What determines whether a bonus is included in a salary?

The bonus paid to the employee will be his income in any case - regardless of whether it is included in the incentive payments that form the remuneration system. However, for both the employer and the employee, the option of issuing a bonus as part of the salary turns out to be more profitable:

- for the employer - because the amount of bonuses included in the salary can be unconditionally attributed to expenses that reduce the profit base;

- for the employee - because bonuses, which are part of the payment for work, will be taken into account among his income involved in calculating average earnings.

Important! Practical situation from ConsultantPlus Is it possible not to pay an employee a bonus during the probationary period? The answer to this question depends on what kind of remuneration system the employer has adopted. You can find out more details in K+. Trial access to the legal system is free.

Art. allows you to include a bonus in the list of payments that make up the remuneration system. 129 and 135 of the Labor Code of the Russian Federation. In order to give the bonus a legally significant form, the employer must designate it as one of the types of remuneration for work, enshrining this in its internal document (regulations on remuneration or collective agreement).

In addition, you will have to develop bonus rules, which should include:

- lists of types of bonuses accrued;

- an indication of the frequency of accrual of each type;

- determining the circle of employees who will be eligible for bonuses with one payment or another;

- listing of indicators giving the right to accrue bonuses;

- description of the system for assessing indicators that serve as the basis for bonuses;

- formulas for calculating bonus amounts based on an assessment of the indicators that must be achieved to receive a bonus;

- description of the procedure for considering the above indicators;

- a list of grounds for deprivation of a bonus;

- a description of the procedure that allows an employee to challenge the results of the assessment of his right to a bonus.

Read about the main document describing the wage system in this material.

Important! ConsultantPlus recommends that you can pay bonuses to an employee in accordance with your current system of remuneration and bonuses. If you want to issue an award as a one-time incentive, you can follow the procedure... Read more about the procedure for assigning and issuing one-time bonuses in K+. Trial access to the system is free.

Bonus concept

A bonus based on annual performance is the amount of cash payments, which is an incentive bonus for staff in order to achieve better work results and increase the efficiency of the company. The employer can set goals independently at the beginning of the year, and then provide various incentive measures to achieve these goals. The award is one such method.

As a rule, a bonus is understood as the amount of a monetary bonus for achieving a specific threshold of results in work, which is provided for by the plan.

The bonus system is regulated by the company’s internal local documents, the collective agreement, and the regulations on bonuses at the enterprise. The legislation does not have a direct obligation on the employer to provide bonuses to employees. However, if such a point is stipulated in agreements and contracts, then the premium must be calculated.

The establishment of bonus parameters, conditions and methods of incentives rests entirely with the employer. There are no restrictions. However, the terms of the incentive should be agreed upon with a representative of the workforce.

The bonus system assumes:

- systematic payments (for example, every month);

- periodic payments;

- individual payment amounts.

Examples of results for which a bonus is paid:

- for the worker: fulfillment of the production plan;

- for an office worker: fulfilling the sales plan.

Bonuses are classified depending on the assessment of work results:

- for the number of units produced at one cost;

- for each unit in excess of the previously established plan;

- fixed bonus percentage upon exceeding the task.

Where and how to write down that the bonus is a monthly addition to your salary (sample)

Bonus rules are also recorded in the employer’s internal document. It could be:

- a document describing the remuneration system;

- a special document developed specifically to set out these rules: bonus regulations;

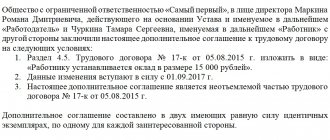

- an employment agreement with a specific employee.

IMPORTANT! An employer may not have a local bonus document if it is a party to industry agreements with employees regarding wages. Such industry agreements, as a rule, contain information about the remuneration system in the industry, including bonuses. In this case, the provisions of the industry document are binding on all employers and workers in the industry who have joined it. Then the premium will be calculated based on the indicators provided for by industry regulations.

The descriptions contained in the first 2 groups of documents are intended for the majority of members of the workforce. Therefore, each employee is presented with the relevant document and signed, and an entry is made in the employment agreement with him that he will be paid bonuses according to the general rules existing at the employer.

Example

“Bonus payments to employees are made in accordance with the procedure approved by the current regulations on bonuses.”

This phrase will also cover the rules for paying a monthly salary bonus.

If the employer applies a simple bonus system (for example, there is one type of bonus and is calculated as a percentage of the salary) or an individual procedure for assessing the results of his work for incentive purposes has been established for the employee, then a description of the bonus calculation procedure can be included directly in the text of the employment agreement with each specific employee. It is assumed that such a description will not be cumbersome, and in relation to the monthly salary bonus will be reduced, for example, to the following words:

“For work under irregular working hours, the employee is paid a monthly bonus in the amount of 25% of the salary accrued for that month.”

For other important rules for drawing up an employment contract, read the article “Procedure for concluding an employment contract (nuances)” .

You will see entries for accounting for bonuses and the specifics of their taxation in ConsultantPlus if you receive a free trial access.

Registration, accrual and payment

IMPORTANT! A sample order to reduce an employee's bonus from ConsultantPlus is available here

The procedure for calculating the monthly “addition” to the basic salary must be specified in the LNA in detail. The bonus can be expressed:

- in a fixed amount;

- as a percentage of the basic salary.

Such a payment can be legally taken into account in calculations for income tax (Article 255-2 of the Tax Code of the Russian Federation), provided that it is properly processed.

The bonus clause or other similar LNA must contain:

- clear reasons for bonuses (if the payment is related to financial performance, indicate them);

- sources of bonuses (bonuses from net profit and other sources, according to Article 270 of the Tax Code of the Russian Federation, paragraphs 1, 22, cannot be included);

- calculation formula and bonus amount.

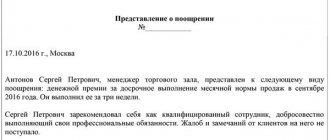

The justification for the accrual of amounts and their payments is the order of the manager on bonuses (according to form T-11A or according to the form developed in the organization). If the bonus is included in the general system of labor payments and is issued every month, the employees’ signature on familiarization with the document is not required - they must be familiar with the practice of bonuses in the organization when hiring.

The monthly bonus is paid according to the same algorithm as the basic salary: in cash from the cash desk or to the employee’s bank account.

Question: An illegally dismissed employee was subsequently reinstated by a court decision. How to determine the amount of payments to an employee, accepted for calculating the average daily earnings during forced absence, if during the specified period the organization experienced a 10% increase in salaries? In addition, during the billing period, the employee was paid monthly bonuses in the amount of 10 to 30% of the salary, depending on the results achieved and the time actually worked in the month. View answer

How is the bonus included in the calculation of average earnings?

The rules for calculating average earnings contain Art. 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

They oblige all payments that form the employer’s remuneration system, including bonuses, to be taken into account in this calculation. However, due to the fact that bonuses, unlike salaries, can be accrued at intervals exceeding a month, taking them into account has a number of features, depending on:

- from the completeness of the calculation period;

- the duration of the period for which bonuses are accrued;

- correspondence between the periods for calculating average earnings and calculating bonuses;

- the fact of accounting (non-accounting) of actual work time during the bonus period;

- the existence of a prohibition on taking into account more than one payment accrued in the same period for the same indicator at the same frequency.

For more information about the rules for taking bonuses into account when calculating average earnings, read the material “Are bonuses taken into account when calculating vacation pay?” .

What is a wage system

The remuneration system is a method of calculating remuneration that guarantees that an employee receives a salary corresponding to his knowledge, experience and position.

Article 135 of the Labor Code of the Russian Federation includes a set of rules that define what the remuneration system is and guarantees decent payments to citizens. The structure of these payments - what the salary consists of - is determined by the quantity and quality of labor costs invested by the employee in fulfilling his work duties, and corresponds to the actual results achieved. Since the main measure of labor costs is working time and the completion of assigned tasks, wages depend on the method of accounting for costs and have varieties: such as piecework and time-based, as stated in Articles 129 of the Labor Code of the Russian Federation and 150 of the Labor Code of the Russian Federation. Forms of piecework wages:

- direct piecework;

- piecework-bonus;

- chord;

- piecework-progressive;

- indirect piecework.

Forms of time wages:

- simple;

- time-bonus.

Results

The bonuses that are present in the description of the wage system approved by the employer form part of the employee’s salary and, as part of this salary, must be indicated in the employment agreement with the employee.

This can be done either by referring from the text of the employment contract to the internal regulatory act on bonuses, or by recording the terms of bonuses directly in the provisions of the employment agreement. The bonus, which is part of the payment for labor, is taken into account when calculating average earnings. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to calculate salary by salary

This is how the premium amount is found. The rest of the calculation is as usual. Example 3. Ivanov I.I. receives a salary of 10,000 (January, February, March) rubles per month.

He lives in the Chelyabinsk region, where the regional coefficient is set at 15%. Let's calculate the quarterly bonus, which amounted to 10% of earnings and earnings for April.

1.

We calculate the amount of earnings for the quarter. 10,000 + 10,000 + 10,000 = 30,000 2. We calculate the bonus 30,000 * 10% = 3,000 rubles. 3. Based on the results of the quarter, the bonus is usually issued in the month following the quarter - in April.

Then the earnings for April will be (10,000 + 3,000)*1.15 = 14950. 4. We calculate personal income tax 14950*13% = 1943.50 5. Earnings for April to be issued in person 14950-1943.5 = 13,006.50 rubles.

How to calculate vacation pay correctly and have time to relax. Go on vacation soon! To receive a free book, enter your information in the form below and click the “Get Book” button.

The legislation establishes samples of these orders: No. T-11 if the bonus will be paid to just one employee No. T-11a if the bonus is awarded to a group of different employees at once The employer can also use his own orders, in a local format

It is important to remember: it is mandatory to calculate and accrue this type of incentive payment if it is specified in the employment agreement. Often employers reflect the need to pay bonuses in such an agreement

Moreover, deprivation is possible only if this point is reflected in the contract. Otherwise it will be illegal. The procedure for calculating the bonus amount has some features and nuances. First of all, they are related precisely to the type of bonus accrued.

Accounting in accounting

All types of bonus payments are reflected differently in accounting. The choice remains with the management of the enterprise or another authorized person. Each method has its own differences (we talked about how to formalize and record the payment of one-time bonuses here).

All bonus payments relate to the income of working personnel and are fully subject to taxation, and require strict accounting (we talked in detail about the peculiarities of taxation of funds allocated for bonuses to employees here).

Examples:

Crediting production allowance

For example, an employee is awarded a bonus for a certain percentage of his salary because the plan was exceeded. And since such incentives are production-related, they are necessarily included in wages.

Crediting non-production allowance

The employee was awarded a one-time bonus. This is taken into account by other expenses, due to the fact that this type of incentive refers to a non-production bonus to wages and is not part of it.

Types of employee bonuses

Rewards can be divided into two large groups. Some of them are included in the salary, the other is considered separate.

- Bonuses as part of remuneration for work.

To issue such amounts, it is necessary to draw up the appropriate local act in the company. Employment contracts, certain provisions, and other types of documents are allowed. The payment of bonuses is dependent on the employee having a suitable basis. It is important to achieve the results agreed upon in advance. If there are no results, then there is no right to receive money.

The quantity and quality of work performed by subordinates are encouraged to the same extent. The first ones are achieved when the production plan is fulfilled, and even exceeded. That is, when a citizen strives to increase productivity. Qualitative indicators are also important, they suggest:

- Reduced costs in time and effort.

- Saving on raw materials and fuel.

- Creating as many high quality products as possible.

- Customer service that meets all requirements.

Can they pay a significant amount at a time, for example, a bonus of 8 - 10 salaries

In many organizations, the size of the bonus is tied to the salary portion of the salary. Salary is a fixed amount of wages for one month, which does not include other payments (compensation and incentives). The amount of the salary portion of the salary is specified in the employment contract.

A one-time bonus of 10 salaries can be paid if:

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

- This is what the management decided (on their own initiative, based on a memo or employee statement) and issued an order on bonuses.

- The obligation to pay is fixed in the employment contract with the employee (for example, the contract states that at the end of the year, or upon dismissal, the employee is paid a significant bonus).

- The obligation to pay or certain conditions for its implementation are enshrined in a local act, collective agreement, or agreement.

This is an exhaustive list of cases when a premium of such a significant amount can be transferred. The accrual of such bonuses is the exception rather than the rule. It is enough to simply calculate what expenses the employer will incur if he pays 10 salaries at once.

Let's assume that an employee's salary is 15,000 rubles. Thus, the size of the bonus payment will be 150,000 rubles. With this money, the employer must pay 22% of insurance premiums, 5.1% for health insurance, and 2.9% to the Social Insurance Fund, which is another 45,000 rubles. Thus, if in a normal month the employer would pay the employee a salary of 15,000 rubles and transfer 30% of this amount to various funds, then with additional payment of bonuses, the total expenses will be 214,500 rubles.