reporting on employees, the fine for individual entrepreneurs depends on the specific form. So, for the monthly report of SZV-M, the amount depends on the number of employees - 500 rubles per person.

The highest fines are based on statistical forms. Rosstat achieved the adoption of the following sanctions for individual entrepreneurs under Article 13.19 of the Code of Administrative Offenses of the Russian Federation:

- from 10 to 20 thousand rubles for the first violation;

- from 30 to 50 thousand rubles for repeated violation.

The deadlines for submission to Rosstat are specific. Once every five years, this body conducts continuous monitoring of the activities of small businesses (the last time was carried out in 2020). And in the intervals between observations, reporting is submitted selectively, at the request of statistical authorities. But it’s better to find out in advance on the Rosstat website whether and when you need to report.

What can happen to individual entrepreneurs and legal entities for non-payment of taxes?

When registering as an individual entrepreneur (hereinafter referred to as IP), the choice of taxation system plays an important role. If the entrepreneur himself is far from the economic issue of running a business, then it is better not to delve into this issue personally, but to hire a specialist who will help in maintaining accounting and tax records. After all, from the moment of registration, an individual entrepreneur is responsible for his actions, including the commission of offenses and crimes established by current legislation.

Lack of tax accounting

Entrepreneurs do not keep accounting, but in addition to accounting, there is another accounting – tax. This type of accounting includes not only declarations, but also special books for recording income and expenses, developed for all modes except UTII.

Books of income and expenses are tax accounting registers, and for their absence a fine of 10 to 30 thousand rubles is imposed under Article 120 of the Tax Code of the Russian Federation (if failure to keep records did not lead to an understatement of tax). If, during the audit, it turns out that as a result of lack of accounting, the tax payable was underestimated, then the fine will be 40 thousand rubles.

In addition to accounting books and declarations in modes that require confirmation of expenses (OSNO, Unified Agricultural Tax, Simplified Tax System Income minus expenses), it is necessary to correctly draw up primary documents. An error in their execution may result in tax authorities not recognizing the amount of the calculated tax and, accordingly, charging a fine.

If you hire staff or work in a mode that requires confirmation of expenses, we advise you to entrust accounting to 1C:BO specialists. This is much cheaper than hiring an accountant on staff.

Free accounting services from 1C

What are the penalties for failure to file an individual entrepreneur’s tax return on time?

What can happen if a declaration is not submitted on time? The minimum fine for such a violation is one thousand rubles. This is the lower limit of sanctions specified in the Tax Code; its application is possible only under favorable circumstances. However, if the fine calculation shows a lower amount, it will still be increased to a thousand. The delay time in this situation is not significant. The same fines apply for delays of one day or a month.

If you are not only late in submitting your declaration, but also fail to pay the tax penalty for individual entrepreneurs on time, its amount may increase even more significantly. In this case, it will depend on the size of the debt and the delay period (it is measured in months).

Each month of delay incurs a penalty of 5% of the unpaid tax. However, it cannot exceed 30% and be less than a thousand rubles. If the taxes were transferred, but you just did not submit the necessary reports about this, the sanction will be limited to a thousand rubles.

If you delay your declaration for more than ten days, the tax service has the right to block your accounts for all transfers except mandatory ones (salaries, alimony, etc.).

The ban on using the account will be lifted the next day after you provide the necessary data.

The fine for failure to submit information about the average number of employees is 200 rubles per document.

The fine for delay in the calculation of 6-NDFL is 1000 rubles for each month from the date established for provision.

Tax arrears due to a decrease in the tax base due to incorrectly determined income and expenses and other reasons leading to errors in calculations, as well as other illegal actions, entail a tax penalty for individual entrepreneurs of 20% of the unpaid amount.

As an example, let’s take the following case: based on the results of the calendar year, the simplified tax system (income less expenses) was calculated in the amount of 20 thousand rubles. This amount was paid to the budget on time. However, a tax audit showed that some of the expenses were calculated incorrectly, resulting in an illegal understatement of the tax base. The amount of mandatory payments was recalculated and turned out to be equal to 30 thousand rubles. Consequently, the amount of arrears amounted to 10 thousand rubles. In addition to this, the entrepreneur will have to pay a fine of 20% of this amount, that is, 2 thousand rubles.

Such violations may be subject to a much larger fine for individual entrepreneurs - up to 40% of the debt if the taxpayer’s malicious intent is proven.

Important! If you do not submit such a calculation, you will pay a fine of one thousand rubles every month until you eliminate the violation. If false information is found in the documents presented, you will be fined another 500 rubles for each such document. By the way, a fine of 200 rubles for violating the deadline for submitting 2-NDFL will also be retained. Thus, an unscrupulous employer may face fairly large sanctions.

Not less important! If an entrepreneur does not submit Form 6-NDFL, the tax service will have legal grounds to block his accounts. This interim measure is applied if documents are not submitted more than ten days after the deadline.

Read the material on the topic: How to switch to the simplified tax system

Violation of tax rules

An entrepreneur must pay taxes on time and in full. Payment deadlines for different taxation systems are also indicated in our calendar. The fine for non-payment of taxes by individual entrepreneurs under Article 122 of the Tax Code of the Russian Federation is 20% of the amount of unpaid tax.

In addition, an entrepreneur, if he has employees, becomes a tax agent, and therefore must withhold personal income tax from their income and transfer it to the budget. For violation of the deadlines for transferring this tax, a fine is imposed on the individual entrepreneur according to the same rules, i.e. 20% of the amount not transferred.

Non-payment of personal income tax by an entrepreneur - tax agent

An entrepreneur who has employees and also pays money to individuals under civil contracts by virtue of clause 1 of Art. 226 of the Tax Code of the Russian Federation is obliged to calculate, withhold from the above persons and transfer to the budget personal income tax (NDFL).

Tax agents - entrepreneurs must withhold personal income tax upon actual payment of income to an individual (clause 4 of Article 226 of the Tax Code) and transfer the withheld funds to the budget no later than the next day (clause 6 of Article 226 of the Tax Code).

According to Art. 123 Tax Code:

- illegal non-withholding of personal income tax;

- illegal transfer of withheld funds to the budget;

- incomplete withholding and/or transfer -

are punishable by a fine of 20% of the amount of money that was subject to withholding/transfer.

Non-payment of insurance premiums

Every entrepreneur, regardless of the income from the business, must pay insurance premiums for himself. The deadline for paying the mandatory amount of contributions is at any time no later than December 31 of the current year.

For an additional contribution in the amount of 1% of annual income exceeding 300 thousand rubles, a different payment deadline has been established. If you received income above this limit in 2020, you can pay the additional contribution until July 1, 2020.

Do individual entrepreneurs have to pay fines for non-payment of insurance premiums? This depends on whether the contributions have been calculated correctly. According to the Ministry of Finance (letter dated May 24, 2020 N 03-02-07/1/31912), it is impossible to punish individual entrepreneurs for failure to pay insurance premiums with a fine if their amount was not underestimated intentionally or by mistake.

Accordingly, if contributions are accrued correctly and correctly reflected in timely submitted reports or calculations, then violation of the deadline for their payment will only lead to the accrual of penalties, but not to a fine.

Free tax consultation

What about forms for insurance funds?

If we are talking about forms for 2020, then everything is the same:

The penalty for late submission of the RSV-1 report is also calculated at the rate of 5% for full and partial overdue months. But the amount from which this 5% is calculated is calculated differently. You need to count 5% of the amount of contributions calculated for the last three months for late submitted reports.

Example: You untimely submitted the RSV-1 for 6 months - the fine must be calculated from the contributions for April + May + June. If we are talking about RSV-1 for the year, then the fine is calculated from contributions for October + November + December.

The fine has limits: the lower limit is 1 thousand rubles. — minimum fine; the upper limit is 30% of contributions for the last three months.

But with form 4-FSS everything is somewhat more complicated, because there are two fines to be counted. Why two? Because the form reflects two types of information: contributions for temporary disability and contributions for injuries. It turns out that the fine is calculated for each amount.

The first amount is calculated in the same way as the fine under RSV-1: for all full and partial months of delay in the form of 5% of the amount of contributions for the last three months. The minimum and maximum fine limits are similar.

The second amount will depend on the length of the overdue period:

- if you are late with the report for up to 180 days (inclusive), the fine is equal to 5% for full (and incomplete) overdue months of the amount of contributions on the report. The minimum fine is 100 rubles, the maximum is 30% of the contributions according to the report;

- If you are late with your report for more than 180 days, penalties will consist of several components:

- a fine at the rate of 30% of the amount according to the report for all full and incomplete overdue months;

- fixed amount;

- 10% of the contributions according to the report for each month (also full and incomplete) over 181 days of delay.

The minimum amount of this fine is set at 1 thousand rubles.

As a result, the lower limit of monetary sanctions for late 4-FSS amounts to 1,100 rubles.

Important! Since 2020, insurance premiums have been transferred to the jurisdiction of the tax service, accordingly, and we report them to the tax service by submitting a single calculation for insurance premiums. Late payment and late payment of the contributions themselves in 2020 will result in sanctions similar to fines for filing returns and non-payment of taxes. We talked about them in the first part of the article.

Lack of contract with individual entrepreneur

An individual entrepreneur is the same employer as an organization. You must conclude a written contract with your employee - labor or civil law. The fine for an individual entrepreneur for an unregistered employee is provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation. This is an amount from 5 to 10 thousand rubles.

If this offense is discovered again, then the fine of an individual entrepreneur for an unregistered employee will increase significantly and will amount to from 30 to 40 thousand rubles.

Moreover, an entrepreneur can be punished under this article even if his family members help him in business. It will most likely be necessary to prove that the help of relatives was gratuitous, inconsistent and did not have the nature of an employment relationship.

Tax liability

Please note that individuals are also responsible for non-payment of taxes. In case of non-payment of taxes in an amount exceeding 3 thousand rubles and overdue for more than 6 months, the tax service has the right to go to court with a demand for forced withdrawal of the debt. Responsibility for non-payment of taxes by an individual is provided for in Article 198 of the Criminal Code of the Russian Federation

Penalties are accrued from the day following the last day of payment. So, if payment was supposed to occur on January 10 at the most, then January 11 is the first day for accrual of penalties. If the rate has changed during the calculation of the penalty, then the calculation is made by period, differentiated.

Failure to use a cash register

After the changes on the procedure for using cash registers came into force, there are very few situations left when the absence of a cash register is allowed.

Despite business resistance, online cash registers have been mandatory since mid-2017 for those trading under the OSNO, simplified tax system and unified agricultural tax regimes. And since mid-2020, entrepreneurs on UTII and PSN have also lost the right to work without a cash register.

A short delay (until July 1, 2021) for the installation of cash register systems is provided for individual entrepreneurs without employees who are engaged in:

- provision of services;

- performance of work;

- sale of products of own production.

The tax system on which the individual entrepreneur operates does not matter.

In addition, working without a cash register is now impossible when accepting online payments, as well as when receiving payment directly to an individual entrepreneur’s bank account if the buyer is an ordinary individual. The sanction for the absence of a cash register is established by Article 14.5 of the Code of Administrative Offenses of the Russian Federation. This is from ¼ to ½ of the sale amount, but not less than 10 thousand rubles.

For example, if a sale in the amount of 30 thousand rubles is recorded, then the fine may be 15 thousand rubles. And if the purchase was a penny, 100 rubles worth, then they will still charge 10 thousand rubles. That is, in this case, the fine for the absence of an online cash register for individual entrepreneurs will be 100 times greater than the sale amount!

The essence of penalties for non-payment

First of all, you need to take into account the fact that additional money is added daily to the amount of non-payment, starting from the last date on which the transaction should have been completed. In order to notify the debtor of the need to pay, the Federal Tax Service sends a notice to him at the official address. It indicates how much debt there is, the period within which it must be repaid, as well as the amount of penalties that existed on the day the notice was sent.

The message indicates a list of consequences in the form of penalties that will be applied in the event of failure to comply with legal requirements. Usually, in order to avoid the tax authorities going to court, it is necessary to transfer property taxes and penalties for individuals within 8 days. The countdown period will begin from the moment the paper is received, but other deadlines may well be prescribed in the requirement.

Important! When sending a notice by registered mail via mail, tax inspectors consider it received after six working days. That is, even if the letter was sent to an invalid address, the taxpayer will be considered to have received the notice. This norm is regulated in Article 69 of the Tax Code of the Russian Federation.

The amount of the property tax penalty in 2020 that will be assessed to an individual can be calculated using a simple formula that requires multiplying the amount owed by the number of days overdue for payment of the tax assessed on the property of specific individuals, and then the result is multiplied by 1/300 Central Bank refinancing rates. The latter value is constantly changing and you need to operate with the value established at the time the debt arose.

Conducting activities without a license

Of the licensed areas, only road transportation of passengers, pharmaceutical, medical, educational and private detective activities are available to entrepreneurs. The absence of a license, if it is required, is punishable under Article 14.1 of the Code of Administrative Offenses of the Russian Federation - in the amount of 4 to 5 thousand rubles with possible confiscation of manufactured products, production tools and raw materials.

As for strong alcohol, the sale of which is prohibited by entrepreneurs, there is a special article 14.17.1 in the Administrative Code for this purpose. According to this norm, sanctions for individual entrepreneurs for selling alcohol without a license range from 100 to 200 thousand rubles with mandatory confiscation of alcohol and alcohol-containing products.

An individual entrepreneur is not punished for selling alcohol without a license only if he sells beer, not strong alcohol. At the same time, certain requirements have been established for the sale of beer, which must also be observed.

What can an individual entrepreneur be fined for?

If there are several reasons why an individual entrepreneur may face fines:

- The individual entrepreneur violated the deadlines for submitting reports (tax, statistical);

- The individual entrepreneur did not pay taxes and contributions on time;

- an entrepreneur operates without a license, but must have one;

- violation of cash accounting;

- improper maintenance of KUDiR;

- The required OKVED is not open.

In addition to the tax, an individual entrepreneur may also receive an administrative fine. Its amount under the Code of Administrative Offenses is significantly less than for an LLC. For example, if an individual entrepreneur placed an advertisement that he did not agree with local authorities, he will face the largest fine in the amount of 5 thousand rubles, and an LLC - 1 million rubles. But this is only if we are talking about administrative offenses; with tax offenses, everyone is equal.

Fines are possible during any tax audit of individual entrepreneurs (desk, field), labor inspectorate (if employees work without concluding a contract) and other structures that are responsible for the safety of people and the environment.

Next, we will consider in more detail the most common fines provided for individual entrepreneurs.

Fine to entrepreneur for lack of IP

According to the law, if an individual a person receives regular income from the sale of his products, the provision of services, and any resales; he is required to register with the tax authorities, open an individual entrepreneur or register as self-employed, submit reports (if required) and pay taxes.

Fiscal officials may find out by chance that the activity is ongoing but there is no tax status - from social media. networks, advertisements of an advertising nature placed on special platforms, purchases of control services, for example, car repairs, hairdressing services, from bank information about replenishing a card, with the same amounts, etc. We are talking about receiving regular income, and not just any -or a one-time amount. Receipt of income must be recorded with supporting documents, a protocol on the violation must be drawn up, and the culprit will be summoned to the inspectorate to give an explanation.

If the fact of violation is confirmed, the individual will be held accountable in the form of an administrative fine (income received up to 1 million rubles per year), or criminal liability will be discussed (if the income received is much higher). You also need to pay all taxes and, accordingly, penalties on them. In the same way, a case will be considered against an individual who has closed an individual entrepreneur but continues to receive income.

We recommend reading: Where is it profitable to open a current account for individual entrepreneurs: comparison of tariffs for cash settlement services and reviews.

Individual entrepreneur fine for non-payment of taxes

If during a desk audit it turns out that the tax base was underestimated and you did not pay the tax on time (this may simply be a technical error), the tax office will charge a fine. The Federal Tax Service will also require payment of the amount of overdue tax. To all this will be added penalties for late payment.

Therefore, it is better to double-check the submitted reports, and if you find an error, you need to urgently pay the missing tax and send it to the tax return. This way, fines and penalties can be avoided.

If criminal intent to evade paying taxes is proven, and the amount of arrears is more than 900 thousand rubles. over the last three reporting periods, a criminal case may be opened against the individual entrepreneur. The maximum fine amount reaches about 500 thousand rubles. Depending on the severity of the offense, arrest for a period of six months to three years may be considered.

Individual entrepreneur fines for lack of a license

If an individual entrepreneur operates in one of the areas subject to mandatory licensing:

- Passenger Transportation;

- medical activities;

- educational;

- pharmaceuticals;

- detective services

and does not have a properly issued license, then a fine cannot be avoided. As well as all raw materials, manufactured products and equipment may be subject to confiscation.

If during the inspection it is discovered that the individual entrepreneur sells strong alcohol (which is prohibited by law), the fines will be impressive - from 100 to 200 thousand rubles. All alcoholic beverages will be confiscated. This rule does not apply to the sale of beer. An individual entrepreneur can trade them in compliance with the established rules.

Individual entrepreneur fine for KUDiR

All transactions that an individual entrepreneur had during the year must be recorded in the book of income and expenses. Penalties are also provided for its absence. The exception is those entrepreneurs who work for UTII. On the simplified tax system “Revenues” and the patent, only the revenue (receipts from sales) part of the book is filled out.

We recommend reading: What kind of reporting does an individual entrepreneur submit to the tax authorities and funds: types, rules, dates and deadlines.

Individual entrepreneur fine for failure to submit reports

If you have an open individual entrepreneur, but do not actually work, you will still have to submit reports. She will have zero indicators. The exception is the UTII declaration. It cannot be zero: it always contains a physical indicator, which does not depend on whether an activity is in progress or not. Therefore, in order to avoid unnecessary taxes, during the suspension of work, you need to submit a corresponding notification to the tax office.

If you have employees, you will have to report to the Pension Fund and the Social Insurance Fund, which also provides for liability for failure to submit reports on time.

Fines for individual entrepreneurs in trade

If your seller violated the rules of trade, responsibility for this offense will still lie with you, in this case, as the employer. This could be selling beer and cigarettes to minors or something else. Then it’s your right to decide whether to punish the employee for the damage caused.

If illegal sales of alcoholic beverages are discovered in a store, the Department of Economic Crimes will deal with you. The amount of penalties depends on the violations identified.

Innovations for 2020 regarding penalties for taxes

Since the beginning of 2020, the law regulating tax obligations has extended to insurance premiums (medical, pension, disability and maternity leave). Accordingly, penalties are also calculated for these types of contributions in case of late payment.

Penalties are calculated the same for both individuals and legal entities, but at different interest rates

Since the fall of 2020, according to the new rules, penalties began to be calculated for firms, companies and organizations - legal entities. For them, the interest rate of the penalty has changed.

Penalty interest rate

For individuals, including individual entrepreneurs, penalties are calculated at an interest rate equal to one three hundredth of the refinancing rate of the Central Bank of the country. For legal entities the interest rate is different.

Table 1. Interest rate for legal entities

| Overdue period | Penalty calculation formula |

| Firms that are late in payments by no more than thirty days inclusive will pay penalties at a rate of one three-hundredth of the refinancing rate of the Central Bank of the Russian Federation (as well as individuals). | Formula for calculating penalties for legal entities as a general rule |

| Firms that are overdue for tax payments by more than thirty calendar days will pay for the period of those same thirty days at the standard rate (1/300 of the refinancing rate of the Central Bank of the Russian Federation), and starting from the thirty-first day of debt - at a rate equal to one hundred and fiftieth (1 /150), that is, half as much. | Formula for calculating penalties for legal entities for the first 30 days of delay Formula for calculating penalties for legal entities starting from 31 days of delay |

Let's look at an example . is obliged to pay UTII in the amount of ten thousand rubles for the third quarter of the year no later than October 25, 2020. In fact, the money entered the state treasury only on November 30 of the same year. The refinancing rate during this period was 8.5 percent. Accordingly, “Belye Rosy” will have to pay a penalty in the amount of 113.3 rubles. How did this amount come about?

According to the 2020 innovations that we mentioned, for the first thirty days of delay the formula will be: 10,000 rubles debt x 8.5% x 1/300 x 30 days (from October 26 to November 24). The next period is calculated differently: 10,000 rubles of debt x 8.5% x 1/150 x 5 days (from November 25 to November 29).

Calculation of penalties: formula

As we indicated above, penalties are calculated as a percentage of the amount of tax not paid on time. The classic formula for calculations is as follows:

Amount of tax debt x Refinancing rate of the Central Bank of the Russian Federation for the period of delay x 1/300 x Number of days for which payments are overdue

The current value of the Central Bank key rate needs to be clarified for the period of existing debt

Important point! Since the beginning of 2020, the concept of “refinancing rate” has been abolished. The Central Bank approves the key rate, which corresponds to the abolished value. As of March 2020, the refinancing rate of the Central Bank of the Russian Federation is 7.5 percent. Taking this fact into account, penalties must be calculated separately for each period if the rate was adjusted at that time.

Next, you need to figure out how to calculate the number of days in which the payment was overdue. According to Article No. 75 of the country's tax code, the delay begins to be considered from the day following the due date for payment of the tax fee (the date when it was necessary to pay, but this did not happen) until the day preceding the actual payment. That is, the delay in basic tax payments in any case is considered from December 2 (as we remember, the deadline for depositing money is December 1 of the year following the tax period). For example, a person needs to pay taxes for 2020. He did not do this on time, but transferred the money on March 16, 2020. The number of days of delay in his case is thirteen. Accordingly, if the payment was late by only a day, the payer would not face a penalty.

Do not forget that penalties are also charged on advance tax payments that are not transferred on time. In this situation, the number of days of delay is calculated individually, depending on the schedule for making advances. This information is relevant only for legal entities.

You may be interested in information on how to record tax penalties. In the presented material we will tell you what transactions exist for accruing and depositing funds for debt of the required type.

Video - How to calculate tax penalties according to the new rules?

Administrative liability for non-payment of N&S

Individual entrepreneurs, if they calculate taxes independently, are recognized as officials and are subject to liability under the Code of Administrative Offenses of the Russian Federation.

Table No. 2. Administrative responsibility

| Type of offense | A comment | Article of the Code of Administrative Offenses of the Russian Federation | Applicable sanctions |

| Gross violation of accounting and financial reporting requirements | This offense means distortion of data, indication of knowingly false information in accounting documents, which led to an underestimation of the amount of research and development (by no less than 10%) payable to the budget, inclusion in primary documents of transactions that did not take place at all, etc. P. | Art. 15.11 | 5,000 – 10,000 rub. Repeated offense – 10,000 – 20,000 rubles. or disqualification for a period of 1-2 years |

Tax risks

From the moment of registration as an individual entrepreneur, the citizen assumes responsibility for the offenses committed in accordance with the regulations of the Tax Code of the Russian Federation. Some of the most common problems encountered in the activities of individual entrepreneurs are violation of deadlines for submitting declarations, as well as late or incomplete payments of taxes and fees.

An entrepreneur is obliged to pay to the state budget the amount of taxes on cars and trucks, real estate, as well as contributions to the pension insurance fund for himself and his employees. Additionally, the individual entrepreneur acts as a tax agent: he undertakes to deduct, withhold and transfer personal income tax to the regional treasury.

The reasons for deviations from the legislative regulations may be trivial mistakes of the entrepreneur himself or his accounting department. If you provide reports with typos or incorrect calculations, problems with the inspection will already arise. The conflict will be aggravated by the situation with non-payments. Often in practice, money is transferred using incorrect details. If you mix up the BCC, the finances will be listed in another personal account as an overpayment, and penalties and fines will begin to accrue on the main obligation.

Additionally, an individual entrepreneur may find himself in a difficult financial situation due to the unstable situation in the Russian and international markets. High competition leads many companies to a state of crisis; solvency and compliance with transactions, obligations for taxes and insurance premiums decrease. In a critical situation, an individual entrepreneur may face bankruptcy and complete liquidation.

Every individual entrepreneur is required to pay taxes on time

To avoid problems with the regulatory authority, it is necessary to save all primary documents and timely reflect transactions in the income and cost registers. You can’t just make up numbers; don’t forget that the inspectorate has the right to conduct an inspection at any time. When desk or field control shows gross violations and reveals the fact of non-payment of fees, the defaulter will be held accountable under the Tax Code of the Russian Federation.

The lightest form of punishment is fines, the more severe form is fines. Additionally, the entrepreneur faces the seizure of bank accounts, restrictions on the disposal of property and financial assets, and a ban on registration actions. Both the official and the manager can be fined. In the most problematic situations, the perpetrators will be brought not only to administrative, but also to criminal liability.